Overview

The Moving Average Crossover Quantitative Strategy is a quantitative trading strategy that generates buy and sell signals based on the crossover signals of two moving averages with different periods. This strategy uses a 9-day and a 20-day simple moving average (SMA). A buy signal is generated when the short-term moving average (9-day) crosses above the long-term moving average (20-day), and a sell signal is generated when the short-term moving average crosses below the long-term moving average. The strategy logic is simple, clear, and easy to implement and optimize.

Strategy Principles

The core of this strategy is to use the crossover signals of moving averages with different periods to capture the turning points of market trends. Specifically, the main steps of the strategy are as follows:

- Calculate the 9-day and 20-day simple moving averages.

- Determine whether the short-term moving average (9-day) crosses above the long-term moving average (20-day). If so, set the crossoverCondition variable to true, indicating that the buy condition is met.

- Determine whether the current closing price is greater than the opening price and greater than the 9-day moving average. If so, set the buySignal variable to true, indicating that the current bar meets the buy condition.

- If both crossoverCondition and buySignal are true, execute the buy operation and reset crossoverCondition to false to avoid repeated buying.

- Determine whether the short-term moving average (9-day) crosses below the long-term moving average (20-day). If so, set the crossoverCondition variable to false, indicating that the crossover condition is no longer met.

- If the current closing price is less than the 9-day moving average, execute the sell operation.

Through the above steps, the strategy can buy on the first bullish candle after the short-term moving average crosses above the long-term moving average, and sell on the first bearish candle after the short-term moving average crosses below the long-term moving average, thereby realizing timely position opening and closing at trend turning points.

Advantage Analysis

The Moving Average Crossover Quantitative Strategy has the following advantages:

- Simple logic: The strategy is based on the crossover signals of moving averages, with clear logic and easy to understand and implement.

- Strong adaptability: By adjusting the period parameters of the moving averages, it can adapt to different markets and trading instruments.

- Trend tracking: Moving averages can effectively track market trends, enabling the strategy to trade in the direction of the main trend.

- Risk control: On the basis of moving average crossovers, the strategy further confirms the signal by judging the current candle’s trend, avoiding false signals to a certain extent.

Risk Analysis

Although the Moving Average Crossover Quantitative Strategy has certain advantages, it still has the following risks:

- Lag: Moving averages are lagging indicators. When the crossover signal appears, the market has often already moved for a period, and the strategy’s entry point may not be ideal.

- Choppy market: In a choppy market, the short-term and long-term moving averages may frequently cross, causing the strategy to generate more trading signals and increase trading costs.

- Parameter risk: Different market environments and trading instruments may require different moving average period parameters. Improper parameter selection may lead to poor strategy performance.

To address the above risks, the following measures can be taken to improve:

- Introduce other technical indicators or signal filtering conditions, such as trading volume and volatility, to improve signal quality.

- For choppy markets, consider introducing stop-loss or filtering mechanisms to reduce costs caused by frequent trading.

- For different markets and instruments, perform parameter optimization and adaptive adjustment to improve the robustness of the strategy.

Optimization Directions

Parameter optimization: Optimize the period parameters of the moving averages to find the parameter combination that is more suitable for the current market and improve strategy performance.

Signal filtering: On the basis of moving average crossovers, introduce other technical indicators or conditions, such as MACD and RSI, to perform secondary confirmation of trading signals and improve signal reliability.

Position management: Dynamically adjust position size based on factors such as market trend strength and volatility. Increase position size when the trend is strong, and decrease position size when the trend is unclear or volatility increases to improve the risk-return ratio.

Stop-loss and take-profit: Introduce reasonable stop-loss and take-profit mechanisms to control the risk exposure of a single trade while letting profits run to improve strategy returns.

Long-short hedging: Consider adding counter-trend signals to the strategy to hold both long and short positions simultaneously, hedging market risk and improving strategy stability.

The above optimization directions can help improve the performance of the strategy, but the specific implementation still needs to be adjusted and tested according to the actual situation.

Summary

The Moving Average Crossover Quantitative Strategy is a simple and effective trend-following strategy that captures changes in market trends through crossover signals of moving averages with different periods. The strategy logic is clear and adaptable, but it also has problems such as lag and choppy market risks. By introducing other technical indicators, optimizing parameters, improving position management and risk control measures, the performance of this strategy can be further improved, making it a more robust and effective quantitative trading strategy.

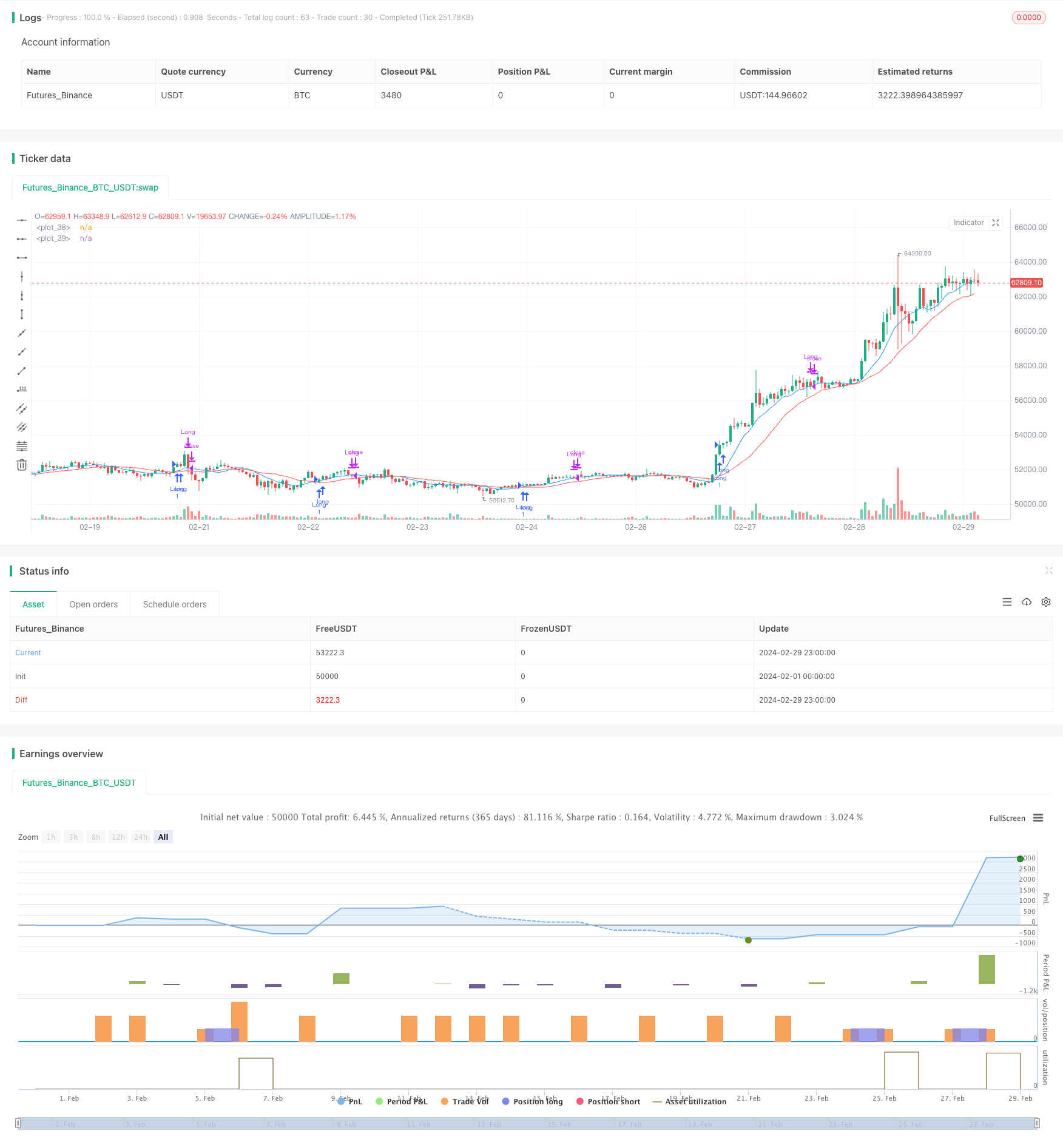

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZeroHeroTrading

//@version=5

strategy("Simple 9/20 Crossover", overlay=true)

// Define moving averages

ma9 = ta.sma(close, 9)

ma20 = ta.sma(close, 20)

// Set persistent variable to keep track of crossover condition

var bool crossoverCondition = false

// 9 MA crosses above 20 MA

// Set crossover condition to true

if ta.crossover(ma9, ma20)

crossoverCondition := true

// 9 MA crosses under 20 MA

// Reset crossover condition to false

if ta.crossunder(ma9, ma20)

crossoverCondition := false

// Set buy and sell signals

buySignal = crossoverCondition and close > open and close > ma9

sellSignal = close < ma9

// Execute trades based on signals

if (buySignal)

strategy.entry("Long", strategy.long)

// Avoid repeat entries by resetting crossover condition to false

crossoverCondition := false

if (sellSignal)

strategy.close("Long")

// Plot moving averages on the chart

plot(ma9, color=color.blue)

plot(ma20, color=color.red)