This article deeply analyzes a Dual Moving Average crossover trading strategy. The strategy uses the crossover of fast and slow moving averages as the buy and sell signals. When the fast moving average crosses above the slow moving average from the bottom up, it generates a buy signal. When the fast moving average crosses down through the slow moving average from the top, it generates a sell signal.

Strategy Principle

The Dual Moving Average strategy utilizes two moving averages with different parameter settings to generate trading signals by comparison. One is a fast moving average with a smaller parameter setting that can quickly capture price changes. The other one is a slow moving average, with a larger parameter setting as the benchmark of long term trend. When short term price is higher than long term trend, i.e. the fast moving average crosses above the slow one, it sends a buy signal. When short term price is lower than long term trend, i.e. the fast moving average crosses below the slow one, it generates a sell signal.

Specifically, this strategy takes two moving average parameters as input, and calculates the fast and slow moving averages respectively. Then it plots both moving averages on the price chart, with the fast line in blue and slow line in red. When the fast blue line crosses above the red line from the bottom up, it triggers a buy signal. When the fast blue line crosses down the red line from the top, it triggers a sell signal. After the trading signal is generated, it executes corresponding long or short entry orders. Finally, it sets stop loss and take profit logic for the long trades.

Advantage Analysis

The Dual Moving Average strategy has the following advantages:

- Simple to understand and implement.

- Makes good use of the merits of moving averages to catch short term opportunities alongside major trends.

- Flexible parameter tuning to adapt to different market environments.

- Applicable across timeframes and instruments.

- Optimizable with additional indicators like volume, stochastics etc.

Risk Analysis

The Dual Moving Average strategy also has the following risks:

- Crossovers may fail to filter out choppy consolidation moves effectively, generating excessive false signals.

- Frequent crosses back and forth when price oscillates near the moving averages, causing over-trading.

- Inappropriate parameter selection negatively impacts strategy performance.

To address the above risks, the following optimization methods can be adopted:

- Add distance filters so crosses too close to the moving averages are ignored.

- Incorporate additional filters like volume spike and STOCH to avoid ineffective trades in range-bound zones.

- Test different moving average parameters and combinations to find the optimal settings.

Optimization Directions

The Dual Moving Average strategy can be further optimized in the following aspects:

- Add volume filter to trigger signals only when price crossover is accompanied by significant volume spike.

- Combine with Stochastic Oscillator etc. to avoid wrong signals in overbought/oversold zones.

- Test optimal moving average parameters across different products and timeframes.

- Incorporate machine learning models to judge trend direction.

- Build adaptive trading systems using deep learning and decision trees.

Conclusion

In summary, the Dual Moving Average strategy is very classical and practical. It combines both trend following and short term mean reversion, enabling it to ride big trends while catching reversal moves. By optimizing the models and tuning parameters properly, it can generate more reliable trading signals while maintaining simplicity and intuitiveness, thus leading to better strategy performance. Different traders can customize details of this strategy based on their own preference and market conditions.

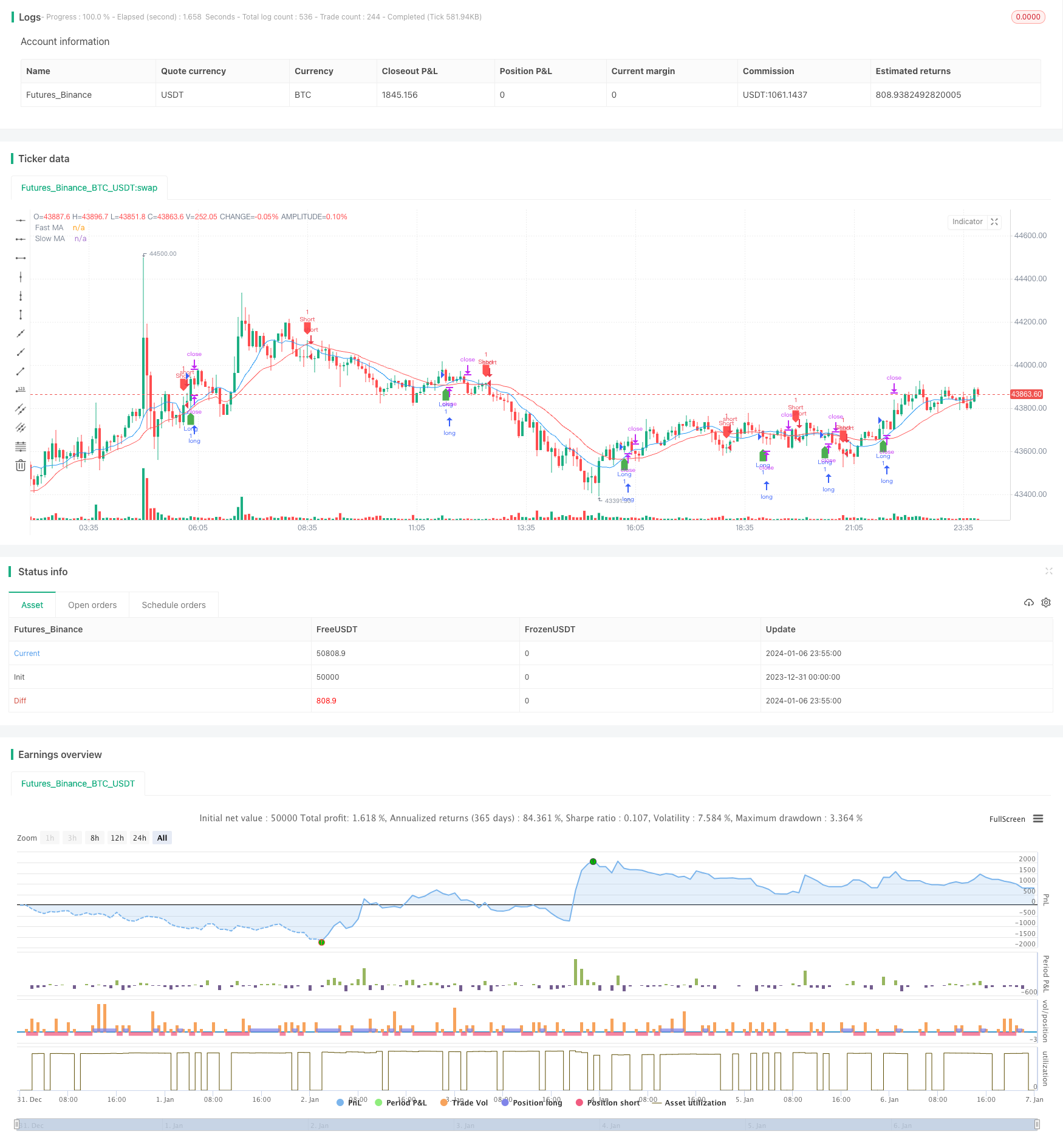

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Crossover Strategy", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(21, title="Slow MA Length")

stopLossPercent = input(1, title="Stop Loss Percentage")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Plot the moving averages on the chart

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Define trading signals

longCondition = ta.crossover(fastMA, slowMA)

shortCondition = ta.crossunder(fastMA, slowMA)

// Execute trades

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Implement stop loss

strategy.exit("Stop Loss/Profit", from_entry="Long", loss=close * stopLossPercent / 100, profit=close * 2)

// Plot buy and sell signals on the chart

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.labelup, location=location.belowbar)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.labeldown, location=location.abovebar)