Dynamic Adaptive Trend Trading Strategy

Author: ChaoZhang, Date: 2024-03-08 15:17:47Tags:

Overview

The Dynamic Adaptive Trend Trading Strategy is an innovative trading approach that dynamically adjusts strategy parameters based on real-time market data to adapt to the ever-changing market environment. Unlike traditional strategies with fixed rules, this strategy employs a flexible framework that optimizes trading decisions in real-time according to current market conditions such as volatility, trends, and price movements. By incorporating dynamic elements, the strategy can more effectively capture emerging opportunities and manage trading risks.

Strategy Principle

The core of the strategy is to utilize advanced technical analysis and machine learning algorithms to analyze market data and dynamically adjust strategy parameters in real-time. Specifically, the strategy follows these steps:

Calculate two Simple Moving Averages (SMAs) with different periods, namely the 10-day and 20-day SMAs. A long signal is generated when the 10-day SMA crosses above the 20-day SMA, while a short signal is generated when the 10-day SMA crosses below the 20-day SMA.

Determine the stop-loss price based on the user-defined stop-loss percentage parameter. For long trades, the stop-loss price is calculated as the entry price multiplied by (1 - stop-loss percentage); for short trades, the stop-loss price is calculated as the entry price multiplied by (1 + stop-loss percentage).

When a long or short signal is triggered, the strategy opens a position and sets the corresponding stop-loss price. If the price reaches the stop-loss level, the strategy closes the position to control risk.

The strategy also introduces a dynamic trailing stop-loss mechanism. For long trades, the trailing stop-loss price is calculated as the highest price multiplied by (1 - stop-loss percentage); for short trades, the trailing stop-loss price is calculated as the lowest price multiplied by (1 + stop-loss percentage). When the price retraces and hits the trailing stop-loss level, the strategy closes the position to lock in profits.

By dynamically adjusting the stop-loss and trailing stop-loss prices, the strategy adapts to market changes, staying in profitable positions during trends while promptly closing positions when prices retrace, effectively managing risks. This flexible trading framework enables the strategy to perform well in various market environments.

Advantage Analysis

The Dynamic Adaptive Trend Trading Strategy offers the following advantages:

Strong adaptability: By dynamically adjusting strategy parameters, the strategy adapts to different market conditions, capturing trending opportunities while managing risks.

Optimized risk management: The introduction of dynamic stop-loss and trailing stop-loss mechanisms allows the strategy to stay in profitable positions during trends while promptly closing positions when prices retrace, effectively controlling potential losses.

Integration of technical analysis and machine learning: The strategy leverages advanced technical analysis indicators and machine learning algorithms to mine valuable trading signals from vast historical data, enhancing the reliability and stability of the strategy.

Easy to implement and optimize: The strategy logic is clear and the code is concise, making it easy to implement and backtest on various trading platforms. Moreover, the strategy parameters can be flexibly adjusted based on market characteristics and personal preferences to optimize strategy performance.

Risk Analysis

Despite the numerous advantages of the Dynamic Adaptive Trend Trading Strategy, it still carries certain risks:

Parameter sensitivity: The performance of the strategy depends to some extent on parameter settings, such as the stop-loss percentage and moving average periods. Inappropriate parameter choices may lead to suboptimal strategy performance.

Market risk: The strategy is primarily suitable for trending markets. In choppy or highly volatile market conditions, frequent trading signals may result in excessive trading costs and potential losses.

Limitations of historical data: The strategy is optimized and backtested based on historical data. However, past market performance does not fully guarantee future results. The strategy may face unknown risks and challenges when applied in real-world trading.

To address these risks, traders can take the following measures:

Conduct thorough parameter optimization and sensitivity analysis to select parameter combinations that suit the current market environment.

Combine other technical indicators and fundamental analysis to confirm trading signals, improving the reliability of the strategy.

Set appropriate risk control measures, such as position sizing and overall stop-loss, to limit potential losses.

Regularly evaluate and adjust the strategy, promptly optimizing and refining it based on market changes and strategy performance.

Optimization Direction

To further enhance the performance of the Dynamic Adaptive Trend Trading Strategy, the following optimization directions can be considered:

Incorporate more technical indicators: In addition to simple moving averages, other technical indicators such as Bollinger Bands, MACD, RSI, etc., can be combined to generate more reliable trading signals. The integration of multiple indicators provides more comprehensive market information and improves the robustness of the strategy.

Optimize parameter selection: For key parameters such as moving average periods and stop-loss percentages, the optimal parameter combinations can be sought through historical data backtesting and optimization algorithms like grid search or genetic algorithms. Regular evaluation and adjustment of parameter settings are necessary to adapt to market changes.

Include market sentiment analysis: Introduce market sentiment indicators, such as the Volatility Index (VIX) or Put-Call Ratio (PCR), to assess market sentiment and risk appetite. In extreme sentiment states, such as excessive optimism or pessimism, the strategy can adjust positions and risk exposure accordingly.

Incorporate machine learning models: Utilize machine learning algorithms, such as Support Vector Machines (SVM) or Random Forests, to model and predict technical indicators and market data. By training on historical data, machine learning models can automatically discover complex trading patterns and generate more accurate trading signals.

Consider multi-market and multi-asset allocation: Extend the strategy to multiple markets and asset classes, such as stocks, futures, and forex, to diversify risks and capture more trading opportunities. Through reasonable asset allocation and risk management, the stability and return potential of the strategy can be improved.

Conclusion

The Dynamic Adaptive Trend Trading Strategy is an innovative quantitative trading approach that dynamically adjusts strategy parameters to adapt to the ever-changing market environment. The strategy utilizes the crossover signals of simple moving averages to identify trends while introducing dynamic stop-loss and trailing stop-loss mechanisms to control risks and lock in profits. The strengths of the strategy lie in its strong adaptability, optimized risk management, integration of technical analysis and machine learning, and ease of implementation and optimization. However, the strategy also carries certain risks, such as parameter sensitivity, market risk, and limitations of historical data. To address these risks, traders can conduct parameter optimization, combine other analysis methods, set appropriate risk control measures, and regularly evaluate and adjust the strategy.

In the future, the strategy can be optimized and refined by incorporating more technical indicators, optimizing parameter selection, including market sentiment analysis, incorporating machine learning models, and considering multi-market and multi-asset allocation. These optimization directions contribute to improving the robustness, adaptability, and return potential of the strategy, enabling it to maintain long-term competitiveness in the dynamically changing financial markets.

In summary, the Dynamic Adaptive Trend Trading Strategy provides a flexible and powerful tool for the field of quantitative trading. Through continuous optimization and innovation, the strategy is expected to play a greater role in future quantitative investment practices, delivering stable and substantial returns for investors.

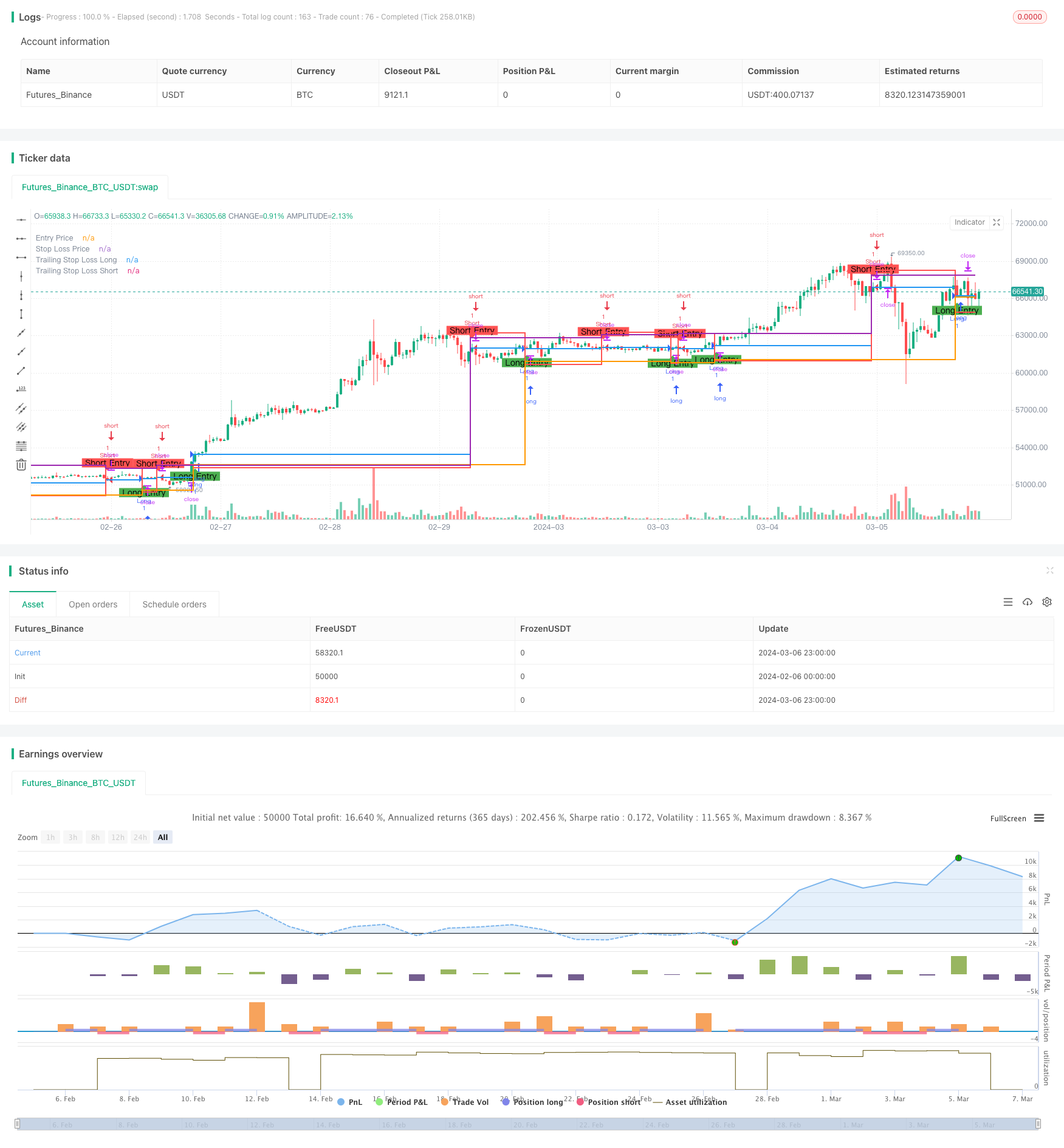

/*backtest

start: 2024-02-06 00:00:00

end: 2024-03-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EfficiVision Trader Strategy", overlay=true)

// Input parameters

longCondition = ta.crossover(ta.sma(close, 10), ta.sma(close, 20))

shortCondition = ta.crossunder(ta.sma(close, 10), ta.sma(close, 20))

stopLossPerc = input(2.0, title="Stop Loss Percentage")

var float entryPrice = na

var float stopLossPrice = na

// Calculate stop loss

if (longCondition)

entryPrice := close

stopLossPrice := close * (1 - stopLossPerc / 100)

if (shortCondition)

entryPrice := close

stopLossPrice := close * (1 + stopLossPerc / 100)

// Strategy entry and exit conditions

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Dynamic stop-loss exit

strategy.exit("Exit Long", "Long", stop=stopLossPrice)

strategy.exit("Exit Short", "Short", stop=stopLossPrice)

// Plot entry and stop-loss levels on the chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="Long Entry")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Short Entry")

plot(entryPrice, color=color.blue, style=plot.style_stepline, linewidth=2, title="Entry Price")

plot(stopLossPrice, color=color.red, style=plot.style_stepline, linewidth=2, title="Stop Loss Price")

// New features

// Add a trailing stop loss for long trades

var float trailingStopLossLong = na

if (longCondition and not na(entryPrice))

trailingStopLossLong := high * (1 - stopLossPerc / 100)

// Add a trailing stop loss for short trades

var float trailingStopLossShort = na

if (shortCondition and not na(entryPrice))

trailingStopLossShort := low * (1 + stopLossPerc / 100)

// Exit long trade when trailing stop loss is triggered

if (trailingStopLossLong < close)

strategy.close("Exit Long Trailing", "Long")

// Exit short trade when trailing stop loss is triggered

if (trailingStopLossShort > close)

strategy.close("Exit Short Trailing", "Short")

// Plot trailing stop loss levels on the chart

plot(trailingStopLossLong, color=color.orange, style=plot.style_stepline, linewidth=2, title="Trailing Stop Loss Long")

plot(trailingStopLossShort, color=color.purple, style=plot.style_stepline, linewidth=2, title="Trailing Stop Loss Short")

- Bollinger Bands and Stochastic KD Crossover Strategy

- Crypto Pullback Trading Strategy Based on Stochastic RSI and EMA Crossover

- BabyShark VWAP Trading Strategy Based on VWAP and OBV RSI Indicators

- Bitcoin Momentum Trailing Stop Strategy

- Multi-Stage Bollinger Bands-MACD Crossover Signal Quantitative Trading Strategy

- MACD Moving Average Bullish Quantitative Trading Strategy

- JiaYiBing Quantitative Trend Momentum Trading Strategy

- Moving Average Breakout Trading Strategy

- Bollinger Bands Breakout with Volatility Filter Strategy

- Dual Moving Average Crossover Strategy - EMA9/20

- Bidirectional Stop-Loss Take-Profit Strategy Based on Stochastic Crossover

- RSI-based Long Strategy with Trailing Stop for Quantitative Trading

- 1-2-3 Pattern Quantitative Trading Strategy with EMAs, MACD, and 4th Candle Extension

- Trend Momentum Strategy Based on 21 EMA, Volume, and RSI

- An Efficient Trading Strategy Based on Dual Moving Average Crossover and Stop Loss

- The Bollinger Bands Mean Reversion Strategy

- Highest High/Lowest Low Stop Strategy

- RSI-based Dual Trading Strategy

- SSL Channel and Green Volume Strategy

- The EMA Cross Quantitative Strategy