Overview

This strategy integrates multiple technical indicators. It looks for high probability reversal trading opportunities when the Bollinger Bands indicator generates price reversal signals, combined with judgments on market structure from RSI, ADX and ATR indicators.

Strategy Logic

Use 20-period Bollinger Bands and wait for reversal candlestick patterns when price reaches band highs or lows.

RSI indicator judges if the market is in ranging mode, with RSI above 60 indicating bullish range and below 40 bearish range.

ADX below 20 suggests ranging market, while above 20 suggests trending conditions.

ATR sets stop loss and trailing stop loss.

Additional filter from EMA lines.

Advantage Analysis

Multiple indicators combined provide high-probability trading signals.

Configurable parameters adapt to different market environments.

Strict stop loss rules effectively control risks.

Risk Analysis

Improper parameter settings may cause over-frequent trading.

Probability of reversal failure still exists.

Trailing stop loss may fail in certain markets.

Optimization Directions

Test more indicator combinations to find better parameter configurations.

Timely identify continuation reversal opportunities after initial failure.

Test different stop loss methods to make stops more intelligent.

Conclusion

This strategy uses Bollinger Bands for core trading signals, and multiple auxiliary indicators form a high-probability filtering system. The stop loss rules are also quite complete. Further performance improvement can be achieved through parameter tuning and indicator optimization. Overall, this strategy forms a reliable reversal trading system.

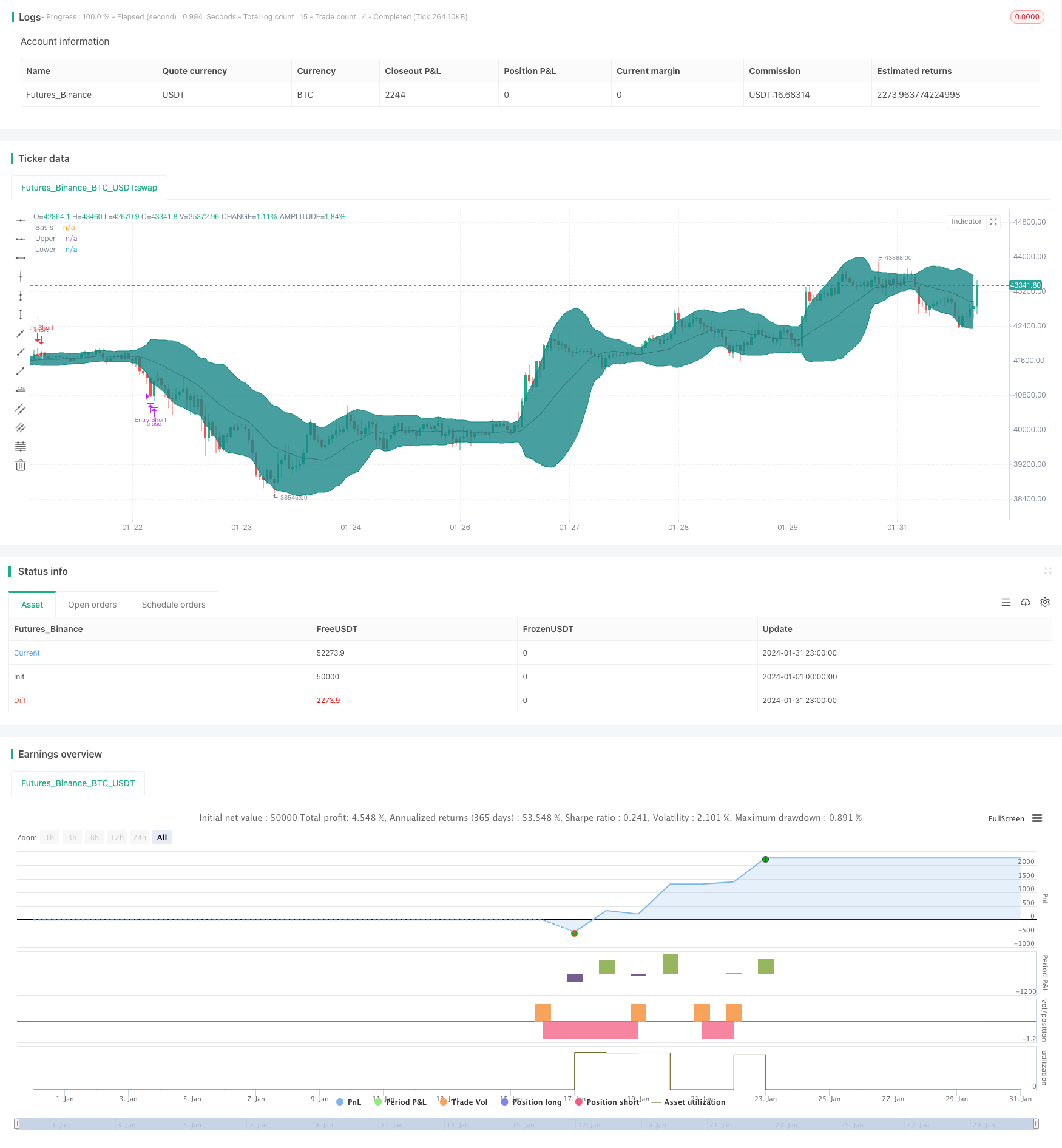

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(shorttitle="BB + EMA + RSI + ADX + ATR Reversal", title="Bollinger Bands Reversal", overlay=true)

// Inputs

ema1Input = input(title = "EMA1 Input", defval = 200, minval = 10, maxval = 400, step = 10, group = "Indicators")

ema2Input = input(title = "EMA2 Input", defval = 100, minval = 10, maxval = 400, step = 10, group = "Indicators")

length = input(title = "BB Length", defval = 20, minval=1, group = "Bollinger Band Indicator")

bbsrc = input(title = "BB Source", defval = close, group = "Bollinger Band Indicator")

mult = input(title = "BB Standard Deviation", type = input.float, defval = 2.0, minval=0.001, maxval=50, group = "Bollinger Band Indicator")

offset = input(title = "BB Offset", defval = 0, minval = -500, maxval = 500, group = "Bollinger Band Indicator")

rsilen = input(title = "RSI Length", defval = 14, minval=1, group = "RSI Indicator")

rsisrc = input(title = "RSI Source", defval = close, group = "RSI Indicator")

rsiMaxEntry = input(title = "RSI Maximum Value", defval = 60, minval = 50, maxval = 100, group = "RSI Indicator")

rsiMinEntry = input(title = "RSI Minimum Value", defval = 40, minval = 0, maxval = 50, group = "RSI Indicator")

rsiMaxExit = input(title = "RSI Max Exit Value", defval = 70, minval = 50, maxval = 100, group = "RSI Indicator")

rsiMinExit = input(title = "RSI Min Exit Value", defval = 30, minval = 0, maxval = 50, group = "RSI Indicator")

atrLength = input(title = "ATR Length", defval = 14, minval = 1, group = "ATR Indicator")

useStructure = input(title = "Use Trailing Stop?", type = input.bool, defval = true, group = "ATR Indicator")

atrlookback = input(title = "ATR Lookback Period", defval = 7, minval = 1, group = "ATR Indicator")

atrMultiplier = input(title = "ATR Multiplier", type = input.float, defval = 1.0, minval = 0.1, group = "ATR Indicator")

sigMaxValue = input(title = "ADX Max Value", type = input.float, defval = 20.0, minval = 0, maxval = 100, step = 0.1, group = "ADX Indicator")

adxlen = input(title = "ADX Smoothing", defval = 14, group = "ADX Indicator")

dilen = input(title = "DI Length", defval = 14, group = "ADX Indicator")

// Date input

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", minval = 1970, group = "Backtest Date Range")

inDataRange = true

// Built in Bollinger Band

basis = sma(bbsrc, length)

dev = mult * stdev(bbsrc, length)

upper = basis + dev

lower = basis - dev

// Built in RSI

up = rma(max(change(rsisrc), 0), rsilen)

down = rma(-min(change(rsisrc), 0), rsilen)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// Built in ADX

dirmov(len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

// Custom variables

ema1 = ema(close, ema1Input)

ema2 = ema(close, ema2Input)

atr = atr(atrLength)

// Entry and exit signals

CrossLongEntry = (close <= lower or close[1] <= lower[1]) and close > open and close[1] < open[1] and close > ema1 and close > ema2 and strategy.position_size == 0 and inDataRange and rsi > rsiMinEntry and rsi < rsiMaxEntry and sig < sigMaxValue

CrossShortEntry = (close >= upper or close[1] >= upper[1]) and close < open and close[1] > open[1] and close < ema1 and close < ema2 and strategy.position_size == 0 and inDataRange and rsi > rsiMinEntry and rsi < rsiMaxEntry and sig < sigMaxValue

CrossLongExit = (close >= upper or close[1] >= upper[1]) and close < open and close[1] > open[1] and strategy.position_size > 0 and inDataRange or rsi < rsiMinExit or rsi > rsiMaxExit

CrossShortExit = (close <= lower or close[1] <= lower[1]) and close > open and close[1] < open[1] and strategy.position_size < 0 and inDataRange or rsi < rsiMinExit or rsi > rsiMaxExit

// Determining the stop loss based on ATR

StopLossLong = (useStructure ? lowest(low, atrlookback) : close) - atr * atrMultiplier

StopLossShort = (useStructure ? highest(high, atrlookback) : close) + atr * atrMultiplier

// Custom variables used to store the stoploss value

var StopLong = 0.0

var StopShort = 0.0

// Telling my script to store the stoploss value in the corresponding variables

if CrossLongEntry

StopLong := StopLossLong

if CrossShortEntry

StopShort := StopLossShort

// Strategy

strategy.entry("Entry Long", strategy.long, when = CrossLongEntry, comment = "Entry Long")

strategy.close("Entry Long", when = CrossLongExit or close < StopLong, comment = "Long Exit")

strategy.entry("Entry Short", strategy.short, when = CrossShortEntry, comment = "Entry Short")

strategy.close("Entry Short", when = CrossShortExit or close > StopShort, comment = "Short Exit")

// Plots the Bollinger Band

plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upper, "Upper", color=color.teal, offset = offset)

p2 = plot(lower, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

// Use this if you want to see the stoploss visualised, be aware though plotting these can be confusing

// plot(StopLong)

// plot(StopShort)