Trend Following Strategy Based on EMA and SMA Crossover

Author: ChaoZhang, Date: 2024-01-17 15:42:22Tags:

Overview

The “Trend Following Strategy Based on EMA and SMA Crossover” is a trend-following trading strategy based on the crossover of Exponential Moving Averages (EMAs) and Simple Moving Averages (SMAs). This strategy aims to identify potential buy and sell signals by capturing moments when the short-term EMA crosses above the long-term SMA.

Strategy Logic

This strategy generates trading signals based on two conditions:

- The latest 5-period EMA crossed above the latest 20-period SMA

- On the 4-hour timeframe, the latest 5-period EMA crossed above the latest 20-period SMA

When both conditions are true, a buy signal is generated. When both conditions are false, a sell signal is generated.

By comparing EMA and SMA crossovers across different timeframes, this strategy comprehensively judges the trend direction and generates trading signals. The short-term EMA reflects price changes more sensitively while the long-term SMA has better trend filtering capability. When the short-term EMA crosses above the long-term SMA, it indicates a slight trend reversal and generates a buy signal. Conversely, when the short-term EMA crosses below the long-term SMA, it indicates a trend reversal and generates a sell signal.

Adding the 4-hour EMA and SMA crossover filters out short-term noise and makes trading signals more reliable.

Advantages of the Strategy

This strategy has the following advantages:

- Simple and easy to understand

- Quick response, timely captures trend reversal

- Noise filtering by incorporating multiple timeframes

Risks of the Strategy

There are also some risks with this strategy:

- Prone to false signals, signals should be carefully validated

- Does not cope well with trendless markets

- EMA and SMA parameters need to be chosen carefully

Risks can be managed through incorporating stop loss/take profit, parameter optimization etc.

Enhancement Areas

Some ways to enhance this strategy:

- Test more EMA and SMA parameter combinations

- Add other indicators for signal validation e.g. MACD, Bollinger Bands

- Build a dynamic stop loss mechanism

- Filter by trading volume

Conclusion

In summary, this is a basic trend following strategy using simple EMA and SMA crossover rules. It can be improved via parameter optimization, signal filtering etc. to adapt better and improve strategy performance.

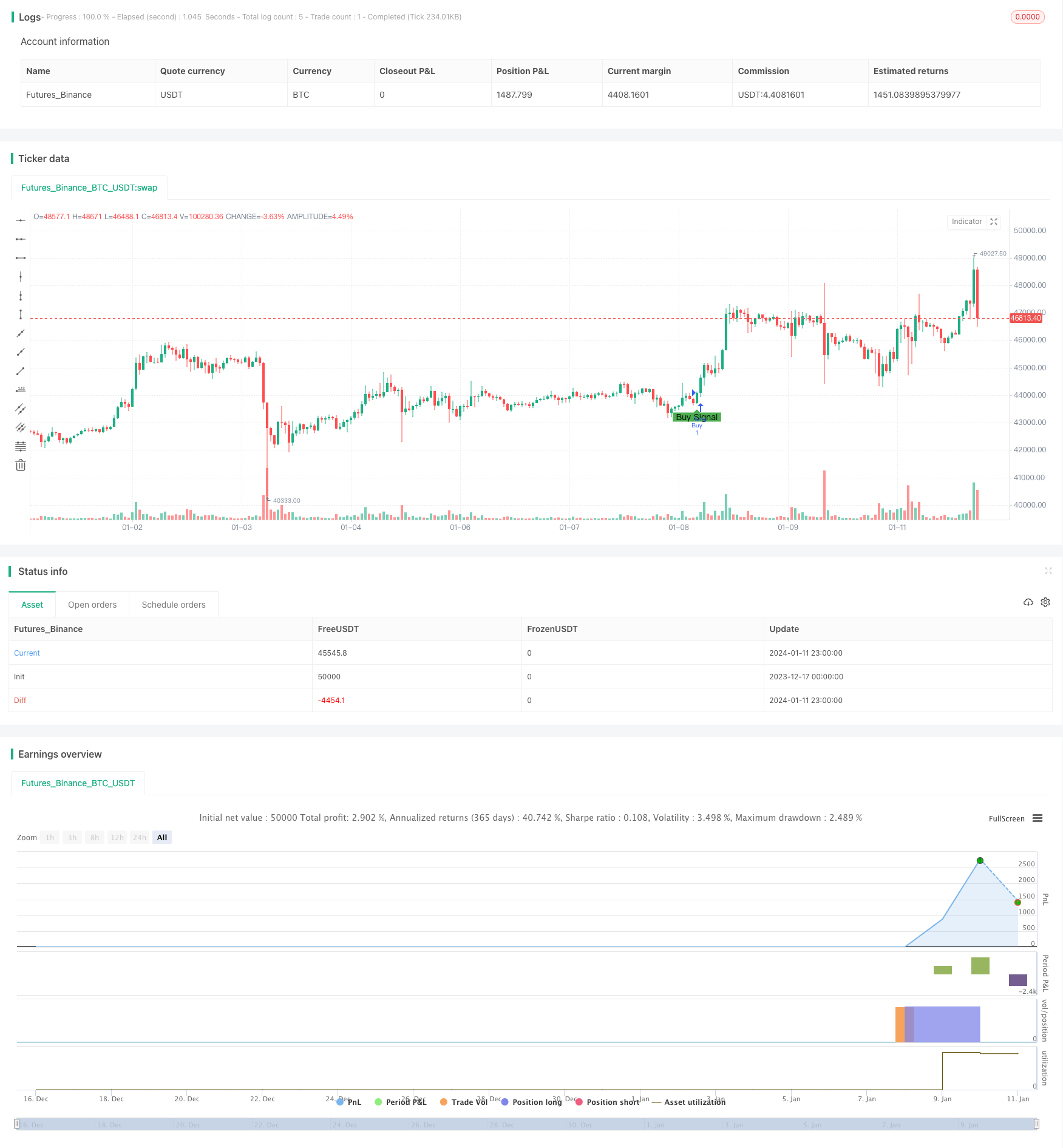

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA and SMA Crossover Strategy", shorttitle="Shashank Cross", overlay=true)

// Condition 1: Latest EMA (Close, 5) crossed above Latest SMA (Close, 20)

ema5 = ta.ema(close, 5)

sma20 = ta.sma(close, 20)

condition1 = ta.crossover(ema5, sma20)

// Condition 2: [0] 4-hour EMA ([0] 4-hour Close, 5) crossed above [0] 4-hour SMA ([0] 4-hour Close, 20)

ema5_4h = request.security(syminfo.tickerid, "240", ta.ema(close, 5))

sma20_4h = request.security(syminfo.tickerid, "240", ta.sma(close, 20))

condition2 = ta.crossover(ema5_4h, sma20_4h)

// Combine both conditions for a buy signal

buy_signal = condition1 and condition2

// Plotting signals on the chart

plotshape(buy_signal, color=color.green, style=shape.labelup, location=location.belowbar, size=size.small, text="Buy Signal")

// Strategy logic

if (buy_signal)

strategy.entry("Buy", strategy.long)

// Exit long position on the next bar at market price

if (ta.barssince(buy_signal) == 1)

strategy.close("Exit")

// You can add more code for stop-loss, take-profit, etc., as per your strategy.

- Triple Moving Average Combined with MACD Quantitative Strategy

- Momentum Breakout Optimization

- Baseline Cross Qualifier ATR Volatility & HMA Trend Bias Mean Reversion Strategy

- Volatility Bands and VWAP Multi-Timeframe Stock Trend Trading Strategy

- Price Reversal with Crossover Capturing Strategy

- Ehlers Stochastic Cyber Cycle Strategy

- Breakthrough of Daily High-low Price Based on Fibonacci Levels

- Improved SuperTrend Strategy

- Quantitative Trading Strategy Integrating MACD, RSI and RVOL

- Momentum Inversion Tracking Strategy

- Simple Pivot Reversal Algorithmic Trading Strategy

- Adaptive Trading Strategy Based on ADX Indicator

- Dynamic Channel Breakout Strategy

- Multi-filter Bollinger Band Trading Strategy

- True Range Based Weighted Moving Average Cross Period Strategy

- Dual SMA Momentum Strategy

- Momentum Mean Deviation Breakthrough Strategy

- Bollinger Bands Based Intelligent Tracking Trading Strategy

- Multifactor-Driven Trend Trading Strategy

- Momentum Breakout Strategy