Overview

The strategy is named “Momentum Trend”. It combines the advantages of MACD indicator and Bollinger Bands to implement a trend tracking strategy. The strategy uses MACD fast line and slow line to build Bollinger Bands. The middle line of Bollinger Bands is the MACD signal line. It goes short when price breaks through the upper rail of Bollinger Bands and goes long when price breaks through the lower rail of Bollinger Bands. It waits for the pullback to test the middle line of Bollinger Bands before entering the market to track medium-long term trends.

Strategy Principle

The core indicators of this strategy are MACD and Bollinger Bands. MACD indicator consists of fast line, slow line and MACD histogram. The fast line is usually 12-day EMA and slow line is 26-day EMA. The difference between them is the MACD histogram. This strategy uses the difference between fast line and slow line as the base middle line of Bollinger Bands. Upper and lower rails are set around the middle line to construct Bollinger Bands.

A buy signal is generated when the price breaks through the lower rail of Bollinger Bands upwards. A sell signal is generated when the price breaks through the upper rail of Bollinger Bands downwards. To reduce the risk of being trapped and missing reversal opportunities, this strategy does not enter the market immediately after the breakout. Instead, it waits for the pullback to test the middle line of Bollinger Bands before entering.

In addition, the upper and lower rails can also be used as resistance and support respectively. When price goes up, the upper rail is resistance and the lower rail is support. When price goes down, the upper rail becomes support and lower rail becomes resistance.

Advantage Analysis

This strategy combines the advantages of MACD and Bollinger Bands to achieve trend tracking, with the following strengths:

MACD has strong trend judgment capability. Bollinger Bands can adaptively adjust itself. The combination can effectively determine trend reversal points.

Pullback entry can effectively avoid stop loss risk and track medium-long term trends.

Utilizing resistance and support on Bollinger Bands can further lock in profits.

MACD and Bollinger Bands parameters can be flexibly adjusted to suit different market environments.

Risk Analysis

There are also some risks to note for this strategy:

In oscillating trends, MACD and Bollinger Bands may generate multiple invalid signals. Position size needs to be reduced then to avoid huge losses.

Stop loss should be set during pullback entry to avoid loss enlargement from overdeep pullback.

Bollinger Bands parameters need to be adjusted based on market volatility. Improper parameter setting increases false breakout probability.

Good risk management and position sizing are the key to sustain profits for this strategy. Purely relying on strategy signals tends to neglect overall risks.

Optimization Directions

The strategy can also be optimized in the following aspects:

Optimize MACD parameters to 8-day fast line and 20-day slow line. Adjust based on different products and timeframes to improve indicator sensitivity.

Add upwards and downwards trend judgment to optimize Bollinger Bands parameters, reducing false signals in oscillating markets.

Add stop loss strategy. Set stop loss line with Bollinger Bands upper and lower rails to control risks.

Incorporate other indicators for verification to improve strategy stability.

Conclusion

The Momentum Trend strategy based on MACD and Bollinger Bands tracks medium-long term trends through indicator combo and enters on pullbacks to reduce risks. It optimizes parameter settings and controls risks. It performs well on trending products. But no strategy is perfect. We need to keep optimizing and improving from multiple perspectives for adapting to the ever-changing market environments.

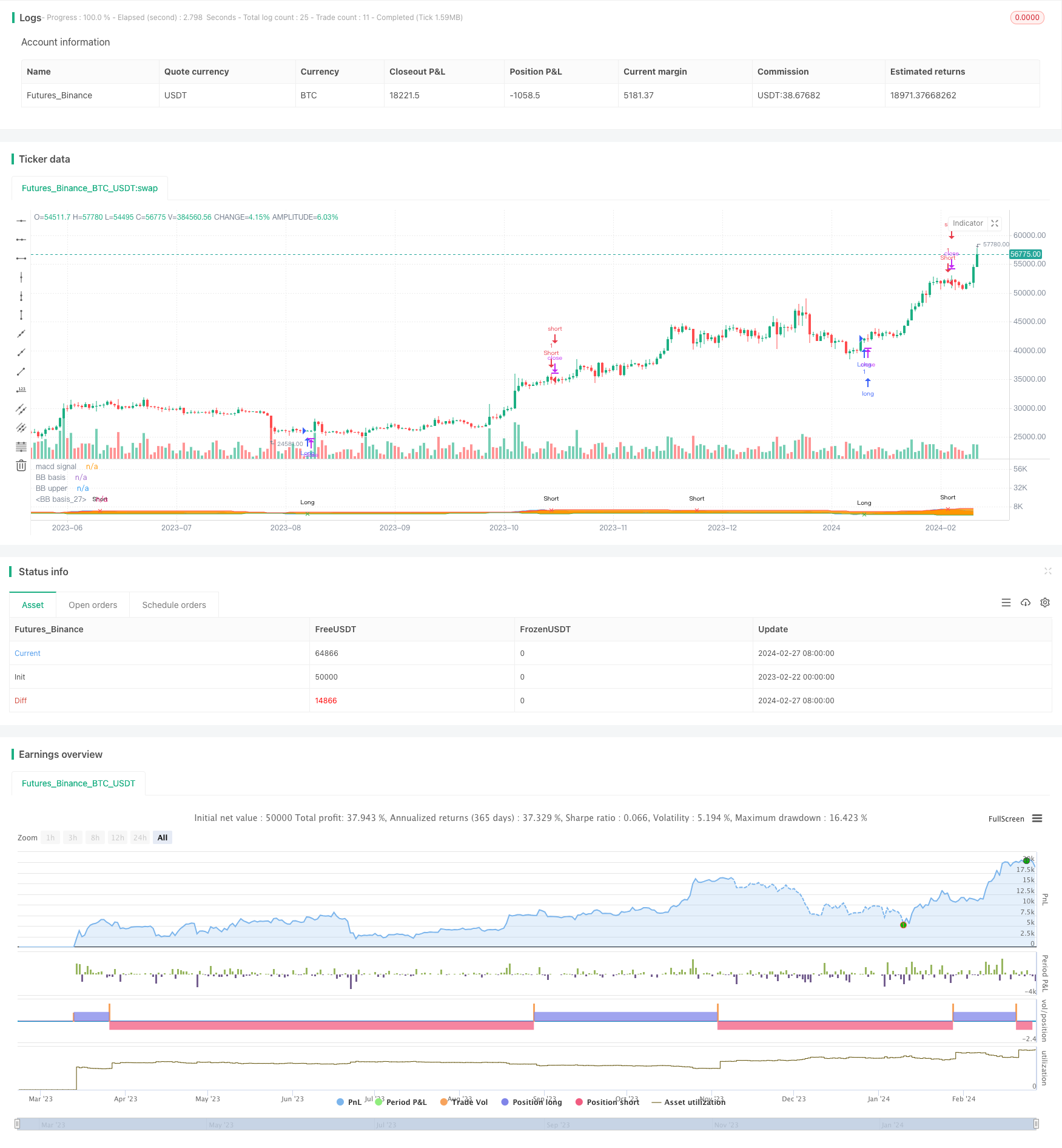

/*backtest

start: 2023-02-22 00:00:00

end: 2024-02-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Simple strategy based on MACD and Bollinger Bands, where BBs are calculatend from macd signal.

strategy("Strategy MACD vs BB", overlay=false)

fast_length = input(title="Fast MA period", type=input.integer, defval=8)

slow_length = input(title="Slow MA period", type=input.integer, defval=21)

src = input(close,"Source")

// ----------MA calculation - ChartArt-------------

smoothinput = input(1, minval=1, maxval=4, title='Moving Average Calculation: (1 = SMA), (2 = EMA), (3 = WMA), (4 = Linear)')

fast_ma = smoothinput == 1 ? sma(src, fast_length):smoothinput == 2 ? ema(src, fast_length):smoothinput == 3 ? wma(src, fast_length):smoothinput == 4 ? linreg(src, fast_length,0):na

slow_ma = smoothinput == 1 ? sma(src, slow_length):smoothinput == 2 ? ema(src, slow_length):smoothinput == 3 ? wma(src, slow_length):smoothinput == 4 ? linreg(src, slow_length,0):na

//----------------------------------------------

macd = fast_ma - slow_ma

p1=plot(macd,"macd signal",color=color.blue)

length = input(40, minval=1)

mult = input(2.0,"BB multiplier")

basis = sma(macd, length)

dev = mult * stdev(macd, length)

plot(basis,"BB basis",color=color.orange)

upper = basis + dev

lower = basis - dev

p2=plot(upper,"BB upper",color=color.red)

p3=plot(lower,"BB basis",color=color.green)

longCondition = crossover(macd, lower)

shortCondition = crossunder(macd, upper)

plotshape(longCondition?lower:na, title="Long", style=shape.xcross, location=location.absolute, text="Long", color=color.green, transp=0, size=size.tiny)

plotshape(shortCondition?upper:na, title="Short", style=shape.xcross, location=location.absolute, text="Short", color=color.red, transp=0, size=size.tiny)

fill(p1,p3,color=macd<lower?color.green:na,transp=90,title="support")

fill(p1,p2,color=macd>upper?color.red:na,transp=90,title="resistance")

if longCondition

strategy.entry("Long",strategy.long)

if shortCondition

strategy.entry("Short",strategy.short)