Multi Timeframe Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-02-19 15:41:29Tags:

Overview

The Multi Timeframe Moving Average Crossover Strategy is an algorithmic trading strategy that utilizes moving average crossover signals between different timeframe periods to determine the trend direction. This strategy combines trend, momentum and volatility indicators to generate more reliable trading signals.

Strategy Logic

This strategy calculates the CCI indicator over different periods to determine the market trend direction, combined with MACD signals to locate golden crosses and death crosses, and finally uses the ATR indicator to set stop loss/take profit levels, in order to buy low and sell high.

Specifically, it first computes the 20-period CCI to judge bullish or bearish trends. Then it checks if MACD lines are crossing to identify trading signals. Next, ATR is used to generate trailing stops for locking in profits. Finally, all signals are consolidated to generate the entry and exit signals.

Advantages

-

Multiple indicators combo improves signal accuracy

The combination of CCI, MACD and ATR enhances the reliability of trading signals by collectively judging trend, momentum and volatility.

-

Multi-timeframe analysis captures market rhythm

Longer period CCI grasps overall trend, while higher frequency MACD locates local turning points, allowing the strategy to capitalize on big market swings.

-

ATR trailing stop controls risk effectively

The stop loss based on ATR can adapt to market volatility, while its trailing feature further locks in profits as the market moves favorably.

Risks

-

Limited optimization space

Most parameters have narrow fine-tuning space, reaching a performance bottleneck easily.

-

Increased computing load

Multiple indicators running together can increase the computing load, causing lags in high frequency trading.

-

Frequent signals, limited risk control

Signals can be frequent, while the risk control relies mainly on ATR trailing stop, which has limitations against extreme moves.

Enhancements

-

Apply machine learning for more efficient parameter tuning

Bayesian optimization, genetic algorithms etc can enable more intelligent and efficient parameter tuning.

-

Add functional indicators to improve adaptability

Incorporating other indicators like volatility, volume, sentiment can make the strategy more robust and flexible.

-

Strengthen risk management for better stability

More scientific stop loss rules can be designed, and further modules like position sizing can help safeguard against extreme events.

Conclusion

The Multi Timeframe Moving Average Crossover Strategy utilizes the powers of CCI, MACD and ATR to achieve reliable trend capturing and efficient risk control. It accounts for trend, momentum and volatility to generate accurate signals, grasp market rhythms and manage risk. Although some aspects like parameter tuning, computing load and risk control can be improved further, it is a solid algorithmic trading system nonetheless. With some enhancements using machine learning, more indicators and better risk management, its performance can reach new levels.

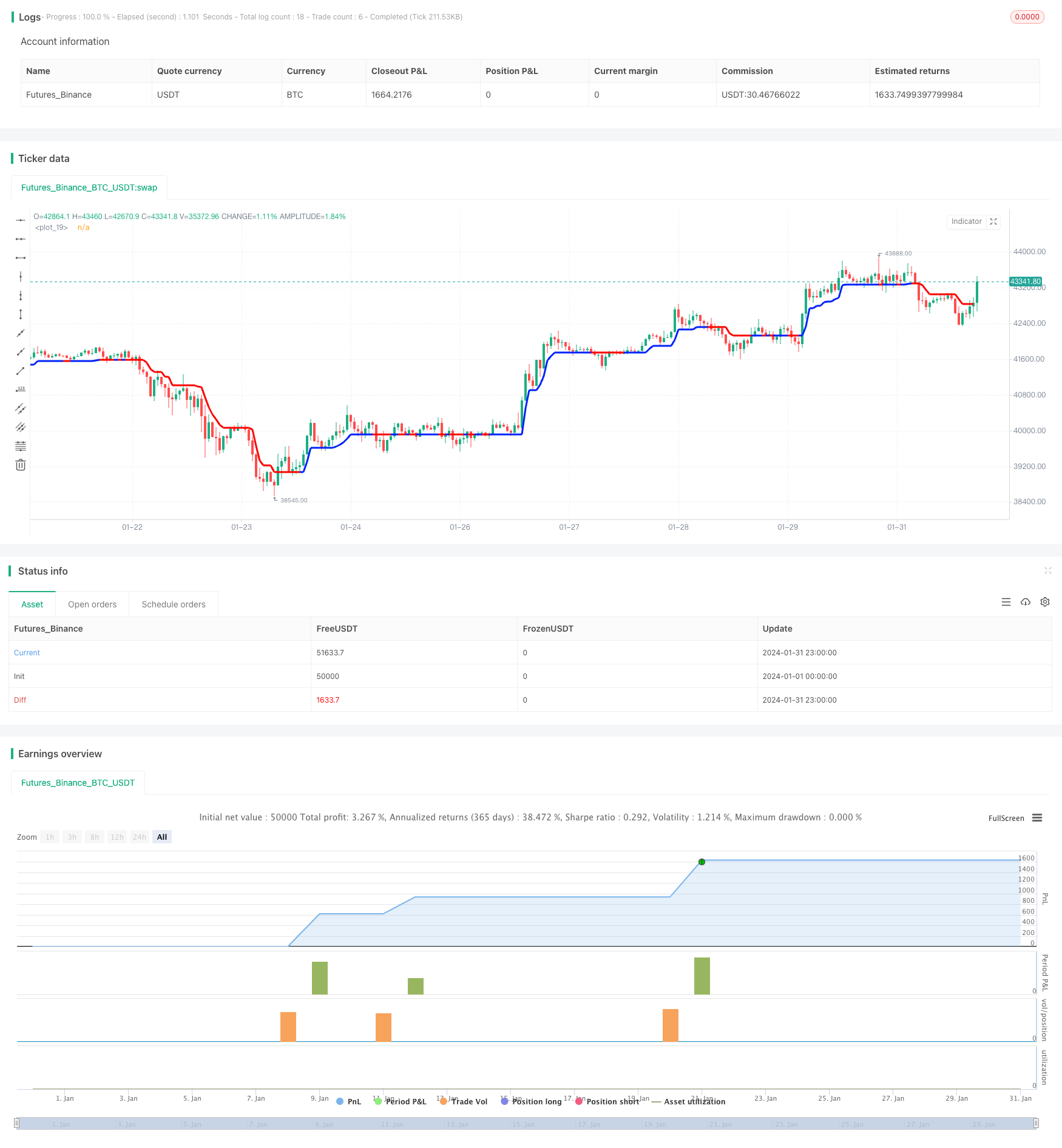

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('smplondonclinic Strategy', shorttitle='SMPLC Strategy', overlay=true, pyramiding = 0, process_orders_on_close = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

direction = input.string(title='Entry Direction', defval='Long', options=['Long', 'Short', 'Both'],group = "Strategy Entry Direction")

TPPerc = input.float(title='Take Profit (%)', minval=0.0, step=0.1, defval=0.5, group='Strategy TP & SL')

SLPerc = input.float(title='Stop Loss (%)', minval=0.0, step=0.1, defval=0.5, group='Strategy TP & SL')

period = input(20, 'CCI period',group = "TREND MAGIC")

coeff = input(1, 'ATR Multiplier',group = "TREND MAGIC")

AP = input(5, 'ATR Period',group = "TREND MAGIC")

ATR = ta.sma(ta.tr, AP)

srctm = close

upT = low - ATR * coeff

downT = high + ATR * coeff

MagicTrend = 0.0

MagicTrend := ta.cci(srctm, period) >= 0 ? upT < nz(MagicTrend[1]) ? nz(MagicTrend[1]) : upT : downT > nz(MagicTrend[1]) ? nz(MagicTrend[1]) : downT

color1 = ta.cci(srctm, period) >= 0 ? #0022FC : #FC0400

plot(MagicTrend, color=color1, linewidth=3)

tmb = ta.cci(srctm, period) >= 0 and close>MagicTrend

tms = ta.cci(srctm, period) <= 0 and close<MagicTrend

//MACD

res = input.timeframe("", "Indicator TimeFrame", group = "MACD")

fast_length = input.int(title="Fast Length", defval=12, group = "MACD")

slow_length = input.int(title="Slow Length", defval=26, group = "MACD")

src = input.source(title="Source", defval=close, group = "MACD")

signal_length = input.int(title="Signal Smoothing", minval = 1, maxval = 999, defval = 9, group = "MACD")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"], group = "MACD")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"], group = "MACD")

fast_ma = request.security(syminfo.tickerid, res, sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length))

slow_ma = request.security(syminfo.tickerid, res, sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length))

macd = fast_ma - slow_ma

signal = request.security(syminfo.tickerid, res, sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length))

hist = macd - signal

trend_up = macd > signal

trend_dn = macd < signal

cross_UP = signal[1] >= macd[1] and signal < macd

cross_DN = signal[1] <= macd[1] and signal > macd

cross_UP_A = (signal[1] >= macd[1] and signal < macd) and macd > 0

cross_DN_B = (signal[1] <= macd[1] and signal > macd) and macd < 0

//UT Bot

srcut = close

showut = input.bool(false, 'Show UT Bot Labels', group = "UT BOT")

keyvalue = input.float(2, title='Key Vaule. \'This changes the sensitivity\'', step=.5, group = "UT BOT")

atrperiod = input(7, title='ATR Period', group = "UT BOT")

xATR = ta.atr(atrperiod)

nLoss = keyvalue * xATR

xATRTrailingStop = 0.0

iff_1 = srcut > nz(xATRTrailingStop[1], 0) ? srcut - nLoss : srcut + nLoss

iff_2 = srcut < nz(xATRTrailingStop[1], 0) and srcut[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), srcut + nLoss) : iff_1

xATRTrailingStop := srcut > nz(xATRTrailingStop[1], 0) and srcut[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), srcut - nLoss) : iff_2

pos = 0

iff_3 = srcut[1] > nz(xATRTrailingStop[1], 0) and srcut < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := srcut[1] < nz(xATRTrailingStop[1], 0) and srcut > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

//plot(xATR, color=xcolor, title='Trailing Stop')

buy = ta.crossover(srcut, xATRTrailingStop)

sell = ta.crossunder(srcut, xATRTrailingStop)

barcolor = srcut > xATRTrailingStop

plotshape(showut ? buy:na, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(showut ? sell:na, title='Sell', text='Sell', style=shape.labeldown, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

//barcolor(barcolor ? color.green : color.red)

goLong = buy and tmb and cross_UP

goShort = sell and tms and cross_DN

plotshape(goLong, location=location.bottom, style=shape.triangleup, color=color.lime, size=size.small)

plotshape(goShort, location=location.top, style=shape.triangledown, color=color.red, size=size.small)

percentAsPoints(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100.0 * strategy.position_avg_price / syminfo.mintick) : float(na)

percentAsPrice(pcnt) =>

strategy.position_size != 0 ? (pcnt / 100.0 + 1.0) * strategy.position_avg_price : float(na)

current_position_size = math.abs(strategy.position_size)

initial_position_size = math.abs(ta.valuewhen(strategy.position_size[1] == 0.0, strategy.position_size, 0))

TP = strategy.position_avg_price + percentAsPoints(TPPerc) * syminfo.mintick * strategy.position_size / math.abs(strategy.position_size)

SL = strategy.position_avg_price - percentAsPoints(SLPerc) * syminfo.mintick * strategy.position_size / math.abs(strategy.position_size)

var long = false

var short = false

if direction == 'Long'

long := goLong

short := false

if direction == 'Short'

short := goShort

long := false

if direction == 'Both'

long := goLong

short := goShort

if long and strategy.opentrades == 0

strategy.entry(id='Long', direction=strategy.long)

if short and strategy.opentrades == 0

strategy.entry(id='Short', direction=strategy.short)

if strategy.position_size > 0

strategy.exit('TPSL', from_entry='Long', qty=initial_position_size, limit=TP, stop=SL)

if strategy.position_size < 0

strategy.exit('TPSL2', from_entry='Short', qty=initial_position_size, limit=TP, stop=SL)

- Multi-Period Moving Average Channel Trend Following Strategy

- Strategy of Indicators Combination Breakthrough Trend Tracking

- Accumulation Stage Identifier and Trading Strategy

- OBV, CMO and Coppock Curve Based Trading Strategy

- CDC Action Zone Strategy

- Multi-factor Quantitative Trading Strategy

- Trend Following Strategy Based on Smoothed Deviation

- Ichimoku Cloud Oscillator Trading Strategy

- Double Bottom Reversal Mean Reversion DCA Grid Strategy

- Assassin's Grid B – A Dynamic Grid Trading Strategy

- Adaptive Zero Lag Exponential Moving Average Quantitative Trading Strategy

- Momentum Brick Strategy

- Volatility Breakout Reversal Trading Strategy

- Candle Patterns Trading Strategy

- ADX-Filtered SuperTrend Pivot Trading Strategy

- Momentum Moving Average Reversal Strategy

- Momentum Moving Average Crossover Trading Strategy

- Momentum Trend Synergy Strategy

- Rational Trading Robot Powered by RSI Strategy

- DYNAMIC MOMENTUM OSCILLATOR TRAILING STOP STRATEGY