Multi Timeframe Moving Average and EMA Based Trend Strategy

Author: ChaoZhang, Date: 2024-02-21 15:59:43Tags:

Overview

This strategy utilizes moving averages (MA) and EMA across different timeframes to identify and trade trends. By combining SMA, EMA of various periods, as well as candlestick bodies, it can effectively filter market noise and trade intermediate to long term trends with low risk.

Strategy Logic

The core idea is based on comparison of 3 SMAs of different periods to determine price momentum. Additionally, EMA is used to check if candle body is pointing up.

Specifically, the strategy employs 3 SMAs - 3-, 8-, and 10-period SMA. When price is below all 3 SMAs, it is considered a downtrend. Long signal triggers when price crosses back above the SMAs.

Also, a 5-period EMA checks if the candle body is pointing up before entering long trades.

For exit rules, maximum number of profitable closes or maximum duration is used as stop loss mechanism.

Advantage Analysis

By combining MAs of various timeframes, this strategy can effectively filter market noise and capture intermediate to long term trends. Optimized parameters allow decent performance in historical backtests.

Using EMA to check candle body direction reduces unnecessary slippage from buying into falling candles.

Overall this is a stable and reliable system suitable for trend following over weeks to months.

Risks and Mitigations

The strategy is sensitive to parameters. Suboptimal choice of 3 SMA or 1 EMA periods can deteriorate signal quality. Parameters need to be optimized for different instruments.

Gap risk is not handled. Sudden fundamental news that gap prices could cause losses. Price stop loss can help mitigate such risks.

Enhancement Opportunities

More timeframes of MAs or EMAs can be added to further improve trend accuracy.

Moderate price stop loss can be tested to lock in profits while reducing losses in extreme moves.

Machine learning can dynamically optimize parameters to adapt to evolving market conditions.

Conclusion

The strategy is robust and reliable overall, using MA crossovers to determine trend supplemented by EMA filter. Further parameter optimization and prudent risk controls can enhance win rate and profitability. Worthy of further research and application.

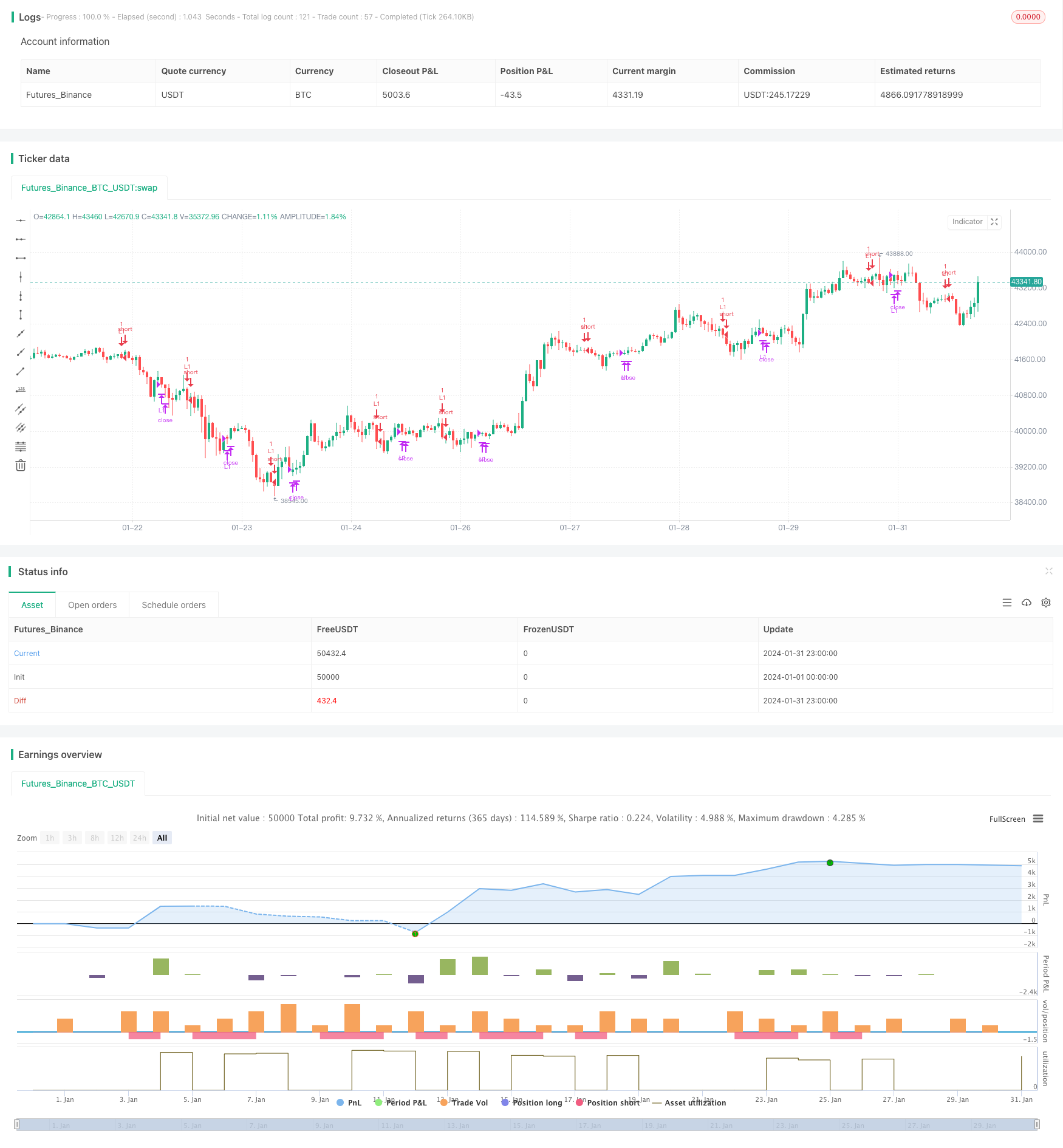

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Free Strategy #02 (ES / SPY)", overlay=true)

// Inputs

Quantity = input(1, minval=1, title="Quantity")

SmaPeriod01 = input(3, minval=1, title="SMA Period 01")

SmaPeriod02 = input(8, minval=1, title="SMA Period 02")

SmaPeriod03 = input(10, minval=1, title="SMA Period 03")

EmaPeriod01 = input(5, minval=1, title="EMA Period 01")

MaxProfitCloses = input(5, minval=1, title="Max Profit Close")

MaxBars = input(10, minval=1, title="Max Total Bars")

// Misc Variables

src = close

BarsSinceEntry = 0

MaxProfitCount = 0

Sma01 = sma(close, SmaPeriod01)

Sma02 = sma(close, SmaPeriod02)

Sma03 = sma(close, SmaPeriod03)

Ema01 = ema(close, EmaPeriod01)

// Conditions

Cond00 = strategy.position_size == 0

Cond01 = close < Sma03

Cond02 = close <= Sma01

Cond03 = close[1] > Sma01[1]

Cond04 = open > Ema01

Cond05 = Sma02 < Sma02[1]

// Update Exit Variables

BarsSinceEntry := Cond00 ? 0 : nz(BarsSinceEntry[1]) + 1

MaxProfitCount := Cond00 ? 0 : (close > strategy.position_avg_price and BarsSinceEntry > 1) ? nz(MaxProfitCount[1]) + 1 : nz(MaxProfitCount[1])

// Entries

strategy.entry(id="L1", long=true, qty=Quantity, when=(Cond00 and Cond01 and Cond02 and Cond03 and Cond04 and Cond05))

// Exits

strategy.close("L1", (BarsSinceEntry - 1 >= MaxBars or MaxProfitCount >= MaxProfitCloses))

- Bi-directional Reversal Quantitative Trading Strategy

- Bollinger Bands Consolidation Strategy

- Cloud-based Trend Strategy Using Ichimoku Cloud

- Trend Reversal Strategy Based on Moving Averages

- Trend Following Strategy Based on Renko Moving Average

- Three RSI Moving Average Bands Strategy

- Bidirectional Trading Strategy Based on Moon Phases

- Reversal Trading Strategy with EMA Crossover and Bollinger Bands

- Adaptive Moving Stop Line Trading Strategy

- Recursive Moving Trend Average Combined with 123 Reversal Pattern Strategy

- Multi Timeframe RSI and Stochastics Strategy

- Enhanced Moving Average Crossover Sakkoulas Trading Strategy

- Simple Moving Average Crossover Strategy

- Donchian Adaptive Moving Average Trading System

- Volume Weighted Trend Reversal Strategy

- Trading Strategy Based on Multiple Time Frame EMA Breakthrough and K-line Pattern Combination

- Trend Following Strategy with Stop Loss and Take Profit

- Dynamic Position Sizing Quant Strategy

- Buy Strategy Based on Close Price Breakthrough

- Dual Moving Average Strategy