Overview

This quantitative trading strategy is a long-term trading system based on multiple technical indicators and price action. It primarily utilizes moving averages, Parabolic SAR, and candlestick patterns to identify potential buying opportunities, while employing multiple exit conditions to manage risk and lock in profits. The core idea of this strategy is to seek short-term oversold opportunities for entry when the market is in an uptrend, while setting up multiple protective measures to respond to market reversals.

Strategy Principles

Entry Conditions:

- Price is above the 200-period Simple Moving Average (SMA), confirming a long-term uptrend.

- Consecutive occurrence of 3 to 6 bearish candles, indicating potential short-term oversold conditions.

Risk Management:

- Using percentage-based stop-loss and take-profit to limit risk and secure profits for each trade.

Exit Conditions:

- Parabolic SAR indicator reversal, suggesting a possible change in short-term trend.

- Price falls below the 5-period SMA, indicating weakening short-term momentum.

- Appearance of a Doji candlestick pattern, signaling market indecision.

The strategy enhances trading accuracy and robustness by combining multiple indicators and price action. The 200-period SMA is used to confirm long-term trends, consecutive bearish candles identify short-term oversold conditions, while SAR, short-term SMA, and Doji patterns are used to capture market sentiment changes in a timely manner.

Strategy Advantages

Multi-dimensional Analysis: Combines long-term trend, short-term oversold conditions, and multiple exit criteria for comprehensive market assessment.

Risk Control: Employs fixed percentage stop-loss and take-profit, effectively controlling risk for each trade.

Flexibility: Allows users to optimize the strategy through parameter adjustments, adapting to different market environments.

Timely Exits: Multiple exit conditions ensure quick position closure during market reversals, protecting profits.

Trend Following: Confirms long-term trends using the 200-period SMA, improving trade success rates.

Prevention of Overtrading: Limits the number of consecutive bearish candles, avoiding entry during extreme downtrends.

Strategy Risks

False Breakout Risk: The market may experience a short-term rebound followed by continued decline, leading to false signals. Solution: Consider adding volume confirmation or other momentum indicators.

Parameter Sensitivity: Strategy performance may be highly sensitive to parameter selection. Solution: Conduct extensive historical data backtesting to find robust parameter combinations.

Market Environment Dependence: May underperform in ranging markets. Solution: Consider adding a market environment filter to pause trading when trends are not clear.

Slippage and Commissions: Frequent entries and exits in real trading may result in high transaction costs. Solution: Optimize trading frequency and consider increasing holding periods.

Over-reliance on Technical Indicators: Ignoring fundamental factors may lead to poor performance during major events. Solution: Incorporate fundamental analysis or consider pausing trades before important economic data releases.

Strategy Optimization Directions

Dynamic Parameter Adjustment: Implement parameter adaptability to automatically adjust moving average periods and SAR parameters based on market volatility.

Incorporate Volume Analysis: Introduce volume indicators such as OBV or CMF to confirm the validity of price movements.

Add Market Environment Filtering: Use ATR or volatility indicators to identify market states and reduce trading during low volatility periods.

Optimize Exit Logic: Consider using trailing stops or ATR-based dynamic stops to better secure profits.

Integrate Multi-timeframe Analysis: Confirm trends on longer timeframes to improve trading accuracy.

Introduce Machine Learning: Use machine learning algorithms to optimize parameter selection and signal generation processes.

Consider Fundamental Factors: Integrate an economic calendar to adjust strategy behavior before important events.

Enhance Risk Management: Implement dynamic position sizing, adjusting trade size based on account equity and market volatility.

Conclusion

This multi-indicator synergy long-term trading strategy provides a comprehensive trading system by combining multiple technical indicators and price action. It seeks short-term oversold opportunities within long-term uptrends while using multiple exit conditions for risk management. The strategy’s main advantages lie in its multi-dimensional analysis and flexible risk management, but it also faces challenges such as parameter sensitivity and market environment dependence.

By implementing the suggested optimization measures, such as dynamic parameter adjustment, incorporating volume analysis, and market environment filtering, the strategy has the potential to further improve its robustness and adaptability. However, users should always remember that there is no perfect trading strategy, and continuous monitoring, backtesting, and optimization are key to achieving long-term success.

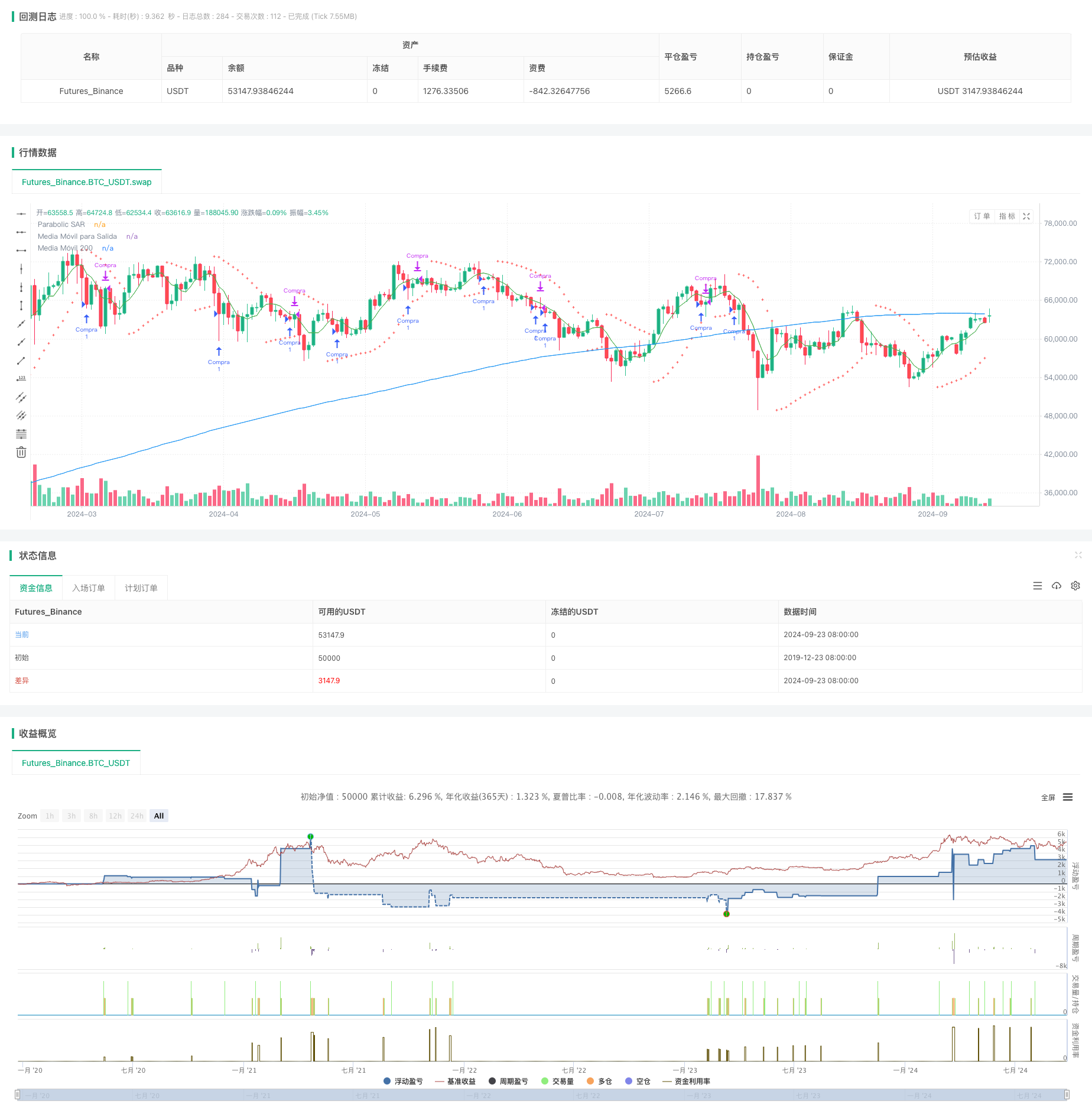

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia Long con 3 Velas Rojas y SL/TP + Parabolic SAR, Media Móvil y Doji", overlay=true)

// Parámetros modificables

lengthMA = input(200, title="Periodo de la Media Móvil")

velas_rojas_apertura = input(3, title="Número de Velas Rojas para Apertura")

velas_rojas_limite = input(6, title="Número Máximo de Velas Rojas Consecutivas")

stopLossPercent = input(0.5, title="Porcentaje de Stop Loss (%)") / 100

takeProfitPercent = input(0.5, title="Porcentaje de Take Profit (%)") / 100

// Parámetros del Parabolic SAR

sarStart = input.float(0.02, title="Parabolic SAR Start")

sarIncrement = input.float(0.02, title="Parabolic SAR Increment")

sarMaximum = input.float(0.2, title="Parabolic SAR Maximum")

enableSARExit = input.bool(true, title="Activar Salida por Parabolic SAR")

closeOnSARClose = input.bool(true, title="Cerrar al Cierre de Vela con Parabolic SAR")

// Parámetros de la Media Móvil para salida

lengthSMAExit = input(5, title="Periodo de la Media Móvil para Salida")

enableSMAExit = input.bool(true, title="Activar Salida por Media Móvil")

// Parámetros para la condición de cierre por velas doji

enableDojiExit = input.bool(true, title="Activar Salida por Velas Doji")

// Cálculo de la media móvil de 200 periodos

ma200 = ta.sma(close, lengthMA)

// Cálculo de la media móvil para salida

maExit = ta.sma(close, lengthSMAExit)

// Cálculo del Parabolic SAR

sar = ta.sar(sarStart, sarIncrement, sarMaximum)

// Contar las velas rojas consecutivas

var int contador_velas_rojas = 0

contador_velas_rojas := close < open ? contador_velas_rojas + 1 : 0

// Condición para abrir una operación Long

puedeAbrirOperacion = (contador_velas_rojas < velas_rojas_limite)

condicion_long = (contador_velas_rojas >= velas_rojas_apertura) and (close > ma200) and puedeAbrirOperacion

// Abrir operación Long si se cumplen las condiciones

if (condicion_long)

entryPrice = close

stopLossPrice = entryPrice * (1 - stopLossPercent)

takeProfitPrice = entryPrice * (1 + takeProfitPercent)

strategy.entry("Compra", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Compra", limit=takeProfitPrice, stop=stopLossPrice)

// Condición para cerrar la operación Long con Parabolic SAR

sarCambiaDown = ta.crossunder(close, sar)

// Cerrar operación Long si cambia la tendencia del Parabolic SAR y está activado

if (strategy.position_size > 0 and enableSARExit)

if (closeOnSARClose and sarCambiaDown[1])

strategy.close("Compra", comment="SAR Cambio al Cierre de Vela")

else if (sarCambiaDown)

strategy.close("Compra", comment="SAR Cambio")

// Condición para cerrar la operación Long con Media Móvil y está activado al cierre de la vela

smaExitCondition = close[1] < maExit[1] and close[0] > maExit[0]

if (strategy.position_size > 0 and enableSMAExit)

if (smaExitCondition)

strategy.close("Compra", comment="Salida por Media Móvil al Cierre de Vela")

// Condición para cerrar la operación Long con velas doji

dojiCondition = math.abs(open - close) <= ((high - low) * 0.1)

if (strategy.position_size > 0 and enableDojiExit)

if (dojiCondition)

strategy.close("Compra", comment="Salida por Doji")

// Para mostrar la media móvil y el Parabolic SAR en el gráfico

plot(ma200, color=color.blue, title="Media Móvil 200")

plot(maExit, color=color.green, title="Media Móvil para Salida")

plot(sar, color=color.red, style=plot.style_cross, title="Parabolic SAR")