Overview

This quantitative trading strategy primarily utilizes the crossover signals of the Parabolic SAR (PSAR) and Exponential Moving Average (EMA) indicators, combined with multiple custom conditions to generate buy and sell signals. The main idea behind the strategy is: when the PSAR breaks above the EMA from below and satisfies certain conditions, a buy signal is generated; when the PSAR falls below the EMA from above and meets certain conditions, a sell signal is generated. Additionally, the strategy sets take-profit and stop-loss levels to manage risk.

Strategy Principle

- Calculate the PSAR and 30-period EMA indicators

- Determine the crossover relationship between PSAR and EMA, and set corresponding flags

- Define IGC (Ideal Green Candle) and IRC (Ideal Red Candle) based on the relative positions of PSAR and EMA, as well as the color of the candles

- Generate buy and sell signals based on the occurrence of IGC and IRC

- Set take-profit levels at 8%, 16%, and 32% above the buy price, and the stop-loss level at 16% below the buy price; set take-profit levels at 8%, 16%, and 32% below the sell price, and the stop-loss level at 16% above the sell price

- Execute buy, sell, or close positions based on the trading session and position status

Strategy Advantages

- Combines multiple indicators and conditions to improve signal reliability

- Sets multiple take-profit and stop-loss levels for flexible risk and return management

- Establishes filters for buy and sell conditions based on different market situations, enhancing the adaptability of the strategy

- Highly modularized code, making it easy to understand and modify

Strategy Risks

- The parameter settings of the strategy may not be suitable for all market environments and need to be adjusted based on actual conditions

- In choppy markets, the strategy may generate frequent trading signals, leading to increased trading costs

- The strategy lacks judgment on market trends and may miss opportunities in strong trending markets

- The stop-loss settings may not completely avoid risks brought by extreme market conditions

Strategy Optimization Directions

- Introduce more technical indicators or market sentiment indicators to improve signal accuracy and reliability

- Optimize the settings of take-profit and stop-loss levels, considering the implementation of dynamic take-profit/stop-loss or volatility-based take-profit/stop-loss

- Set different trading parameters and rules for different market states to enhance the adaptability of the strategy

- Incorporate a money management module to dynamically adjust positions and risk exposure based on factors such as account equity ratio and balance

Summary

This quantitative trading strategy is based on the PSAR and EMA indicators, generating buy and sell signals through multiple custom conditions and rules. The strategy has a certain level of adaptability and flexibility while also setting take-profit and stop-loss levels to manage risk. However, there is still room for optimization in terms of parameter settings and risk control. Overall, this strategy can serve as a basic template, and with further optimization and improvements, it has the potential to become a robust trading strategy.

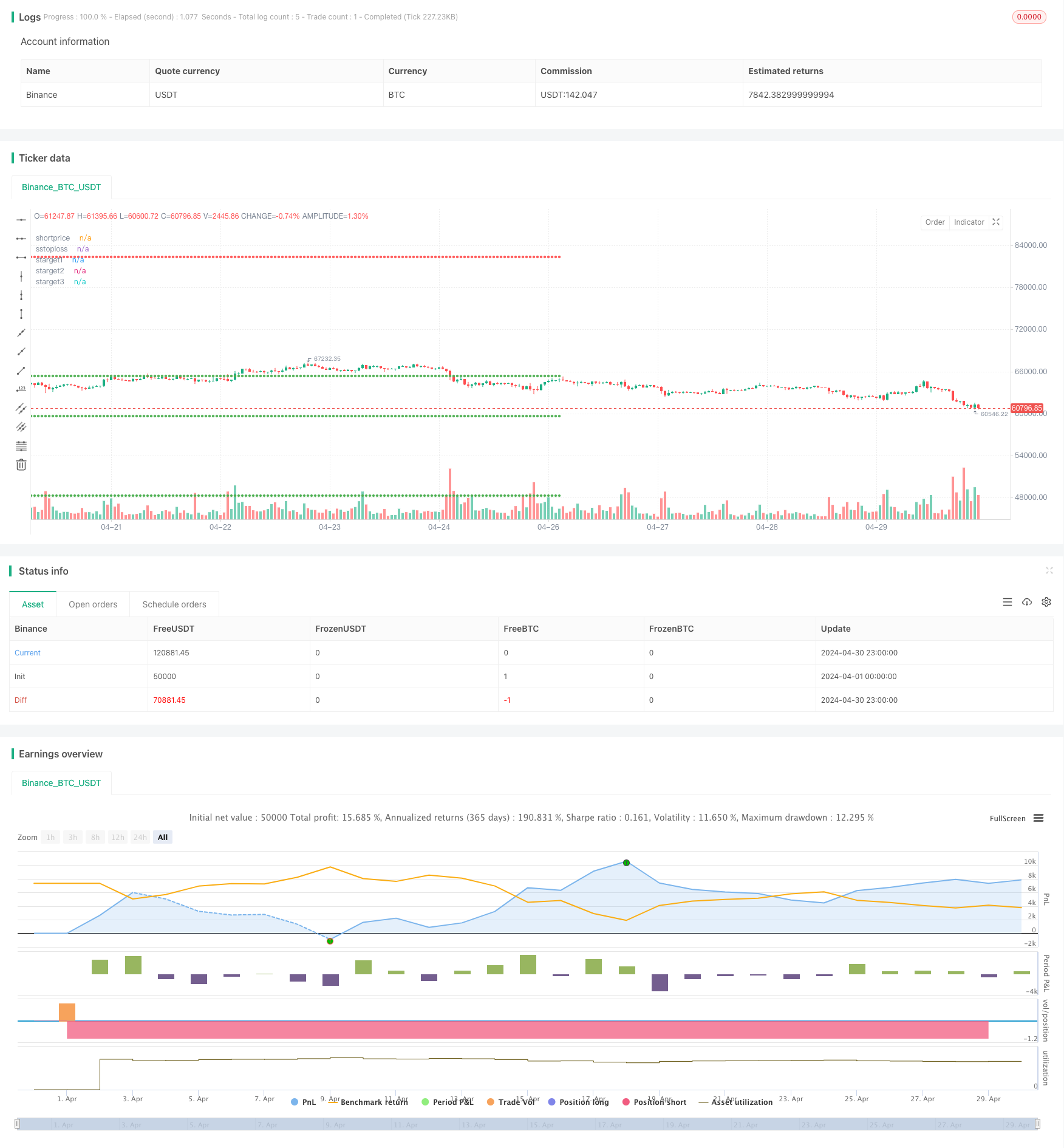

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SwapnilRaykar

//@version=5

strategy("aj sir second project", overlay=true, margin_long=100, margin_short=100)

start=input("0915-1515","session time")

st11=time(timeframe.period,start)

st=st11>0

et= not st

psar=ta.sar(0.02,0.02,0.2)

emared=ta.ema(close,30)

//plot(psar,"psar",color.yellow,style = plot.style_cross)

//plot(emared,"emared",color.red)

var crodownflag=0

var croupflag=0

var igcflag=0

var ircflag=0

cdown1=ta.crossunder(psar,emared) and not (psar<close and psar[1]>close[1])

cup1=ta.crossover(psar,emared) and not (psar>close and psar[1]<close[1])

cdown=ta.crossunder(psar,emared)

cup=ta.crossover(psar,emared)

green_candle=close>open

red_candle=close<open

if ta.crossunder(psar,emared) and crodownflag==0 and not (psar<close and psar[1]>close[1])

crodownflag:=1

else if cdown and crodownflag==1

crodownflag:=0

if crodownflag==1 and green_candle and igcflag==0

igcflag:=1

else if cdown and igcflag==1

igcflag:=0

//plot(igcflag,"igcflag",color.lime)

if ta.crossover(psar,emared) and croupflag==0 and not (psar>close and psar[1]<close[1])

croupflag:=1

else if cdown and croupflag==1

croupflag:=0

//plot(crodownflag,"crodownflag",color.white)

irc_cond=croupflag==1 or cup

if (croupflag==1 and red_candle and ircflag==0)

ircflag:=1

else if cup and croupflag==1

ircflag:=0

igc_candle1=(igcflag==1 and igcflag[1]==0) or (cdown1 and green_candle)

irc_candle1=(ircflag==1 and ircflag[1]==0) or (cup1 and red_candle)

///////////////////////////

dm=dayofmonth(time)

newday=dm!=dm[1]

dmc=dm==ta.valuewhen(bar_index==last_bar_index,dm,0)

///////////////////////////////////////////

var irc_there=0

if irc_candle1[1] and irc_there==0

irc_there:=1

else if cdown and irc_there==1

irc_there:=0

irc_candle=irc_candle1 and irc_there==0// and dmc

var igc_there=0

if igc_candle1[1] and igc_there==0

igc_there:=1

else if cup and igc_there ==1

igc_there:=0

igc_candle=igc_candle1 and igc_there==0// and dmc

/////////// to get rid of irc being valid even after crossdown

var valid_igc_low=0

var valid_irc_high=0

if irc_candle[1] and valid_irc_high==0

valid_irc_high:=1

else if igc_candle and valid_irc_high==1

valid_irc_high:=0

if igc_candle and valid_igc_low==0

valid_igc_low:=1

else if irc_candle and valid_igc_low==1

valid_igc_low:=0

igc_low=ta.valuewhen(igc_candle,low,0)

irc_high=ta.valuewhen(irc_candle,high,0)

//////////////////////////////

//plot(irc_high,"irc_high",color.red)

//plot(valid_irc_high,"valid_irc_high",color.purple)

buy12=ta.crossunder(close,igc_low) and valid_igc_low==1

buy1=buy12[1]

short12=ta.crossover(close,irc_high) and valid_irc_high==1

short1=short12[1]

//plotshape(short12,"short12",shape.arrowdown,color=color.purple)

// plotshape(igc_candle,"igc_candle",shape.arrowdown,color=color.green)

// plotshape(irc_candle,"irc_candle",shape.arrowdown,color=color.red)

//plotshape((psar<close and psar[1]>close[1]) ,"croup",shape.arrowdown,color=color.red)

//plotshape(cup ,"croup",shape.arrowdown,color=color.orange)

buyprice=ta.valuewhen(buy1 and strategy.position_size[1]==0,open,0)

shortprice=ta.valuewhen(short1 and strategy.position_size[1]==0,open,0)

btarget1=buyprice+(buyprice*0.08)

btarget2=buyprice+(buyprice*0.16)

btarget3=buyprice+(buyprice*0.32)

bstoploss=buyprice-(buyprice*0.16)

starget1=shortprice-(shortprice*0.08)

starget2=shortprice-(shortprice*0.16)

starget3=shortprice-(shortprice*0.32)

sstoploss=shortprice+(shortprice*0.16)

if buy12 and strategy.position_size==0 and st11

strategy.entry("buy",strategy.long)

if strategy.position_size >0

strategy.exit("sell",from_entry = "buy",stop=bstoploss,limit=btarget3)

if short12 and strategy.position_size==0 and st11

strategy.entry("short",strategy.short)

if strategy.position_size<0

strategy.exit("cover",from_entry = "short",stop = sstoploss,limit = starget3)

if et

strategy.close_all(comment = "timeover")

plot(strategy.position_size>0?buyprice:na,"buyprice",color.white, style=plot.style_circles )

plot(strategy.position_size>0?bstoploss:na,"bstoploss",color.red, style=plot.style_circles )

plot(strategy.position_size>0?btarget1:na,"btarget1",color.green, style=plot.style_circles )

plot(strategy.position_size>0?btarget2:na,"btarget2",color.green, style=plot.style_circles )

plot(strategy.position_size>0?btarget3:na,"btarget3",color.green, style=plot.style_circles )

plot(strategy.position_size<0?shortprice:na,"shortprice",color.white, style=plot.style_circles )

plot(strategy.position_size<0?sstoploss:na,"sstoploss",color.red, style=plot.style_circles )

plot(strategy.position_size<0?starget1:na,"starget1",color.green, style=plot.style_circles )

plot(strategy.position_size<0?starget2:na,"starget2",color.green, style=plot.style_circles )

plot(strategy.position_size<0?starget3:na,"starget3",color.green, style=plot.style_circles )