Overview

The dual moving average intelligent tracking trading strategy is a trend following strategy based on moving averages and specific indicators. The strategy uses two moving averages with different parameter settings to build a channel and combines the OTT indicator to set the upper and lower limits of the channel to intelligently track price trends. When prices break through the channel, buy or sell operations are executed.

Strategy Principle

The core methodology of this strategy is to construct an adaptive channel using two moving averages and the OTT indicator, specifically:

Calculate the fast line MAvg using CLOSE and custom moving average as input, with a length of 5 periods;

Calculate the long line position LongStop and short line position ShortStop for the channel based on MAvg and preset percentage;

Calculate the channel stop loss MT in OTT indicator, and channel price OTT based on long/short direction;

Generate trading signals when price breaks through OTT.

The above process enables real-time tracking of price trend changes, generating trading signals.

Strategy Advantages

The advantages of this strategy include:

- The dual moving average channel structure effectively captures price trends;

- OTT indicator sets channel stop loss to control risks;

- Adaptive channel structure responds quickly to price changes;

- Flexible parameter tuning for different products and timeframes.

Strategy Risks

There are also some risks:

- Dual moving averages can form divergence resulting in false signals;

- Improper OTT parameter settings may be too aggressive or conservative;

- The strategy relies solely on technical indicators without considering fundamentals.

Risks can be addressed through parameter optimization, integrating other indicators and fundamentals filters.

Optimization Directions

The strategy can be optimized in several aspects:

- Optimize moving average parameters for proper product and timeframes;

- Optimize channel width parameters balancing sensitivity and stability;

- Add filters based on trading volume;

- Set direction filters based on fundamentals.

Summary

In summary, this is a trend following strategy based on a dual moving average channel and OTT indicator. The core idea is constructing an adaptive channel and generating signals when prices breakout. The strategy has merits but also room for improvements. With parameter tuning and logic optimization, it has the potential to become an efficient quant trading strategy worth deploying.

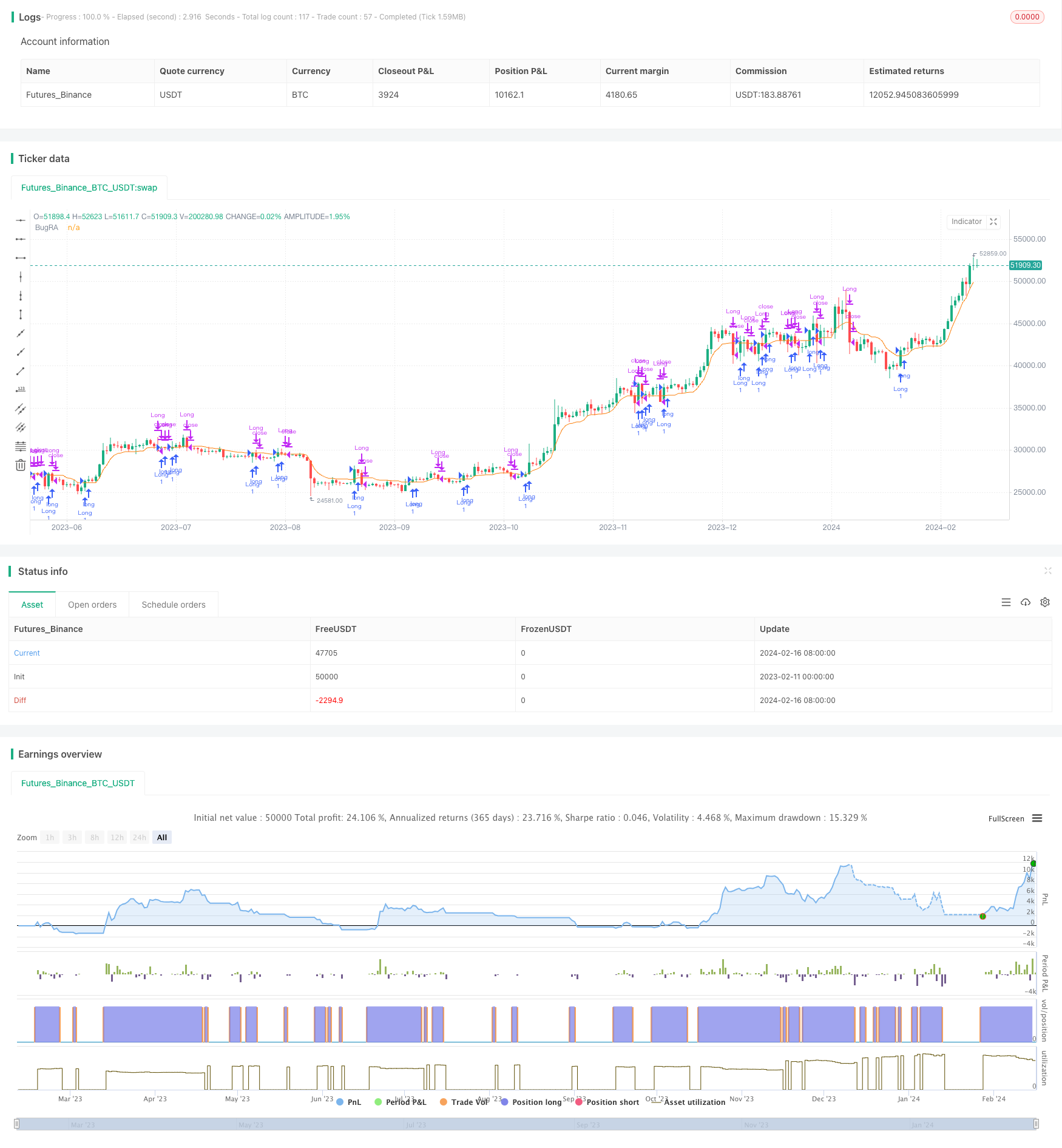

/*backtest

start: 2023-02-11 00:00:00

end: 2024-02-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="BugRA_Trade_Strategy", shorttitle="BugRA_Trade_Strategy", overlay=true)

// Kullanıcı Girdileri

length = input(5, title="Period", minval=1)

percent = input(1, title="Sihirli Yüzde", type=input.float, step=0.1, minval=0)

mav = input(title="Hareketli Ortalama Türü", defval="VAR", options=["SMA", "EMA", "WMA", "TMA", "VAR", "WWMA", "ZLEMA", "TSF"])

wt_n1 = input(10, title="Kanal Periyodu")

wt_n2 = input(21, title="Averaj Uzunluğu")

src = close

// Tarih Aralığı Girdileri

startDate = input(20200101, title="Başlangıç Tarihi (YYYYMMDD)")

endDate = input(20201231, title="Bitiş Tarihi (YYYYMMDD)")

// Tarih Filtresi Fonksiyonu

isDateInRange() => true

// Özel Fonksiyonlar

Var_Func(src, length) =>

valpha = 2 / (length + 1)

vud1 = src > src[1] ? src - src[1] : 0

vdd1 = src < src[1] ? src[1] - src : 0

vUD = sum(vud1, length)

vDD = sum(vdd1, length)

vCMO = (vUD - vDD) / (vUD + vDD)

varResult = 0.0

varResult := nz(valpha * abs(vCMO) * src + (1 - valpha * abs(vCMO)) * nz(varResult[1]))

varResult

Wwma_Func(src, length) =>

wwalpha = 1 / length

wwma = 0.0

wwma := wwalpha * src + (1 - wwalpha) * nz(wwma[1])

wwma

Zlema_Func(src, length) =>

zxLag = floor(length / 2)

zxEMAData = src + (src - src[zxLag])

zlema = ema(zxEMAData, length)

zlema

Tsf_Func(src, length) =>

lrc = linreg(src, length, 0)

lrs = lrc - linreg(src, length, 1)

tsf = lrc + lrs

tsf

getMA(src, length) =>

ma = mav == "SMA" ? sma(src, length) :

mav == "EMA" ? ema(src, length) :

mav == "WMA" ? wma(src, length) :

mav == "TMA" ? sma(sma(src, ceil(length / 2)), floor(length / 2) + 1) :

mav == "VAR" ? Var_Func(src, length) :

mav == "WWMA" ? Wwma_Func(src, length) :

mav == "ZLEMA" ? Zlema_Func(src, length) :

mav == "TSF" ? Tsf_Func(src, length) : na

// Strateji Hesaplamaları

MAvg = getMA(src, length)

fark = MAvg * percent * 0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir==1 ? longStop: shortStop

OTT = MAvg > MT ? MT*(200+percent)/200 : MT*(200-percent)/200

plot(OTT, title="BugRA", color=color.rgb(251, 126, 9))

// Alım ve Satım Koşulları

longCondition = crossover(src, OTT) and isDateInRange()

shortCondition = crossunder(src, OTT) and isDateInRange()

// Strateji Giriş ve Çıkış Emirleri

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long")