Strategy Overview

This strategy is a dynamic trend following system that combines multiple technical indicators. It integrates Pivot Points, SuperTrend indicator, and moving average crossover signals to identify market trends and trading opportunities. The strategy’s key feature is its fixed timeframe analysis approach, ensuring signal consistency while validating signals through pivot points.

Strategy Principles

The strategy operates based on the following core mechanisms: 1. Uses fixed timeframe price data for analysis, avoiding interference from different timeframes 2. Calculates SMAs based on 8-period and 21-period EMAs to form trend following foundation 3. Combines ATR and pivot points to calculate SuperTrend indicator for trend direction confirmation 4. Only considers SMA crossover signals valid if they occur within 3 periods of a pivot point 5. Dynamically calculates and tracks support/resistance levels for trading reference

Strategy Advantages

- Multiple indicator cross-validation improves signal reliability

- Fixed timeframe analysis reduces false signal interference

- Pivot point validation ensures trades occur at key price levels

- Dynamic tracking of support/resistance helps determine stop-loss and take-profit levels

- SuperTrend indicator provides additional trend direction confirmation

- Flexible parameter settings allow adjustment for different market conditions

Strategy Risks

- Multiple indicators may lead to signal lag

- May generate excessive false signals in ranging markets

- Fixed timeframe analysis might miss important signals in other timeframes

- Pivot point validation may cause missing some important trading opportunities

- Parameter optimization may lead to overfitting

Strategy Optimization Directions

- Introduce volatility filtering mechanism to reduce trading frequency during low volatility periods

- Add trend strength confirmation indicators like ADX or MACD

- Develop adaptive parameter system that dynamically adjusts based on market conditions

- Incorporate volume analysis to improve signal reliability

- Implement dynamic stop-loss mechanism that adjusts based on market volatility

Summary

This strategy establishes a relatively complete trend following trading system through the combination of multiple technical indicators. Its core advantage lies in improving signal reliability through fixed timeframe analysis and pivot point validation. While there are certain lag risks, these can be effectively controlled through parameter optimization and risk management measures. Traders are advised to conduct thorough backtesting before live implementation and adjust parameters according to specific market characteristics.

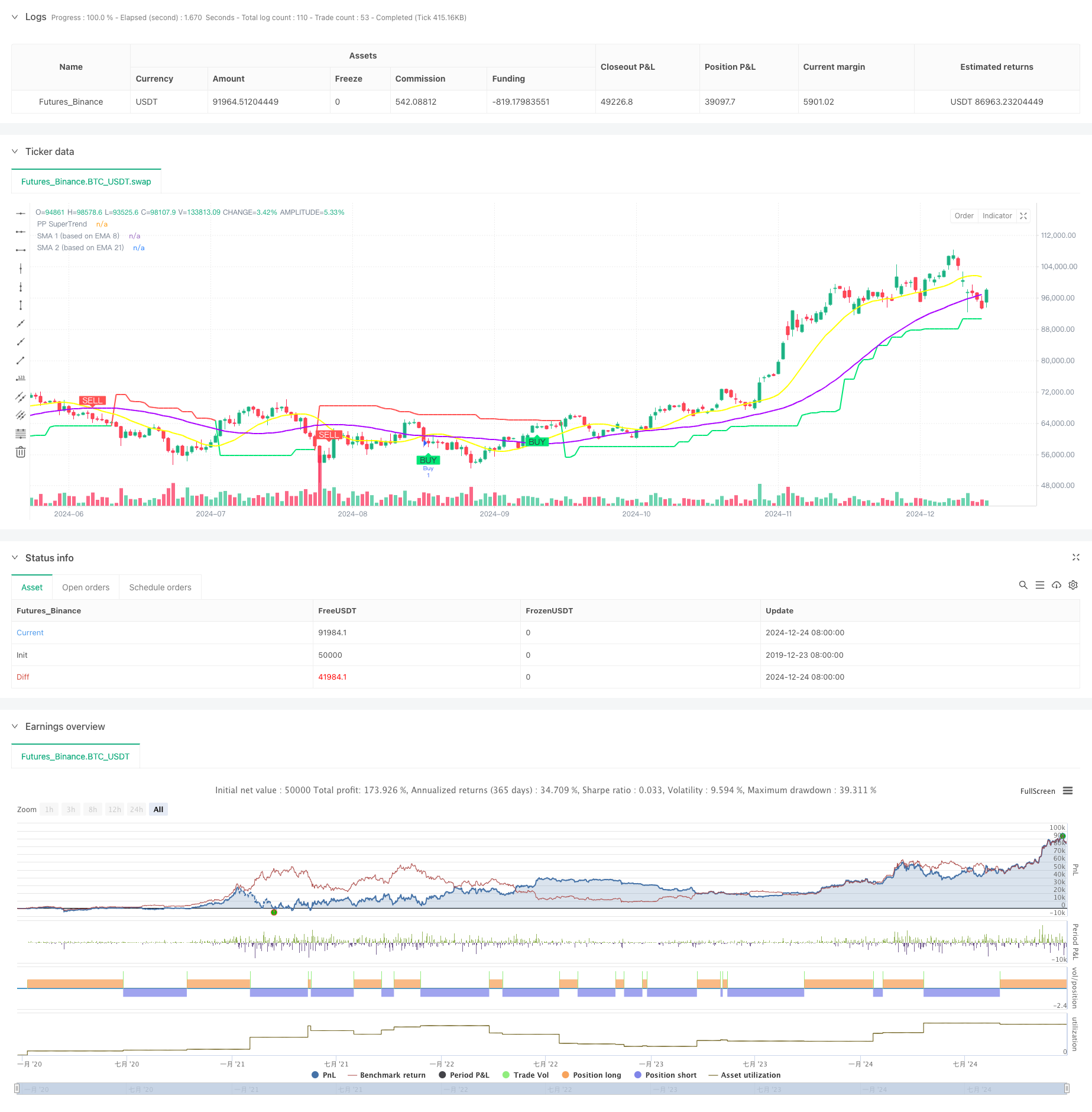

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Buy Sell Pivot Point", overlay=true)

// Input Parameters

prd = input.int(defval=2, title="Periodo Pivot Point", minval=1, maxval=50)

Factor = input.float(defval=3, title="Fator ATR", minval=1, step=0.1)

Pd = input.int(defval=10, title="Periodo ATR", minval=1)

showpivot = input.bool(defval=false, title="Mostrar Pivot Points")

showlabel = input.bool(defval=true, title="Mostrar Buy/Sell Labels")

showcl = input.bool(defval=false, title="Mostrar PP Center Line")

showsr = input.bool(defval=false, title="Mostrar Support/Resistance")

sma1_length = input.int(defval=8, title="SMA 1")

sma2_length = input.int(defval=21, title="SMA 2")

timeframe_fix = input.timeframe("D", title="Timeframe Fixo")

// Request data from the fixed timeframe

fix_close = request.security(syminfo.tickerid, timeframe_fix, close)

fix_high = request.security(syminfo.tickerid, timeframe_fix, high)

fix_low = request.security(syminfo.tickerid, timeframe_fix, low)

fix_ph = request.security(syminfo.tickerid, timeframe_fix, ta.pivothigh(prd, prd))

fix_pl = request.security(syminfo.tickerid, timeframe_fix, ta.pivotlow(prd, prd))

fix_atr = request.security(syminfo.tickerid, timeframe_fix, ta.atr(Pd))

// Convert Pivot High/Low to valid boolean for conditions

ph_cond = not na(fix_ph)

pl_cond = not na(fix_pl)

// Draw Pivot Points

plotshape(ph_cond and showpivot, title="Pivot High", text="H", style=shape.labeldown, color=color.red, textcolor=color.red, location=location.abovebar, offset=-prd)

plotshape(pl_cond and showpivot, title="Pivot Low", text="L", style=shape.labelup, color=color.lime, textcolor=color.lime, location=location.belowbar, offset=-prd)

// Calculate the Center line using pivot points

var float center = na

lastpp = ph_cond ? fix_ph : pl_cond ? fix_pl : na

if not na(lastpp)

center := na(center) ? lastpp : (center * 2 + lastpp) / 3

// Upper/Lower bands calculation

Up = center - (Factor * fix_atr)

Dn = center + (Factor * fix_atr)

// Get the trend

var float TUp = na

var float TDown = na

var int Trend = 0

TUp := na(TUp[1]) ? Up : fix_close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := na(TDown[1]) ? Dn : fix_close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := fix_close > TDown[1] ? 1 : fix_close < TUp[1] ? -1 : nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// Plot the trend

linecolor = Trend == 1 ? color.lime : Trend == -1 ? color.red : na

plot(Trailingsl, color=linecolor, linewidth=2, title="PP SuperTrend")

// Plot Center Line

plot(showcl ? center : na, color=showcl ? (center < fix_close ? color.blue : color.red) : na, title="Center Line")

// Calculate Base EMAs

ema_8 = ta.ema(fix_close, 8)

ema_21 = ta.ema(fix_close, 21)

// Calculate SMAs based on EMAs

sma1 = ta.sma(ema_8, sma1_length)

sma2 = ta.sma(ema_21, sma2_length)

// Plot SMAs

plot(sma1, color=#ffff00, linewidth=2, title="SMA 1 (based on EMA 8)")

plot(sma2, color=#aa00ff, linewidth=2, title="SMA 2 (based on EMA 21)")

// Initialize variables to track pivot points

var float last_pivot_time = na

// Update the pivot time when a new pivot is detected

if (ph_cond)

last_pivot_time := bar_index

if (pl_cond)

last_pivot_time := bar_index

// Calculate the crossover/crossunder signals

buy_signal = ta.crossover(sma1, sma2) // SMA 8 crossing SMA 21 upwards

sell_signal = ta.crossunder(sma1, sma2) // SMA 8 crossing SMA 21 downwards

// Ensure signal is only valid if it happens within 3 candles of a pivot point

valid_buy_signal = buy_signal and (bar_index - last_pivot_time <= 3)

valid_sell_signal = sell_signal and (bar_index - last_pivot_time <= 3)

// Plot Buy/Sell Signals

plotshape(valid_buy_signal and showlabel, title="Buy Signal", text="BUY", style=shape.labelup, color=color.lime, textcolor=color.black, location=location.belowbar)

plotshape(valid_sell_signal and showlabel, title="Sell Signal", text="SELL", style=shape.labeldown, color=color.red, textcolor=color.white, location=location.abovebar)

// Get S/R levels using Pivot Points

var float resistance = na

var float support = na

support := pl_cond ? fix_pl : support[1]

resistance := ph_cond ? fix_ph : resistance[1]

// Plot S/R levels

plot(showsr and not na(support) ? support : na, color=showsr ? color.lime : na, style=plot.style_circles, offset=-prd)

plot(showsr and not na(resistance) ? resistance : na, color=showsr ? color.red : na, style=plot.style_circles, offset=-prd)

// Execute trades based on valid signals

if valid_buy_signal

strategy.entry("Buy", strategy.long)

if valid_sell_signal

strategy.entry("Sell", strategy.short)

// Alerts

alertcondition(valid_buy_signal, title="Buy Signal", message="Buy Signal Detected")

alertcondition(valid_sell_signal, title="Sell Signal", message="Sell Signal Detected")

alertcondition(Trend != Trend[1], title="Trend Changed", message="Trend Changed")