Overview

This strategy is designed based on the Bollinger Bands indicator. It goes long when the price breaks through the upper band and goes short when the price breaks through the lower band. It belongs to the trend following strategy.

Strategy Logic

- Calculate the middle band, upper band and lower band of Bollinger Bands

- When the closing price breaks through the upper band, go long

- When the closing price breaks through the lower band, go short

- Exit rule: close long position when price breaks through middle band, close short position when price breaks through middle band

This strategy uses Bollinger Bands to determine the fluctuation range and trend direction of the market. When the price breaks through the upper or lower bands of Bollinger Bands, it is considered as a trend reversal signal for entry. The area around the middle band is used as the stop loss position. Exit positions when the price breaks through the middle band.

Advantage Analysis

- Use Bollinger Bands indicator to determine market trend and support/resistance levels

- High probability when breakout of Bollinger Bands

- Clear entry and exit rules

Risk Analysis

- Risk of false breakout signals from Bollinger Bands, which could be short-term price fluctuations

- Larger stop loss when huge price swings

Solutions: 1. Combine with other indicators to confirm the trend 2. Adjust parameters to expand Bollinger Bands range

Optimization Directions

- Combine with trend indicators to avoid unnecessary reverse trading

- Dynamically adjust Bollinger Bands parameters to optimize parameter size

Summary

This strategy uses the Bollinger Bands indicator to determine price trend and support/resistance levels. It enters at Bollinger Bands breakout points and sets stop loss at the middle band. The strategy logic is simple and clear, easy to implement. It can be optimized by adjusting parameters or combining with other indicators, works well in trending markets.

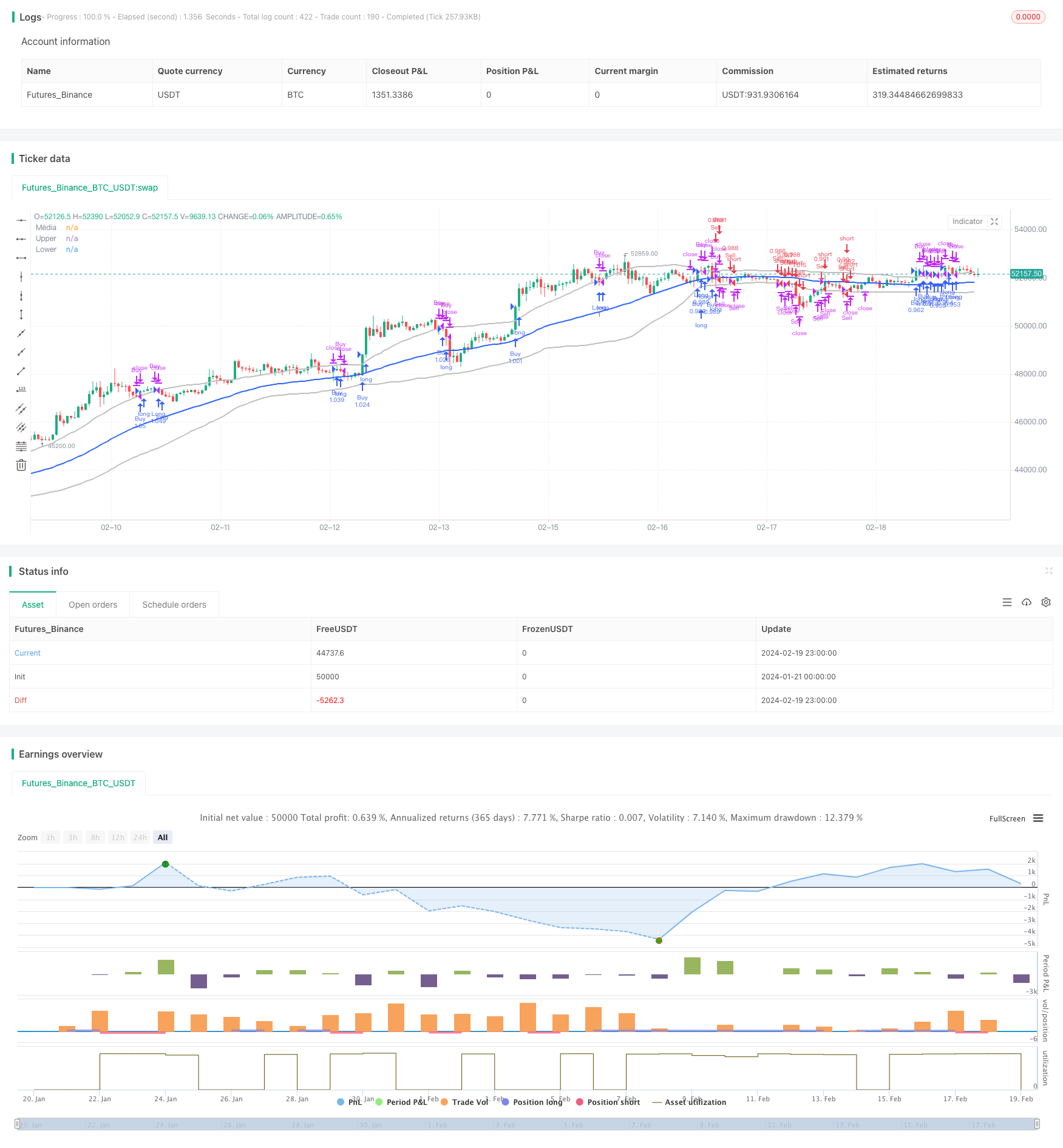

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("FFFDBTC", overlay=true,initial_capital = 100,commission_type =strategy.commission.percent,commission_value= 0.15,default_qty_value = 100,default_qty_type = strategy.percent_of_equity)

// === INPUT BACKTEST RANGE ===

FromMonth = input.int(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input.int(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input.int(defval=1972, title="From Year", minval=1972)

ToMonth = input.int(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input.int(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input.int(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

// Definindo tamanho da posição

position_size = strategy.equity

// Definir parâmetros das Bandas de Bollinger

length = input.int(51, "Comprimento")

mult = input.float(1.1, "Multiplicador")

// Calcular as Bandas de Bollinger

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// Definir condições de entrada e saída

entrada_na_venda = low < lower

saida_da_venda = high > lower and strategy.position_size < 0

entrada_na_compra = high > upper

saida_da_compra = low < upper and strategy.position_size > 0

shortCondition = close[1] < lower[1] and close > lower and close < basis

longCondition = close[1] > upper[1] and close < upper and close > basis

// Entrar na posição longa se a condição longCondition for verdadeira

if ((entrada_na_compra) and window() )

strategy.entry("Buy", strategy.long)

//saida da compra

if (saida_da_compra)

strategy.close("Buy")

//entrada na venda

if ((entrada_na_venda) and window() )

strategy.entry("Sell", strategy.short)

//saida da venda

if (saida_da_venda)

strategy.close("Sell")

if ((longCondition) and window())

strategy.entry("Long", strategy.long)

// Entrar na posição curta se a condição shortCondition for verdadeira

if ((shortCondition) and window())

strategy.entry("Short", strategy.short)

// Definir a saída da posição

strategy.exit("Exit_Long", "Long", stop=ta.sma(close, length), when = close >= basis)

strategy.exit("Exit_Short", "Short", stop=ta.sma(close, length), when = close <= basis)

// Desenhar as Bandas de Bollinger no gráfico

plot(basis, "Média", color=#2962FF, linewidth=2)

plot(upper, "Upper", color=#BEBEBE, linewidth=2)

plot(lower, "Lower", color=#BEBEBE, linewidth=2)