Overview

This strategy combines two technical indicators: the modified Hull Moving Average (HMA) and Ichimoku Kinko Hyo (IKHS), aiming to capture medium to long-term market trends. The main idea is to utilize the crossover signals between the HMA and the Kijun Sen (baseline) of IKHS, while using the Kumo (cloud) of IKHS as a filtering condition to determine the trend direction and make trading decisions.

Strategy Principles

- Calculate the modified Hull Moving Average (HMA)

- Calculate the Weighted Moving Average (WMA) and apply double smoothing to obtain the modified HMA

- Calculate the various indicators of Ichimoku Kinko Hyo

- Calculate the Tenkan Sen (conversion line), Kijun Sen (baseline), Senkou Span A (leading span A), and Senkou Span B (leading span B)

- Generate trading signals

- When the HMA crosses above the Kijun Sen and the closing price is above the Kumo, generate a long signal

- When the HMA crosses below the Kijun Sen and the closing price is below the Kumo, generate a short signal

- Execute trades

- Perform corresponding trading operations based on the long or short signals

- Exit trades

- When the HMA crosses the Kijun Sen in the opposite direction, exit the current position

Strategy Advantages

- Combines two effective trend-following indicators, HMA and IKHS, to better capture market trends

- Utilizes the Kumo of IKHS as a filtering condition to effectively reduce false signals and improve the win rate of trades

- The modified HMA has a faster response speed and lower lag compared to traditional moving averages, enabling timely reflection of market changes

- The strategy logic is clear, easy to understand, and implement, suitable for various markets and time frames

Strategy Risks

- During market fluctuations or unclear trends, the strategy may generate more false signals, leading to frequent trading and capital losses

- The parameter settings of the strategy have a significant impact on trading results, and different parameter combinations may lead to different performances

- The strategy does not consider market emergencies and irrational behaviors, and may face greater risks under extreme market conditions

Strategy Optimization Directions

- Introduce other technical indicators or market sentiment indicators to improve the reliability and stability of signals

- Optimize strategy parameters, such as using machine learning or genetic algorithms to find the optimal parameter combination

- Consider adding a risk management module, such as setting stop-loss and take-profit levels, position sizing, etc., to control the risk exposure of the strategy

- Based on the characteristics of different markets and time frames, make targeted adjustments and optimizations to the strategy

Summary

By combining the modified Hull Moving Average and Ichimoku Kinko Hyo, this strategy constructs a relatively stable trend-following trading system. The strategy logic is clear and easy to implement, while also having certain advantages. However, the performance of the strategy is still affected by market conditions and parameter settings, requiring further optimization and improvement. In practical applications, it is necessary to make appropriate adjustments and management based on specific market characteristics and risk preferences to obtain better trading results.

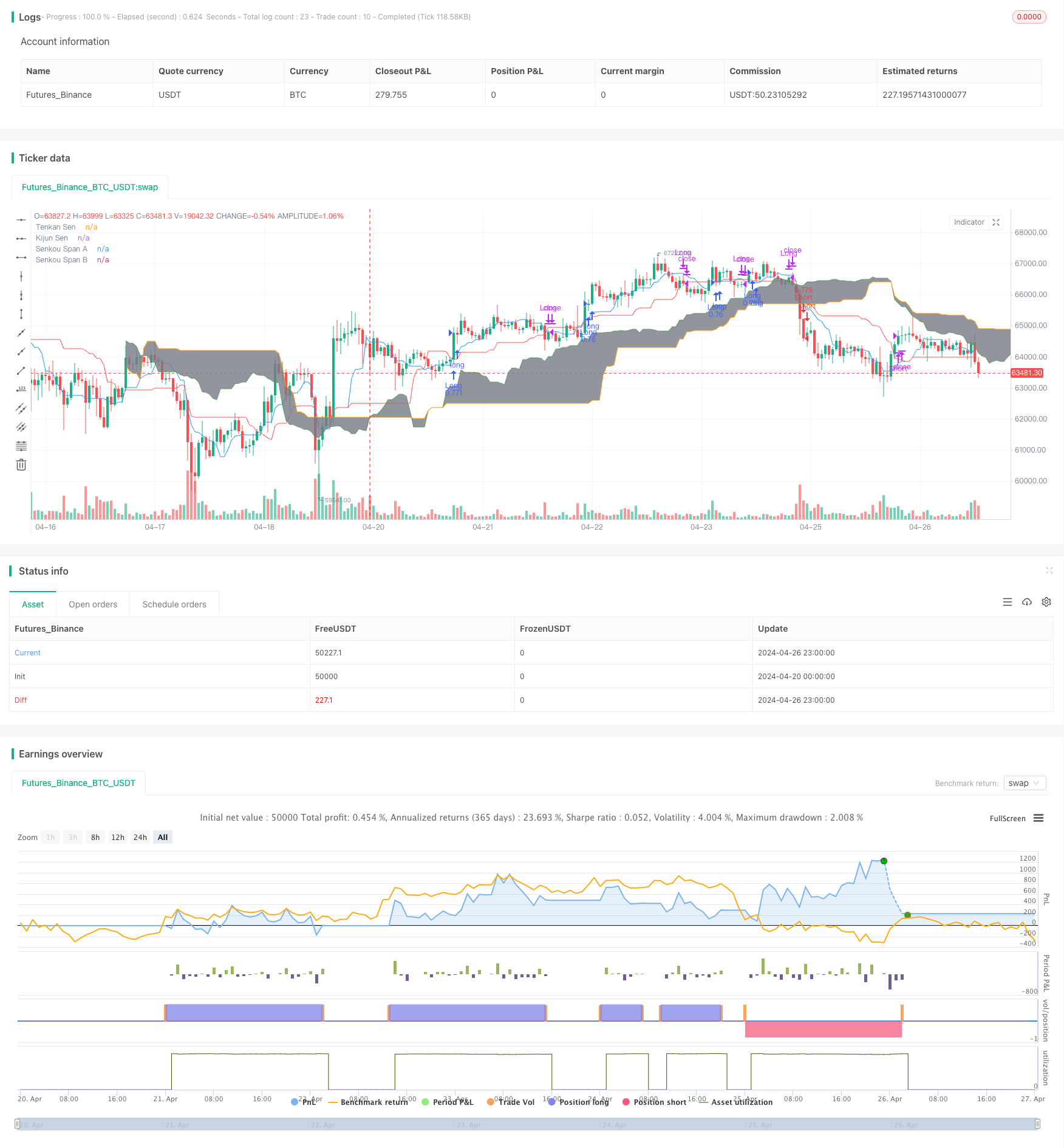

/*backtest

start: 2024-04-20 00:00:00

end: 2024-04-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hull MA_X + Ichimoku Kinko Hyo Strategy", shorttitle="HMX+IKHS", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, pyramiding=0)

// Hull Moving Average Parameters

keh = input(12, title="Double HullMA")

n2ma = 2 * wma(close, round(keh/2)) - wma(close, keh)

sqn = round(sqrt(keh))

hullMA = wma(n2ma, sqn)

// Ichimoku Kinko Hyo Parameters

tenkanSenPeriods = input(9, title="Tenkan Sen Periods")

kijunSenPeriods = input(26, title="Kijun Sen Periods")

senkouSpanBPeriods = input(52, title="Senkou Span B Periods")

displacement = input(26, title="Displacement")

// Ichimoku Calculations

highestHigh = highest(high, max(tenkanSenPeriods, kijunSenPeriods))

lowestLow = lowest(low, max(tenkanSenPeriods, kijunSenPeriods))

tenkanSen = (highest(high, tenkanSenPeriods) + lowest(low, tenkanSenPeriods)) / 2

kijunSen = (highestHigh + lowestLow) / 2

senkouSpanA = ((tenkanSen + kijunSen) / 2)

senkouSpanB = (highest(high, senkouSpanBPeriods) + lowest(low, senkouSpanBPeriods)) / 2

// Plot Ichimoku

p1 = plot(tenkanSen, color=color.blue, title="Tenkan Sen")

p2 = plot(kijunSen, color=color.red, title="Kijun Sen")

p3 = plot(senkouSpanA, color=color.green, title="Senkou Span A", offset=displacement)

p4 = plot(senkouSpanB, color=color.orange, title="Senkou Span B", offset=displacement)

fill(p3, p4, color=color.gray, title="Kumo Shadow")

// Trading Logic

longCondition = crossover(hullMA, kijunSen) and close > senkouSpanA[displacement] and close > senkouSpanB[displacement]

shortCondition = crossunder(hullMA, kijunSen) and close < senkouSpanA[displacement] and close < senkouSpanB[displacement]

// Strategy Execution

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Exit Logic - Exit if HullMA crosses KijunSen in the opposite direction

exitLongCondition = crossunder(hullMA, kijunSen)

exitShortCondition = crossover(hullMA, kijunSen)

if (exitLongCondition)

strategy.close("Long")

if (exitShortCondition)

strategy.close("Short")