Moving Average Trading Strategy

Author: ChaoZhang, Date: 2024-02-26 11:36:37Tags:

Overview

This is a trend-following trading strategy based on moving average lines. It uses a 14-day simple moving average (SMA) to determine market trend direction and enter trades when price approaches the moving average line.

Strategy Logic

The core logic of this strategy is:

- Calculate the 14-day simple moving average (SMA)

- When close price is below 99% of moving average, market is considered oversold, generating buy signals

- After entering, set stop loss and take profit price

- Stop loss price is set at 10 pips below entry price

- Take profit price is set at 60 pips above entry price

This is a trend-following strategy. It identifies overall market trend using the moving average line and enters oversold stages along the major trend. Stop loss and take profit are used to exit trades.

Advantage Analysis

The main advantages of this strategy are:

- Simple and clear strategy logic, easy to understand and implement

- Moving average filters out some noise and determines market trend

- Only taking oversold setups avoids large drawdowns

- Reasonable stop loss and take profit controls risk

- Drawdown and loss can be limited to reasonable range

Risk Analysis

There are also some risks associated with this strategy:

- Moving average has lagging effect, possibly missing short-term opportunities

- Stop loss may be too aggressive leading to premature exit

- Significant price gaps or trend reversals on major news events

- Interference from algorithmic and high-frequency trades

Some methods to mitigate risks include allowing wider entry range, adjusting stop loss position etc.

Optimization Directions

Some ways to optimize this strategy:

- Optimize moving average parameters for more market regimes

- Add multiple time frame moving averages for combo assessment

- Use dynamic stop loss/take profit ratios for certain sessions

- Utilize volatility metrics to time entries

- Incorporate machine learning for enhanced trend and key points prediction

Conclusion

In summary, this is a simple and practical trend-following strategy. It identifies trend direction using moving average, enters oversold stages, and sets reasonable stop loss and take profit to control risk. With proper enhancements and combinations, it can be adapted to more market conditions and further improve stability and profitability.

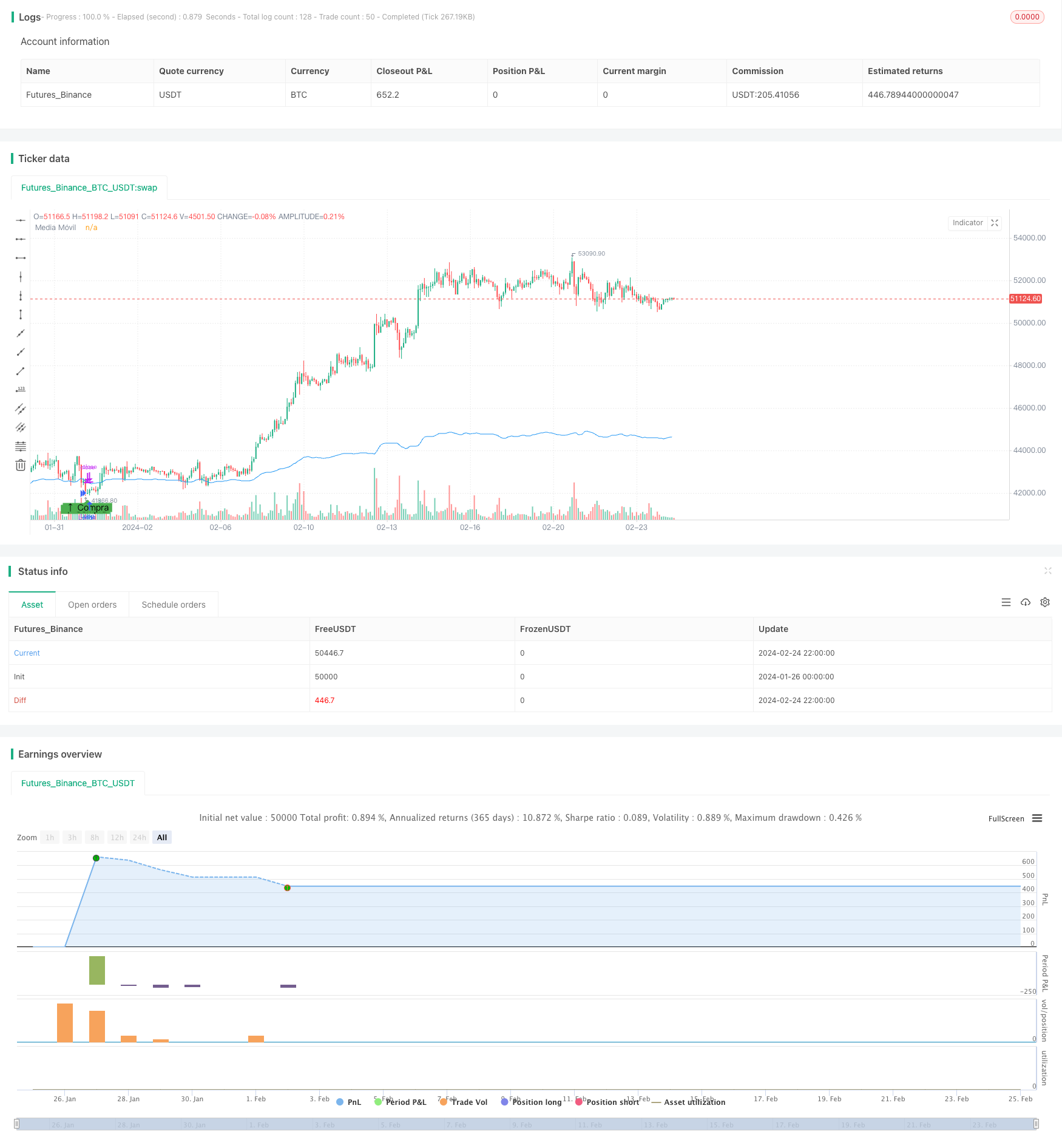

/*backtest

start: 2024-01-26 00:00:00

end: 2024-02-25 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia MA - mejor", overlay=true)

// Parámetros de la estrategia

initialCapital = 1000 // Inversión inicial

riskPerTrade = 0.02 // Riesgo por operación (2% del capital por operación)

lengthMA = 14 // Período de la media móvil

pipValue = 20 / 10 // Valor de un pip (30 euros / 10 pips)

// Apalancamiento

leverage = 10

// Cálculo de la media móvil en el marco temporal de 30 minutos

ma = request.security(syminfo.tickerid, "30", ta.sma(close, lengthMA))

// Condiciones de Entrada en Sobreventa

entryCondition = close < ma * 0.99 // Ejemplo: 1% por debajo de la MA

// Lógica de entrada y salida

if entryCondition

riskAmount = initialCapital * riskPerTrade // Cantidad de euros a arriesgar por operación

size = 1 // Tamaño de la posición con apalancamiento

strategy.entry("Long", strategy.long, qty=size)

stopLossPrice = close - (10 * pipValue / size)

takeProfitPrice = close + (60 * pipValue / size)

strategy.exit("Exit Long", "Long", stop=stopLossPrice, limit=takeProfitPrice)

// Gráficos

plot(ma, color=color.blue, title="Media Móvil")

plotshape(series=entryCondition, title="Entrada en Sobreventa", location=location.belowbar, color=color.green, style=shape.labelup, text="↑ Compra")

- Follow The Bear Strategy

- Intelligent Accumulator Buy Strategy

- The Dual EMA Price Swing Strategy

- RSI Indicator Long Short Separation Trading Strategy

- Trend Following Quant Trading Strategy Based on Moving Average

- Inside Bar Breakout Strategy

- Gold Standard Quantitative Trading Strategy

- The Dual Reversal Strategy

- The Order Block Momentum Breakout Strategy

- Dual EMA Intelligent Tracking Strategy

- Dual Moving Average HullMA Crossover Trend Strategy

- Dynamic Dual Moving Average Trailing Stop Strategy

- Moving Average Indicator Strategy

- Pivot Point SuperTrend Strategy

- Elliott Wave Strategy with 200 Day Moving Average

- Supertrend and CCI Scalping Strategy

- Supertrend and CCI Scalping Strategy

- Threefold Overlapping SuperTrend Strategy

- Trend Following Strategy Based on Moving Average Crossover

- Spaced Out Trading Strategy