Overview

This article introduces an optimized quantitative trading strategy based on the Hull Moving Average (HMA), which combines multi-timeframe analysis with a dynamic stop-loss mechanism. The strategy is an improvement on the famous Hull Suite, incorporating the “strategy.exit()” command from PineScript v5 to implement a trailing stop or delayed trailing stop. The strategy primarily leverages the fast-response characteristics of HMA to capture market trends, while enhancing signal reliability through analysis across multiple timeframes. The dynamic stop-loss mechanism helps protect profits and control risks. This strategy is applicable to various financial markets, particularly suited for highly volatile market environments.

Strategy Principles

Hull Moving Average (HMA): The core of the strategy uses HMA and its variants (EHMA and THMA) to identify market trends. HMA offers faster response and less lag compared to traditional moving averages.

Multi-timeframe Analysis: The strategy generates trading signals by comparing HMA across different timeframes. This method reduces false signals and improves trading accuracy.

Dynamic Stop-Loss: The strategy employs a trailing stop mechanism that activates after reaching a certain profit point, effectively locking in profits and controlling risks.

Trading Session Control: The strategy allows users to define specific trading sessions, helping to avoid trades during periods of low volatility or liquidity.

Direction Control: The strategy offers options to choose trading direction (long, short, or both), making it adaptable to different market environments and trading styles.

Strategy Advantages

High Flexibility: The strategy allows users to choose between different Hull Moving Average variants (HMA, EHMA, THMA) to adapt to various market conditions.

Excellent Risk Management: Through the use of a dynamic stop-loss mechanism, the strategy can protect profits while limiting potential losses.

Strong Adaptability: The multi-timeframe analysis method enables the strategy to adapt to different market environments, reducing the impact of false signals.

Good Visualization: The strategy provides multiple visualization options, such as color-coded HMA bands, helping traders understand market trends more intuitively.

High Degree of Automation: The strategy can be fully automated, reducing the possibility of emotional influence and operational errors.

Strategy Risks

Overtrading: Due to the strategy’s reliance on the fast-reacting HMA, it may generate excessive false signals in ranging markets, leading to overtrading.

Slippage Risk: The strategy employs scalping techniques, which may face high slippage risk, especially in markets with lower liquidity.

Parameter Sensitivity: The strategy’s performance is highly dependent on parameter settings; inappropriate parameters may lead to poor strategy performance.

Market Condition Changes: In the face of drastic market condition changes, the strategy may require parameter re-optimization to maintain effectiveness.

Technology Dependence: The strategy’s execution relies on stable network connections and trading platforms; technical failures could lead to significant losses.

Strategy Optimization Directions

Incorporate Market Sentiment Indicators: Integrating market sentiment indicators such as VIX or implied volatility from options can help the strategy better adapt to different market environments.

Introduce Machine Learning Algorithms: Using machine learning techniques to dynamically adjust HMA parameters and stop-loss levels can improve the strategy’s adaptability.

Add Volume Analysis: Incorporating volume data can increase the accuracy of trend judgments and reduce losses from false breakouts.

Optimize Timeframe Selection: Through backtesting different timeframe combinations, find the optimal multi-timeframe analysis settings.

Introduce Risk Parity Methods: Using risk parity methods for capital allocation in multi-asset trading can better control overall portfolio risk.

Conclusion

The Optimized Multi-Timeframe HMA Quantitative Trading Strategy with Dynamic Stop-Loss is a flexible and efficient trading system. By combining the fast-response characteristics of the Hull Moving Average, the stability of multi-timeframe analysis, and the risk control of dynamic stop-loss, it provides traders with a comprehensive quantitative trading solution. While this strategy performs excellently in rapidly changing markets, traders still need to closely monitor changes in market conditions and adjust parameters timely to maintain its effectiveness. Through continuous optimization and the introduction of new technical elements, this strategy has the potential to remain competitive in various market environments. However, users should fully understand the potential risks of quantitative trading and use it cautiously in live trading.

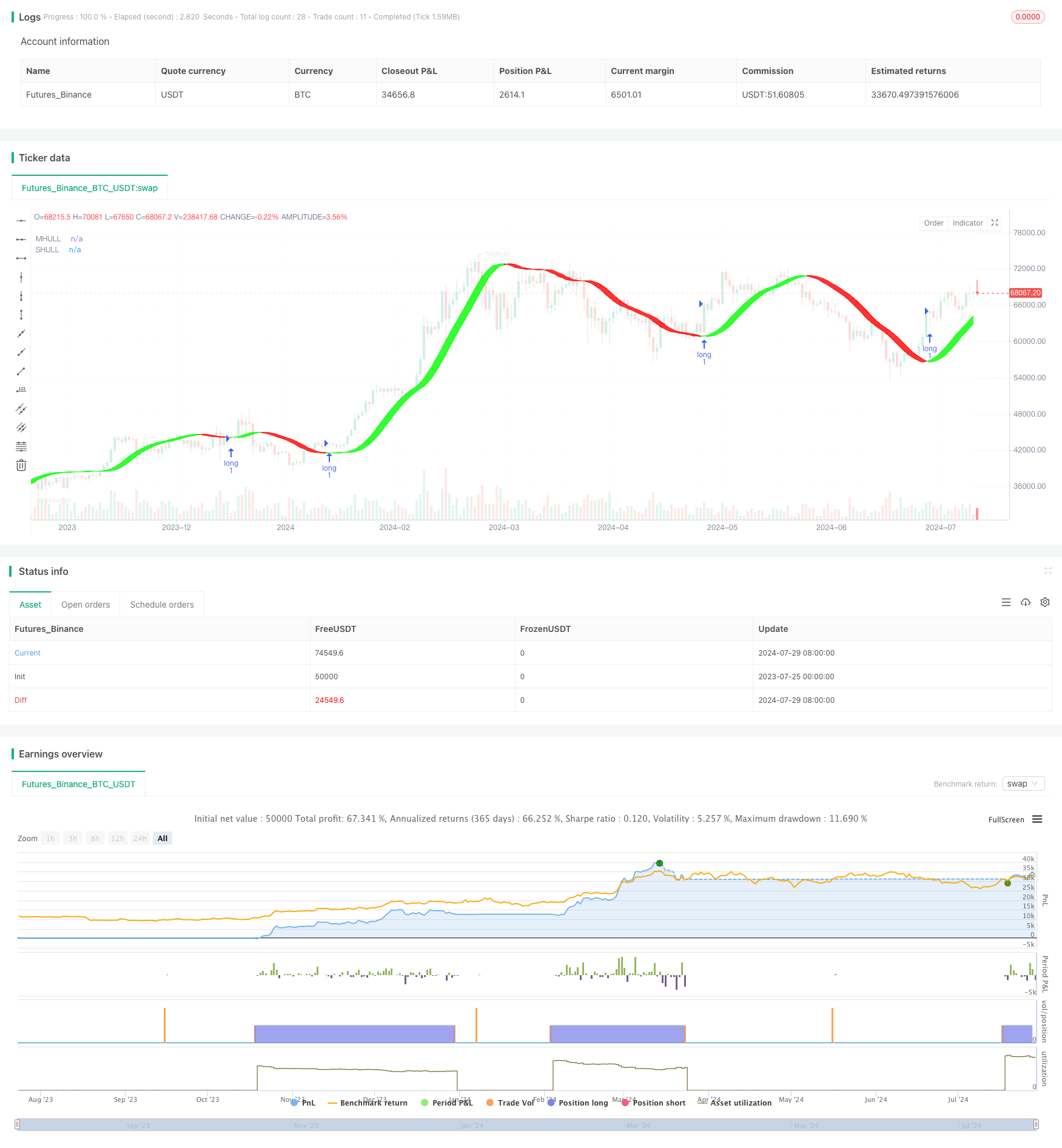

/*backtest

start: 2023-07-25 00:00:00

end: 2024-07-30 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © anotherDAPTrader

//Based upon Hull Suite by InSilico and others//

//with SCALP exit//

//@version=5

strategy('DAP Hull Sweet Scalp v1 Strategy', overlay=true)

// Session //

session = input(title='Session (Goes flat at end of session!)', defval='1800-1700')

//Check if it's in session//

is_session(session) =>

not na(time(timeframe.period, session))

//Call the function

Session = is_session(session)

//Start and end of the session

start = Session and not Session[1]

end = not Session and Session[1]

//Plot the background color to see the session

bgcolor(Session ? color.new(color.white, 0) : na)

// trade directions //

strat_dir_input = input.string(title='Strategy Direction', defval='long', options=['long', 'short', 'all'])

strat_dir_value = strat_dir_input == 'long' ? strategy.direction.long : strat_dir_input == 'short' ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

src = close

modeSwitch = input.string('Hma', title='Hull Variation', options=['Hma', 'Thma', 'Ehma'])

length = input(55, title='Length(180-200 for floating S/R , 55 for swing entry)')

switchColor = input(true, 'Color Hull according to trend?')

candleCol = input(false, title='Color candles based on Hull\'s Trend?')

visualSwitch = input(true, title='Show as a Band?')

thicknesSwitch = input(1, title='Line Thickness')

transpSwitch = input.int(40, title='Band Transparency', step=5)

//FUNCTIONS

//HMA

HMA(_src, _length) =>

ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

//EHMA

EHMA(_src, _length) =>

ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

//THMA

THMA(_src, _length) =>

ta.wma(ta.wma(_src, _length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

//SWITCH

Mode(modeSwitch, src, len) =>

modeSwitch == 'Hma' ? HMA(src, len) : modeSwitch == 'Ehma' ? EHMA(src, len) : modeSwitch == 'Thma' ? THMA(src, len / 2) : na

//OUT

HULL = Mode(modeSwitch, src, length)

MHULL = HULL[0]

SHULL = HULL[2]

//COLOR

hullColor = switchColor ? HULL > HULL[2] ? #00ff00 : #ff0000 : #ff9800

//PLOT

///< Frame

Fi1 = plot(MHULL, title='MHULL', color=hullColor, linewidth=thicknesSwitch, transp=50)

Fi2 = plot(visualSwitch ? SHULL : na, title='SHULL', color=hullColor, linewidth=thicknesSwitch, transp=50)

///< Ending Filler

fill(Fi1, Fi2, title='Band Filler', color=hullColor, transp=transpSwitch)

///BARCOLOR

barcolor(color=candleCol ? switchColor ? hullColor : na : na)

// Scalp //

slPoints = input.int(title='Profit Points Before Stop', minval=0, maxval=1000, step=1, defval=1, confirm=false)

slOffset = input.int(title='Then Trailing Stop Loss of ', minval=1, maxval=1000, step=1, defval=1, confirm=false)

//trades//

// Long Entry Function//

if Session and ta.crossover(HULL[0] , HULL[2])

strategy.entry('long', strategy.long)

strategy.exit('trailing stop', from_entry='long', trail_points=slPoints, trail_offset=slOffset)

// Short Entry Function//

if Session and ta.crossunder(HULL[0] , HULL[2])

strategy.entry('short', strategy.short)

strategy.exit('trailing stop', from_entry='short', trail_points=slPoints, trail_offset=slOffset)

if end

strategy.close_all("End of Session - Go FLat")