Overview

This strategy uses the Parabolic SAR indicator to identify turning points in stock price trends and enters long or short positions when reversals occur. It can automatically detect upward and downward momentum in stock prices and adjust positions accordingly.

Strategy Logic

The core indicator of this strategy is Parabolic SAR. This indicator can identify upward and downward trends in stock prices. When prices rise, the SAR dots stay below the prices. When prices fall, the SAR dots jump above the prices. The strategy detects crossover between price and SAR dots as trading signals. Specifically, when the price line crosses above the SAR dots from below, a long entry signal is generated. When the price line crosses below the SAR dots from above, a short entry signal is triggered.

The long condition is: close above sar, indicating the price line has crossed above the SAR dots from below, a long signal. The short condition is: close below sar, indicating the price line has crossed below the SAR dots from above, a short signal. So the core logic of this strategy is to track inversion points in price momentum and trade on crossovers.

Advantages

The biggest advantage of this strategy is it can automatically identify turning points in price trends without manual interference, avoiding common mistakes like chasing peaks and killing dips. The Parabolic SAR is a reliable trend identification indicator, which reduces trading mistakes.

Besides, SAR reacts sensitively to price changes, capturing minor pullbacks in time. This is important for strategies targeting high win rate and frequent trading. So the strategy can adjust positions automatically to avoid being trapped in significant pullbacks.

Risks

The major risk is SAR may overreact to minor price oscillations, generating false signals and causing over-trading, increasing costs and slippage.

Also, in strong uptrends or downtrends, the SAR parameters like starting and increment values could impact the accuracy and timeliness of catching trend reversals. Careful parameter tuning is important.

Inappropriate position sizing, over-reacting to SAR signals can lead to fluctuating exposure, increasing practical difficulties in trading.

Enhancement

The strategy can be optimized in the following aspects:

Optimize SAR parameters for higher accuracy of signals

Add filters to avoid false signals caused by SAR

Employ proper position sizing and stop loss to control risks

Incorporate trend filters to avoid whipsaws in ranging markets

Optimize entry and exit prices considering costs and slippage to improve efficiency

Conclusion

The strategy mainly relies on SAR to determine trend reversal points. It has reliable trend identification capability. When optimized, it can serve as an effective trend following strategy by automatically adjusting positions to capture directional price movements. But position churning should be controlled and risk of false signals should be mitigated.

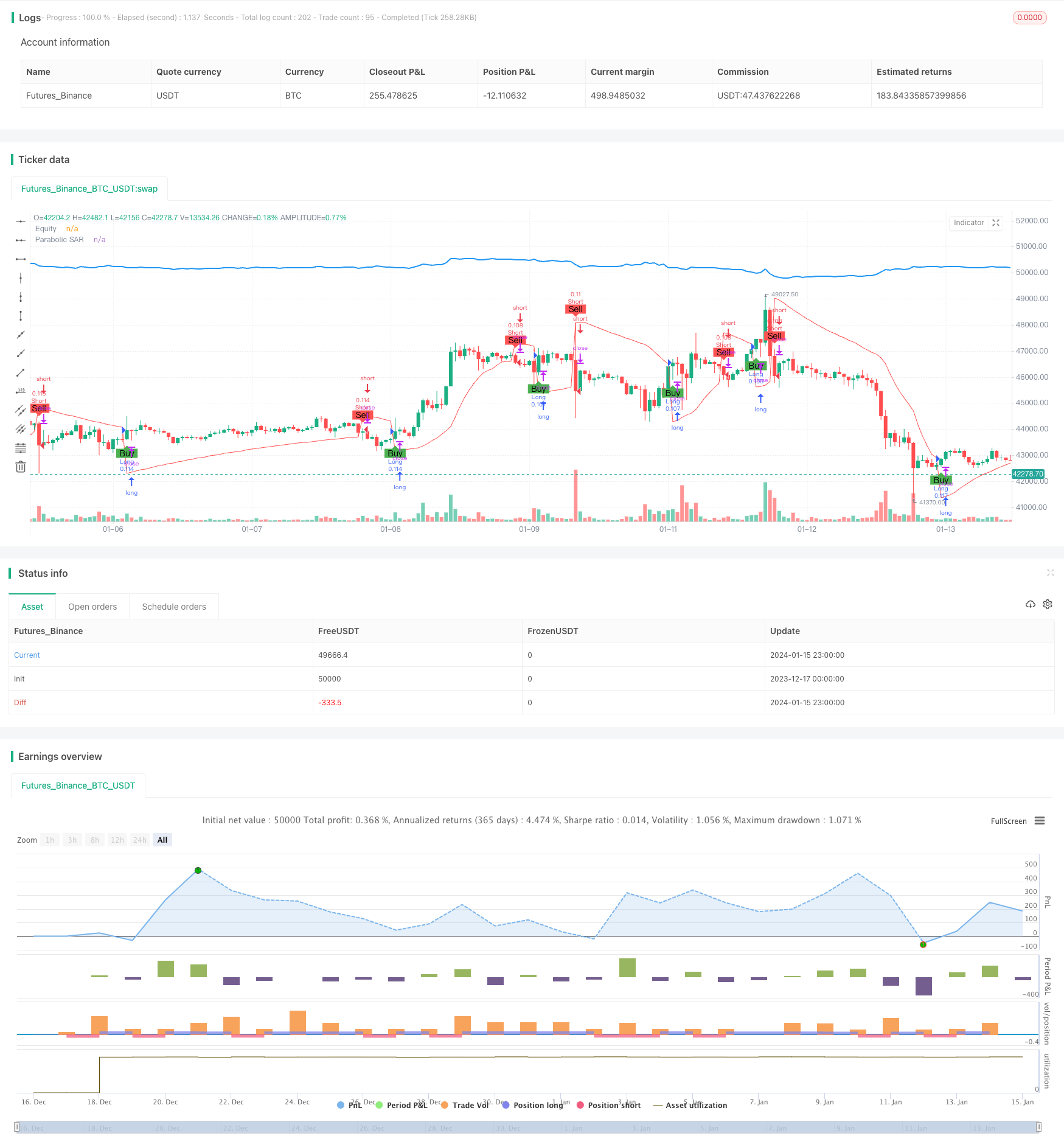

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Parabolic SAR Strategy", shorttitle="PSAR", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Parabolic SAR settings

start = input(0.02, title="Start")

increment = input(0.02, title="Increment")

maximum = input(0.2, title="Maximum")

// Calculate Parabolic SAR

sar = ta.sar(start, increment, maximum)

// Plot Parabolic SAR on the chart

plot(sar, color=color.red, title="Parabolic SAR")

// Strategy logic

longCondition = ta.crossover(close, sar)

shortCondition = ta.crossunder(close, sar)

// Execute strategy orders

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Plot buy and sell signals on the chart

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.labelup, location=location.belowbar, text="Buy")

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.labeldown, location=location.abovebar, text="Sell")

// Calculate equity manually

equity = strategy.equity

equity_str = str.tostring(equity)

equity_plot = plot(equity, title="Equity", color=color.blue, linewidth=2)

// Update equity plot only on bar close to avoid repainting issues

label.new(bar_index, na, text=equity_str, style=label.style_none, color=color.blue, yloc=yloc.abovebar)