Overview

This is a trend following trading strategy based on a modified volume oscillator indicator. It utilizes volume moving averages to identify increasing volume Signals and determines entries or exits. Meanwhile, it incorporates price trend judgment to avoid wrong Signals during price oscillations.

Strategy Logic

- Calculate volume moving average vol_sum with length of vol_length and smooth it by vol_smooth period moving average.

- Generate long Signals when vol_sum rises above threshold and short Signals when vol_sum falls below threshold.

- To filter false Signals, only take long when price trend checked in past direction bars is up and vice versa.

- Set two threshold values threshold and threshold2. threshold generates trade Signals while threshold2 acts as a stop loss.

- Manage open/close orders through a state machine logic.

Advantage Analysis

- Volume indicator captures changes in market buying/selling power for more accurate Signals.

- Combining with price trend avoids wrong Signals during price swings.

- Two threshold values better control risks.

Risk Analysis

- Volume indicator has lag and may miss price turning points.

- Wrong parameter settings lead to over-trading or signal delays.

- Stop loss may be hit during spikes in trading volumes.

Risks can be mitigated by tuning parameters, optimizing indicator calculation, and combining other confirmations.

Optimization Directions

- Adaptive optimization of parameters based on market conditions.

- Incorporate other indicators like volatility index to further verify Signals.

- Research applying machine learning models to improve signal accuracy.

Conclusion

This strategy utilizes an improved volume oscillator with price trend to determine entries and exits with two stop loss threshold values. It is a stable trend following system with optimization space in parameter tuning, signal filtering and stop loss strategies. Overall it has practical value worth further research and optimization.

Strategy source code

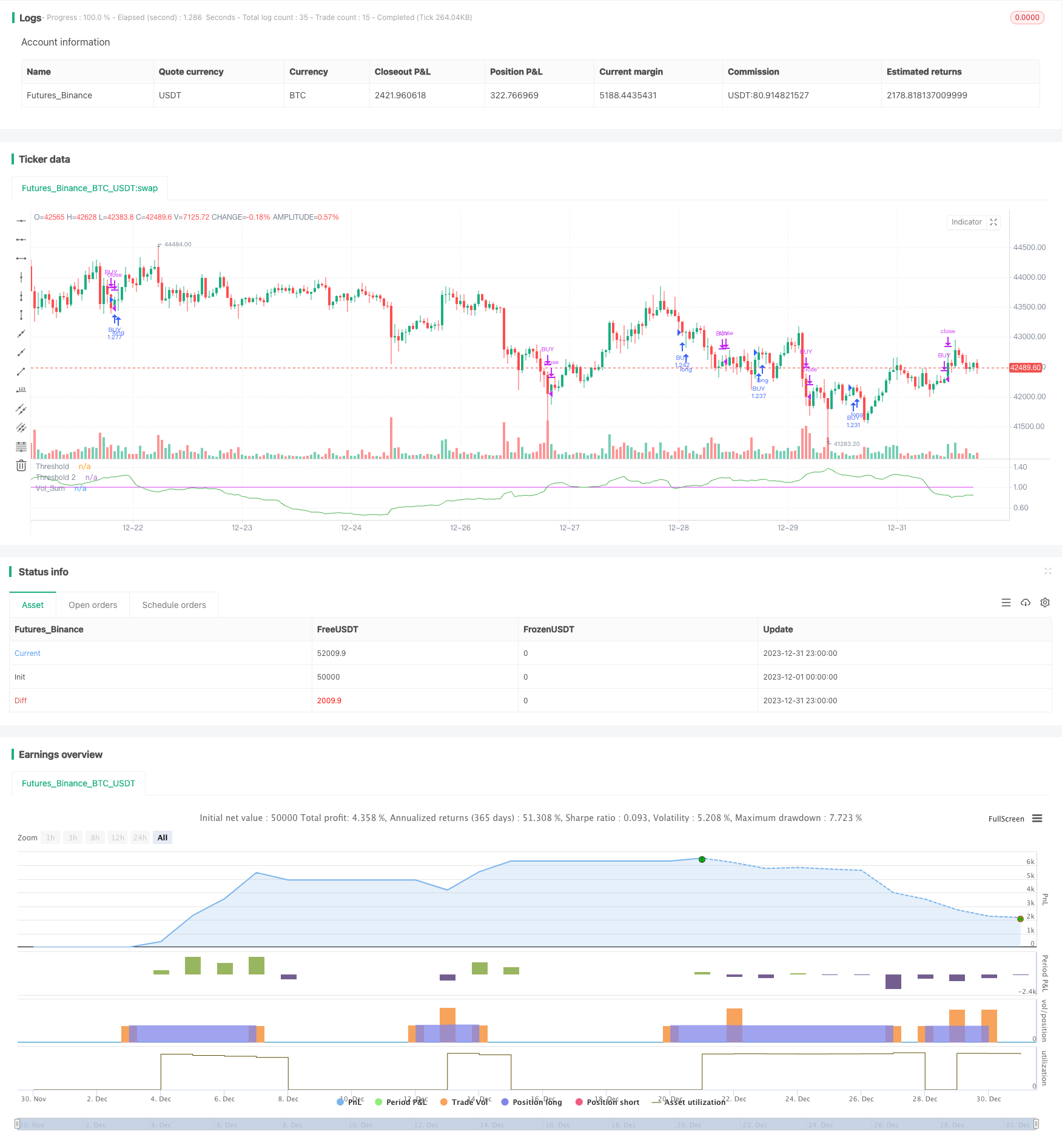

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy('Volume Advanced', default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.075, currency='USD')

startP = timestamp(input(2017, "Start Year"), input(12, "Start Month"), input(17, "Start Day"), 0, 0)

end = timestamp(input(9999, "End Year"), input(1, "End Month"), input(1, "End Day"), 0, 0)

_testPeriod() =>

iff(time >= startP and time <= end, true, false)

source = close

vol_length = input(34, title = "Volume - Length")

vol_smooth = input(200,title = "Volume - Smoothing")

volriselen = input(21, title = "Volume - Risinglength")

volfalllen = input(13, title = "Volume - Fallinglength")

threshold = input(1,"threshold")

threshold2 = input(1.2,step=0.1, title="Threshold 2")

direction = input(13,"amount of bars")

volsum = sum(volume, vol_length) / (sum(volume, vol_smooth) / (vol_smooth / vol_length))

LongEntry = (rising(volsum, volriselen) or crossover (volsum, threshold)) and close > close[direction]

ShortEntry = (rising(volsum, volriselen) or crossover (volsum, threshold)) and close < close[direction]

LongExit1 = falling (volsum,volfalllen)

ShortExit1 = falling (volsum,volfalllen)

LongExit2= (crossover(volsum, threshold2) and close < close[direction])

_state = 0

_prev = nz(_state[1])

_state := _prev

if _prev == 0

if LongEntry

_state := 1

_state

if ShortEntry

_state := 2

_state

if _prev == 1

if ShortEntry or LongExit1

_state := 0

_state

if _prev == 2

if LongEntry or ShortExit1

_state := 0

_state

_bLongEntry = _state == 1

_bLongClose = _state == 0

long_condition = _bLongEntry and close > close[direction]

strategy.entry('BUY', strategy.long, when=long_condition)

short_condition = _bLongClose or LongExit2

strategy.close('BUY', when=short_condition)

plot(volsum, color = color.green, title="Vol_Sum")

plot(threshold, color = color.fuchsia, transp=50, title="Threshold")

plot(threshold2, color=color.white, transp = 50, title="Threshold 2")