Overview

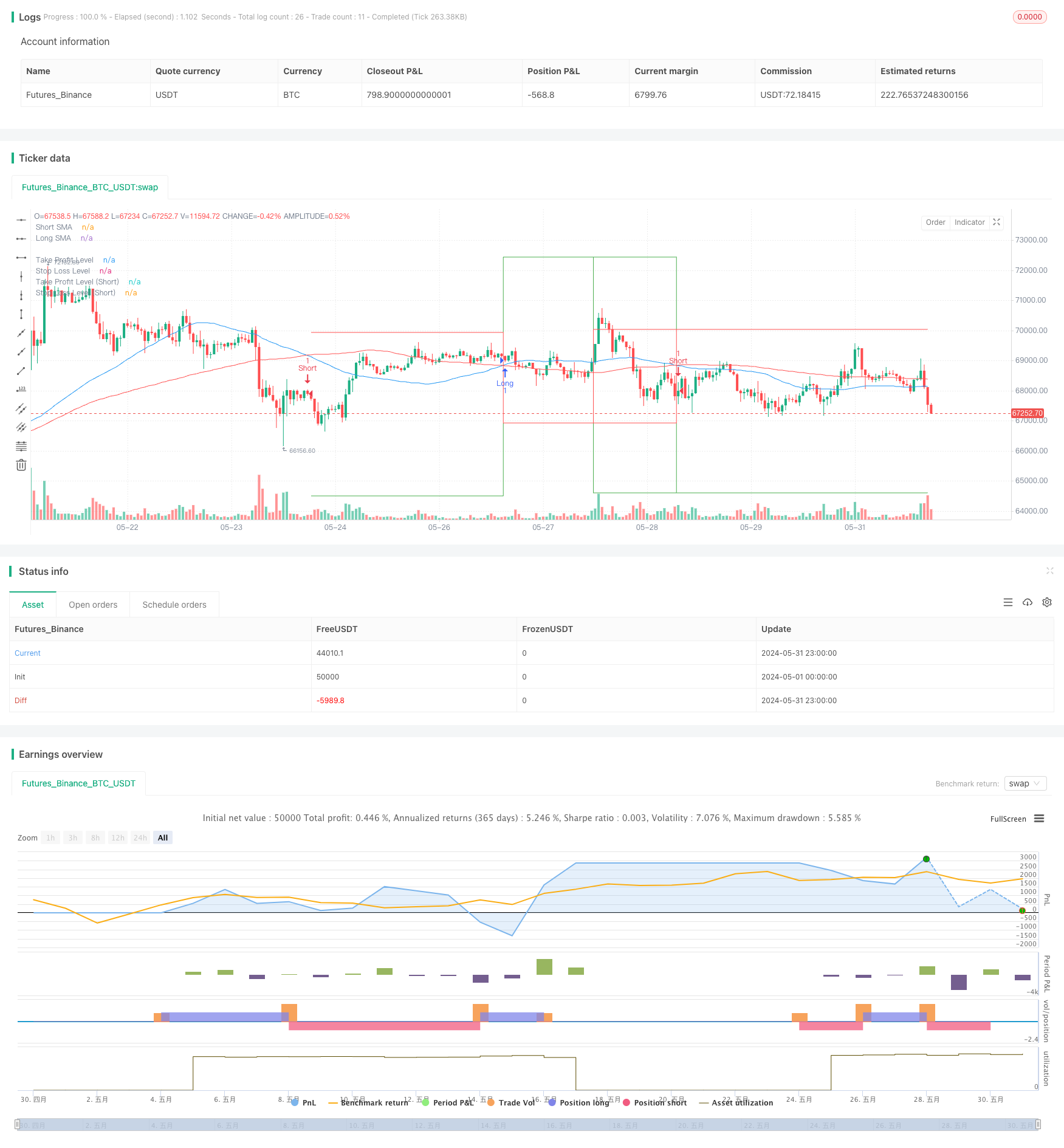

This strategy is an automated trading system based on Simple Moving Average (SMA) crossovers, combined with dynamic take-profit and stop-loss mechanisms. It uses two SMAs of different periods to generate buy and sell signals through their crossovers. Additionally, the strategy sets percentage-based take-profit and stop-loss levels to control risk and lock in profits.

Strategy Principles

- Uses two SMAs: a short-term (50-period) and a long-term (100-period).

- Generates a buy signal when the short-term SMA crosses above the long-term SMA; generates a sell signal when the short-term SMA crosses below the long-term SMA.

- Calculates take-profit and stop-loss levels based on the current price and preset percentages for each trade entry.

- Automatically closes positions when the price reaches the take-profit or stop-loss level.

- Marks buy and sell signals on the chart and plots take-profit and stop-loss level lines.

Strategy Advantages

- Simple to understand: Dual moving average crossover is a classic technical analysis method, easy to comprehend and implement.

- Trend-following: Capable of capturing medium to long-term trends, beneficial for profiting from significant market movements.

- Risk management: Effectively controls risk for each trade through dynamic setting of take-profit and stop-loss levels.

- Automation: Fully executed by the program, reducing human intervention and emotional influence.

- Visualization: Clearly marks trading signals and key price levels on the chart, facilitating analysis and backtesting.

Strategy Risks

- Unsuitable for ranging markets: May generate frequent false signals in sideways markets, leading to consecutive losses.

- Lag: SMAs inherently have a lag, potentially missing optimal entry points or delaying exits.

- Fixed percentage risk: Using fixed percentage take-profit and stop-loss may not be suitable for all market conditions.

- Lack of additional confirmation indicators: Relying solely on moving average crossovers may ignore other important market information.

- Disregard for trading costs: Frequent trading can generate substantial transaction costs, affecting final returns.

Strategy Optimization Directions

- Introduce filters: Add volume, volatility, or other technical indicators as filtering conditions to reduce false signals.

- Dynamic adjustment of SMA periods: Automatically adjust SMA lengths based on market volatility to adapt to different market environments.

- Optimize take-profit and stop-loss: Consider using ATR (Average True Range) to set dynamic take-profit and stop-loss levels for better adaptation to market volatility.

- Enhance trend confirmation: Incorporate other trend indicators like MACD or ADX to improve the reliability of trading signals.

- Implement position sizing: Dynamically adjust the size of each trade based on account size and market volatility.

- Time filtering: Add trading time window restrictions to avoid periods of high volatility or low liquidity.

- Drawdown control: Add maximum drawdown limits to pause trading when consecutive losses reach a certain level.

Conclusion

This dual moving average crossover trading strategy provides a simple yet effective framework suitable for beginners entering automated trading. It combines elements of trend following and risk management by dynamically setting take-profit and stop-loss levels to protect capital. However, to achieve better results in actual trading, further optimization and refinement are necessary. Consider adding more technical indicators as filters, optimizing the method for setting take-profit and stop-loss levels, and introducing more sophisticated position management strategies. Simultaneously, thorough backtesting and validation across different market environments and timeframes are essential. Through continuous improvement and adaptation to market changes, this strategy has the potential to become a reliable trading system.

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pubgentleman

//@version=5

//@version=5

strategy("TSLA 1-Hour SMA Crossover Strategy with Buy/Sell Signals", overlay=true)

// Parameters

shortSmaLength = input.int(50, title="Short SMA Length")

longSmaLength = input.int(100, title="Long SMA Length")

takeProfitPerc = input.float(5.0, title="Take Profit Percentage", step=0.1) // 5.0% take profit

stopLossPerc = input.float(3.0, title="Stop Loss Percentage", step=0.1) // 3.0% stop loss

// Calculate SMAs

shortSma = ta.sma(close, shortSmaLength)

longSma = ta.sma(close, longSmaLength)

// Plot SMAs

plot(shortSma, color=color.blue, title="Short SMA")

plot(longSma, color=color.red, title="Long SMA")

// Entry Conditions

longCondition = ta.crossover(shortSma, longSma)

shortCondition = ta.crossunder(shortSma, longSma)

// Trade Management

var float entryPrice = na

var float takeProfitLevel = na

var float stopLossLevel = na

if (longCondition)

entryPrice := close

takeProfitLevel := entryPrice * (1 + takeProfitPerc / 100)

stopLossLevel := entryPrice * (1 - stopLossPerc / 100)

strategy.entry("Long", strategy.long)

label.new(x=bar_index, y=low, text="Buy", style=label.style_label_up, color=color.green, textcolor=color.white)

if (shortCondition)

entryPrice := close

takeProfitLevel := entryPrice * (1 - takeProfitPerc / 100)

stopLossLevel := entryPrice * (1 + stopLossPerc / 100)

strategy.entry("Short", strategy.short)

label.new(x=bar_index, y=high, text="Sell", style=label.style_label_down, color=color.red, textcolor=color.white)

// Exit Conditions

if (strategy.position_size > 0)

if (close >= takeProfitLevel or close <= stopLossLevel)

strategy.close("Long")

if (strategy.position_size < 0)

if (close <= takeProfitLevel or close >= stopLossLevel)

strategy.close("Short")

// Plot Take Profit and Stop Loss Levels

plot(strategy.position_size > 0 ? takeProfitLevel : na, title="Take Profit Level", color=color.green, style=plot.style_stepline)

plot(strategy.position_size > 0 ? stopLossLevel : na, title="Stop Loss Level", color=color.red, style=plot.style_stepline)

plot(strategy.position_size < 0 ? takeProfitLevel : na, title="Take Profit Level (Short)", color=color.green, style=plot.style_stepline)

plot(strategy.position_size < 0 ? stopLossLevel : na, title="Stop Loss Level (Short)", color=color.red, style=plot.style_stepline)