Strategy Overview

This strategy is a trend following and reversal trading system based on price equilibrium points. It determines the equilibrium price by calculating the midpoint between the highest and lowest points over X bars, and judges trend direction based on the closing price’s position relative to the equilibrium price. When price maintains on one side of the equilibrium for a set number of bars, the system confirms a trend. It seeks entry opportunities on the first pullback (price crossing equilibrium). The strategy can be configured for either trend following or reversal trading modes.

Strategy Principles

- Equilibrium Price Calculation: Uses the midpoint between the highest and lowest prices over X bars as equilibrium price, identical to the baseline calculation in Ichimoku Cloud.

- Trend Determination: A trend is confirmed when price stays on the same side of equilibrium for X consecutive bars (default 7).

- Entry Signals: Triggers entry on first pullback (price crossing equilibrium) after trend confirmation.

- Stop Loss and Take Profit: Uses 60th percentile of ATR for dynamic adjustment of stop loss and take profit distances, providing flexible risk control.

- Large Movement Protection: Automatically closes positions when price deviates from equilibrium beyond a set ATR multiple.

Strategy Advantages

- High Adaptability: Flexibly switches between trend following and reversal trading modes based on market characteristics.

- Comprehensive Risk Control: Employs dynamic ATR stops and large movement protection mechanisms.

- Clear Operations: Trading signals are clear and don’t rely on complex technical indicator combinations.

- Good Visualization: Uses colored candlesticks and backgrounds for intuitive market state display.

- Automation Friendly: Easily interfaces with trading platforms like MT5 for automated trading.

Strategy Risks

- Choppy Market Risk: May generate frequent false signals in sideways markets.

- Slippage Impact: May face significant slippage during violent market movements.

- Parameter Sensitivity: Core parameters like equilibrium period and trend determination period need careful optimization for different markets.

- Market Transition Risk: Transitions from trending to ranging markets may cause significant drawdowns.

Strategy Optimization Directions

- Market Environment Recognition: Add market environment identification module to dynamically adjust strategy parameters under different market conditions.

- Signal Filtering: Consider adding volume, volatility, and other auxiliary indicators to filter false signals.

- Position Management: Introduce more sophisticated position management mechanisms, such as volatility-based dynamic adjustment.

- Multiple Timeframes: Integrate signals from multiple timeframes to improve trading accuracy.

- Trading Cost Optimization: Optimize entry and exit timing based on cost characteristics of different trading instruments.

Summary

This is a well-designed trend trading system that provides clear trading logic through the core concept of equilibrium price. The strategy’s greatest strength is its flexibility, being suitable for both trend following and reversal trading while maintaining comprehensive risk control mechanisms. Although it may face challenges under certain market conditions, through continuous optimization and flexible adjustment, the strategy has the potential to maintain stable performance across various market environments.

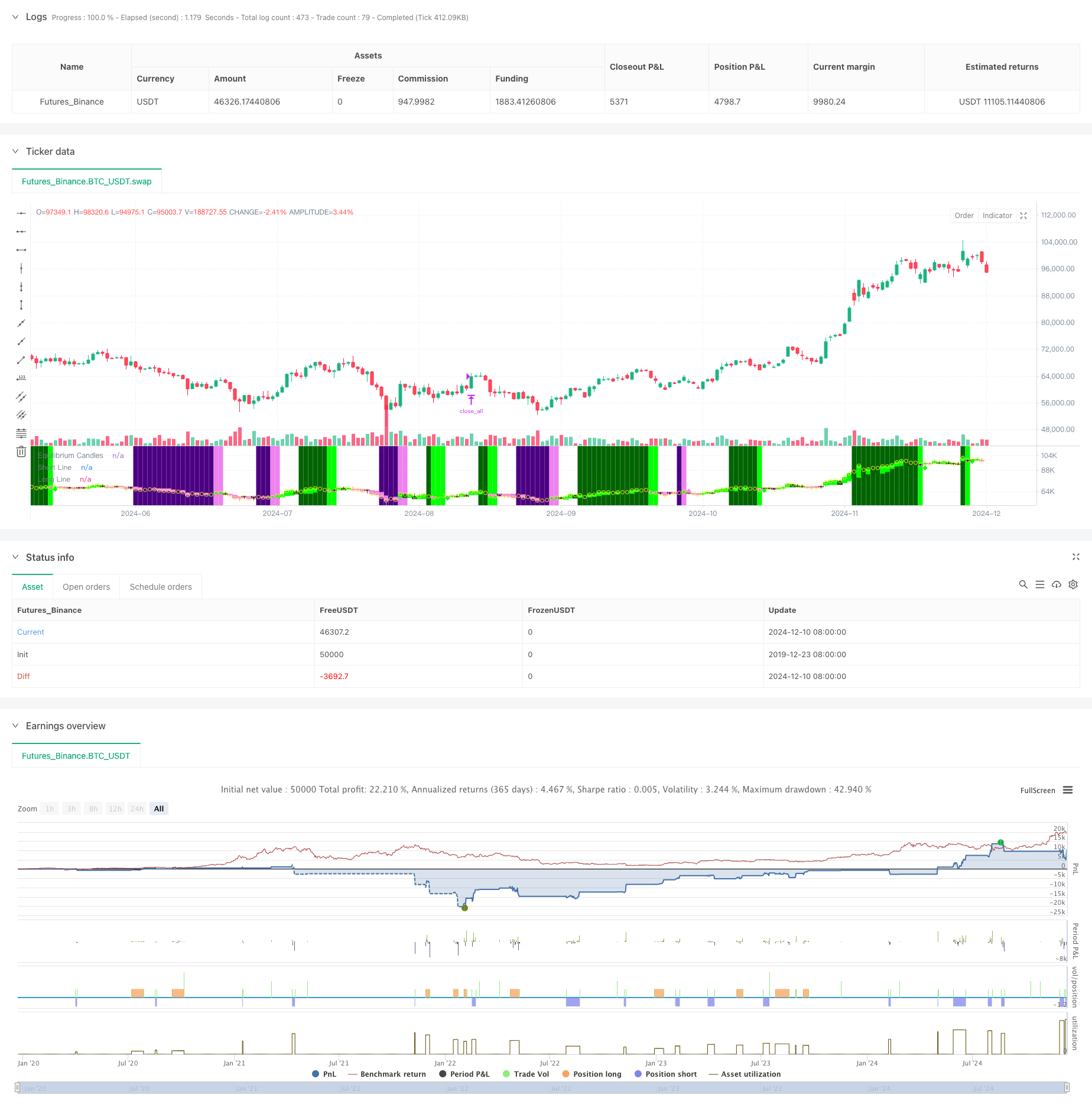

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-11 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Honestcowboy

//@version=5

strategy("Equilibrium Candles + Pattern [Honestcowboy]", overlay=false)

// ================================== //

// ---------> User Input <----------- //

// ================================== //

candleSmoothing = input.int(9, title="Equilibrium Length", tooltip="The lookback for finding equilibrium.\nIt is same calculation as the Baseline in Ichimoku Cloud and is the mid point between highest and lowest value over this length.", group="Base Settings")

candlesForTrend = input.int(7, title="Candles needed for Trend", tooltip="The amount of candles in one direction (colored) before it's considered a trend.\nOrders get created on the first candle in opposite direction.", group="Base Settings")

maxPullbackCandles = input.int(2, title="Max Pullback (candles)", tooltip="The amount of candles can go in opposite direction until a pending trade order is cancelled.", group="Base Settings")

candle_bull_c1 = input.color(color.rgb(0,255,0), title="", inline="1", group="Candle Coloring")

candle_bull_c2 = input.color(color.rgb(0,100,0), title="", inline="1", group="Candle Coloring")

candle_bear_c1 = input.color(color.rgb(238,130,238), title="", inline="2", group="Candle Coloring")

candle_bear_c2 = input.color(color.rgb(75,0,130), title="", inline="2", group="Candle Coloring")

highlightClosePrices = input.bool(defval=true, title="Highlight close prices", group="Candle Coloring", tooltip="Will put small yellow dots where closing price would be.")

useBgColoring = input.bool(defval=true, title="color main chart Bg based on trend and entry point", tooltip="colors main chart background based on trend and entry points", group="Chart Background")

trend_bull_c = input.color(color.rgb(0,100,0,50), title="Trend Bull Color", group="Chart Background")

trend_bear_c = input.color(color.rgb(75,0,130, 50), title="Trend Bear Color", group="Chart Background")

long_zone_c = input.color(color.rgb(0,255,0,60), title="Long Entry Zone Color", group="Chart Background")

short_zone_c = input.color(color.rgb(238,130,238,60), title="Short Entry Zone Color", group="Chart Background")

atrLenghtScob = input.int(14, title="ATR Length", group = "Volatility Settings")

atrAverageLength = input.int(200, title="ATR percentile averages lookback", group = "Volatility Settings")

atrPercentile = input.int(60, minval=0, maxval=99, title="ATR > bottom X percentile", group = "Volatility Settings", tooltip="For the Final ATR value in which percentile of last X bars does it need to be a number. At 60 it's the lowest ATR in top 40% of ATR over X bars")

useReverse = input.bool(true, title="Use Reverse", group="Strategy Inputs", tooltip="The Strategy will open short orders where normal strategy would open long orders. It will use the SL as TP and the TP as SL. So would create the exact opposite in returns as the normal strategy.")

stopMultiplier = input.float(2, title="stop+tp atr multiplier", group="Strategy Inputs")

useTPSL = input.bool(defval=true, title="use stop and TP", group="Strategy Inputs")

useBigCandleExit = input.bool(defval=true, title="Big Candle Exit", group="Strategy Inputs", inline="1", tooltip="Closes all open trades whenever price closes too far from the equilibrium")

bigCandleMultiplier = input.float(defval=1, title="Exit Multiplier", group="Strategy Inputs", inline="1", tooltip="The amount of times in ATR mean candle needs to close outside of equilibrium for it to be a big candle exit.")

tvToQPerc = input.float(defval=1, title="Trade size in Account risk %", group="Tradingview.to Connection (MT5)", tooltip="Quantity as a percentage with stop loss in the commands; the lot size is calculated based on the percentage to lose in case sl is hit. If SL is not specified, the Lot size will be calculated based on account balance.")

tvToOverrideSymbol = input.bool(defval=false, title="Override Symbol?", group="Tradingview.to Connection (MT5)")

tvToSymbol = input.string(defval="EURUSD", title="", group="Tradingview.to Connection (MT5)")

// ================================== //

// -----> Immutable Constants <------ //

// ================================== //

var bool isBullTrend = false

var bool isBearTrend = false

var bool isLongCondition = false

var bool isShortCondition = false

var int bullCandleCount = 0

var int bearCandleCount = 0

var float longLine = na

var float shortLine = na

// ================================== //

// ---> Functional Declarations <---- //

// ================================== //

baseLine(len) =>

math.avg(ta.lowest(len), ta.highest(len))

// ================================== //

// ----> Variable Calculations <----- //

// ================================== //

longSignal = false

shortSignal = false

equilibrium = baseLine(candleSmoothing)

atrEquilibrium = ta.atr(atrLenghtScob)

atrAveraged = ta.percentile_nearest_rank(atrEquilibrium, atrAverageLength, atrPercentile)

equilibriumTop = equilibrium + atrAveraged*bigCandleMultiplier

equilibriumBottom = equilibrium - atrAveraged*bigCandleMultiplier

// ================================== //

// -----> Conditional Variables <---- //

// ================================== //

if not isBullTrend and close>equilibrium

bullCandleCount := bullCandleCount + 1

bearCandleCount := 0

isBearTrend := false

if not isBearTrend and close<equilibrium

bearCandleCount := bearCandleCount + 1

bullCandleCount := 0

isBullTrend := false

if bullCandleCount >= candlesForTrend

isBullTrend := true

isBearTrend := false

bullCandleCount := 0

bearCandleCount := 0

if bearCandleCount >= candlesForTrend

isBearTrend := true

isBullTrend := false

bullCandleCount := 0

bearCandleCount := 0

// ================================== //

// ------> Strategy Execution <------ //

// ================================== //

if isBullTrend[1] and close<equilibrium

if useReverse and (not na(atrAveraged))

strategy.entry("short", strategy.short, limit=high)

alert("Sell " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(high) + " TP=" + str.tostring(high-stopMultiplier*atrAveraged)+ " SL=" + str.tostring(high+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

if (not useReverse) and (not na(atrAveraged))

strategy.entry("long", strategy.long, stop=high)

alert("Buy " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(high) + " TP=" + str.tostring(high+stopMultiplier*atrAveraged) + " SL=" + str.tostring(high+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

isLongCondition := true

isBullTrend := false

longLine := high

if isBearTrend[1] and close>equilibrium

if useReverse and (not na(atrAveraged))

strategy.entry("long", strategy.long, limit=low)

alert("Buy " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(low) + " TP=" + str.tostring(low+stopMultiplier*atrAveraged) + " SL=" + str.tostring(low-stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

if (not useReverse) and (not na(atrAveraged))

strategy.entry("short", strategy.short, stop=low)

alert("Sell " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(low) + " TP=" + str.tostring(low-stopMultiplier*atrAveraged) + " SL=" + str.tostring(low+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

isShortCondition := true

isBearTrend := false

shortLine := low

if isLongCondition and (bearCandleCount >= maxPullbackCandles)[1]

if useReverse

strategy.cancel("short")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=sell")

if not useReverse

strategy.cancel("long")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=buy")

isLongCondition := false

bullCandleCount := 0

longLine := na

if isShortCondition and (bullCandleCount >= maxPullbackCandles)[1]

if useReverse

strategy.cancel("long")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=buy")

if not useReverse

strategy.cancel("short")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=sell")

isShortCondition := false

bearCandleCount := 0

shortLine := na

// ---- Save for graphical display that there is a longcondition + reset other variables

if high>longLine

longSignal := true

longLine := na

isLongCondition := false

if low<shortLine

shortSignal := true

shortLine := na

isShortCondition := false

// ---- Get Stop loss and Take Profit in there

if useReverse

if useTPSL

if strategy.position_size < 0 and strategy.position_size[1] >= 0

strategy.exit("short exit", "short", limit=longLine[1]-stopMultiplier*atrAveraged, stop=longLine[1]+stopMultiplier*atrAveraged)

if strategy.position_size > 0 and strategy.position_size[1] <= 0

strategy.exit("long exit", "long", limit=shortLine[1]+stopMultiplier*atrAveraged, stop=shortLine[1]-stopMultiplier*atrAveraged)

if not useReverse

if useTPSL

if strategy.position_size > 0 and strategy.position_size[1] <= 0

strategy.exit("long exit", "long", limit=longLine[1]+stopMultiplier*atrAveraged, stop=longLine[1]-stopMultiplier*atrAveraged)

if strategy.position_size < 0 and strategy.position_size[1] >=0

strategy.exit("short exit", "short", limit=shortLine[1]-stopMultiplier*atrAveraged, stop=shortLine[1]+stopMultiplier*atrAveraged)

// ----- Logic for closing positions on a big candle in either direction

if (strategy.position_size[1]>0 or strategy.position_size[1]<0) and useBigCandleExit

if close>equilibriumTop or close<equilibriumBottom

strategy.close_all("Big Candle Stop")

alert("close " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)))

// ================================== //

// ------> Graphical Display <------- //

// ================================== //

// Deviation from equilibrium using smoothed ATR and percentile nearest rank to rank the coloring of the candles

candle_c2 = close>equilibrium ? close>open ? candle_bull_c1 : candle_bull_c2 : close<open ? candle_bear_c1 : candle_bear_c2

//

plotcandle(equilibrium, high, low, close, title="Equilibrium Candles", color=candle_c2, wickcolor=candle_c2, bordercolor=candle_c2)

plotshape(highlightClosePrices ? close : na, title="Closing Bubble", style=shape.circle, location=location.absolute, color=color.yellow)

bgcolor(useBgColoring ? (isBullTrend ? trend_bull_c : isBearTrend ? trend_bear_c : isLongCondition ? long_zone_c : isShortCondition ? short_zone_c : na) : na, force_overlay=true)

plot(longLine, color=candle_bull_c1, title="Long Line", style=plot.style_linebr, linewidth=4)

plot(shortLine, color=candle_bear_c1, title="Short Line", style=plot.style_linebr, linewidth=4)

plotshape(longSignal ? math.min(equilibrium, low)+(-0.5*atrAveraged) : na, title="Long Signal", color=candle_bull_c1, style=shape.diamond, size=size.tiny, location=location.absolute)

plotshape(shortSignal ? math.max(equilibrium, high)+(0.5*atrAveraged) : na, title="Short Signal", color=candle_bear_c1, style=shape.diamond, size=size.tiny, location=location.absolute)

// =================================== //

// ------> Simple Form Alerts <------- //

// =================================== //

alertcondition(longSignal, "Simple Long Signal")

alertcondition(shortSignal, "Simple Short Signal")