Overview

This strategy is an improvement of traditional moving average strategies, using Ichimoku Cloud indicator to help determine bullish and bearish bias. It identifies potential trend reversal points through price breakouts and moving average crossovers, enabling the capture of low-risk trading opportunities.

Strategy Logic

The Ichimoku Cloud consists of the tenkan line, kijun line, chikou line and senkou lines. Golden cross and dead cross signals are generated when the tenkan line crosses over or under the kijun line. Price breakouts of the Cloud act as entry signals, while the kijun and senkou lines that form the Cloud act as stop loss lines.

Specifically, the long entry signal is triggered when the tenkan line crosses over the kijun line and the price breaks above the top of the Cloud. After entering long, if the price breaks below the bottom of the Cloud, the position will be stopped out. The short entry and stop loss rules are similar.

Advantages

Compared with traditional moving average strategies, this strategy has the following advantages:

- Ichimoku Cloud combines price action to avoid false breakout signals

- The Cloud acts as an adaptive stop loss to control risk

- Parameters can be tuned for different timeframes and market regimes

Risk Analysis

The main risks of this strategy include:

- Trend reversal risk. Price may revert after breakout entry signal.

- False breakout signal risk. Short term pullbacks may generate erroneous signals.

- Parameter optimization risk. Different parameters suit different timeframes.

Solutions:

- Employ adaptive stop loss and partial profit taking

- Reference higher timeframe context to avoid noise

- Robust parameter optimization through backtesting

Enhancement Opportunities

This strategy can be further improved by:

- Incorporating machine learning to determine breakout credibility

- Implementing adaptive stops that automatically adjust stop distance

- Parameter optimization to find optimal combinations

Conclusion

In conclusion, this is an overall reliable, low-risk trend following strategy. By incorporating Ichimoku Cloud on top of moving averages, it helps filter out some false signals. The Cloud stop loss also makes it robust in terms of risk management. Further optimizations may lead to more consistent alpha generation.

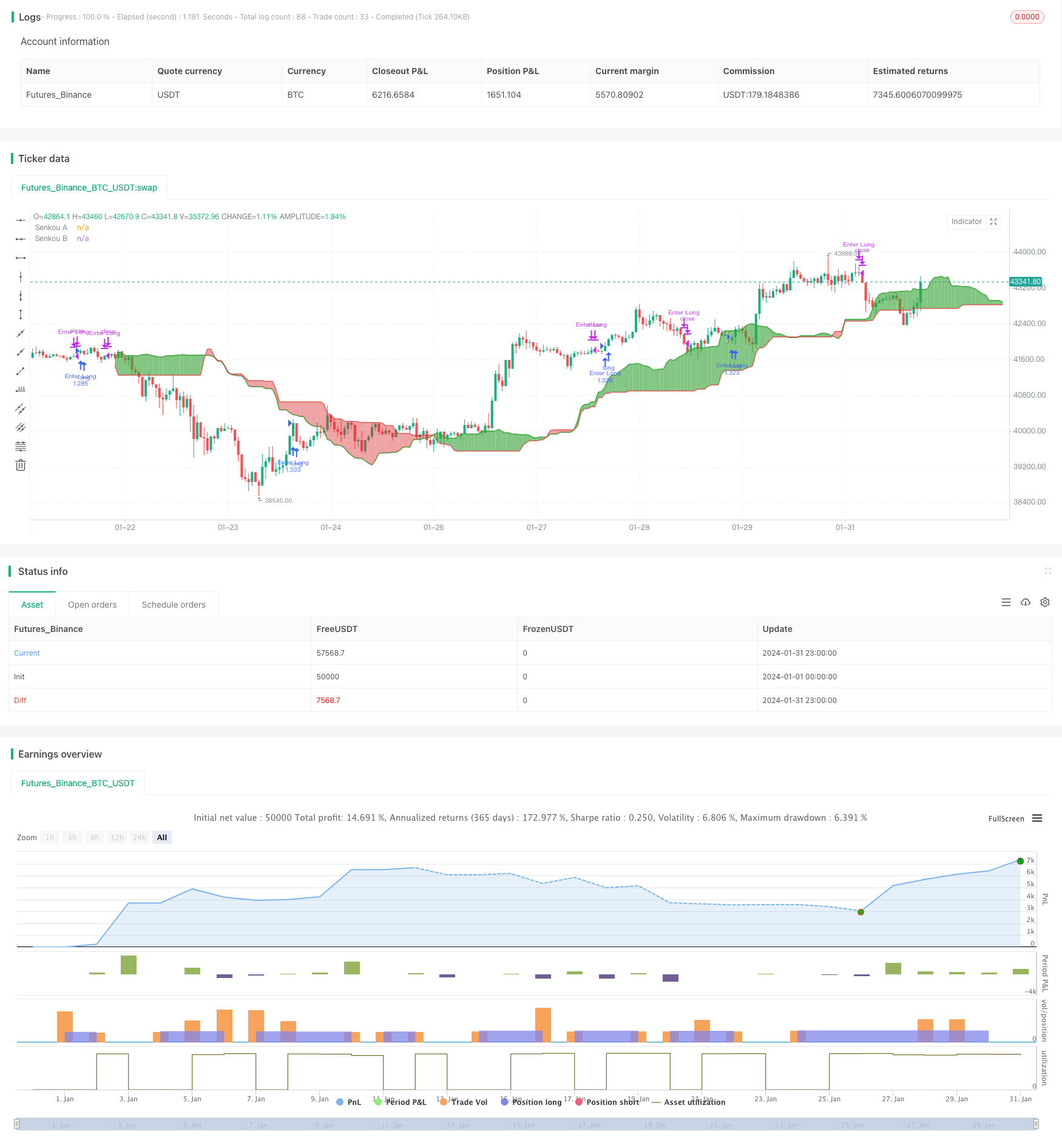

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// -----------------------------------------------------------------------------

// Copyright © 2024 Skyrex, LLC. All rights reserved.

// -----------------------------------------------------------------------------

// Version: v2

// Release: Jan 19, 2024

strategy(title = "Advanced Ichimoku Clouds Strategy Long and Short",

shorttitle = "Ichimoku Strategy Long and Short",

overlay = true,

format = format.inherit,

pyramiding = 1,

calc_on_order_fills = false,

calc_on_every_tick = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0)

// Trading Period Settings

lookBackPeriodStart = input(title="Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "Trading Period")

lookBackPeriodStop = input(title="Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "Trading Period")

// Trading Mode

tradingMode = input.string("Long", "Trading Mode", options = ["Long", "Short"], group = "Position side")

// Long Mode Signal Options

entrySignalOptionsLong = input.string("Bullish All", "Select Entry Signal (Long)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

exitSignalOptionsLong = input.string("Bearish Weak", "Select Exit Signal (Long)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

// Short Mode Signal Options

entrySignalOptionsShort = input.string("None", "Select Entry Signal (Short)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

exitSignalOptionsShort = input.string("None", "Select Exit Signal (Short)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

// Risk Management Settings

takeProfitPct = input.float(7, "Take Profit, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

stopLossPct = input.float(3.5, "Stop Loss, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

// Indicator Settings

tenkanPeriods = input.int(9, "Tenkan", minval=1, group="Indicator Settings")

kijunPeriods = input.int(26, "Kijun", minval=1, group="Indicator Settings")

chikouPeriods = input.int(52, "Chikou", minval=1, group="Indicator Settings")

displacement = input.int(26, "Offset", minval=1, group="Indicator Settings")

// Display Settings

showTenkan = input(false, "Show Tenkan Line", group = "Display Settings")

showKijun = input(false, "Show Kijun Line", group = "Display Settings")

showSenkouA = input(true, "Show Senkou A Line", group = "Display Settings")

showSenkouB = input(true, "Show Senkou B Line", group = "Display Settings")

showChikou = input(false, "Show Chikou Line", group = "Display Settings")

// Function to convert percentage to price points based on entry price

pctToPoints(pct) =>

strategy.position_avg_price * pct / 100

// Colors and Transparency Level

transparencyLevel = 90

colorGreen = color.new(#36a336, 23)

colorRed = color.new(#d82727, 47)

colorTenkanViolet = color.new(#9400D3, 0)

colorKijun = color.new(#fdd8a0, 0)

colorLime = color.new(#006400, 0)

colorMaroon = color.new(#8b0000, 0)

colorGreenTransparent = color.new(colorGreen, transparencyLevel)

colorRedTransparent = color.new(colorRed, transparencyLevel)

// Ichimoku Calculations

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = math.avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement - 1]

displacedSenkouB = senkouB[displacement - 1]

// Plot Ichimoku Lines

plot(showTenkan ? tenkan : na, color=colorTenkanViolet, title = "Tenkan", linewidth=2)

plot(showKijun ? kijun : na, color=colorKijun, title = "Kijun", linewidth=2)

plot(showChikou ? close : na, offset=-displacement, color = colorLime, title = "Chikou", linewidth=1)

p1 = plot(showSenkouA ? senkouA : na, offset=displacement - 1, color=colorGreen, title = "Senkou A", linewidth=2)

p2 = plot(showSenkouB ? senkouB : na, offset=displacement - 1, color=colorRed, title = "Senkou B", linewidth=2)

fill(p1, p2, color=senkouA > senkouB ? colorGreenTransparent : colorRedTransparent)

// Signal Calculations

bullishSignal = ta.crossover(tenkan, kijun)

bearishSignal = ta.crossunder(tenkan, kijun)

bullishSignalValues = bullishSignal ? tenkan : na

bearishSignalValues = bearishSignal ? tenkan : na

strongBullishSignal = bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB

neutralBullishSignal = ((bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB))

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB

neutralBearishSignal = ((bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB))

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

// Functions to determine entry and exit conditions for Long and Short

isEntrySignalLong() =>

entryCondition = false

if entrySignalOptionsLong == "None"

entryCondition := false

else if entrySignalOptionsLong == "Bullish Strong"

entryCondition := strongBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral"

entryCondition := neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Weak"

entryCondition := weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Neutral"

entryCondition := strongBullishSignal or neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral and Weak"

entryCondition := neutralBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Weak"

entryCondition := strongBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish All"

entryCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

entryCondition

isExitSignalLong() =>

exitCondition = false

if exitSignalOptionsLong == "None"

exitCondition := false

else if exitSignalOptionsLong == "Bearish Strong"

exitCondition := strongBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral"

exitCondition := neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Weak"

exitCondition := weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Neutral"

exitCondition := strongBearishSignal or neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral and Weak"

exitCondition := neutralBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Weak"

exitCondition := strongBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish All"

exitCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

exitCondition

isEntrySignalShort() =>

entryCondition = false

if entrySignalOptionsShort == "None"

entryCondition := false

else if entrySignalOptionsShort == "Bearish Strong"

entryCondition := strongBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral"

entryCondition := neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Weak"

entryCondition := weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Neutral"

entryCondition := strongBearishSignal or neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral and Weak"

entryCondition := neutralBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Weak"

entryCondition := strongBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish All"

entryCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

entryCondition

isExitSignalShort() =>

exitCondition = false

if exitSignalOptionsShort == "None"

exitCondition := false

else if exitSignalOptionsShort == "Bullish Strong"

exitCondition := strongBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral"

exitCondition := neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Weak"

exitCondition := weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Neutral"

exitCondition := strongBullishSignal or neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral and Weak"

exitCondition := neutralBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Weak"

exitCondition := strongBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish All"

exitCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

exitCondition

// Strategy logic for entries and exits

if true

if tradingMode == "Long"

takeProfitLevelLong = strategy.position_avg_price * (1 + takeProfitPct / 100)

stopLossLevelLong = strategy.position_avg_price * (1 - stopLossPct / 100)

if isEntrySignalLong()

strategy.entry("Enter Long", strategy.long)

if (takeProfitPct > 0 and close >= takeProfitLevelLong) or (stopLossPct > 0 and close <= stopLossLevelLong) or (exitSignalOptionsLong != "None" and isExitSignalLong())

strategy.close("Enter Long", comment="Exit Long")

else if tradingMode == "Short"

takeProfitLevelShort = strategy.position_avg_price * (1 - takeProfitPct / 100)

stopLossLevelShort = strategy.position_avg_price * (1 + stopLossPct / 100)

if isEntrySignalShort()

strategy.entry("Enter Short", strategy.short)

if (takeProfitPct > 0 and close <= takeProfitLevelShort) or (stopLossPct > 0 and close >= stopLossLevelShort) or (exitSignalOptionsShort != "None" and isExitSignalShort())

strategy.close("Enter Short", comment="Exit Short")