Overview

This strategy is a trend-following options trading system that combines multiple technical indicators. It uses EMA crossover as the core signal, along with SMA and VWAP for trend confirmation, while utilizing MACD and RSI as supplementary indicators for signal filtering. The strategy employs fixed take-profit levels for risk management and enhances trading success through strict entry conditions and position management.

Strategy Principles

The strategy uses the crossover of 8-period and 21-period EMAs as the primary trading signal. A long (Call) signal is triggered when the short-term EMA crosses above the long-term EMA and meets the following conditions: price is above both 100 and 200-period SMAs, MACD line is above the signal line, and RSI is above 50. Short (Put) signals are triggered under opposite conditions. VWAP is incorporated as a price-weighted reference to help assess relative price position. Each trade uses a fixed position size of 1 contract with a 5% take-profit level. The strategy tracks position status using a positionOpen flag to ensure only one position is held at a time.

Strategy Advantages

- Multiple indicators work in synergy, cross-validating signals through different periods and types of indicators

- Combines trend-following and momentum indicators to capture both trend and short-term momentum

- Fixed take-profit levels help protect profits and prevent excessive greed

- Strict position management prevents overlapping positions and reduces risk exposure

- Clear visualization including EMA, SMA, VWAP trends and signal markers

Strategy Risks

- May generate frequent false signals in ranging markets

- Fixed take-profit levels might limit profit potential

- Absence of stop-loss could lead to significant losses in extreme market conditions

- Multiple indicators might result in delayed signals

- May face slippage risk in options contracts with low liquidity

Strategy Optimization Directions

- Implement adaptive take-profit and stop-loss mechanisms based on market volatility

- Add position sizing module to dynamically adjust based on account size and market conditions

- Include volatility filters to adjust strategy parameters in high-volatility environments

- Optimize indicator parameters, considering adaptive periods instead of fixed ones

- Add time filters to avoid trading during highly volatile market opening and closing periods

Summary

This is a well-structured, logically sound multi-indicator trend-following options trading strategy. It enhances trading signal reliability through the coordination of multiple technical indicators and manages risk using fixed take-profit levels. While the strategy has some inherent risks, the proposed optimization directions can further improve its stability and profitability. The strategy’s visualization design also helps traders intuitively understand and execute trading signals.

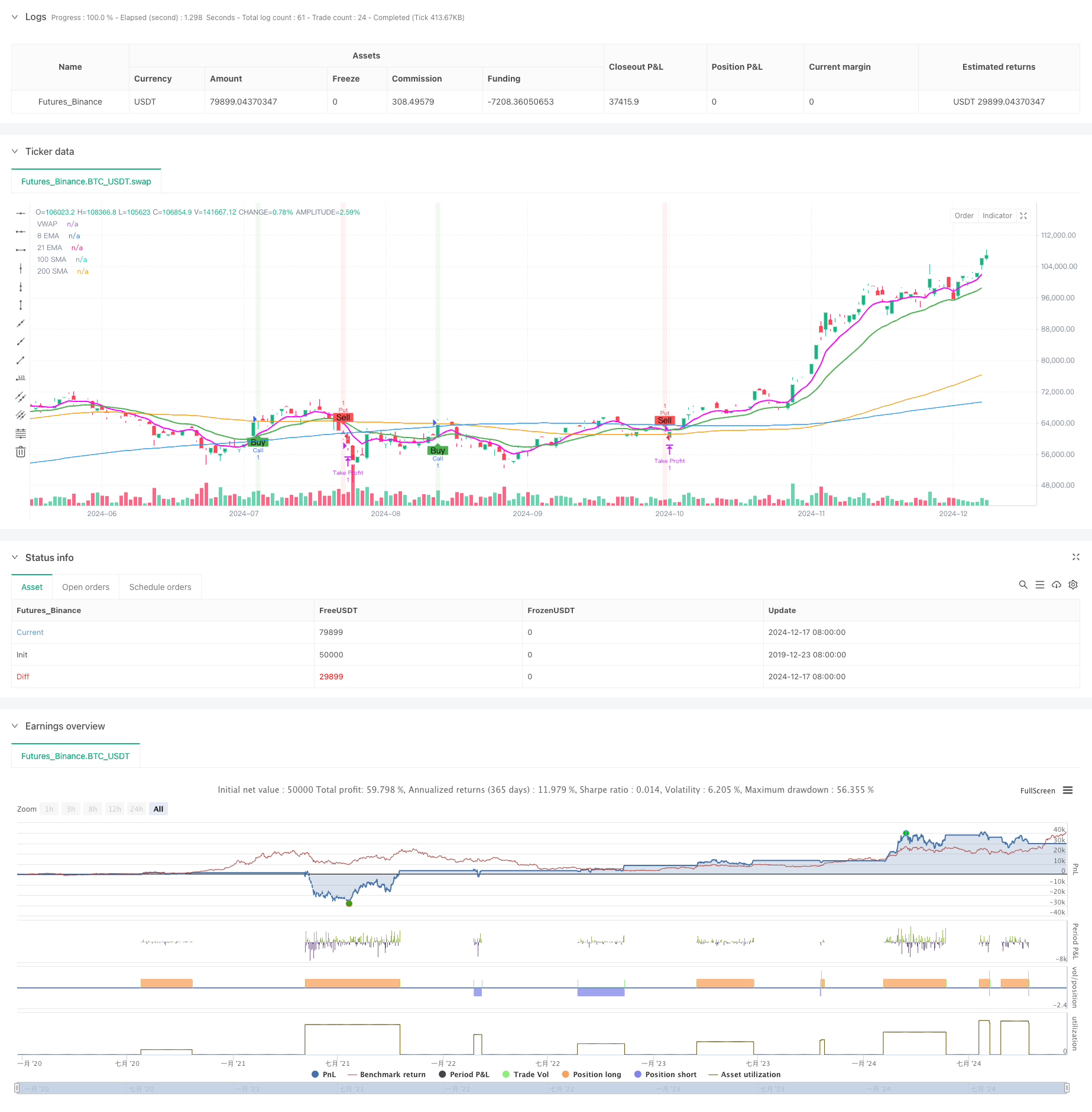

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("OptionsMillionaire Strategy with Take Profit Only", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Define custom magenta color

magenta = color.rgb(255, 0, 255) // RGB for magenta

// Input settings for Moving Averages

ema8 = ta.ema(close, 8)

ema21 = ta.ema(close, 21)

sma100 = ta.sma(close, 100)

sma200 = ta.sma(close, 200)

vwap = ta.vwap(close) // Fixed VWAP calculation

// Input settings for MACD and RSI

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

rsi = ta.rsi(close, 14)

// Define trend direction

isBullish = ema8 > ema21 and close > sma100 and close > sma200

isBearish = ema8 < ema21 and close < sma100 and close < sma200

// Buy (Call) Signal

callSignal = ta.crossover(ema8, ema21) and isBullish and macdLine > signalLine and rsi > 50

// Sell (Put) Signal

putSignal = ta.crossunder(ema8, ema21) and isBearish and macdLine < signalLine and rsi < 50

// Define Position Size and Take-Profit Level

positionSize = 1 // Position size set to 1 (each trade will use one contract)

takeProfitPercent = 5 // Take profit is 5%

// Variables to track entry price and whether the position is opened

var float entryPrice = na // To store the entry price

var bool positionOpen = false // To check if a position is open

// Backtesting Execution

if callSignal and not positionOpen

// Enter long position (call)

strategy.entry("Call", strategy.long, qty=positionSize)

entryPrice := close // Store the entry price

positionOpen := true // Set position as opened

if putSignal and not positionOpen

// Enter short position (put)

strategy.entry("Put", strategy.short, qty=positionSize)

entryPrice := close // Store the entry price

positionOpen := true // Set position as opened

// Only check for take profit after position is open

if positionOpen

// Calculate take-profit level (5% above entry price for long, 5% below for short)

takeProfitLevel = entryPrice * (1 + takeProfitPercent / 100)

// Exit conditions (only take profit)

if strategy.position_size > 0

// Long position (call)

if close >= takeProfitLevel

strategy.exit("Take Profit", "Call", limit=takeProfitLevel)

if strategy.position_size < 0

// Short position (put)

if close <= takeProfitLevel

strategy.exit("Take Profit", "Put", limit=takeProfitLevel)

// Reset position when it is closed (this happens when an exit is triggered)

if strategy.position_size == 0

positionOpen := false // Reset positionOpen flag

// Plot EMAs

plot(ema8, color=magenta, linewidth=2, title="8 EMA")

plot(ema21, color=color.green, linewidth=2, title="21 EMA")

// Plot SMAs

plot(sma100, color=color.orange, linewidth=1, title="100 SMA")

plot(sma200, color=color.blue, linewidth=1, title="200 SMA")

// Plot VWAP

plot(vwap, color=color.white, style=plot.style_circles, title="VWAP")

// Highlight buy and sell zones

bgcolor(callSignal ? color.new(color.green, 90) : na, title="Call Signal Background")

bgcolor(putSignal ? color.new(color.red, 90) : na, title="Put Signal Background")

// Add buy and sell markers (buy below, sell above)

plotshape(series=callSignal, style=shape.labelup, location=location.belowbar, color=color.green, text="Buy", title="Call Signal Marker")

plotshape(series=putSignal, style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell", title="Put Signal Marker")