Overview

The main idea behind this strategy is to decide when to buy and sell cryptocurrency based on price momentum indicators. It tries to capture trends as price reversals happen and profit from the momentum of price movements.

Strategy Logic

The strategy uses two metrics to determine entry and exit signals. The first one is price itself – it checks the highest and lowest prices over the past 10 candlesticks. The second one is a momentum indicator based on price - the %K value.

Specifically, when the price falls below 98% of the highest price over the past 10 candlesticks (buy threshold), the strategy triggers a buy signal. This means a downward breakout has happened. Similarly when the price rises above 102% of the lowest price over the past 10 candlesticks (sell threshold), the strategy triggers a sell signal, meaning an upward breakout has occurred.

This way the strategy can capture reversal points as new trends form in price movement. By tuning the buy/sell thresholds, sensitivity of the strategy to breakout signals can be adjusted.

Advantage Analysis

The biggest advantage of this strategy is that it considers both price level and momentum factors. Relying on momentum indicators allows more reliable capturing of true trend reversals instead of being misled by false breakouts. Specific advantages are:

- Filters out noise using momentum metrics to identify real signals

- Excellent backtest results with relatively small max drawdown

- Frequency can be controlled via adjustable parameters

- Risk can be effectively managed by incorporating stop loss

Risk Analysis

Some risks to note with this strategy:

- Market crash leading to flash crash that cannot be stopped out

- Impact of trading fees and slippage

- Parameter misconfiguration resulting in overtrading or missing opportunities

Mitigations:

- Employ multifactor models to prevent single indicator failure

- Incorporate stop loss to restrict max loss

- Optimize parameters to make strategy more robust

Enhancement Opportunities

Further optimizations for the strategy:

- Add more filters like volume, Bollinger Bands etc.

- Dynamically tune parameters based on machine learning

- Incorporate fundamental analysis to adjust strategy around key events

- Optimize capital utilization via leverage to amplify returns

Summary

Overall this momentum breakout strategy is well suited for capturing short term trading opportunities in cryptocurrencies. It effectively capitalizes on momentum characteristics of price reversals for profit while controlling risk. Continued refinements to parameters and model can make the strategy more robust for consistent returns.

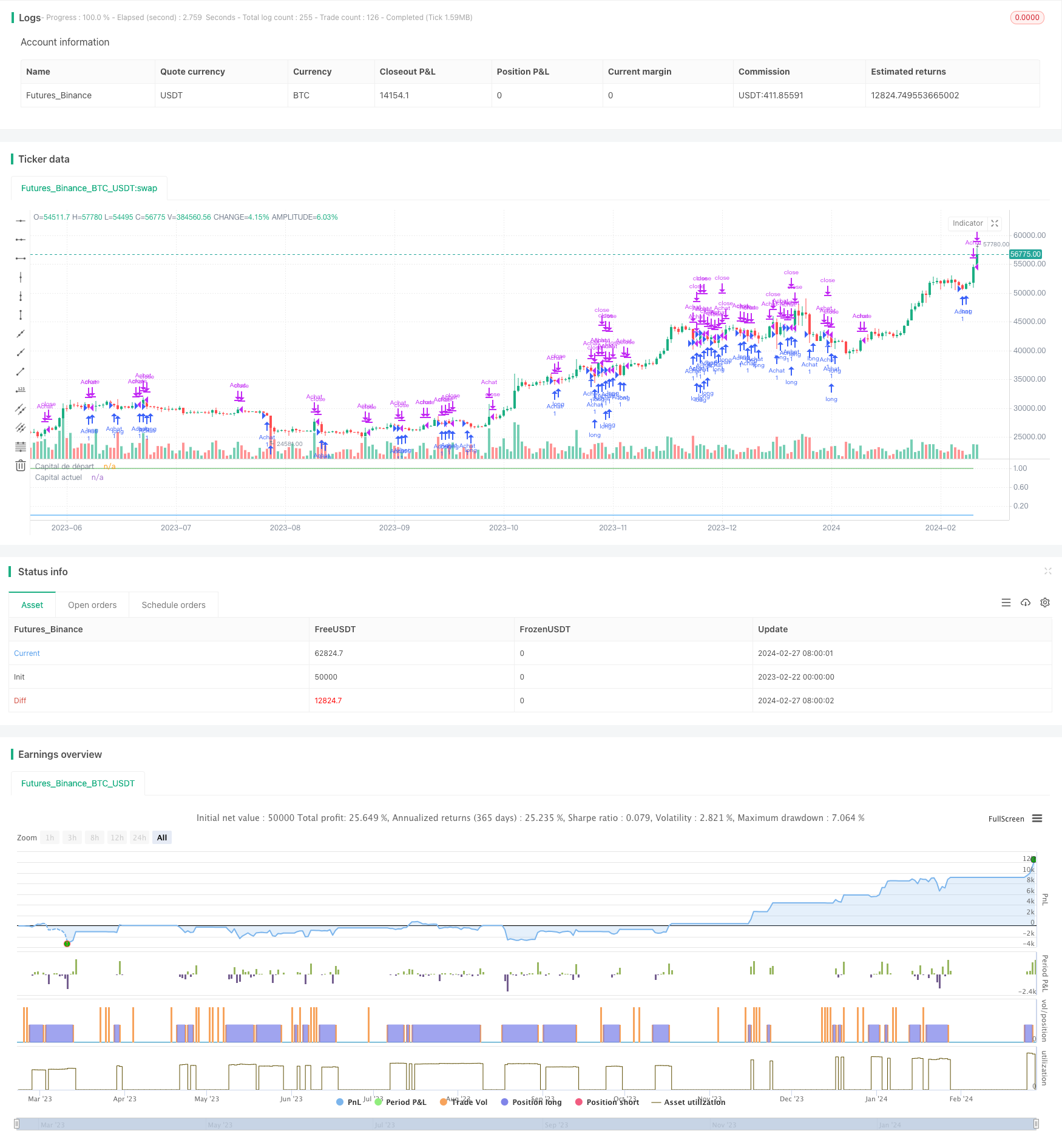

/*backtest

start: 2023-02-22 00:00:00

end: 2024-02-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nyxover

//@version=5

strategy("Stratégie d'achat bas/vendre haut", shorttitle="Achat/Vente")

// Paramètres d'entrée

crypto = input("BTC", "Crypto-monnaie")

capital = input(1.0, "Capital de départ")

buy_threshold = input(0.02, "Seuil d'achat")

sell_threshold = input(0.02, "Seuil de vente")

fee_rate = input(0.01, "Taux de frais")

// Balances

var float initial_balance = na

var float current_balance = na

// Fonction pour calculer les frais

calculate_fees(amount) =>

amount * fee_rate

// Fonction pour acheter

should_buy() =>

close < ta.highest(close, 10) * (1 - buy_threshold)

// Fonction pour vendre

should_sell() =>

close > ta.lowest(close, 10) * (1 + sell_threshold)

// Logique de la stratégie

if barstate.isfirst

initial_balance := capital

current_balance := capital

if should_buy()

amount_to_buy = current_balance / close

fees = calculate_fees(amount_to_buy)

current_balance := current_balance - amount_to_buy - fees

strategy.entry("Achat", strategy.long)

if should_sell()

amount_to_sell = current_balance

fees = calculate_fees(amount_to_sell)

current_balance := current_balance - amount_to_sell - fees

strategy.close("Achat")

// Affichage des informations

plot(initial_balance, color=color.green, title="Capital de départ")

plot(current_balance, color=color.blue, title="Capital actuel")