Overview

This strategy is a high-frequency quantitative trading approach based on multiple technical indicators. It combines candlestick pattern analysis, trend following, and momentum indicators to enhance trading accuracy through multi-dimensional signal confirmation. The strategy employs a 1:3 risk-reward ratio, which helps maintain stable returns in volatile markets through conservative money management.

Strategy Principles

The core logic is built on the synergistic effect of three main technical indicators. First, Heiken Ashi candles are used to filter market noise and provide clearer trend direction. Second, Bollinger Bands identify overbought and oversold areas while providing dynamic support and resistance levels. Third, the stochastic RSI confirms price momentum and helps judge trend continuity. The strategy also incorporates ATR for dynamic stop-loss and profit targets, making risk management more flexible.

Strategy Advantages

- Multiple signal confirmation mechanism significantly reduces false signals

- Dynamic stop-loss and profit targets improve market volatility adaptation

- Strict risk-reward ratio (1:3) supports long-term stable profitability

- ATR-based position sizing provides good scalability

- Simple and clear strategy logic, easy to understand and maintain

Strategy Risks

- High-frequency trading may face higher transaction costs

- Slippage risk in volatile markets

- Multiple indicators may lead to signal lag

- Fixed risk-reward ratio might miss opportunities in certain market conditions It’s recommended to control these risks through strict money management and regular backtesting.

Optimization Directions

- Introduce adaptive indicator parameters for better market environment adaptation

- Add volume analysis to improve signal reliability

- Develop dynamic risk-reward ratio adjustment mechanism

- Add market volatility filters to adjust trading frequency during high volatility

- Consider implementing machine learning algorithms for parameter optimization

Summary

This strategy combines classical technical analysis methods with modern quantitative trading concepts. Through the coordinated use of multiple indicators, it pursues high profitability while ensuring robustness. The strategy’s scalability and flexibility make it suitable for various market environments, but traders need to carefully control risks and regularly optimize parameters.

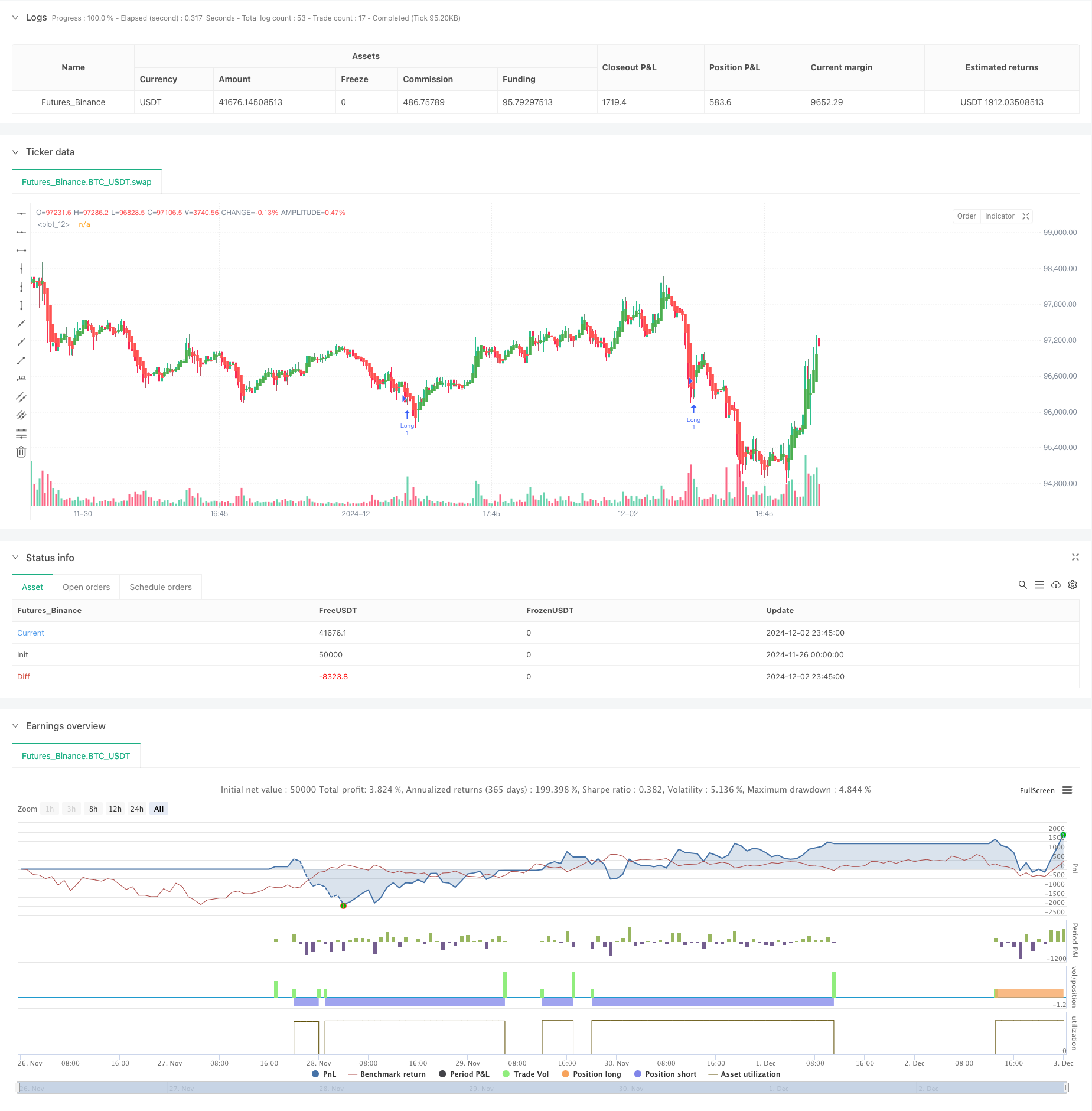

/*backtest

start: 2024-11-26 00:00:00

end: 2024-12-03 00:00:00

period: 15m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BTC Scalping Strategy with Risk-Reward 1:3", overlay=true)

// Heiken Ashi Candle Calculation

var float haOpen = na

haClose = (open + high + low + close) / 4

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Plot Heiken Ashi Candles

plotcandle(haOpen, haHigh, haLow, haClose, color=haClose >= haOpen ? color.green : color.red)

// Bollinger Bands Calculation

lengthBB = 20

src = close

mult = 2.0

basis = ta.sma(src, lengthBB)

dev = mult * ta.stdev(src, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// Stochastic RSI Calculation (fixed parameters)

kLength = 14

dSmoothing = 3

stochRSI = ta.stoch(close, high, low, kLength)

// Average True Range (ATR) for stop loss and take profit

atrLength = 14

atrValue = ta.atr(atrLength)

// Entry conditions

longCondition = ta.crossover(close, lowerBB) and stochRSI < 20

shortCondition = ta.crossunder(close, upperBB) and stochRSI > 80

// Alerts and trade signals

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", "Long", profit=atrValue*3, loss=atrValue)

alert("Buy Signal Triggered", alert.freq_once_per_bar_close)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit", "Short", profit=atrValue*3, loss=atrValue)

alert("Sell Signal Triggered", alert.freq_once_per_bar_close)