Overview

The Marubozu candle range balance strategy is an intraday quantitative trading strategy. It identifies Marubozu candle patterns and examines the balance of candle ranges to determine market trends and find trading opportunities.

Strategy Principle

The core logic of this strategy is based on the following points:

Identify Marubozu white bullish and black bearish candles. Marubozu candles are special candlestick patterns with no shadows between the open and close prices, divided into white bullish and black bearish types.

Calculate the average candle body range and compare it with the current candle body range to determine whether the range is long or short.

Determine whether the candle ranges are balanced, that is, whether the upper shadow and lower shadow lengths are roughly equal.

Go long when a Marubozu white bullish candle is identified; Go short when a Marubozu black bearish candle is identified.

Use the closing prices of the previous two candles to determine trend reversal as the exit signal.

The strategy relies mainly on the strong one-sided trend signals provided by the Marubozu candles themselves and the balanced range conditions to determine long and short opportunities. When a Marubozu candle is identified, it indicates that the market has a strong one-sided trend. The balanced range situation also confirms the reliability of this trend. Exit positions in a timely manner when the strong trend reverses to capture the trend profit.

Advantage Analysis

The Marubozu candle range balance strategy has the following advantages:

Identify high-probability strong trends. Marubozu candles themselves provide extremely explosive one-sided price signals.

Balanced range effectively filters false breakouts and avoids traps. When the range is imbalanced, it indicates potential risks of false breakout and will skip the trading signal.

Using the previous two candles to determine trend reversal can capture profits from the trend in a timely manner.

The strategy is simple and clear, easy to understand and implement, suitable for beginners.

Can be used on any products and timeframes, with strong applicability.

Risk Analysis

The strategy also has the following risks:

Inability to effectively filter whipsaw markets, with higher risks of false signals and traps in range-bound trends. Can be mitigated by adjusting parameters to shorten holding period or increase stop loss.

Reliance on parameter settings. Different parameters can lead to significantly different results. Parameters can be optimized through backtesting.

Inability to identify secondary strong trends, relying solely on extreme Marubozu candles for judgements, thus missing secondary opportunity. Can be improved by relaxing balanced range requirements.

Strategy Optimization

The strategy can be optimized in the following aspects:

Optimize the threshold percentage of Marubozu determination to adjust identification sensitivity.

Optimize balanced threshold parameters to identify more balanced or imbalanced balanced patterns.

Add close price vs moving average comparison as an auxiliary judgement indicator.

Add indicators to determine surges in trading volume.

Relax balanced range requirements to identify more secondary strong Marubozu opportunities.

Conclusion

The Marubozu candle range balance strategy identifies high-probability one-sided trend opportunities by recognizing specific candle patterns coupled with balanced judgements. The strategy is simple and clear with high win rate. It is suitable for both beginners to learn and advanced traders to find potential opportunities. Further improvements can be made through signal and parameter optimizations. Overall it is a very practical intraday quantitative strategy.

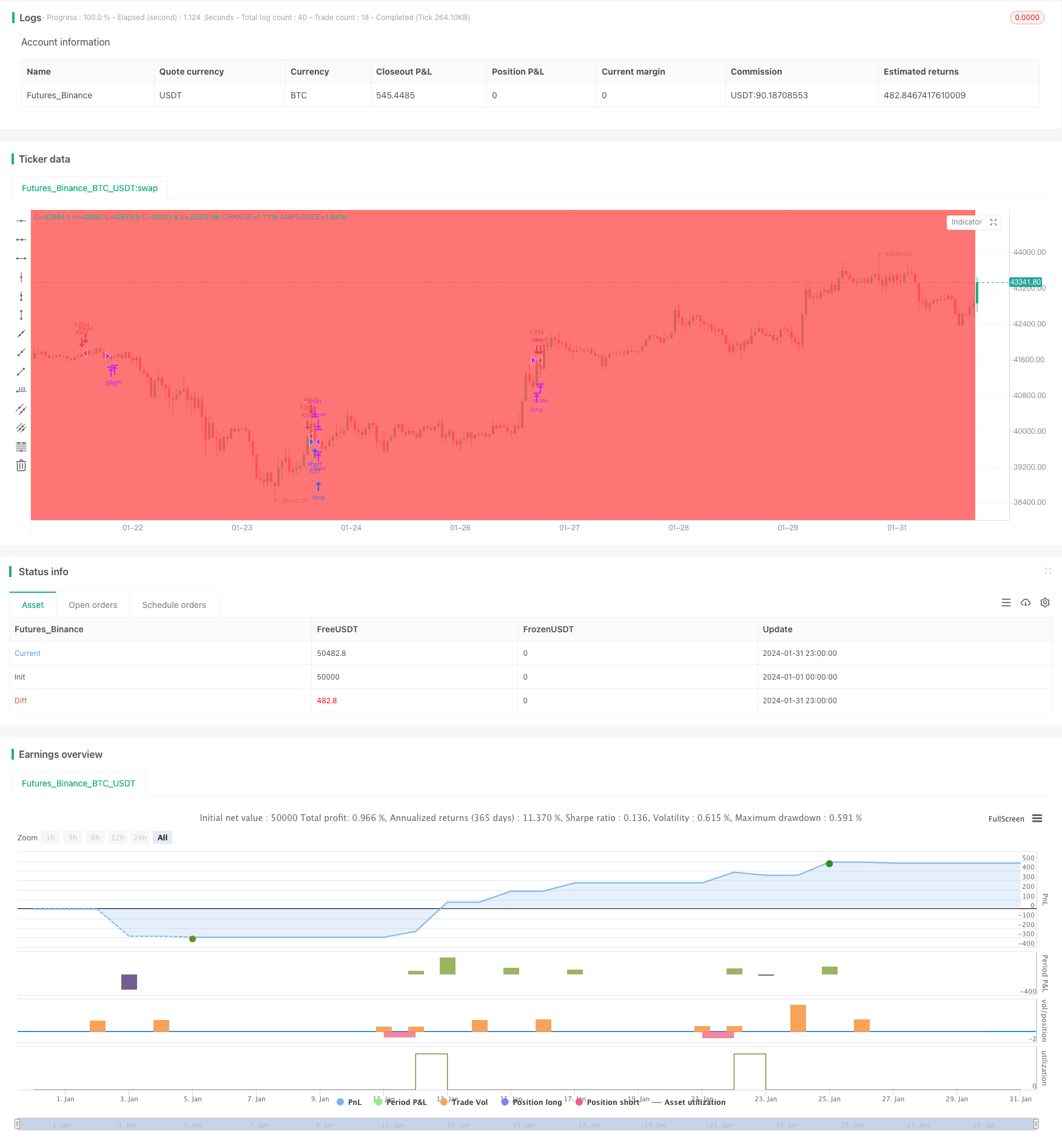

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Marubozu", shorttitle="Marubozu", overlay=true, initial_capital = 1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent , commission_value=0 )

C_Len = 14 // ema depth for bodyAvg

C_ShadowPercent = 5.0 // size of shadows

C_ShadowEqualsPercent = 100.0

C_DojiBodyPercent = 5.0

C_Factor = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi = max(close, open)

C_BodyLo = min(close, open)

C_Body = C_BodyHi - C_BodyLo

C_BodyAvg = ema(C_Body, C_Len)

C_SmallBody = C_Body < C_BodyAvg

C_LongBody = C_Body > C_BodyAvg

C_UpShadow = high - C_BodyHi

C_DnShadow = C_BodyLo - low

C_HasUpShadow = C_UpShadow > C_ShadowPercent / 100 * C_Body

C_HasDnShadow = C_DnShadow > C_ShadowPercent / 100 * C_Body

C_WhiteBody = open < close

C_BlackBody = open > close

C_Range = high-low

C_IsInsideBar = C_BodyHi[1] > C_BodyHi and C_BodyLo[1] < C_BodyLo

C_BodyMiddle = C_Body / 2 + C_BodyLo

C_ShadowEquals = C_UpShadow == C_DnShadow or (abs(C_UpShadow - C_DnShadow) / C_DnShadow * 100) < C_ShadowEqualsPercent and (abs(C_DnShadow - C_UpShadow) / C_UpShadow * 100) < C_ShadowEqualsPercent

C_IsDojiBody = C_Range > 0 and C_Body <= C_Range * C_DojiBodyPercent / 100

C_Doji = C_IsDojiBody and C_ShadowEquals

patternLabelPosLow = low - (atr(30) * 0.6)

patternLabelPosHigh = high + (atr(30) * 0.6)

C_MarubozuWhiteBullishNumberOfCandles = 1

C_MarubozuShadowPercentWhite = 5.0

C_MarubozuWhiteBullish = C_WhiteBody and C_LongBody and C_UpShadow <= C_MarubozuShadowPercentWhite/100*C_Body and C_DnShadow <= C_MarubozuShadowPercentWhite/100*C_Body and C_WhiteBody

alertcondition(C_MarubozuWhiteBullish, title = "Marubozu White", message = "New Marubozu White - Bullish pattern detected.")

if C_MarubozuWhiteBullish

var ttBullishMarubozuWhite = "Marubozu White\nA Marubozu White Candle is a candlestick that does not have a shadow that extends from its candle body at either the open or the close. Marubozu is Japanese for “close-cropped” or “close-cut.” Other sources may call it a Bald or Shaven Head Candle."

label.new(bar_index, patternLabelPosLow, text="MW", style=label.style_label_up, color = color.blue, textcolor=color.white, tooltip = ttBullishMarubozuWhite)

bgcolor(highest(C_MarubozuWhiteBullish?1:0, C_MarubozuWhiteBullishNumberOfCandles)!=0 ? color.blue : na, offset=-(C_MarubozuWhiteBullishNumberOfCandles-1))

C_MarubozuBlackBearishNumberOfCandles = 1

C_MarubozuShadowPercentBearish = 5.0

C_MarubozuBlackBearish = C_BlackBody and C_LongBody and C_UpShadow <= C_MarubozuShadowPercentBearish/100*C_Body and C_DnShadow <= C_MarubozuShadowPercentBearish/100*C_Body and C_BlackBody

alertcondition(C_MarubozuBlackBearish, title = "Marubozu Black", message = "New Marubozu Black - Bearish pattern detected.")

if C_MarubozuBlackBearish

var ttBearishMarubozuBlack = "Marubozu Black\nThis is a candlestick that has no shadow, which extends from the red-bodied candle at the open, the close, or even at both. In Japanese, the name means “close-cropped” or “close-cut.” The candlestick can also be referred to as Bald or Shaven Head."

label.new(bar_index, patternLabelPosHigh, text="MB", style=label.style_label_down, color = color.red, textcolor=color.white, tooltip = ttBearishMarubozuBlack)

bgcolor(highest(C_MarubozuBlackBearish?1:0, C_MarubozuBlackBearishNumberOfCandles)!=0 ? color.red : na, offset=-(C_MarubozuBlackBearishNumberOfCandles-1))

strategy.entry("short",1,when= C_MarubozuBlackBearish)

strategy.entry("long",0,when=C_MarubozuWhiteBullish)

strategy.close("long",when= close[1] < open[1]and close[2] < open[2] and close > open)

strategy.close("short",when= close[1] > open[1]and close[2] > open[2] and close < open)