Overview: The “Bollinger Bands Long Only Strategy” is a powerful TradingView strategy script designed for traders who specialize in long positions. Utilizing the renowned Bollinger Bands indicator, this strategy aims to identify potential entry points when the price closes above the upper Bollinger Band and signals exits when the price dips below the lower band. Tailored for the 5-minute chart, it’s perfect for day traders focusing on rapid market movements and short-term volatility, especially in the ES and NQ markets.

Strategy Principle: At the core of this strategy is the Bollinger Bands indicator, which consists of three lines: the middle band, upper band, and lower band. The middle band is a simple moving average (SMA) of the price, while the upper and lower bands are set at a certain number of standard deviations above and below the middle band, respectively. This strategy uses a 100-period SMA as the basis for the Bollinger Bands, with the upper and lower band multipliers set at 3 and 1 standard deviations, providing a dynamic range that adapts to market volatility.

When the closing price breaks above the upper band, the strategy initiates a long position, indicating strong upward momentum. When the closing price falls below the lower band, the strategy closes the position, signaling a potential reversal or loss of momentum. The strategy also includes a unique feature that ensures all positions are closed by 3 PM EST, aligning with day trading schedules and avoiding overnight market risk.

Advantages Analysis: 1. The strategy is optimized for traders seeking to capitalize on upward market trends, helping to capture long opportunities. 2. The Bollinger Bands indicator provides a dynamically adjusting range that can adapt to different market volatility conditions. 3. The strategy is optimized for day trading activities, ensuring positions are closed by 3 PM EST, reducing overnight risk exposure. 4. The strategy plots the Bollinger Bands directly on the chart, providing a clear visual representation of current market conditions and potential trade setups. 5. Traders can adjust the sensitivity of the Bollinger Bands based on their trading style or the asset’s volatility, allowing for flexible customization and optimization.

Risk Analysis: 1. The strategy only considers long positions, potentially missing out on certain short opportunities. 2. In market conditions with low volatility or unclear trends, the strategy may generate false signals, leading to losing trades. 3. The strategy relies on the Bollinger Bands indicator, and its effectiveness may be impacted if the market exhibits unusual volatility or deviates from the typical behavior of Bollinger Bands. 4. The strategy is optimized for the 5-minute chart, and adjustments and re-optimization may be necessary when applied to other timeframes or markets.

Optimization Directions: 1. Consider incorporating additional technical indicators or market sentiment indicators to enhance the accuracy of entry and exit signals. 2. Introduce risk management measures, such as stop-losses and trailing stops, to limit potential losses and protect profits. 3. Explore the possibility of dynamically adjusting the Bollinger Bands parameters to adapt to different market conditions and volatility levels. 4. Consider combining the strategy with other complementary strategies to create a more comprehensive and diversified trading system.

Summary: The “Bollinger Bands Long Only Strategy” is a powerful and versatile tool that can assist day traders in capturing long opportunities in the ES and NQ markets. By leveraging the dynamic nature of the Bollinger Bands indicator, the strategy adapts to various market conditions and provides clear entry and exit signals. While the strategy has been optimized for the 5-minute chart, traders can customize it according to their preferences and trading styles.

However, it’s important to recognize that the strategy is not infallible and may face challenges under certain market conditions. Therefore, thorough backtesting and risk assessment are crucial before applying it in real-world scenarios. Traders should also consider incorporating the strategy into a broader trading plan and combine it with appropriate risk management measures.

Through continuous optimization and refinement, the “Bollinger Bands Long Only Strategy” can become a valuable asset for day traders, helping them navigate dynamic markets and uncover profitable trading opportunities. Whether you are an experienced trader or just starting out, this strategy provides a solid foundation that can be tailored to your unique needs and goals.

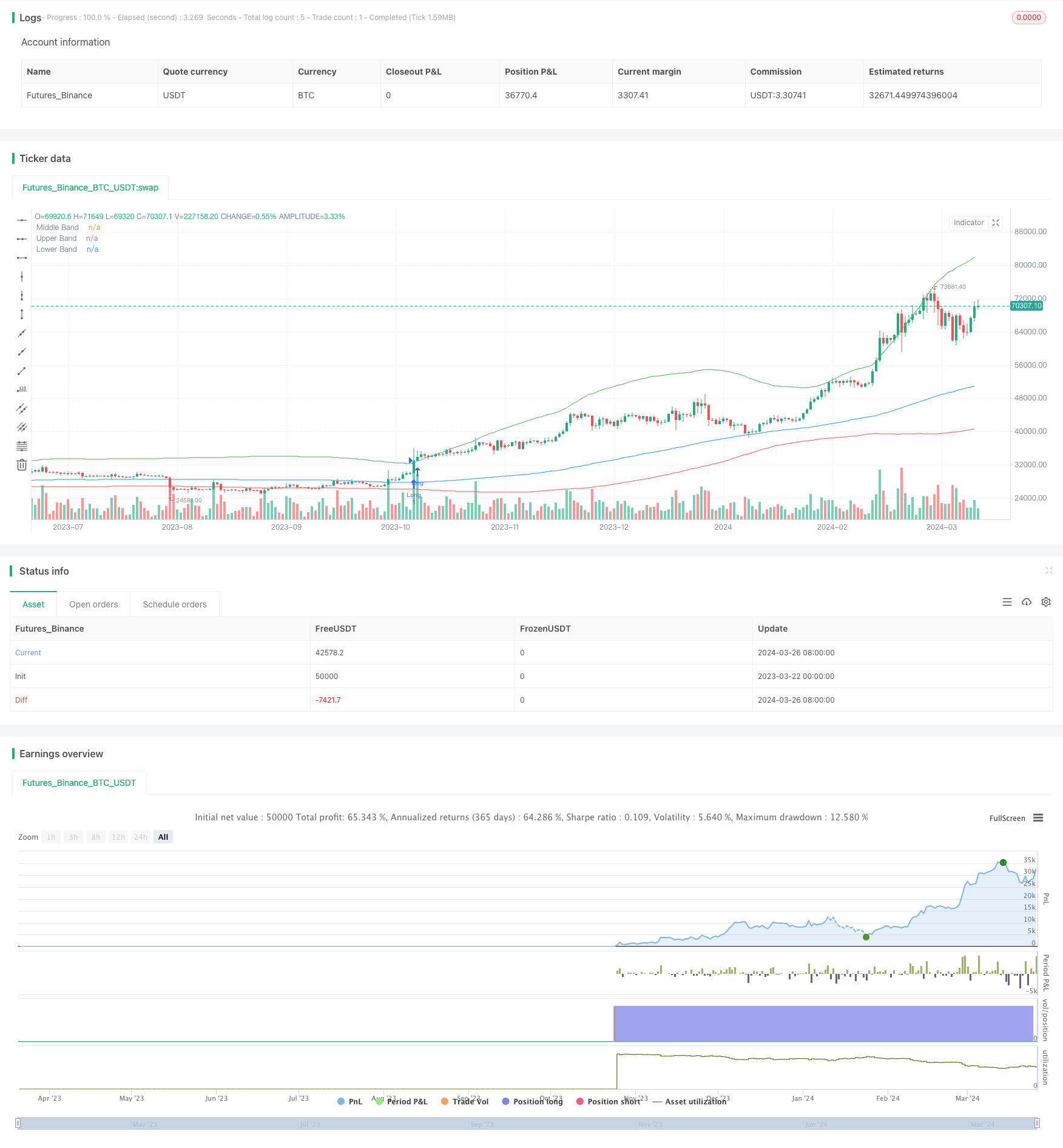

/*backtest

start: 2023-03-22 00:00:00

end: 2024-03-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Long Only Strategy", overlay=true, margin_long=100, margin_short=100)

// Strategy parameters

length = 100

multUpper = 3.0

multLower = 1.0

// Calculating Bollinger Bands

basis = ta.sma(close, length)

dev = ta.stdev(close, length)

upperBand = basis + multUpper * dev

lowerBand = basis - multLower * dev

// Entry condition

longCondition = ta.crossover(close, upperBand)

// Exit condition

exitCondition = ta.crossunder(close, lowerBand)

// Plotting Bollinger Bands

plot(basis, color=color.blue, title="Middle Band")

plot(upperBand, color=color.green, title="Upper Band")

plot(lowerBand, color=color.red, title="Lower Band")

// Strategy execution

if (longCondition)

strategy.entry("Long", strategy.long)

if (exitCondition)

strategy.close("Long")

// This script should be applied to a daily chart as specified. Adjust the 'length', 'multUpper', and 'multLower' parameters based on your preferences.