Overview

This strategy is a trend-following trading system that combines multiple technical indicators. It primarily uses the Parabolic SAR, Simple Moving Average (SMA), and Directional Movement Index (DMI) to determine market trends and entry points, while optimizing exits through percentage-based profit targets and MACD divergence. The core concept is to enter positions after confirming strong trends and exit when reaching preset profit targets or when trend reversal signals appear.

Strategy Principles

The strategy employs a multi-layered filtering mechanism: 1. Initial trading signals are captured through SAR crossovers 2. Overall trend direction is determined using a 50-period SMA 3. DMI indicator confirms trend strength and direction 4. Entry conditions require: price crossing above SAR, price above SMA, and bullish DMI 5. Dual exit mechanism: 3% target profit or MACD bearish crossover 6. ATR indicator for market volatility reference

Strategy Advantages

- Multiple technical indicator cross-validation reduces false signals

- Combination of trend following and momentum indicators improves success rate

- Fixed percentage profit targets ensure consistent gains

- MACD divergence exit mechanism prevents trend reversal drawdowns

- Strategy parameters can be flexibly adjusted for different market characteristics

- ATR monitoring provides market state reference

Strategy Risks

- Multiple indicators may lead to signal lag

- Fixed percentage profit targets might result in early exits during strong trends

- Lack of stop-loss mechanism increases risk exposure

- Excessive false signals may occur in ranging markets

- DMI indicators may generate misleading signals in choppy markets

Optimization Directions

- Implement adaptive stop-loss mechanism using ATR-based dynamic stops

- Develop volatility filters to adjust position sizing during high volatility periods

- Optimize MACD parameters for improved trend reversal detection

- Add volume confirmation mechanism for enhanced signal reliability

- Develop dynamic profit targets based on market volatility

Summary

This strategy builds a relatively complete trend-following trading system through the coordination of multiple technical indicators. Its strength lies in signal confirmation reliability and risk control flexibility. While there are inherent lag risks, the strategy maintains good practical value through parameter optimization and dynamic management mechanisms. Through continuous optimization and improvement, this strategy can serve as a robust trading tool.

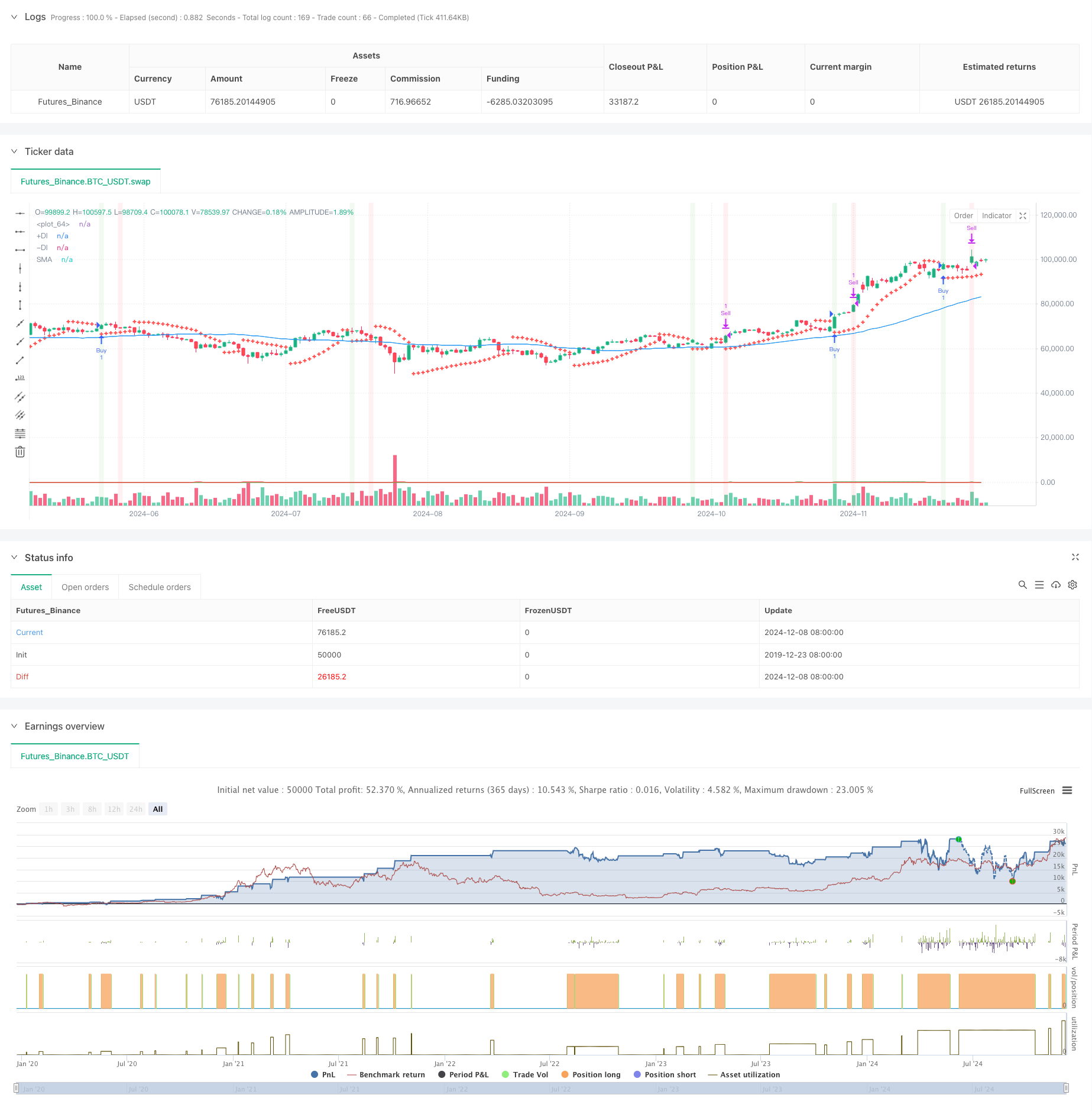

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Trading Strategy with DMI", overlay=true)

// Define parameters

sarStart = input.float(0.02, title="SAR Start")

sarIncrement = input.float(0.02, title="SAR Increment")

sarMax = input.float(0.2, title="SAR Max")

atrLength = input.int(10, title="ATR Length")

macdShort = input.int(12, title="MACD Short Length")

macdLong = input.int(26, title="MACD Long Length")

macdSignal = input.int(9, title="MACD Signal Length")

smaLength = input.int(50, title="SMA Length")

dmiLength = input.int(14, title="DMI Length")

adxSmoothing = input.int(14, title="ADX Smoothing") // Smoothing period for ADX

targetProfitPercentage = input.float(3.0, title="Target Profit Percentage")

// Calculate SAR

sar = ta.sar(sarStart, sarIncrement, sarMax)

// Calculate ATR

atr = ta.atr(atrLength)

// Calculate MACD

[macdLine, macdSignalLine, _] = ta.macd(close, macdShort, macdLong, macdSignal)

// Calculate SMA

sma = ta.sma(close, smaLength)

bullishTrend = close > sma

// Calculate DMI

[plusDI, minusDI, adx] = ta.dmi(dmiLength, adxSmoothing) // Specify ADX smoothing period

// Determine if DMI is bullish

dmiBullish = plusDI > minusDI

// Define buy signal

buySignal = ta.crossover(close, sar) and bullishTrend and dmiBullish

// Track buy price and position state

var float buyPrice = na

var bool inPosition = false

// Enter position

if (buySignal and not inPosition)

buyPrice := close

inPosition := true

strategy.entry("Buy", strategy.long)

// Define target price (3% above the buy price)

targetPrice = na(buyPrice) ? na : buyPrice * (1 + targetProfitPercentage / 100)

// Define MACD sell signal

macdSellSignal = ta.crossunder(macdLine, macdSignalLine)

// Define sell signal

sellSignal = inPosition and (close >= targetPrice or macdSellSignal)

// Exit position

if (sellSignal)

inPosition := false

strategy.exit("Sell", "Buy", limit=targetPrice)

// Plot SAR on the chart

plot(sar, color=color.red, style=plot.style_cross, linewidth=2)

// Plot SMA (optional, for visualizing the trend)

plot(sma, color=color.blue, title="SMA")

// Plot DMI +DI and -DI

plot(plusDI, color=color.green, title="+DI")

plot(minusDI, color=color.red, title="-DI")

// Plot buy signal on the chart

//plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

// Plot sell signal on the chart

//plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Optional: Plot background color for buy and sell signals

bgcolor(buySignal ? color.new(color.green, 90) : na, title="Buy Signal Background")

bgcolor(sellSignal ? color.new(color.red, 90) : na, title="Sell Signal Background")