Overview

This strategy is a dual-direction trading system that combines Exponential Moving Averages (EMA) with time intervals. The system determines the main trading direction based on EMA relationships within user-defined fixed time intervals, while monitoring another set of EMA indicators for crossover signals or approaching the next trading cycle to execute reverse hedge trades, thereby capturing bi-directional trading opportunities.

Strategy Principle

The strategy operates on two core mechanisms: main trades at fixed intervals and flexible reverse trades. The main trades judge trend direction based on the relative position of 5⁄40-minute EMAs, executing trades at each interval (default 30 minutes). Reverse trades are triggered either by monitoring 5⁄10-minute EMA crossover signals or one minute before the next main trade, whichever occurs first. All trading occurs within a user-defined time window to ensure trading effectiveness.

Strategy Advantages

- Combines trend-following and mean-reversion trading approaches to capture opportunities in different market environments

- Controls trading frequency through time intervals to avoid overtrading

- Reverse trading mechanism provides risk hedging functionality to help control drawdowns

- Highly customizable parameters including EMA periods and trading intervals for strong adaptability

- Adjustable trading time windows for optimization according to different market characteristics

Strategy Risks

- EMA indicators have inherent lag, potentially generating delayed signals in volatile markets

- Fixed time interval trading might miss important market opportunities

- Reverse trades may result in unnecessary losses during strong trends

- Improper parameter selection can lead to excessive or insufficient trading signals

- Need to consider the impact of trading costs on strategy returns

Strategy Optimization Directions

- Introduce volatility indicators to dynamically adjust EMA parameters for improved adaptability

- Add volume analysis to enhance trading signal reliability

- Develop dynamic time interval mechanisms that adjust trading frequency based on market activity

- Implement stop-loss and profit target management to optimize capital management

- Consider incorporating additional technical indicators for cross-validation to improve trading accuracy

Summary

This is a comprehensive strategy that combines trend following with reverse trading, achieving bi-directional opportunity capture through the coordination of time intervals and EMA indicators. The strategy offers strong customization capabilities and good potential for risk control, but requires parameter optimization and risk management refinement based on actual market conditions. For live trading implementation, it is recommended to conduct thorough backtesting and parameter optimization, along with specific adjustments based on market characteristics.

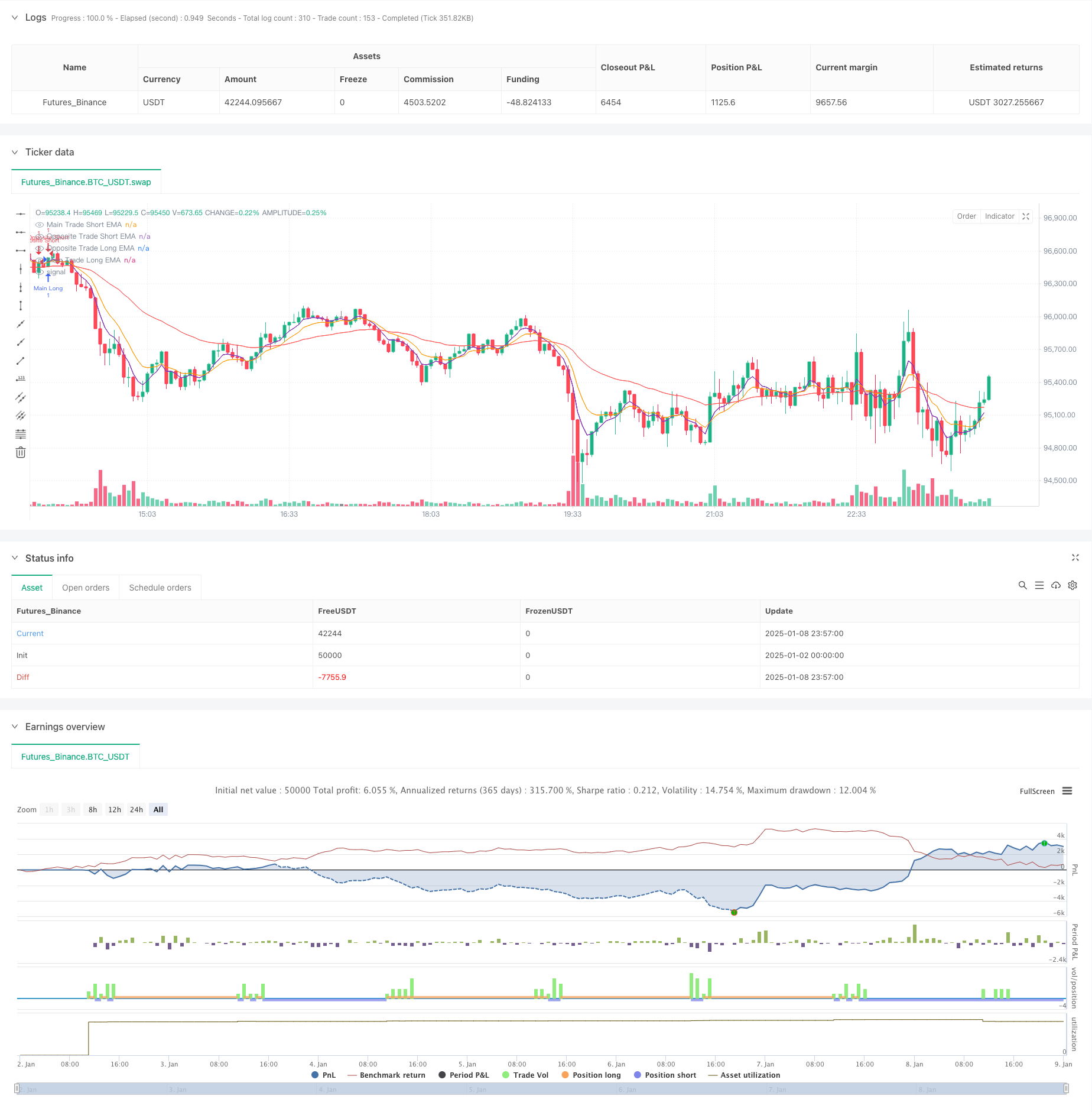

/*backtest

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SPX EMA Strategy with Opposite Trades", overlay=true)

// User-defined inputs

tradeIntervalMinutes = input.int(30, title="Main Trade Interval (in minutes)", minval=1)

oppositeTradeDelayMinutes = input.int(1, title="Opposite Trade time from next trade (in minutes)", minval=1) // Delay of opposite trade (1 min before the next trade)

startHour = input.int(10, title="Start Hour", minval=0, maxval=23)

startMinute = input.int(30, title="Start Minute", minval=0, maxval=59)

stopHour = input.int(15, title="Stop Hour", minval=0, maxval=23)

stopMinute = input.int(0, title="Stop Minute", minval=0, maxval=59)

// User-defined EMA periods for main trade and opposite trade

mainEmaShortPeriod = input.int(5, title="Main Trade EMA Short Period", minval=1)

mainEmaLongPeriod = input.int(40, title="Main Trade EMA Long Period", minval=1)

oppositeEmaShortPeriod = input.int(5, title="Opposite Trade EMA Short Period", minval=1)

oppositeEmaLongPeriod = input.int(10, title="Opposite Trade EMA Long Period", minval=1)

// Calculate the EMAs for main trade

emaMainShort = ta.ema(close, mainEmaShortPeriod)

emaMainLong = ta.ema(close, mainEmaLongPeriod)

// Calculate the EMAs for opposite trade (using different periods)

emaOppositeShort = ta.ema(close, oppositeEmaShortPeriod)

emaOppositeLong = ta.ema(close, oppositeEmaLongPeriod)

// Condition to check if it is during the user-defined time window

startTime = timestamp(year, month, dayofmonth, startHour, startMinute)

stopTime = timestamp(year, month, dayofmonth, stopHour, stopMinute)

currentTime = timestamp(year, month, dayofmonth, hour, minute)

// Ensure the script only trades within the user-defined time window

isTradingTime = currentTime >= startTime and currentTime <= stopTime

// Time condition: Execute the trade every tradeIntervalMinutes

var float lastTradeTime = na

timePassed = na(lastTradeTime) or (currentTime - lastTradeTime) >= tradeIntervalMinutes * 60 * 1000

// Entry Conditions for Main Trade

longCondition = emaMainShort > emaMainLong // Enter long if short EMA is greater than long EMA

shortCondition = emaMainShort < emaMainLong // Enter short if short EMA is less than long EMA

// Detect EMA crossovers for opposite trade (bullish or bearish)

bullishCrossoverOpposite = ta.crossover(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses above long

bearishCrossoverOpposite = ta.crossunder(emaOppositeShort, emaOppositeLong) // Opposite EMA short crosses below long

// Track the direction of the last main trade (true for long, false for short)

var bool isLastTradeLong = na

// Track whether an opposite trade has already been executed after the last main trade

var bool oppositeTradeExecuted = false

// Execute the main trades if within the time window and at the user-defined interval

if isTradingTime and timePassed

if longCondition

strategy.entry("Main Long", strategy.long)

isLastTradeLong := true // Mark the last trade as long

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, low, "Main Long", color=color.green, textcolor=color.white, size=size.small)

else if shortCondition

strategy.entry("Main Short", strategy.short)

isLastTradeLong := false // Mark the last trade as short

oppositeTradeExecuted := false // Reset opposite trade status

lastTradeTime := currentTime

// label.new(bar_index, high, "Main Short", color=color.red, textcolor=color.white, size=size.small)

// Execute the opposite trade only once after the main trade

if isTradingTime and not oppositeTradeExecuted

// 1 minute before the next main trade or EMA crossover

if (currentTime - lastTradeTime) >= (tradeIntervalMinutes - oppositeTradeDelayMinutes) * 60 * 1000 or bullishCrossoverOpposite or bearishCrossoverOpposite

if isLastTradeLong

// If the last main trade was long, enter opposite short trade

strategy.entry("Opposite Short", strategy.short)

//label.new(bar_index, high, "Opposite Short", color=color.red, textcolor=color.white, size=size.small)

else

// If the last main trade was short, enter opposite long trade

strategy.entry("Opposite Long", strategy.long)

//label.new(bar_index, low, "Opposite Long", color=color.green, textcolor=color.white, size=size.small)

// After entering the opposite trade, set the flag to true so no further opposite trades are placed

oppositeTradeExecuted := true

// Plot the EMAs for visual reference

plot(emaMainShort, title="Main Trade Short EMA", color=color.blue)

plot(emaMainLong, title="Main Trade Long EMA", color=color.red)

plot(emaOppositeShort, title="Opposite Trade Short EMA", color=color.purple)

plot(emaOppositeLong, title="Opposite Trade Long EMA", color=color.orange)