Overview

This strategy uses the 50-period EMA and the closing price of candlesticks to determine signals. When the price breaks through the EMA line downward, it goes short. After the price pulls back for 2-3 candlesticks, if a candlestick with engulfing pattern appears, it opens a short position after the close of that candlestick for short-term trading.

Strategy Principle

First, the 50-period EMA line is calculated. Then it judges if the price breaks through this EMA line downward. If broken, it records a bearish impulse signal. Next, it checks if the subsequent candlesticks have an upward pullback, if the pullback amplitude is higher than the lowest price of the previous candlestick, it records a pullback signal. After the pullback, it further judges if the next 1-2 candlesticks form an engulfing pattern. If engulfing formed, it records an engulfing signal. When the bearish impulse, pullback and engulfing signals appear together, it opens a short position after the close of the engulfing candlestick for short-term trading.

The strategy plots the 50-period EMA line. When a short signal triggers, it plots a red downward triangle below the candlestick. It also gives a stop loss level and plots a red stop loss line.

Advantage Analysis

This strategy combines trend judgment and pattern recognition, which can effectively catch trend reversal opportunities. It first uses EMA to determine the trend direction, then uses the engulfing pattern during pullback to avoid being misguided by false breakouts. The stop loss is clear and drawdown is well controlled. It is suitable for short-term trading.

Risk Analysis

This strategy mainly relies on EMA to determine the trend direction. In case of violent breakout, misjudgment may occur. The engulfing pattern judgment has some subjectivity, the quantity and depth need parameter optimization. The stop loss position also needs adjustment based on market volatility. Overall, this strategy is more suitable for stable index markets and short-term trading.

Parameters like EMA period, number of pullback candles, number of engulfing candles can be optimized for better strategy performance. In addition, other indicators can be considered to determine trend and pullback signals.

Optimization Directions

EMA Period Optimization: Test more EMA periods like 30, 40 or 60 to find the optimal one.

Number of Pullback Candles: Test 2-5 candles to find the optimal pullback signal.

Number of Engulfing Candles: Test 1-3 candles to find the optimal engulfing signal.

Stop Loss Multiple: Test 0.5-2 ATR for optimal stop loss position.

Consider adding other indicators like MACD, KDJ to improve signal accuracy.

Test on different products like indexes, crude oil, gold to expand scope.

Conclusion

This strategy first uses EMA to determine the trend direction, then combines pullback and engulfing pattern to generate short signals, a typical trend reversal strategy. By combining trend judgment and pattern recognition, it can effectively catch reversal opportunities. After parameter optimization, good results can be achieved. Overall, this strategy has easy operation, controllable risk and is suitable for short-term trading. Its advantage lies in timely catching reversal trends, with a clear stop loss point. In general, this strategy has good practical value.

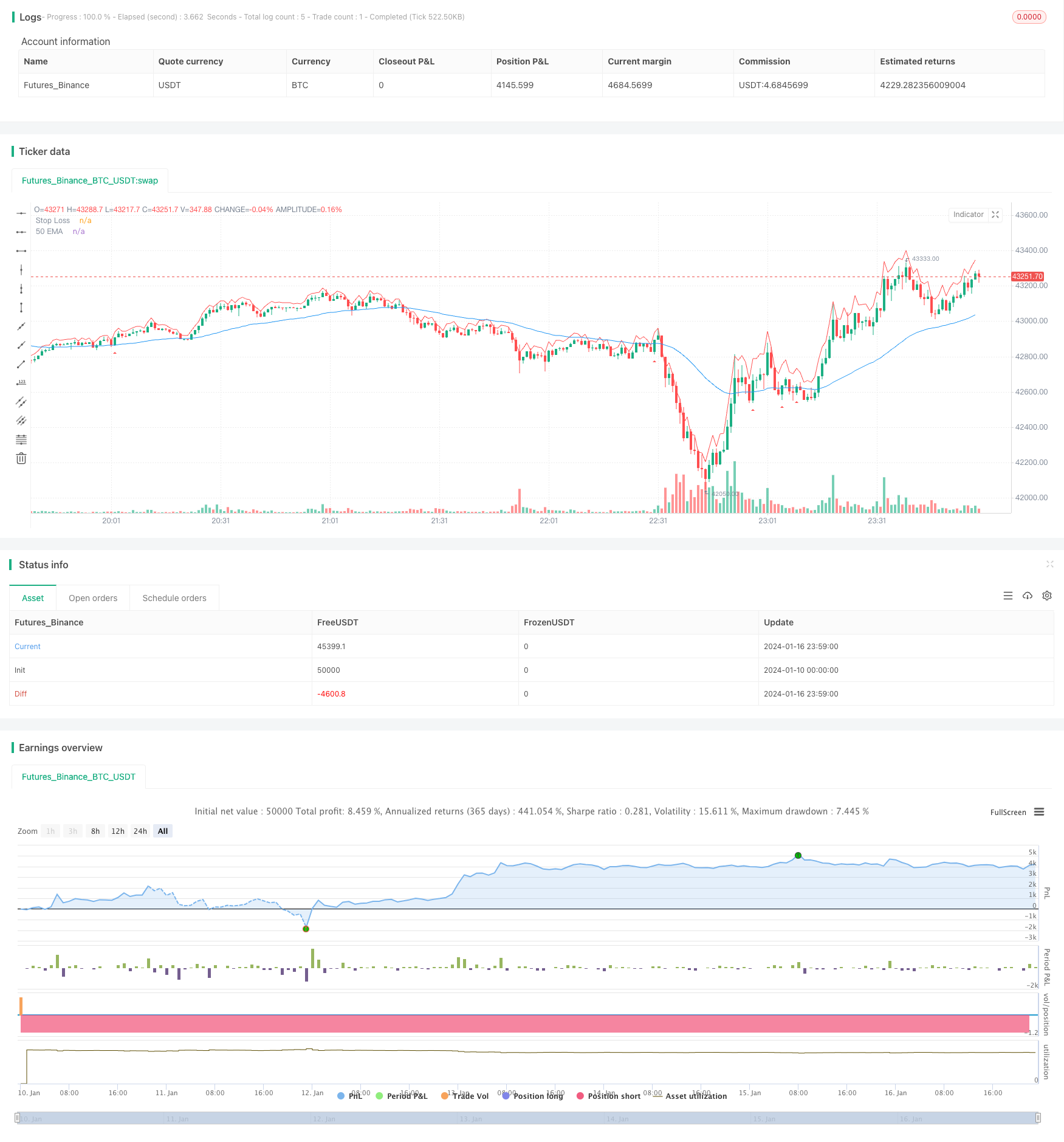

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-17 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Linor Pullback Short Strategy", shorttitle="EMA Pullback", overlay=true)

// Define strategy parameters

ema_length = input(50, title="EMA Length")

pullback_candles = input(3, title="Number of Pullback Candles")

engulfing_candles = input(1, title="Number of Engulfing Candles")

stop_loss = input(1, title="Stop Loss (in ATR)")

// Calculate the EMA

ema = ema(close, ema_length)

// Define bearish impulse condition

bearish_impulse = crossover(close, ema)

// Define pullback condition

pullback_condition = false

for i = 1 to pullback_candles

if close[i] > close[i - 1]

pullback_condition := true

else

pullback_condition := false

// Define engulfing condition

engulfing_condition = false

for i = 1 to engulfing_candles

if close[i] < open[i] and close[i-1] > open[i-1]

engulfing_condition := true

else

engulfing_condition := false

// Define the entry condition

entry_condition = bearish_impulse and pullback_condition and engulfing_condition

// Plot the EMA on the chart

plot(ema, color=color.blue, title="50 EMA")

// Plot shapes on the chart to mark entry points

plotshape(entry_condition, style=shape.triangleup, location=location.belowbar, color=color.red, size=size.small)

// Define and plot the stop loss level

atr_value = atr(14)

stop_loss_level = close + atr_value * stop_loss

plot(stop_loss_level, color=color.red, title="Stop Loss")

// Strategy orders

strategy.entry("Short", strategy.short, when=entry_condition)

strategy.exit("Stop Loss/Target", from_entry="Short", stop=stop_loss_level, when=strategy.position_size[1] > 0)

// Plot strategy performance on the chart