Overview

This strategy is a comprehensive trading system that combines multiple key technical indicators, including a dual Simple Moving Average (SMA) system, Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and resistance level analysis. The core concept is to confirm trading signals through multi-dimensional technical indicators while incorporating market sentiment indicators for position management optimization, ultimately aiming to improve win rates and risk-reward ratios.

Strategy Principles

The strategy employs short-term (10-day) and long-term (30-day) simple moving averages as the primary signal system. A buy signal is generated when the short-term SMA crosses above the long-term SMA, and the MACD shows bullish momentum (MACD line above signal line). The sell condition incorporates resistance level analysis, triggering position closure when the price reaches the highest point of the past 20 periods and MACD shows bearish signals. Additionally, the RSI indicator serves as a sentiment filter for position management: early exit on losses when RSI exceeds 70, and position holding on profits when RSI is below 30.

Strategy Advantages

- Multiple confirmation mechanism: Enhances signal reliability through SMA crossover, MACD trend, and resistance level validation

- Intelligent position management: Incorporates RSI for sentiment monitoring and better risk management

- Strong adaptability: Strategy parameters can be adjusted for different market conditions

- Comprehensive risk control: Multiple stop-loss mechanisms including technical and sentiment-based stops

- High systematization: Fully systematic trading decisions reducing subjective interference

Strategy Risks

- SMA system may generate false signals in ranging markets

- Over-reliance on technical indicators might ignore fundamental factors

- Parameter optimization may lead to overfitting

- Resistance level identification might lag in fast-moving markets

- RSI indicator may become ineffective under certain market conditions

Strategy Optimization Directions

- Incorporate volume indicators: Enhance trend strength assessment

- Dynamic parameter adjustment: Automatically adjust SMA periods and RSI thresholds based on market volatility

- Add trend filters: Introduce longer-term moving averages for trend filtering

- Optimize resistance level calculation: Consider dynamic resistance identification algorithms

- Include volatility indicators: For position sizing and stop-loss placement

Summary

This strategy constructs a complete trading system by combining multiple classic technical indicators. Its strengths lie in the multiple signal confirmation mechanism and comprehensive risk control system, though market conditions’ impact on strategy performance should be monitored. Through the suggested optimization directions, the strategy’s stability and adaptability can be further enhanced. In live trading, investors are advised to adjust parameters according to their risk preferences and market environment while maintaining attention to market fundamentals.

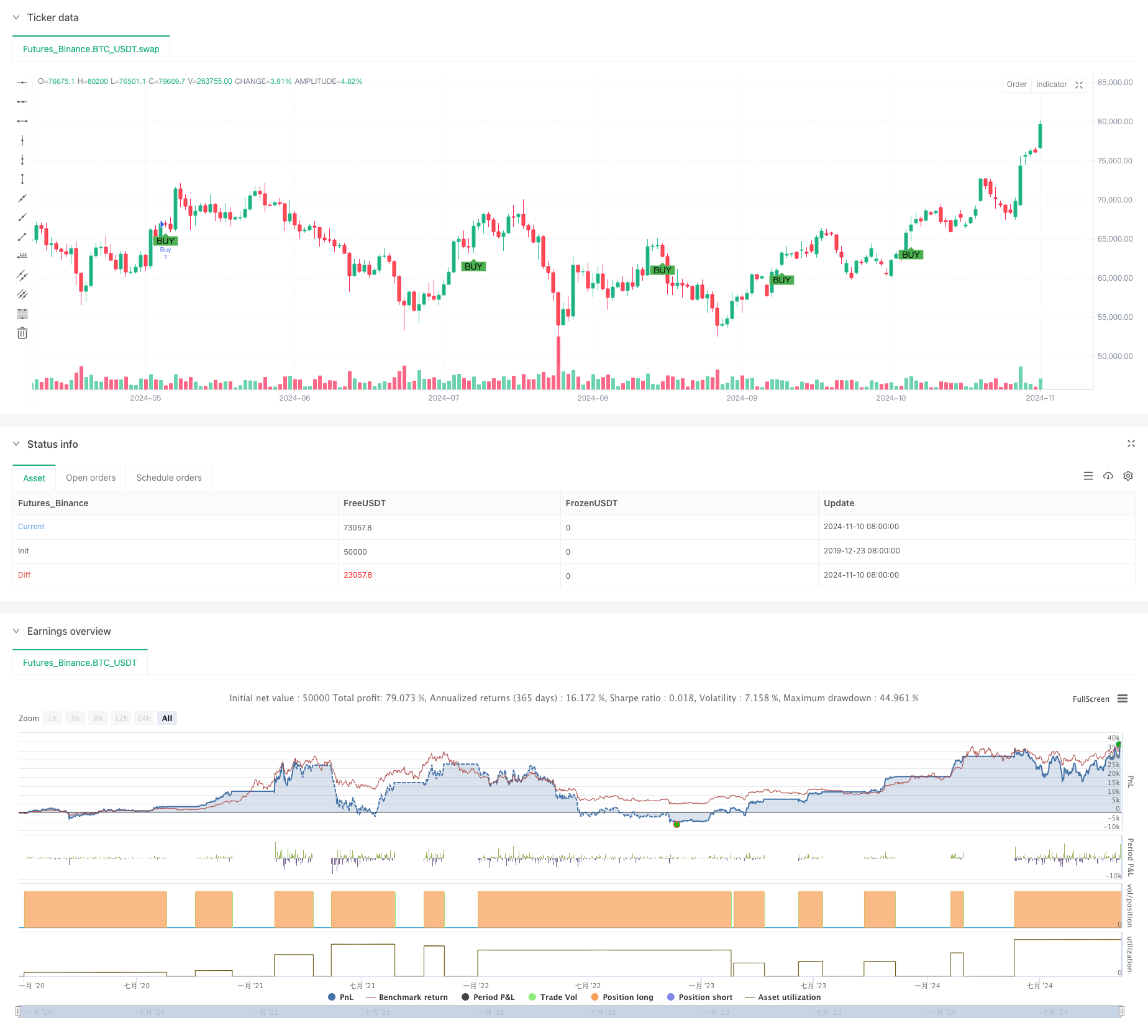

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment (Enhanced RR)", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Define buy condition based on SMA and MACD

buyCondition = ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance

sellCondition = close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance)

if (sellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Add alert for buy condition

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

// Add alert for sell condition to notify when price hits major resistance

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

// Add alert for early close condition (for losing trades)

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

// Add alert for holding winning condition (optional)

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")