Overview

This strategy generates trading signals by calculating the moving average lines and the relative strength index (RSI) of prices to identify buying and selling points. It issues buy and sell signals when the RSI indicator reaches overbought or oversold levels. Meanwhile, it uses Bollinger Bands to determine the support and resistance levels of prices to filter out some noisy trading signals.

Strategy Principle

This strategy is mainly based on the combination of the RSI indicator and multiple moving average lines with different periods. Specifically, it calculates multiple MAs from 1-day to 200-day and the RSI indicator. It generates a buy signal when the price crosses above the 200-day moving average and the RSI indicator drops below 10. It generates a sell signal when the price breaks below the 5-day moving average and the 1-day MA crosses below the 3-day MA.

This strategy also uses Bollinger Bands to determine the support and resistance levels of prices. Bollinger Bands consist of a middle band, an upper band and a lower band. When the price approaches the upper band, the stock is viewed as overvalued. When the price approaches the lower band, the stock is viewed as undervalued. So Bollinger Bands can effectively judge the relative value of the stock.

Advantage Analysis

Using the RSI indicator to determine overbought and oversold levels is a classic econometric strategy that can capture price reversal opportunities.

Combining multiple MA lines can enhance the filtering function and avoid being trapped.

Adding Bollinger Bands to determine support and resistance levels can further avoid chasing high prices and chasing low prices, filtering out noisy trading signals.

Risk Analysis

RSI indicators can easily generate erroneous signals and need to be combined with price action to determine.

MA lines are often used to determine trends, but divergence between price and MA may wrongly judge turning points.

Determining support and resistance levels using Bollinger Bands upper and lower rails has lagging features and may not accurately determine temporary high and low extrema points.

This strategy adopts a relatively short holding period and may be easily disturbed by short-term market noise.

Optimization Directions

Can test appropriately extending the holding period, such as changing the closing line to 10-day or 20-day line.

Can test adjusting RSI parameters, such as changing to (3,5) parameters or (2,8) parameters.

Can try increasing Bollinger Bands parameters to obtain more obvious support and resistance intervals.

Can test combinations of other indicators with RSI, such as KDJ indicator, MACD indicator, etc.

Can test the combination of RSI and the volume indicator OBV.

Summary

The strategy is relatively classic and robust as a whole, taking advantage of different indicators to make trading signals more accurate and reliable. There are also some directions that need optimization. The key is to grasp the trend judgment function of the RSI indicator and Bollinger Bands’ judgement on support and resistance levels. Through appropriate parameter adjustment and indicator combination optimization, this strategy can achieve better results.

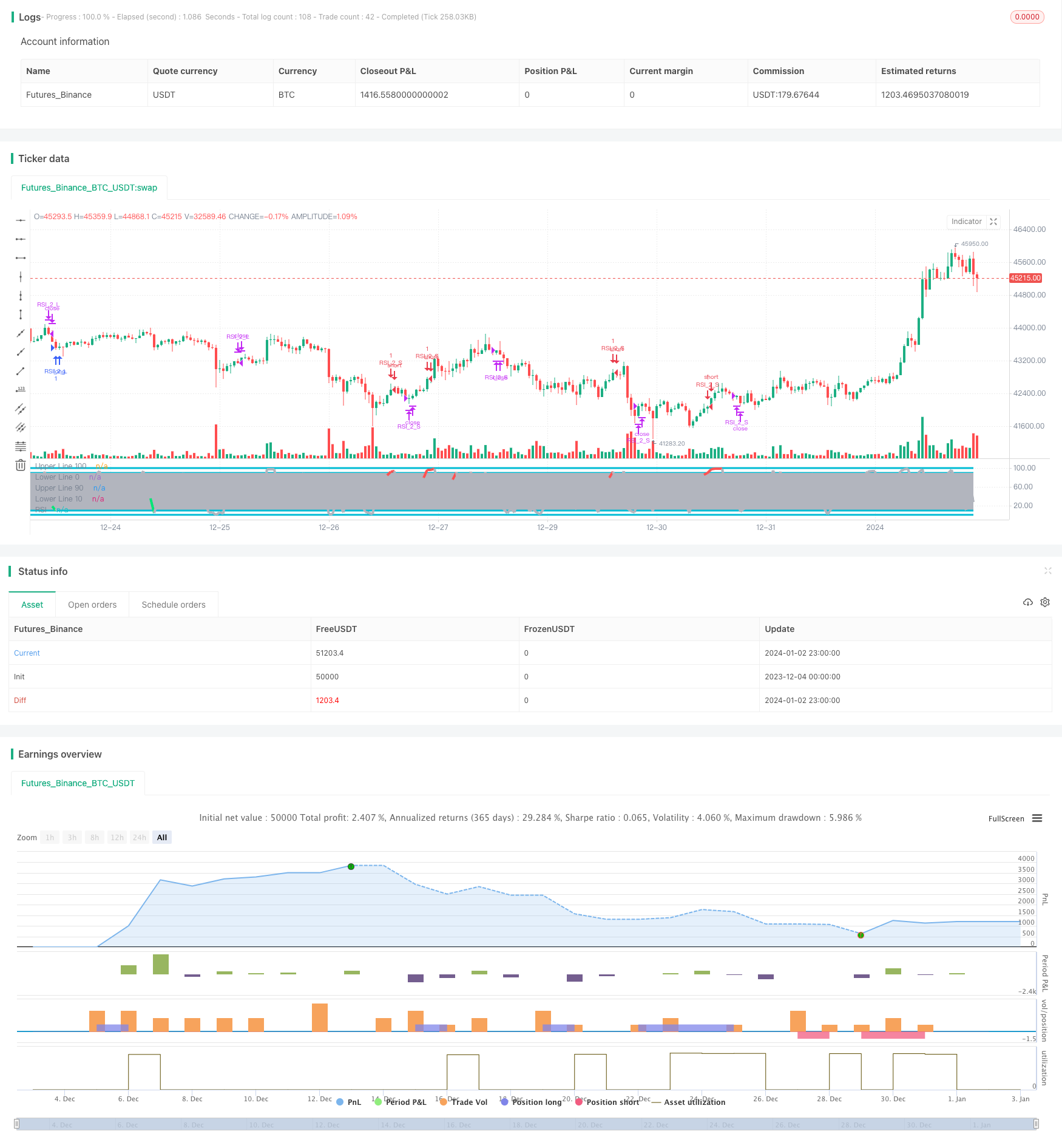

/*backtest

start: 2023-12-04 00:00:00

end: 2024-01-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//Created by ChrisMoody

//Based on Larry Connors RSI-2 Strategy - Lower RSI

strategy(title="_CM_RSI_2_Strat_Low", shorttitle="_CM_RSI_2_Strategy_Lower", overlay=false)

src = close,

//RSI CODE

up = rma(max(change(src), 0), 2)

down = rma(-min(change(src), 0), 2)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

//Criteria for Moving Avg rules

ma1 = sma(close,1)

ma2 = sma(close,2)

ma3 = sma(close,3)

ma4 = sma(close,4)

ma5 = sma(close,5)

ma6 = sma(close,6)

ma7 = sma(close,7)

ma8 = sma(close,8)

ma9 = sma(close,9)

ma200= sma(close, 120)

//Rule for RSI Color

col = close > ma200 and close < ma5 and rsi < 10 ? lime : close < ma200 and close > ma5 and rsi > 90 ? red : silver

plot(rsi, title="RSI", style=line, linewidth=4,color=col)

plot(100, title="Upper Line 100",style=line, linewidth=3, color=aqua)

plot(0, title="Lower Line 0",style=line, linewidth=3, color=aqua)

band1 = plot(90, title="Upper Line 90",style=line, linewidth=3, color=aqua)

band0 = plot(10, title="Lower Line 10",style=line, linewidth=3, color=aqua)

fill(band1, band0, color=silver, transp=90)

///////////// RSI + Bollinger Bands Strategy

if (close > ma200 and rsi < 10 and rsi >1)

strategy.entry("RSI_2_L", strategy.long, comment="Bullish")

if (close < ma200 and rsi > 90 and rsi <98)

strategy.entry("RSI_2_S", strategy.short, comment="Bearish")

strategy.close("RSI_2_L", when = close > ma5 and ma1 < ma3)

strategy.close("RSI_2_S", when = close < ma5 and ma1 > ma2)