Overview

The Bull Market Breakout Darvas Box Buy Strategy is a modified version of the Darvas Box strategy that only goes long during a bull market. The strategy first draws a box area based on recent high prices, and goes long at the closing price when the price breaks out above the top band of the box.

Strategy Logic

This strategy is built upon the Darvas Box theory. The Darvas Box theory believes that when price breaks out of the box after a consolidation, it is a good long entry signal. This strategy identifies long entries based on this theory.

Specifically, the strategy first calculates the lowest low over the past 5 days to plot the bottom band of the box. Then it calculates the highest high over the past 5 days to plot the top band. When the closing price breaks above the top band, it signals that the trend has turned bullish and goes long at the closing price.

After going long, the strategy sets the stop loss near the bottom band of the box, and the take profit at 5 times the size of the stop loss.

Advantage Analysis

The advantages of this strategy include:

Using the box theory to identify chasing breakout long entries can effectively filter out some noise.

Only going long at the clear breakout signal avoids many unnecessary random trades.

Having predefined stop loss and take profit can control risk well.

Only buying breakouts during bull market avoids risks of choppy and bear markets.

Risk Analysis

There are also some risks with this strategy:

The box theory is not perfect, breakout does not guarantee further upside.

It does not consider the pullback risk after breakout, which may hit stop loss.

There is no exit mechanism, long term holding can be risky.

The parameters may need adjustments for different markets.

Some methods to optimize and improve based on the risks:

Combine with more indicators to confirm the reliability of breakout signals.

Consider waiting for retest or second breakout for confirmation before entering.

Add trailing stop loss to lock in profits.

Test and optimize parameters using different market data.

Optimization Directions

Some directions this strategy can be improved on:

Optimize box parameter, test whether different day parameters can get better results.

Add filtering indicators to ensure buying into an upward trend. E.g. combining with moving averages.

Optimize stop loss and take profit for different markets.

Add trailing stop loss to follow profits.

Add exit signals to take profit when there is a pullback.

Conclusion

The Bull Market Breakout Darvas Box Buy Strategy is a simple yet effective trend chasing strategy built on the Darvas theory. It only goes long at clear buy signals to avoid unnecessary random trades. It also has predefined stop loss and take profit to control risk. This strategy is simple and practical for bull markets, but risks need to be monitored and further optimizations can be explored for more stable profits across different markets.

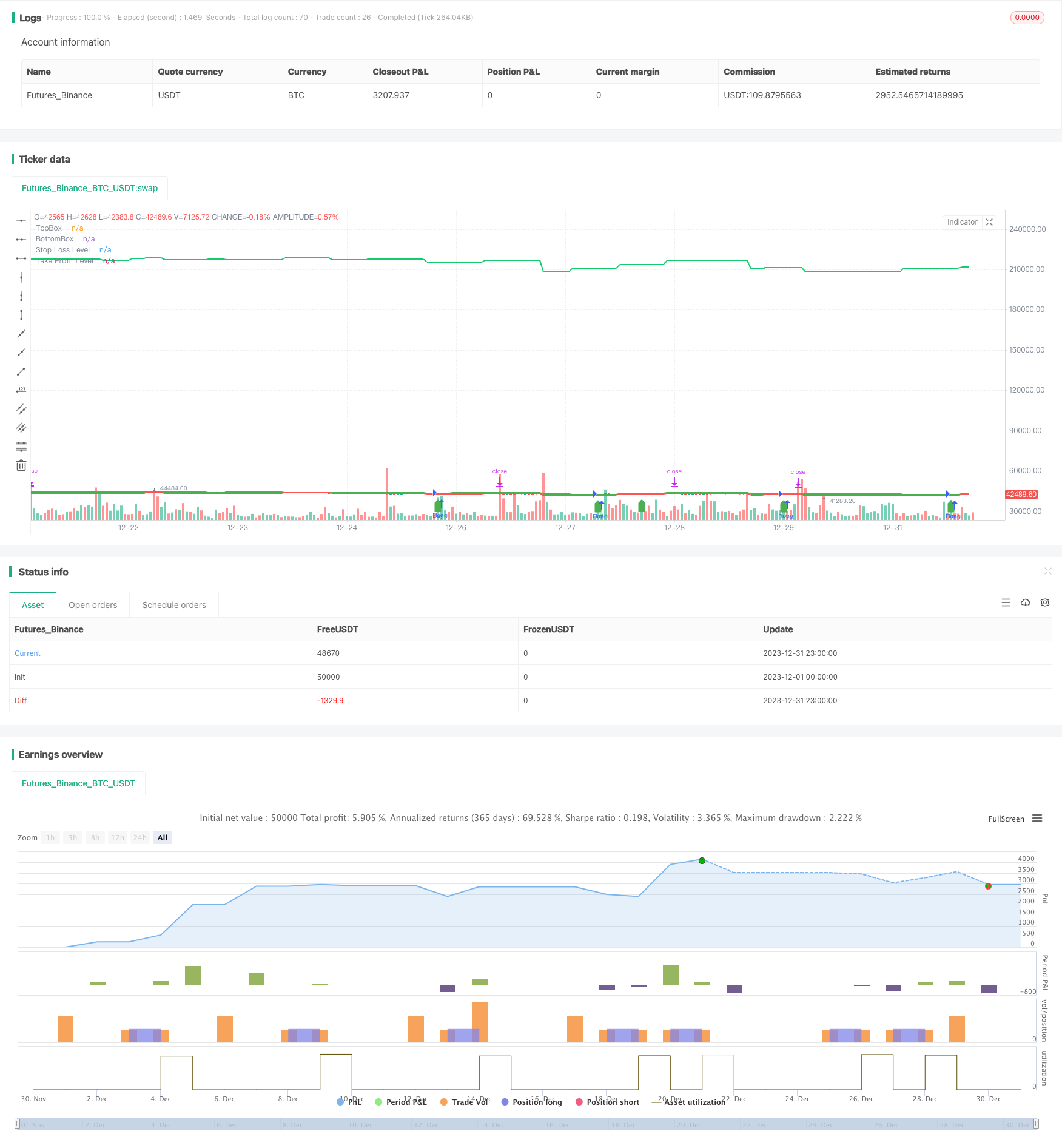

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Darvas Box Strategy - Buy Only", overlay=true)

start_date = timestamp(2023, 10, 15, 0, 0)

boxp = input(5, "BOX LENGTH")

LL = lowest(low, boxp)

k1 = highest(high, boxp)

k2 = highest(high, boxp - 1)

k3 = highest(high, boxp - 2)

NH = valuewhen(high > k1[1], high, 0)

box1 = k3 < k2

TopBox = valuewhen(barssince(high > k1[1]) == boxp - 2 and box1, NH, 0)

BottomBox = valuewhen(barssince(high > k1[1]) == boxp - 2 and box1, LL, 0)

plot(TopBox, linewidth=2, color=color.green, title="TopBox")

plot(BottomBox, linewidth=2, color=color.red, title="BottomBox")

// Define entry conditions

enterLong = crossover(close, TopBox)

// Define exit conditions

exitLong = false // No specific exit condition mentioned in the original script

// Define stop loss level

stopLoss = BottomBox

// Define take profit level (2 times the stop loss)

takeProfit = stopLoss * 5

// Execute buy trade and set stop loss and take profit

strategy.entry("Buy", strategy.long, when = enterLong)

strategy.exit("Exit", "Buy", stop = stopLoss, limit = takeProfit)

// Plot buy signal arrow

plotshape(enterLong, title = "Buy Signal", style = shape.labelup, location = location.belowbar, color = color.green)

// Plot stop loss level

plot(stopLoss, linewidth=2, color=color.red, title="Stop Loss Level")

// Plot take profit level

plot(takeProfit, linewidth=2, color=color.rgb(19, 202, 111), title="Take Profit Level")

// Hide sell signal arrow

plotshape(false, title = "Sell Signal", style = shape.labeldown, location = location.abovebar, color = color.red, transp = 100)