Overview

The Dual Moving Average Crossover Strategy with Stop Loss and Take Profit is a trend following strategy. It uses the golden cross and death cross of the two moving averages K and D lines from the Stochastic indicator to determine entry and exit signals. It also utilizes stop loss and take profit to control risks.

Strategy Logic

The core indicators of this strategy are the fast line K and slow line D of the Stochastic. The fast line K is the 3-period simple moving average of the raw Stochastic values. The slow line D is the 3-period simple moving average of the fast line K. When K line crosses above D line, a golden cross is generated, indicating an uptrend and long entry. When K line crosses below D line, a death cross is generated, indicating a downtrend and short entry.

In addition, this strategy sets a condition that trading signals are only triggered when the Stochastic value is within oversold territory (below 20) or overbought territory (above 80). This helps filter out some false signals.

After entering the market, this strategy uses stop loss and take profit to control risks. The take profit is set at 120 ticks away from entry price and stop loss is 60 ticks away from entry price. When price hits either level, the position will be closed.

Advantages

- Utilize Stochastic indicator to determine trend direction accurately

- Oversold and overbought condition filters out false signals

- Stop loss and take profit limits single trade loss and controls overall risk

Risks

- Stochastic may generate false signals during range-bound markets

- Fixed stop loss and take profit fails to adapt dynamic market changes

- Unable to limit maximum drawdown

Risk Solutions:

- Add other indicators like MACD, KDJ for combo confirmation

- Set dynamic stop loss and take profit levels

- Add maximum drawdown exit mechanism

Optimization Directions

- Combine with MACD, KDJ etc. to improve signal accuracy

- Set dynamic stop loss/take profit base on ATR

- Add maximum drawdown exit criteria

- Optimize stop loss/take profit coefficients for best parameters

Summary

The Dual Moving Average Crossover Strategy with Stop Loss and Take Profit is a simple and practical trend following strategy. It uses Stochastic’s dual moving average system for entry timing and stop loss/take profit for risk control. This effective and easy-to-implement strategy is suitable for algorithmic trading. Further optimizations can turn it into a stable profitable trading strategy.

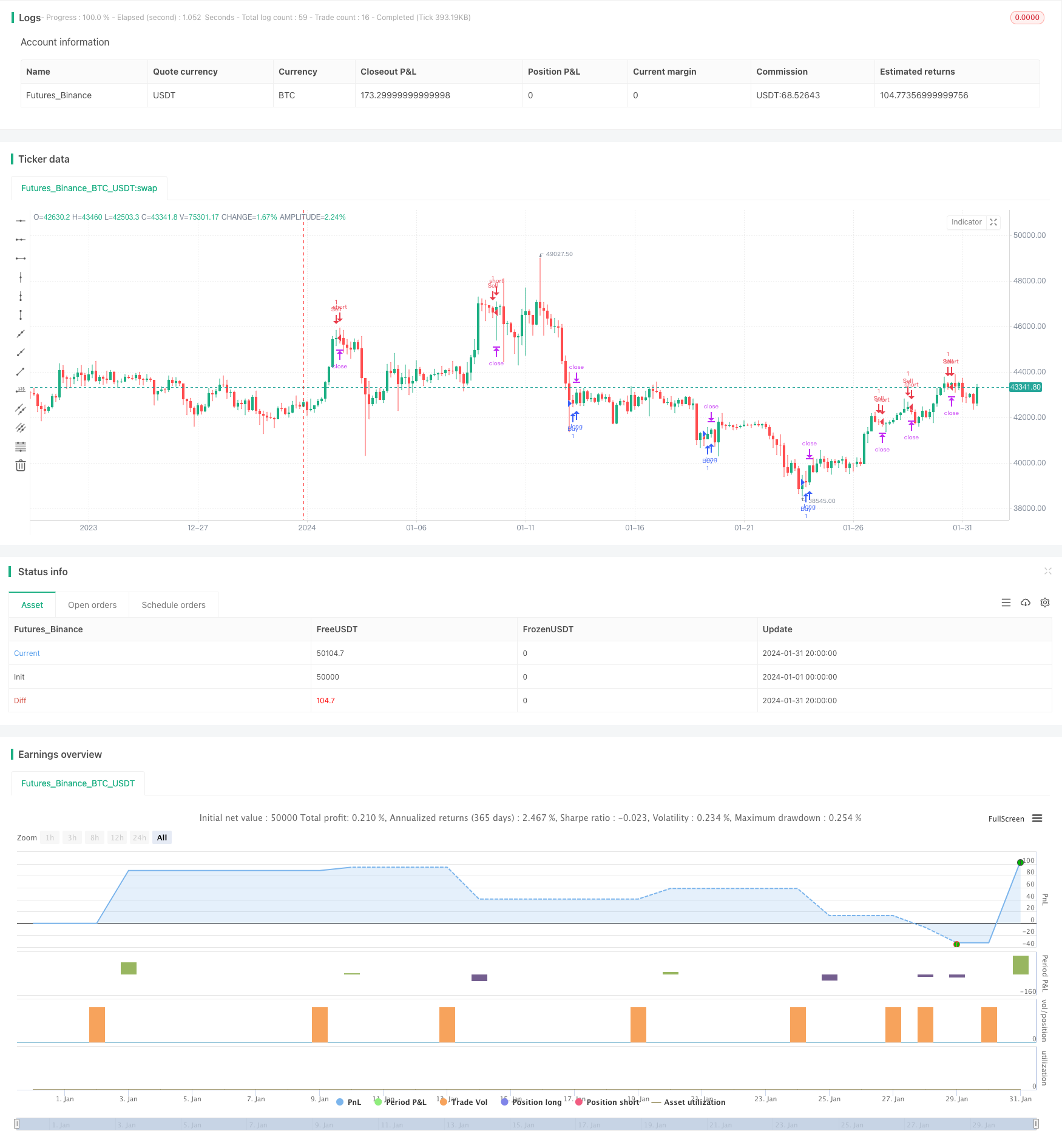

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Strategy alerts workaround", overlay=true)

// disclaimer: this content is purely educational, especially please don't pay attention to backtest results on any timeframe/ticker

// Entries logic: based on Stochastic crossover

k = ta.sma(ta.stoch(close, high, low, 14), 3)

d = ta.sma(k, 3)

crossover = ta.crossover(k,d)

crossunder = ta.crossunder(k,d)

if (crossover and k < 20)

strategy.entry("Buy", strategy.long, alert_message="buy")

if (crossunder and k > 80)

strategy.entry("Sell", strategy.short, alert_message="sell")

// StopLoss / TakeProfit exits:

SL = input.int(60, title="StopLoss Distance from entry price (in Ticks)")

TP = input.int(120, title="TakeProfit Distance from entry price (in Ticks)")

strategy.exit("xl", from_entry="Buy", loss=SL, profit=TP, alert_message="closebuy")

strategy.exit("xs", from_entry="Sell", loss=SL, profit=TP, alert_message="closesell")

// logical conditions exits:

if (crossunder and k <= 80)

strategy.close("Buy", alert_message="closebuy")

if (crossover and k >= 20)

strategy.close("Sell", alert_message="closesell")