Volume Ratio Reversal Trading Strategy

Author: ChaoZhang, Date: 2024-01-12 12:08:05Tags:

Overview

The Volume Ratio Reversal Trading Strategy (VR Reversal Strategy) is a short-term reversal trading strategy based on volume indicator. It judges the market participation of major players by calculating the ratio between volume and mean volume over a period of time to generate trading signals. This strategy is mainly suitable for short-term strongly mean-reverting assets.

Strategy Logic

The core indicator of the VR reversal strategy is Volume Ratio (referred to as VR for short), which represents the ratio between the current period’s trading volume and the average trading volume over a period of time. The specific calculation method is:

VR = Current Volume / SMA(Volume, N)

Where N stands for the parameter Length, the trading volume of the current cycle divided by the simple moving average of the trading volume over the Length cycle.

When VR > threshold, it is considered as a signal of major players’ participation. At this time, combined with the breakthrough of the price up or down, buy and sell signals are generated.

The strategy also introduces an auxiliary directional judgment indicator dir. It compares the closing price of the current cycle with that of N cycles ago. Greater than 1 is a bullish direction and less than 1 is a bearish direction.

When VR is greater than the specified threshold, if dir=1, a buy signal is generated. If dir=-1, a sell signal is generated.

Advantages

The biggest advantage of VR reversal strategy is to capture the chance of sudden price reversal. When there is a signal of major players’ intervention, the strategy can make judgments quickly and capture the opportunity of rebound or retracement in a timely manner.

Other advantages include:

- Using volume indicator, the judgment on major players is relatively reliable

- Simple algorithm, easy to understand and implement

- Flexible configurable parameters, better adaptability

Risks

Although the VR reversal strategy has some advantages, there are still some risks to note:

- As a short-term strategy, there is some randomness with fluctuating return curve

- VR indicator may fail to accurately determine the major players

- Proper underlying products need to be selected. Less effective if fluctuation is mild

In addition, over trading should be avoided, stop loss should be set to control single loss, etc.

Optimization Suggestions

There is room for further optimization of the VR reversal strategy. The main suggestions are:

- Combine more indicators for judgment to avoid VR failure

- Add stop loss logic, can refer to ATR indicator to set stop loss range

- Optimize parameters, especially the Length cycle parameter for different cycles and products

- Adjust the threshold of positive and negative VR based on backtest results to ensure robustness

Conclusion

The VR reversal trading strategy is a simple, easy-to-implement short-term quantitative strategy. It captures reversal opportunities by catching major players’ signals. The strategy is particularly suitable for volatile products with obvious reversal, but risk control is also needed. Further optimization can make the strategy more robust and filter out more false signals.

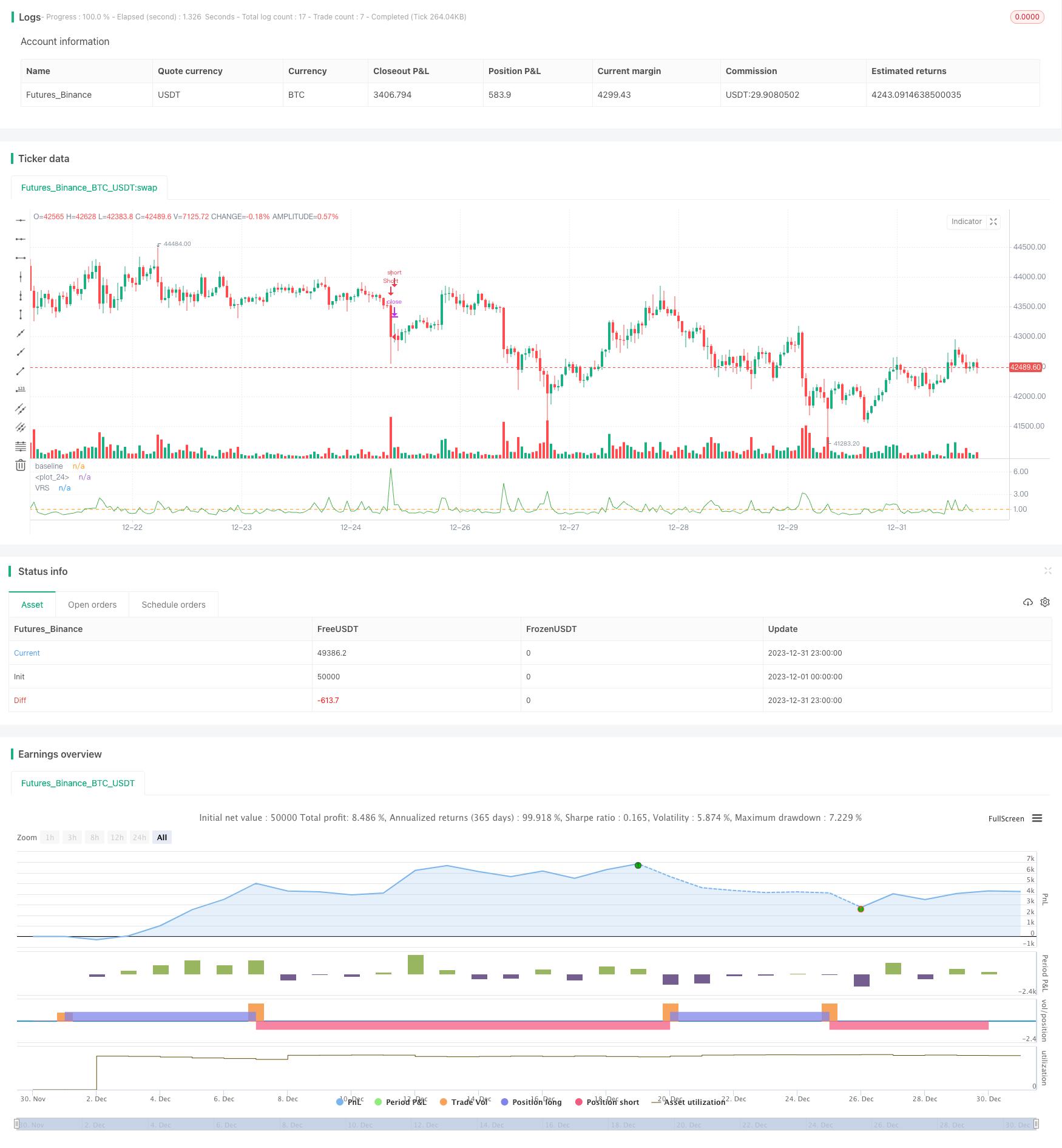

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Volume Ratio_30min", shorttitle="VR_30min")//,initial_capital=1000)

// User Input ------------------------------------------------------------------

len = input(20, title="Length", minval=1)

threshold = input(3,step=0.05, title="閾値")

// Volume Caliculetion ---------------------------------------------------------

vol = volume

sma=sma(volume,len)

vrs = vol / sma

// Direction -------------------------------------------------------------------

dirtime=input(1,"direction picker # bars")

dir=if close/close[dirtime] > 1

1

else

-1

// Plot ------------------------------------------------------------------------

plot(vrs, title="VRS", color=color.green, transp=0)

hline(1, title="baseline")

plot(threshold, color=color.white)

// ️⚠️⚠️Logic -----------------------------------------------------------------

long = vrs > threshold and dir == 1

short = vrs > threshold and dir ==-1

// Back Test Fnction -----------------------------------------------------------

start = timestamp(input(2019, "Start Year"), input(1, "Start Month"), input(1, "Start Day"), 0, 0)

end = timestamp(input(9999, "End Year"), input(1, "End Month"), input(1, "End Day"), 0, 0)

_testPeriod() => true

// Order -----------------------------------------------------------------------

if _testPeriod()

if long

strategy.entry("Long", strategy.long)

if short

strategy.entry("Short", strategy.short)

- Exponential Moving Average Crossover Strategy

- Dual EMA Golden Cross Profit-Taking Strategy

- Dynamic Santa Claus Regression Strategy

- Stochastic Overlap with RSI Index Quant Trading Strategy

- RSI V-shaped Pattern Swing Trading Strategy

- Momentum Breakthrough ATR Volatility Strategy

- Polynomial Interpolation Based RSI Momentum Strategy

- Momentum Reversal Combo Strategy

- BTC Hash Ribbons Strategy

- Multi-level Moving Average Crossing Strategy for Quant Masters

- Dynamic Momentum Weighted Moving Average Crossover Strategy

- Bull Power Trading Strategy

- Daily Moving Average Tracking Strategy for Gold Value

- Multi-Timeframe Moving Average Combined with Trading Hours Quantitative Trading Strategy

- Multi-Timeframe Trading Strategy Based on MACD

- Bear Power Tracking Strategy

- Trend Following Trading Strategy Based on Multiple Indicators

- Swing Trading Strategy with 20/50 EMA Cross

- Dynamic Trend Tracking Optimized Strategy

- Dual Moving Average Strategy Combined with Stochastic Indicator