Overview

The Multi-Level Balanced Quantitative Trading Strategy is a complex trading system that combines multiple technical indicators and price levels. This strategy utilizes indicators such as MACD, RSI, EMA, and Bollinger Bands, along with Fibonacci retracement levels, to implement different trading tactics at various price ranges, achieving multi-level balanced trading. The core idea of the strategy is to increase trading accuracy through multiple confirmations while optimizing capital management through gradual position building.

Strategy Principles

The core principles of this strategy include: 1. Using MACD, RSI, and EMA indicators to determine market trends and momentum. 2. Utilizing Bollinger Bands and Fibonacci retracement levels to identify key support and resistance levels. 3. Setting multiple entry points at different price levels to achieve gradual position building. 4. Managing risk through different take-profit and stop-loss levels. 5. Using Heikin Ashi candlesticks to provide additional market structure information.

The strategy comprehensively analyzes these factors to take appropriate trading actions under different market conditions, aiming to achieve stable returns.

Strategy Advantages

- Multiple Confirmations: Combining multiple technical indicators increases the reliability of trading signals.

- Flexible Capital Management: The gradual position building approach allows for better risk control and capital utilization optimization.

- High Adaptability: The strategy can adjust trading behavior according to different market conditions.

- Comprehensive Risk Management: Multiple levels of stop-loss and take-profit mechanisms effectively control risk.

- High Degree of Automation: The strategy can be fully automated, reducing human intervention.

Strategy Risks

- Over-trading: The multiple trading levels may lead to frequent trading, increasing transaction costs.

- Parameter Sensitivity: The strategy uses multiple indicators and parameters, requiring careful adjustment to adapt to different market environments.

- Drawdown Risk: In highly volatile markets, the strategy may face significant drawdown risks.

- Technical Dependence: The strategy heavily relies on technical indicators, which may fail under certain market conditions.

- Capital Management Risk: The gradual position building approach may lead to overexposure in certain situations.

Strategy Optimization Directions

- Dynamic Parameter Adjustment: Introduce machine learning algorithms to automatically adjust strategy parameters based on market conditions.

- Market Sentiment Analysis: Integrate market sentiment indicators, such as the VIX index, to improve strategy adaptability.

- Multi-Timeframe Analysis: Introduce multi-timeframe analysis to enhance the reliability of trading signals.

- Volatility Adjustment: Dynamically adjust trading volume and stop-loss levels based on market volatility.

- Transaction Cost Optimization: Introduce a transaction cost model to optimize trading frequency and size.

Summary

The Multi-Level Balanced Quantitative Trading Strategy is a comprehensive and adaptive trading system. By combining multiple technical indicators and price levels, this strategy can maintain stability in different market environments. Although there are some risks, they can be effectively controlled through continuous optimization and adjustment. In the future, by introducing more advanced technologies such as machine learning and sentiment analysis, this strategy has the potential to achieve better performance. For investors seeking a comprehensive, automated trading solution, this is a worthy option to consider.

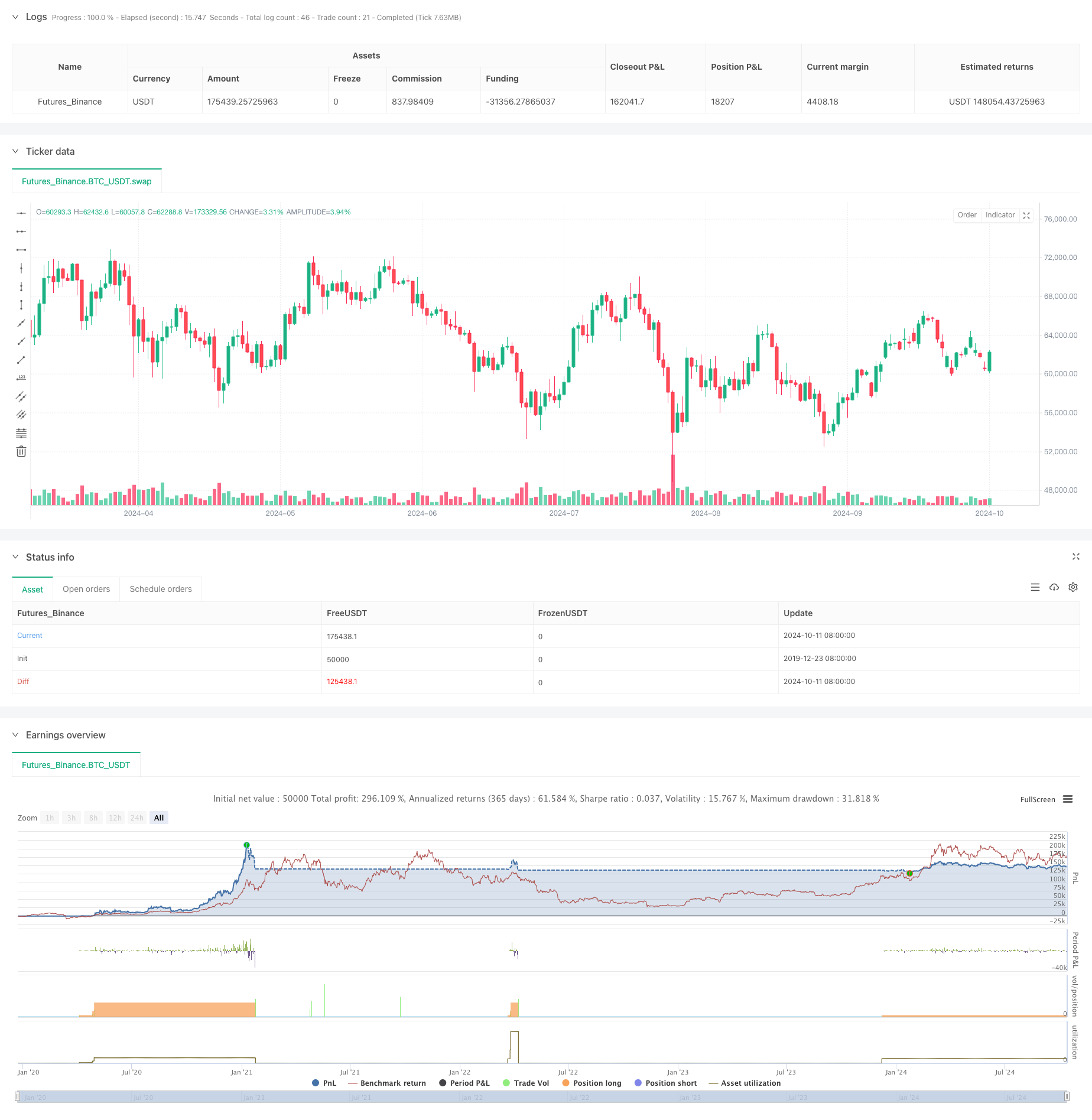

/*backtest

start: 2019-12-23 08:00:00

end: 2024-10-12 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Incremental Order size +', shorttitle='TradingPost', overlay=true, default_qty_value=1, pyramiding=10)

//Heiken Ashi

isHA = input(false, 'HA Candles')

//MACD

fastLength = 12

slowlength = 26

MACDLength = 9

MACD = ta.ema(close, fastLength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

//Bollinger Bands Exponential

src = open

len = 18

e = ta.ema(src, len)

evar = (src - e) * (src - e)

evar2 = math.sum(evar, len) / len

std = math.sqrt(evar2)

Multiplier = input.float(3, minval=0.01, title='# of STDEV\'s')

upband = e + Multiplier * std

dnband = e - Multiplier * std

//EMA

ema3 = ta.ema(close, 3)

//RSIplot

length = 45

overSold = 90

overBought = 10

price = close

vrsi = ta.rsi(price, length)

notna = not na(vrsi)

macdlong = ta.crossover(delta, 0)

macdshort = ta.crossunder(delta, 0)

rsilong = notna and ta.crossover(vrsi, overSold)

rsishort = notna and ta.crossunder(vrsi, overBought)

lentt = input(14, 'Pivot Length')

//The length defines how many periods a high or low must hold to be a "relevant pivot"

h = ta.highest(lentt)

//The highest high over the length

h1 = ta.dev(h, lentt) ? na : h

//h1 is a pivot of h if it holds for the full length

hpivot = fixnan(h1)

//creates a series which is equal to the last pivot

l = ta.lowest(lentt)

l1 = ta.dev(l, lentt) ? na : l

lpivot = fixnan(l1)

//repeated for lows

last_hpivot = 0.0

last_lpivot = 0.0

last_hpivot := h1 ? time : nz(last_hpivot[1])

last_lpivot := l1 ? time : nz(last_lpivot[1])

long_time = last_hpivot > last_lpivot ? 0 : 1

//FIBS

z = input(100, 'Z-Index')

p_offset = 2

transp = 60

a = (ta.lowest(z) + ta.highest(z)) / 2

b = ta.lowest(z)

c = ta.highest(z)

fibonacci = input(0, 'Fibonacci') / 100

//Fib Calls

fib0 = (hpivot - lpivot) * fibonacci + lpivot

fib1 = (hpivot - lpivot) * .21 + lpivot

fib2 = (hpivot - lpivot) * .3 + lpivot

fib3 = (hpivot - lpivot) * .5 + lpivot

fib4 = (hpivot - lpivot) * .62 + lpivot

fib5 = (hpivot - lpivot) * .7 + lpivot

fib6 = (hpivot - lpivot) * 1.00 + lpivot

fib7 = (hpivot - lpivot) * 1.27 + lpivot

fib8 = (hpivot - lpivot) * 2 + lpivot

fib9 = (hpivot - lpivot) * -.27 + lpivot

fib10 = (hpivot - lpivot) * -1 + lpivot

//Heiken Ashi Candles

heikenashi_1 = ticker.heikinashi(syminfo.tickerid)

data2 = isHA ? heikenashi_1 : syminfo.tickerid

res5 = input.timeframe('5', 'Resolution')

//HT Fibs

hfib0 = request.security(data2, res5, fib0[1])

hfib1 = request.security(data2, res5, fib1[1])

hfib2 = request.security(data2, res5, fib2[1])

hfib3 = request.security(data2, res5, fib3[1])

hfib4 = request.security(data2, res5, fib4[1])

hfib5 = request.security(data2, res5, fib5[1])

hfib6 = request.security(data2, res5, fib6[1])

hfib7 = request.security(data2, res5, fib7[1])

hfib8 = request.security(data2, res5, fib8[1])

hfib9 = request.security(data2, res5, fib9[1])

hfib10 = request.security(data2, res5, fib10[1])

vrsiup = vrsi > vrsi[1] and vrsi[1] > vrsi[2]

vrsidown = vrsi < vrsi[1] and vrsi[1] < vrsi[2]

long = ta.cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

short = ta.cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long2 = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short2 = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

reverseOpens = input(false, 'Reverse Orders')

if reverseOpens

tmplong = long

long := short

short := tmplong

short

//Strategy

ts = input(99999, 'TS')

tp = input(30, 'TP')

sl = input(15, 'SL')

last_long = 0.0

last_short = 0.0

last_long := long ? time : nz(last_long)

last_short := short ? time : nz(last_short)

in_long = last_long > last_short

in_short = last_short > last_long

long_signal = ta.crossover(last_long, last_short)

short_signal = ta.crossover(last_short, last_long)

last_open_long = 0.0

last_open_short = 0.0

last_open_long := long ? open : nz(last_open_long[1])

last_open_short := short ? open : nz(last_open_short[1])

last_open_long_signal = 0.0

last_open_short_signal = 0.0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_high = 0.0

last_low = 0.0

last_high := not in_long ? na : in_long and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short ? na : in_short and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = not na(last_high) and high <= last_high - ts and high >= last_open_long_signal

short_ts = not na(last_low) and low >= last_low + ts and low <= last_open_short_signal

long_tp = high >= last_open_long + tp and long[1] == 0

short_tp = low <= last_open_short - tp and short[1] == 0

long_sl = low <= last_open_long - sl and long[1] == 0

short_sl = high >= last_open_short + sl and short[1] == 0

last_hfib_long = 0.0

last_hfib_short = 0.0

last_hfib_long := long_signal ? fib1 : nz(last_hfib_long[1])

last_hfib_short := short_signal ? fib5 : nz(last_hfib_short[1])

last_fib7 = 0.0

last_fib10 = 0.0

last_fib7 := long ? fib7 : nz(last_fib7[1])

last_fib10 := long ? fib10 : nz(last_fib10[1])

last_fib8 = 0.0

last_fib9 = 0.0

last_fib8 := short ? fib8 : nz(last_fib8[1])

last_fib9 := short ? fib9 : nz(last_fib9[1])

last_long_signal = 0.0

last_short_signal = 0.0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

last_long_tp = 0.0

last_short_tp = 0.0

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

last_long_ts = 0.0

last_short_ts = 0.0

last_long_ts := long_ts ? time : nz(last_long_ts[1])

last_short_ts := short_ts ? time : nz(last_short_ts[1])

long_ts_signal = ta.crossover(last_long_ts, last_long_signal)

short_ts_signal = ta.crossover(last_short_ts, last_short_signal)

last_long_sl = 0.0

last_short_sl = 0.0

last_long_sl := long_sl ? time : nz(last_long_sl[1])

last_short_sl := short_sl ? time : nz(last_short_sl[1])

long_tp_signal = ta.crossover(last_long_tp, last_long)

short_tp_signal = ta.crossover(last_short_tp, last_short)

long_sl_signal = ta.crossover(last_long_sl, last_long)

short_sl_signal = ta.crossover(last_short_sl, last_short)

last_long_tp_signal = 0.0

last_short_tp_signal = 0.0

last_long_tp_signal := long_tp_signal ? time : nz(last_long_tp_signal[1])

last_short_tp_signal := short_tp_signal ? time : nz(last_short_tp_signal[1])

last_long_sl_signal = 0.0

last_short_sl_signal = 0.0

last_long_sl_signal := long_sl_signal ? time : nz(last_long_sl_signal[1])

last_short_sl_signal := short_sl_signal ? time : nz(last_short_sl_signal[1])

last_long_ts_signal = 0.0

last_short_ts_signal = 0.0

last_long_ts_signal := long_ts_signal ? time : nz(last_long_ts_signal[1])

last_short_ts_signal := short_ts_signal ? time : nz(last_short_ts_signal[1])

true_long_signal = long_signal and last_long_sl_signal > last_long_signal[1] or long_signal and last_long_tp_signal > last_long_signal[1] or long_signal and last_long_ts_signal > last_long_signal[1]

true_short_signal = short_signal and last_short_sl_signal > last_short_signal[1] or short_signal and last_short_tp_signal > last_short_signal[1] or short_signal and last_short_ts_signal > last_short_signal[1]

// strategy.entry("BLUE", strategy.long, when=long)

// strategy.entry("RED", strategy.short, when=short)

g = delta > 0 and vrsi < overSold and vrsiup

r = delta < 0 and vrsi > overBought and vrsidown

long1 = ta.cross(close, fib1) and g and last_long_signal[1] > last_short_signal // and last_long_signal > long

short1 = ta.cross(close, fib5) and r and last_short_signal[1] > last_long_signal // and last_short_signal > short

last_long1 = 0.0

last_short1 = 0.0

last_long1 := long1 ? time : nz(last_long1[1])

last_short1 := short1 ? time : nz(last_short1[1])

last_open_long1 = 0.0

last_open_short1 = 0.0

last_open_long1 := long1 ? open : nz(last_open_long1[1])

last_open_short1 := short1 ? open : nz(last_open_short1[1])

long1_signal = ta.crossover(last_long1, last_long_signal)

short1_signal = ta.crossover(last_short1, last_short_signal)

last_long1_signal = 0.0

last_short1_signal = 0.0

last_long1_signal := long1_signal ? time : nz(last_long1_signal[1])

last_short1_signal := short1_signal ? time : nz(last_short1_signal[1])

long2 = ta.cross(close, fib2) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short2 = ta.cross(close, fib4) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long2 = 0.0

last_short2 = 0.0

last_long2 := long2 ? time : nz(last_long2[1])

last_short2 := short2 ? time : nz(last_short2[1])

last_open_short2 = 0.0

last_open_short2 := short2 ? open : nz(last_open_short2[1])

long2_signal = ta.crossover(last_long2, last_long1_signal) and long1_signal == 0

short2_signal = ta.crossover(last_short2, last_short1_signal) and short1_signal == 0

last_long2_signal = 0.0

last_short2_signal = 0.0

last_long2_signal := long2_signal ? time : nz(last_long2_signal[1])

last_short2_signal := short2_signal ? time : nz(last_short2_signal[1])

//Trade 4

long3 = ta.cross(close, fib3) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short3 = ta.cross(close, fib3) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long3 = 0.0

last_short3 = 0.0

last_long3 := long3 ? time : nz(last_long3[1])

last_short3 := short3 ? time : nz(last_short3[1])

last_open_short3 = 0.0

last_open_short3 := short3 ? open : nz(last_open_short3[1])

long3_signal = ta.crossover(last_long3, last_long2_signal) and long2_signal == 0

short3_signal = ta.crossover(last_short3, last_short2_signal) and short2_signal == 0

last_long3_signal = 0.0

last_short3_signal = 0.0

last_long3_signal := long3_signal ? time : nz(last_long3_signal[1])

last_short3_signal := short3_signal ? time : nz(last_short3_signal[1])

//Trade 5

long4 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short4 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long4 = 0.0

last_short4 = 0.0

last_long4 := long4 ? time : nz(last_long4[1])

last_short4 := short4 ? time : nz(last_short4[1])

long4_signal = ta.crossover(last_long4, last_long3_signal) and long2_signal == 0 and long3_signal == 0

short4_signal = ta.crossover(last_short4, last_short3_signal) and short2_signal == 0 and short3_signal == 0

last_long4_signal = 0.0

last_short4_signal = 0.0

last_long4_signal := long4_signal ? time : nz(last_long4_signal[1])

last_short4_signal := short4_signal ? time : nz(last_short4_signal[1])

//Trade 6

long5 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short5 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long5 = 0.0

last_short5 = 0.0

last_long5 := long5 ? time : nz(last_long5[1])

last_short5 := short5 ? time : nz(last_short5[1])

long5_signal = ta.crossover(last_long5, last_long4_signal) and long3_signal == 0 and long4_signal == 0

short5_signal = ta.crossover(last_short5, last_short4_signal) and short3_signal == 0 and short4_signal == 0

last_long5_signal = 0.0

last_short5_signal = 0.0

last_long5_signal := long5_signal ? time : nz(last_long5_signal[1])

last_short5_signal := short5_signal ? time : nz(last_short5_signal[1])

//Trade 7

long6 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short6 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long6 = 0.0

last_short6 = 0.0

last_long6 := long6 ? time : nz(last_long6[1])

last_short6 := short6 ? time : nz(last_short6[1])

long6_signal = ta.crossover(last_long6, last_long5_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0

short6_signal = ta.crossover(last_short6, last_short5_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0

last_long6_signal = 0.0

last_short6_signal = 0.0

last_long6_signal := long6_signal ? time : nz(last_long6_signal[1])

last_short6_signal := short6_signal ? time : nz(last_short6_signal[1])

//Trade 8

long7 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short7 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long7 = 0.0

last_short7 = 0.0

last_long7 := long7 ? time : nz(last_long7[1])

last_short7 := short7 ? time : nz(last_short7[1])

long7_signal = ta.crossover(last_long7, last_long6_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0

short7_signal = ta.crossover(last_short7, last_short6_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0

last_long7_signal = 0.0

last_short7_signal = 0.0

last_long7_signal := long7_signal ? time : nz(last_long7_signal[1])

last_short7_signal := short7_signal ? time : nz(last_short7_signal[1])

//Trade 9

long8 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short8 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long8 = 0.0

last_short8 = 0.0

last_long8 := long8 ? time : nz(last_long8[1])

last_short8 := short8 ? time : nz(last_short8[1])

long8_signal = ta.crossover(last_long8, last_long7_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0

short8_signal = ta.crossover(last_short8, last_short7_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0

last_long8_signal = 0.0

last_short8_signal = 0.0

last_long8_signal := long8_signal ? time : nz(last_long8_signal[1])

last_short8_signal := short8_signal ? time : nz(last_short8_signal[1])

//Trade 10

long9 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short9 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long9 = 0.0

last_short9 = 0.0

last_long9 := long9 ? time : nz(last_long9[1])

last_short9 := short9 ? time : nz(last_short9[1])

long9_signal = ta.crossover(last_long9, last_long8_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0 and long8_signal == 0

short9_signal = ta.crossover(last_short9, last_short8_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0 and short8_signal == 0

last_long9_signal = 0.0

last_short9_signal = 0.0

last_long9_signal := long9_signal ? time : nz(last_long9_signal[1])

last_short9_signal := short9_signal ? time : nz(last_short9_signal[1])

strategy.entry('Long', strategy.long, qty=1, when=long_signal)

strategy.entry('Short', strategy.short, qty=1, when=short_signal)

strategy.entry('Long', strategy.long, qty=2, when=long1_signal)

strategy.entry('Short1', strategy.short, qty=2, when=short1_signal)

strategy.entry('Long', strategy.long, qty=4, when=long2_signal)

strategy.entry('Short2', strategy.short, qty=4, when=short2_signal)

strategy.entry('Long', strategy.long, qty=8, when=long3_signal)

strategy.entry('Short3', strategy.short, qty=8, when=short3_signal)

strategy.entry('Long', strategy.long, qty=5, when=long4_signal)

strategy.entry('Short', strategy.short, qty=5, when=short4_signal)

strategy.entry('Long', strategy.long, qty=6, when=long5_signal)

strategy.entry('Short', strategy.short, qty=6, when=short5_signal)

strategy.entry('Long', strategy.long, qty=7, when=long6_signal)

strategy.entry('Short', strategy.short, qty=7, when=short6_signal)

strategy.entry('Long', strategy.long, qty=8, when=long7_signal)

strategy.entry('Short', strategy.short, qty=8, when=short7_signal)

strategy.entry('Long', strategy.long, qty=9, when=long8_signal)

strategy.entry('Short', strategy.short, qty=9, when=short8_signal)

strategy.entry('Long', strategy.long, qty=10, when=long9_signal)

strategy.entry('Short', strategy.short, qty=10, when=short9_signal)

short1_tp = low <= last_open_short1 - tp and short1[1] == 0

short2_tp = low <= last_open_short2 - tp and short2[1] == 0

short3_tp = low <= last_open_short3 - tp and short3[1] == 0

short1_sl = high >= last_open_short1 + sl and short1[1] == 0

short2_sl = high >= last_open_short2 + sl and short2[1] == 0

short3_sl = high >= last_open_short3 + sl and short3[1] == 0

close_long = ta.cross(close, fib6)

close_short = ta.cross(close, fib0)

// strategy.close("Long", when=close_long)

// strategy.close("Long", when=long_tp)

// strategy.close("Long", when=long_sl)

// strategy.close("Short", when=long_signal)

// strategy.close("Short1", when=long_signal)

// strategy.close("Short2", when=long_signal)

// strategy.close("Short3", when=long_signal)

strategy.close('Short', when=short_tp)

strategy.close('Short1', when=short1_tp)

strategy.close('Short2', when=short2_tp)

strategy.close('Short3', when=short3_tp)

strategy.close('Short', when=short_sl)

strategy.close('Short1', when=short1_sl)

strategy.close('Short2', when=short2_sl)

strategy.close('Short3', when=short3_sl)