Overview

This is an oscillation trading strategy based on double moving averages. It uses the crossover of fast and slow moving averages as buy and sell signals. When the fast MA crosses above the slow MA, a buy signal is generated. When the fast MA crosses below the slow MA, a sell signal is generated. This strategy is suitable for range-bound markets and capturing short-term price fluctuations.

Strategy Logic

The strategy uses a 6-period RMA as the fast MA and a 4-period HMA as the slow MA. It judges price trends and generates trading signals based on the crossover between the fast and slow lines.

When the fast line crosses above the slow line, it indicates a short-term trend change from decline to rise, which is a timing of chip transfer. Hence a buy signal is generated. Conversely, when the fast line crosses below the slow line, a sell signal is generated.

In addition, long-term trend judgments are made to avoid trading against the trend. Actual buy/sell signals are only generated when the long-term trend aligns with the signal.

Advantages

The advantages of this strategy include:

The double MA crossover effectively identifies short-term reversal points.

The fast and slow MA lengths are reasonably combined to produce accurate signals.

Long/short-term trend filtering removes most false signals.

Take profit and stop loss logic actively manages risks.

It is easy to understand and implement, suitable for beginners.

Risks and Solutions

There are also some risks:

Prone to multiple small profits but one huge loss. Fine tune TP/SL levels.

Frequent trading under range-bound markets. Relax trading conditions.

Overfitting parameters. Robustness test needed.

Underperforms under trending markets. Add trend module or combine with trend strategies.

Optimization Directions

Some directions to optimize the strategy:

Upgrade MAs with adaptive Kalman filters etc.

Add ML model to improve signal accuracy.

Add capital management module to automate risk control.

Combine with high-frequency factors for stronger signals.

Cross-market arbitrage across products.

Conclusion

In conclusion, this double MA strategy is a typical and practical quant strategy. It has good adaptivity for beginners to learn from, meanwhile has great potential to optimize further with more quant techniques for better results.

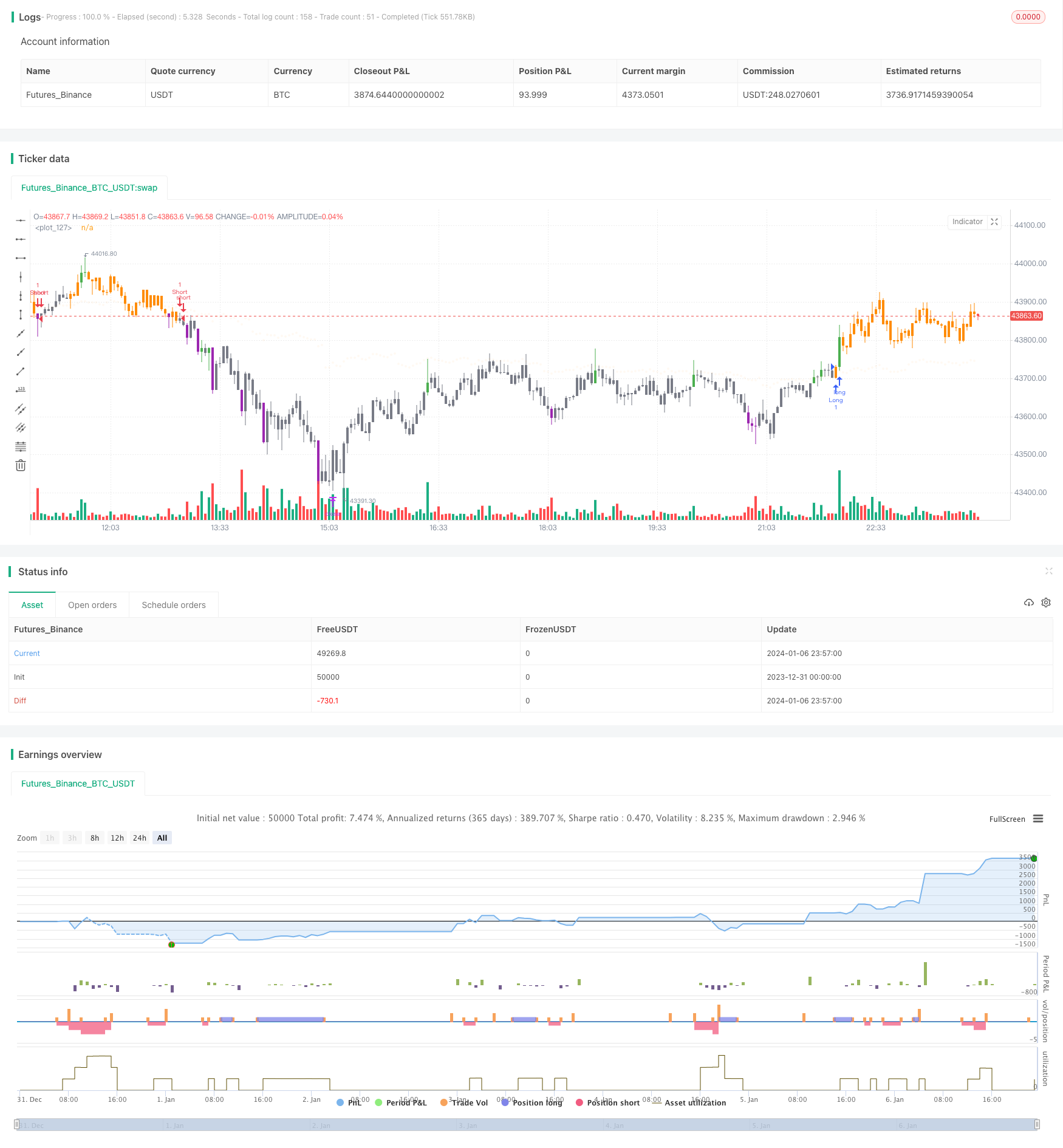

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © dc_analytics

// https://datacryptoanalytics.com/

//@version=5

strategy("Scalping Trading", overlay=true)

// INPUTS //

bar_color = input(true, title='Bar Color', group='⚙ Settings',tooltip='Color chart bars.', inline = "1")

mostrar = input(true, 'Show Alerts', group='⚙ Settings', inline = "1")

tempo = input.timeframe('60', group='⚙ Settings', title='🕗 Timeframe', options=['1', '5', '15', '30', '60', '120', '240', '360', '720', 'D', 'W'])

i_position = input.string("Bottom Center", title = "⚙ D-Panel Location",

options = ["Top Right", "Bottom Center", "Bottom Right"], group='⚙ D-Panel Settings️',

tooltip='Choose the location of the information table on the chart.(D-Panel) ')

position = i_position == "Top Right" ? position.top_right : i_position == "Bottom Center" ? position.bottom_center : position.bottom_right

i_tam = input.string('Big', title = '⚙ D-Painel Size',

options = ["Tiny", "Small", "Big"], group='⚙ D-Panel Settings️',tooltip='Choose the size of the information panel (D-Panel).')

tamanho = i_tam == "Tiny" ? size.tiny : i_tam == "Small" ? size.small : size.normal

show_tp_sl = input(true, title='Show Take Profit/Stop Loss', group='⚙ Settings',tooltip='Show Take Profit/Stop Loss.')

TP = input.float(defval=4500, title='Take Profit:',group='⚙ Risk Management',tooltip='Choose amount of profit')

SL = input.float(defval=2500, title='Stop Loss:', group='⚙ Risk Management',tooltip='Choose amount of loss')

// END INPUTS //

// DECLARATIONS //

t_up = '📈'

t_down = '📉'

c_buy = 'Long ⇡'

c_sell = 'Short ⇣'

// _DECLARATION TREND

t_sma = ta.hma(close, 200)

tend_sma = ta.sma(close, 12)

tendencia = request.security(syminfo.tickerid, timeframe.period, t_sma, barmerge.gaps_off, barmerge.lookahead_off)

tend_tabela = request.security(syminfo.tickerid, timeframe.period, tend_sma, barmerge.gaps_off, barmerge.lookahead_off)

// _END DECLARATION TREND

circle = plot.style_circles

// END DECLARATIONS //

// COLORS //

color gray = color.gray

color red = color.new(#ff8c05, 0)

color orange = color.new(#ff8c05, 0)

color silver = color.silver

color up_vol = color.new(color.green, 0)

color dn_vol = color.new(color.purple, 0)

color orange_tranp = color.new(#ff8c05, 95)

// END COLORS //

// SCANNER MARKET MAKERS //

periodo = input.int(20, 'Period Volume', group='⚙️ Scanner Market Makers Settings')

fator = input.float(1.85, 'Proportion to the mean: (1.25 = 125% of the mean)', minval=0, group='⚙️ Scanner Market Makers Settings')

vol_up = close > open

vol_down = open > close

vol = volume

pesado = volume > ta.ema(volume, periodo) * fator

palette = pesado and vol_up ? gray : pesado and vol_down ? orange : vol_up ? silver : gray

// END SCANNER MARKET MAKERS //

// LOGIC ONE //

s = ta.rma(close, 6)

v = ta.hma(close, 4)

// TREND

t_baixa = tendencia > tendencia[1]

t_alta = tendencia < tendencia[1]

te_d = tend_tabela > tend_tabela[1]

trend = te_d ? t_up : t_down

// END TREND

a = request.security(syminfo.tickerid, tempo, s)

b = request.security(syminfo.tickerid, tempo, ohlc4)

c_dn = a > b and a[1] < b[1]

c_up = b > a and b[1] < a[1]

compra = mostrar and c_up ? a : na

venda = mostrar and c_dn ? a : na

s_sell = venda and t_alta

s_buy = compra and t_baixa

c_vela = b > a and te_d ? gray : orange

s_up = false

s_dw = false

b_sinal = not s_up and s_buy

s_sinal = not s_dw and s_sell

if b_sinal

s_dw := false

s_up := true

s_up

if s_sinal

s_dw := true

s_up := false

s_up

// END LOGIC ONE //

// DATA TABLE //

c = b > a ? orange : gray

c_sinal = b > a ? c_buy : c_sell

// END DATA TABLE //

// PLOT/BARCOLOR //

c_barcolor = pesado and vol_up ? up_vol : pesado and vol_down ? dn_vol : vol_up ? c : c

barcolor(bar_color ? c_barcolor : na)

plot(a, color=orange_tranp, style=circle)

// END PLOT/BARCOLOR //

// TABLE //

var dash = table.new(position=position, columns=2, rows=3, border_width=1)

if barstate.islast

table.cell(table_id=dash, column=1, row=2, text='Scalping DCA', bgcolor=orange)

table.cell(table_id=dash, column=1, row=0, text='Trade: ' + c_sinal)

table.cell(table_id=dash, column=1, row=1, text='Trend: ' + trend)

// END TABLE //

// SETTINGS STRATEGY //

exitPrice = strategy.closedtrades.exit_price(strategy.closedtrades - 1)

// OPEN ORDER

if (b_sinal)

strategy.order("Long", strategy.long , comment = "Entry: " + str.tostring(close, "#.####"))

// strategy.exit("EXIT", trail_points = 1000, trail_offset = 0, comment_trailing = "Close with Profit: " + str.tostring(close, "#.####"))

// strategy.entry("long", strategy.long)

if (s_sinal)

strategy.order("Short", strategy.short , comment = "Entry: " + str.tostring(close, "#.####"))

// strategy.exit("EXIT", trail_points = 1000, trail_offset = 0, comment_trailing = "Close with Profit: " + str.tostring(close, "#.####"))

// strategy.entry("short", strategy.short)

// TP/SL ORDERS

if strategy.position_size > 0

strategy.exit('Long_Close', 'Long',profit = TP , loss=SL, qty_percent=100, comment_profit = "Profit Long: " + str.tostring(exitPrice, "#.####"), comment_loss = "Stop Long: " + str.tostring(exitPrice, "#.####"))

//if strategy.position_size > 0

// strategy.exit("Long", "Long", stop = longSL, limit = longTP, comment_profit = "Profit Long: " + str.tostring(exitPrice, "#.####"), comment_loss = "Stop Long: " + str.tostring(exitPrice, "#.####"))

if strategy.position_size < 0

strategy.exit('Short_Close', 'Short',profit = TP, loss=SL, qty_percent=100, comment_profit = "Profit Short: " + str.tostring(exitPrice, "#.####"), comment_loss = "Stop Short: " + str.tostring(exitPrice, "#.####"))

//if strategy.position_size < 0

// strategy.exit("Short", "Short", stop = shortSL, limit = shortTP, comment_profit = "Profit Short: "+ str.tostring(exitPrice, "#.####"), comment_loss = "Stop Short: " + str.tostring(exitPrice, "#.####"))

// END SETTINGS STRATEGY //

// LOGS

// if strategy.opentrades > 10

// log.warning("{0} positions opened in the same direction in a row. Try adjusting `bracketTickSizeInput`", strategy.opentrades)

// last10Perc = strategy.initial_capital / 10 > strategy.equity

// if (last10Perc and not last10Perc[1])

// log.error("The strategy has lost 90% of the initial capital!")