Strategy Overview

The Dual Exponential Moving Average (EMA) Cloud Crossover Automated Trading Strategy combines the power of two robust trading strategies: the Ripster EMA Clouds with Alerts and the Moving Average Crossover Automated Trading Bot. The strategy utilizes EMAs of different periods to identify long-term and short-term market trends while providing timely buy and sell signals based on the crossovers of the moving averages, executing automated trades accordingly.

Strategy Principles

The core of this strategy lies in the use of multiple EMAs of different periods to analyze market trends. Specifically, the strategy employs 5 sets of EMAs: 1. Short-term EMA1 (default period 8) and Long-term EMA1 (default period 9) 2. Short-term EMA2 (default period 5) and Long-term EMA2 (default period 13) 3. Short-term EMA3 (default period 34) and Long-term EMA3 (default period 50) 4. Short-term EMA4 (default period 72) and Long-term EMA4 (default period 89) 5. Short-term EMA5 (default period 180) and Long-term EMA5 (default period 200)

A buy signal is generated when the short-term EMA crosses above the long-term EMA, while a sell signal is triggered when the short-term EMA crosses below the long-term EMA. Additionally, the strategy incorporates an automated trading bot based on the crossover of 20-day and 50-day Simple Moving Averages (SMAs). It executes a buy order when the 20-day SMA crosses above the 50-day SMA and closes the position when the 20-day SMA crosses below the 50-day SMA.

By combining these two strategies, the market can be analyzed from multiple dimensions and time frames, optimizing trade entry and exit points, and enhancing the strategy’s reliability and profitability.

Strategy Advantages

- Multi-dimensional analysis: The strategy analyzes the market from short-term, medium-term, and long-term perspectives, comprehensively grasping market trends.

- Trend tracking: The EMA clouds can effectively track the main market trends, avoiding premature entries in choppy markets.

- Signal confirmation: The crossover of short-term and long-term EMAs can confirm trend reversals, reducing false signals.

- Automated trading: The moving average crossover bot can automatically execute trades, improving trading efficiency.

- Adaptability: Through parameter optimization, the strategy can adapt to different markets and instruments.

Strategy Risks

- Parameter optimization risk: The performance of the strategy depends on the selection of EMA and SMA parameters, and different markets and time frames may require different optimal parameters.

- Choppy market risk: In choppy markets, frequent EMA crossovers may lead to excessive trading signals, resulting in losses.

- Trend reversal risk: When market trends reverse, the strategy may experience consecutive losses.

- Black swan events: The strategy may fail in extreme market conditions, causing significant drawdowns.

To control risks, the following measures can be considered: 1. Optimize parameters separately for different instruments and time frames. 2. Reduce position sizes or filter trading signals in choppy markets. 3. Set reasonable stop-loss and take-profit levels. 4. Monitor fundamentals and avoid heavy trading before extreme events occur.

Optimization Directions

- Dynamic parameter optimization: Dynamically adjust EMA and SMA parameters based on changes in market conditions to adapt to current market characteristics.

- Incorporate trend filters: Before generating trading signals, determine whether the current market is in a clear trend state to reduce trading in choppy markets.

- Introduce risk control modules: Dynamically adjust position sizes and leverage based on market volatility and drawdown indicators to control overall risk exposure.

- Combine with other technical indicators: Introduce other technical indicators such as RSI and MACD as auxiliary judgment to improve signal accuracy.

- Market sentiment analysis: Control trading under extreme sentiments by incorporating market sentiment indicators such as the VIX fear index.

Through continuous optimization, the adaptability, stability, and profitability of the strategy can be improved, enabling it to run stably in the market over the long term.

Conclusion

The Dual EMA Cloud Crossover Automated Trading Strategy is a powerful quantitative trading tool. By analyzing market trends from multiple time dimensions using the Ripster EMA clouds and executing automated trades based on moving average crossovers, it can effectively capture market opportunities and improve trading efficiency. However, the strategy also faces challenges such as parameter optimization, choppy market risks, and trend reversal risks. By dynamically optimizing parameters, incorporating trend filters and risk control modules, and introducing other technical indicators, the strategy’s performance can be continuously enhanced. Overall, the EMA cloud crossover strategy provides a robust framework for quantitative trading that is worth further exploration and optimization. In practical applications, strategy parameters and risk control rules need to be flexibly adjusted based on specific market characteristics and risk preferences to obtain steady long-term returns.

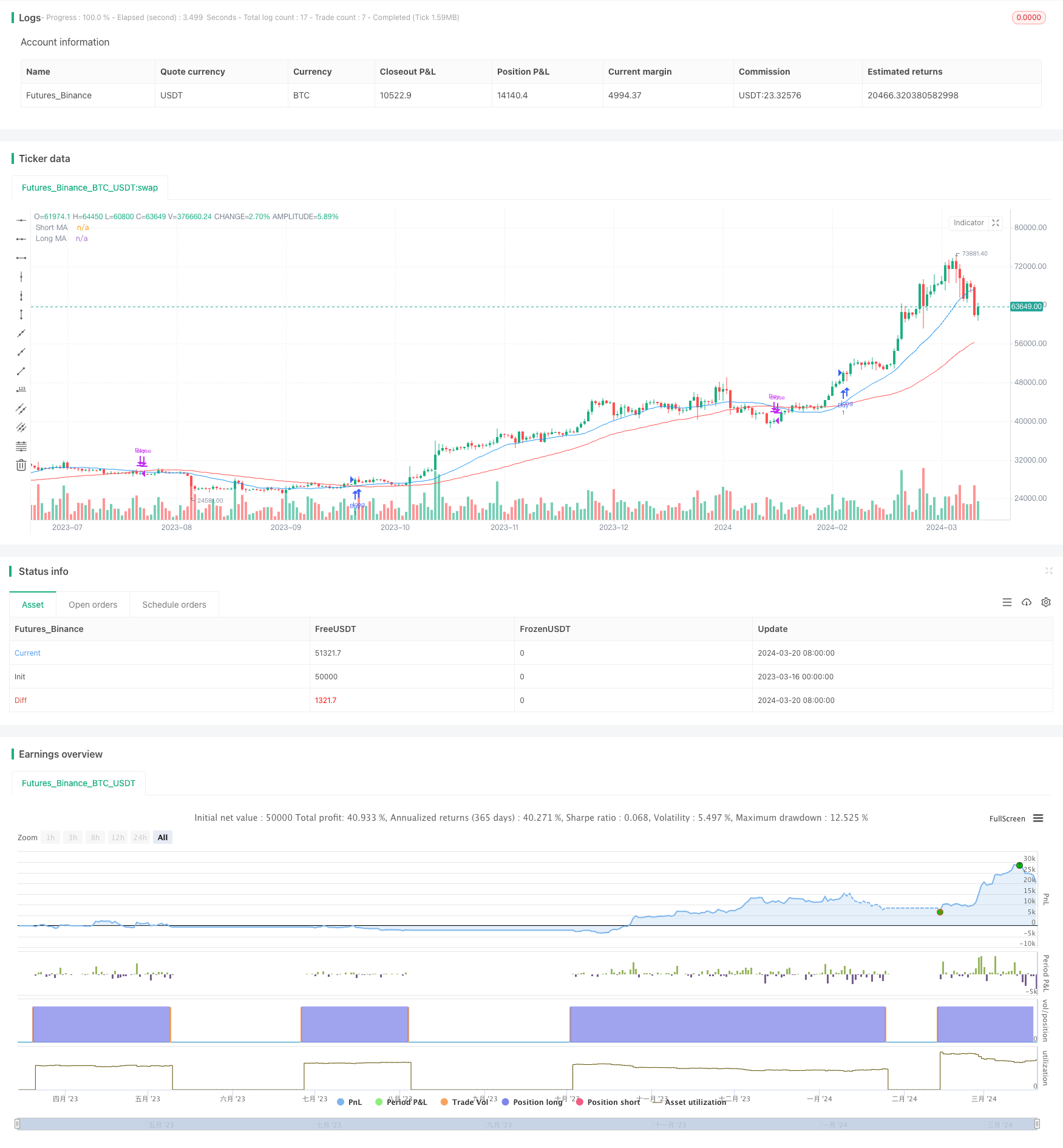

/*backtest

start: 2023-03-16 00:00:00

end: 2024-03-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ripster EMA Clouds with Alerts + Automated Trading Bot", overlay=true)

// Ripster EMA Clouds with Alerts script parameters

matype = input.string(title="MA Type", defval="EMA", options=["EMA", "SMA"])

ma_len1 = input.int(title="Short EMA1 Length", defval=8)

ma_len2 = input.int(title="Long EMA1 Length", defval=9)

ma_len3 = input.int(title="Short EMA2 Length", defval=5)

ma_len4 = input.int(title="Long EMA2 Length", defval=13)

ma_len5 = input.int(title="Short EMA3 Length", defval=34)

ma_len6 = input.int(title="Long EMA3 Length", defval=50)

ma_len7 = input.int(title="Short EMA4 Length", defval=72)

ma_len8 = input.int(title="Long EMA4 Length", defval=89)

ma_len9 = input.int(title="Short EMA5 Length", defval=180)

ma_len10 = input.int(title="Long EMA5 Length", defval=200)

src = input.source(title="Source", defval=hl2)

f_ma(malen) =>

float result = 0

if (matype == "EMA")

result := ta.ema(src, malen)

if (matype == "SMA")

result := ta.sma(src, malen)

result

htf_ma1 = f_ma(ma_len1)

htf_ma2 = f_ma(ma_len2)

htf_ma3 = f_ma(ma_len3)

htf_ma4 = f_ma(ma_len4)

htf_ma5 = f_ma(ma_len5)

htf_ma6 = f_ma(ma_len6)

htf_ma7 = f_ma(ma_len7)

htf_ma8 = f_ma(ma_len8)

htf_ma9 = f_ma(ma_len9)

htf_ma10 = f_ma(ma_len10)

// Define crossover and crossunder conditions for Ripster EMA Clouds with Alerts

long_condition = ta.crossover(htf_ma1, htf_ma2)

short_condition = ta.crossunder(htf_ma1, htf_ma2)

// Create alerts for Ripster EMA Clouds with Alerts

alertcondition(long_condition, title="Buy Signal", message="Buy Signal")

alertcondition(short_condition, title="Sell Signal", message="Sell Signal")

// Moving Average Crossover Bot parameters

shortMA = ta.sma(close, 20)

longMA = ta.sma(close, 50)

// Define buy and sell signals for Moving Average Crossover Bot

buySignal = ta.crossover(shortMA, longMA)

sellSignal = ta.crossunder(shortMA, longMA)

// Execute trades for Moving Average Crossover Bot

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Buy")

// Plot moving averages for visualization

plot(shortMA, color=color.blue, title="Short MA")

plot(longMA, color=color.red, title="Long MA")