Multi Timeframe RSI and Stochastics Strategy

Author: ChaoZhang, Date: 2024-02-21 15:56:37Tags:

Overview

The Multi Timeframe RSI and Stochastics Strategy is a strategy that combines RSI and Stochastics indicators across multiple timeframes to determine overbought and oversold conditions in the market. It utilizes the average values of RSI and Stochastics from 4 different timeframes to gauge overall market momentum and overextension. This allows it to harness the strengths of indicators across different timeframes.

Strategy Logic

1. RSI Indicator

The RSI indicator is a powerful oscillator that measures overbought and oversold levels based on the magnitude of recent price movements. RSI values fluctuate between 0 to 100, where values over 70 are considered overbought and under 30 oversold.

This strategy uses a 14-period RSI and obtains RSI values from the monthly, daily, 4-hour and 1-hour timeframes.

2. Stochastics %K

Stochastics %K is an indicator that shows overbought/oversold levels in the market on a scale of 0 to 100. Generally, values above 80 indicate an overbought market while values below 20 signal an oversold market.

The strategy uses a 14,3 Stochastics configuration and likewise obtains %K values from the aforementioned timeframes.

3. Average Value Combination

The crux of the strategy lies in taking an average of the two indicators across the multiple timeframes. This allows it to tap on the strengths of each timeframe when gauging overall market conditions. The exact formulas are:

RSI Average = (Monthly RSI + Daily RSI + 4H RSI + 1H RSI) / 4

Stochastics Average = (Monthly Stochastics + Daily Stochastics + 4H Stochastics + 1H Stochastics) / 4

4. Trade Signals

The strategy triggers a long when the RSI average falls below 30 and Stochastics average goes below 20. It triggers a short when the RSI average rises above 70 and Stochastics average breaches 80.

The long position is closed when Stochastics average rises above 70 and RSI average climbs over 50. The short position is closed when Stochastics average dips below 30 and RSI average drops under 50.

Advantage Analysis

The key advantage of this strategy lies in the combination of two indicators across multiple timeframes. This greatly enhances the reliability of trade signals and minimizes false signals. Specific advantages include:

RSI and Stochastics verify each other as signals. Relying solely on one indicator tends to generate false signals more frequently. The dual indicator approach promotes accuracy.

Multiple timeframes lead to more robust analysis. For instance, the monthly and daily timeframes show an overbought market but the smaller timeframes have yet to reach overextension levels. This suggests an uptrend is likely to continue. Signals are more reliable when all timeframes agree.

Clearer identification of structural turning points when multiple timeframes concurrently show a break of key S/R levels, signaling a trend reversal.

Auto-computation of averages simplifies the workflow. No manual calculation needed as the code handles data retrieval, indicator computation and averaging automatically.

Risk Analysis

As with all technical analysis strategies, the core risk lies in whipsaws and false signals. Key risks include:

Trend reversals leading to being stopped out. For instance, prices make a short term breach below support before rebounding while long. Such cases may incur short term losses due to the exit logic.

Invalidation of key S/R leading to failed trailing stops. A break of major S/R levels can directly trigger stops designed below them, resulting in above average losses.

Incorrect judgments from suboptimal timeframe configurations. Overssmoothed or undersmoothed timeframes may provide misleading oscillator values.

Divergence across timeframes causing a Dunkirk effect. Where higher timeframes show an overbought market but lower timeframes signal oversold conditions, rendering averages ineffective.

Solutions involve optimizing stop loss strategies, tracking dynamic S/R levels, adjusting timeframe parameters and adding additional filters.

Enhancement Opportunities

In view of the discussed risks, enhancement opportunities include:

Optimizing the stop loss mechanism to incorporate trailing stops and partial exits. This locks in profits while controlling single trade risks.

Adding higher timeframes like the quarterly chart. This allows larger trend guidance to filter false signals. Prioritize readings from higher timeframes when divergence occurs.

Incorporating volume for additional trend validation via bull/bear divergences to avoid zombie trends.

Fine-tuning entry signals by awaiting breakouts around key historic S/R or allowing for optimal pullback entries.

Implementing adaptive stops based on recent volatility and ATR values for dynamic stop positioning.

Conclusion

The Multi Timeframe RSI and Stochastics Strategy is a clear, reliable approach that uses a combination of RSI and Stochastics across multiple timeframes to identify overbought/oversold levels. Its biggest strength lies in the mutual verification of indicators and timeframes to minimize whipsaw and false signal risks. Nonetheless like all technical strategies, it faces inherent risks that need to be addressed via stop loss optimization, timeframe selections etc to refine it into a stable automated trading strategy.

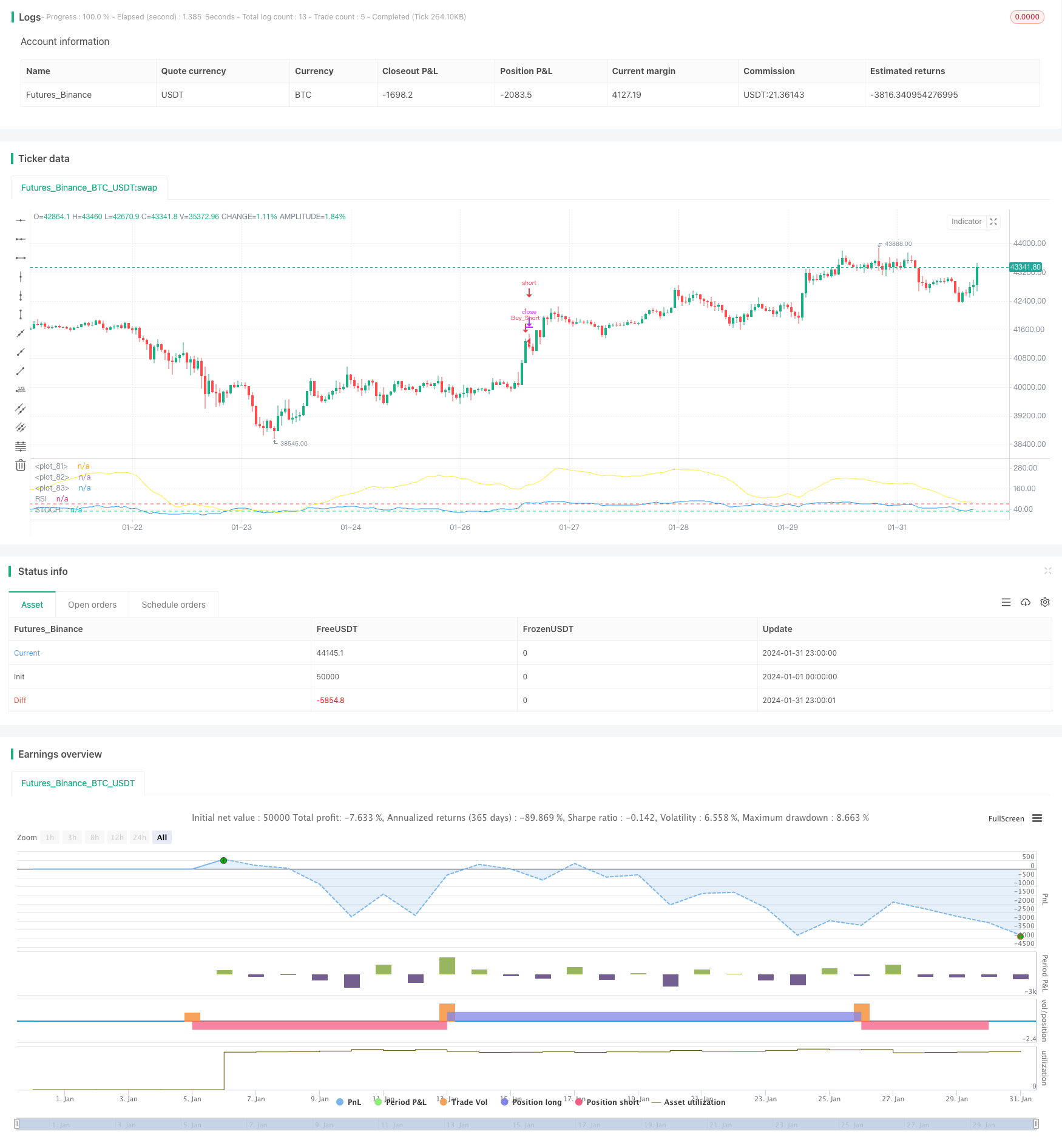

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////// MTF Stochastic & RSI Strategy 🚥 ©️ bykzis /////////////////////////////////////////

//

// *** Inspired by "Binance CHOP Dashboard" from @Cazimiro and "RSI MTF Table" from @mobester16 *** and LOT OF COPY of Indicator-Jones MTF Scanner

//

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

//@version=5

strategy('MTF RSI & STOCH Strategy🚥 by kzi', overlay=false,initial_capital=100, currency=currency.USD, commission_value=0.01, commission_type=strategy.commission.percent)

// Pair list

var string GRP1 = '══════════ General ══════════'

overbought = input.int(80, 'Overbought Level', minval=1, group=GRP1)

oversold = input.int(20, 'Oversold Level', minval=1, group=GRP1)

/// Timeframes

var string GRP2 = '══════════ Timeframes ══════════'

timeframe1 = input.timeframe(title="Timeframe 1", defval="W", group=GRP2)

timeframe2 = input.timeframe(title="Timeframe 2", defval="D", group=GRP2)

timeframe3 = input.timeframe(title="Timeframe 3", defval="240", group=GRP2)

timeframe4 = input.timeframe(title="Timeframe 4", defval="60", group=GRP2)

// RSI settings

var string GRP3 = '══════════ RSI settings ══════════'

rsiLength = input.int(14, minval=1, title='RSI length', group=GRP3)

rsiSource = input(close, 'RSI Source', group=GRP3)

rsioverbought = input.int(70, 'RSI Overbought Level', minval=1, group=GRP3)

rsioversold = input.int(30, 'RSI Oversold Level', minval=1, group=GRP3)

/// Get RSI values of each timeframe /////////////////////////////////////////////////////

rsi = ta.rsi(rsiSource, rsiLength)

callRSI(id,timeframe) =>

rsiValue = request.security(id, str.tostring(timeframe), rsi, gaps=barmerge.gaps_off)

rsiValue

RSI_TF1 = callRSI(syminfo.tickerid, timeframe1)

RSI_TF2 = callRSI(syminfo.tickerid, timeframe2)

RSI_TF3 = callRSI(syminfo.tickerid, timeframe3)

RSI_TF4 = callRSI(syminfo.tickerid, timeframe4)

/////// Calculate Averages /////////////////////////////////////////////////////////////////

calcAVG(valueTF1, valueTF2, valueTF3, valueTF4) =>

math.round((valueTF1 + valueTF2 + valueTF3 + valueTF4) / 4, 2)

AVG=calcAVG(RSI_TF1, RSI_TF2, RSI_TF3, RSI_TF4)

// Stochastic settings

var string GRP4 = '══════════ Stochastic settings ══════════'

periodK = input.int(14, '%K length', minval=1, group=GRP4)

smoothK = input.int(3, 'Smooth K', minval=1, group=GRP4)

stochSource = input(close, 'Stochastic Source', group=GRP4)

stochoverbought = input.int(70, 'Stochastic Overbought Level', minval=1, group=GRP4)

stochoversold = input.int(30, 'Stochastic Oversold Level', minval=1, group=GRP4)

/// Get Stochastic values of each timeframe ////////////////////////////////////////////////

stoch = ta.sma(ta.stoch(stochSource, high, low, periodK), smoothK)

getStochastic(id,timeframe) =>

stochValue = request.security(id, str.tostring(timeframe), stoch, gaps=barmerge.gaps_off)

stochValue

Stoch_TF1 = getStochastic(syminfo.tickerid, timeframe1)

Stoch_TF2 = getStochastic(syminfo.tickerid, timeframe2)

Stoch_TF3 = getStochastic(syminfo.tickerid, timeframe3)

Stoch_TF4 = getStochastic(syminfo.tickerid, timeframe4)

AVG_STOCH=calcAVG(Stoch_TF1, Stoch_TF2, Stoch_TF3, Stoch_TF4)

plot(AVG, color = color.blue, title='RSI')

plot(AVG_STOCH, color = color.yellow,title='STOCH')

hline(rsioverbought,color=color.red)

hline(rsioversold, color=color.lime)

hline(50, color=color.white)

//============ signal Generator ==================================//

if AVG <= rsioversold and AVG_STOCH <=stochoversold

strategy.entry('Buy_Long', strategy.long)

strategy.close("Buy_Long",when=(AVG_STOCH >=70 and AVG >=50 and close >=strategy.position_avg_price),comment="Long_OK")

if AVG >=rsioverbought and AVG_STOCH >=stochoverbought

strategy.entry('Buy_Short', strategy.short)

strategy.close("Buy_Short",when=(AVG_STOCH <=30 and AVG <=50 and close <=strategy.position_avg_price),comment="Short_OK")

///////////////////////////////////////////////////////////////////////////////////////////

- Bollinger Bands Consolidation Strategy

- Cloud-based Trend Strategy Using Ichimoku Cloud

- Trend Reversal Strategy Based on Moving Averages

- Trend Following Strategy Based on Renko Moving Average

- Three RSI Moving Average Bands Strategy

- Bidirectional Trading Strategy Based on Moon Phases

- Reversal Trading Strategy with EMA Crossover and Bollinger Bands

- Adaptive Moving Stop Line Trading Strategy

- Recursive Moving Trend Average Combined with 123 Reversal Pattern Strategy

- Multi Timeframe Moving Average and EMA Based Trend Strategy

- Enhanced Moving Average Crossover Sakkoulas Trading Strategy

- Simple Moving Average Crossover Strategy

- Donchian Adaptive Moving Average Trading System

- Volume Weighted Trend Reversal Strategy

- Trading Strategy Based on Multiple Time Frame EMA Breakthrough and K-line Pattern Combination

- Trend Following Strategy with Stop Loss and Take Profit

- Dynamic Position Sizing Quant Strategy

- Buy Strategy Based on Close Price Breakthrough

- Dual Moving Average Strategy

- Breakout Bollinger Bands Oscillation Trading Strategy