Estrategia de cobertura de futuros y spot manuales de criptomonedas

El autor:FMZ~Lydia, Creado: 2022-08-16 16:01:47, Actualizado: 2023-09-19 21:39:31

En vista del hecho de que la frecuencia de cobertura de la estrategia de cobertura de futuros y puntos no es alta, en realidad es posible operar manualmente. Sin embargo, si lo hace manualmente, es muy inconveniente cambiar de página de varios intercambios, observar los precios y calcular la diferencia, y a veces puede que desee ver más variedades, y no es necesario configurar varios monitores para mostrar el mercado. ¿Es posible lograr este objetivo de operación manual con una estrategia semiautomática? Es mejor tener múltiples especies, oh! Sí, es mejor abrir y cerrar posiciones con un solo clic. Oh! Sí, también hay una posición de visualización...

¡Cuando haya una necesidad, hazlo ahora!

Diseñar una estrategia de cobertura de futuros y puntos manuales de criptomonedas

La escritura es bastante larga, con menos de 600 líneas de código.

function createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio) {

var self = {}

self.fuEx = fuEx

self.spEx = spEx

self.symbolPairs = symbolPairs

self.pairs = []

self.fuExTickers = null

self.spExTickers = null

self.tickerUpdateTS = 0

self.fuMarginLevel = fuMarginLevel

self.fuMarginReservedRatio = fuMarginReservedRatio

self.cmdHedgeAmount = cmdHedgeAmount

self.preUpdateAccTS = 0

self.accAndPosUpdateCount = 0

self.profit = []

self.allPairs = []

self.PLUS = 0

self.MINUS = 1

self.COVER_PLUS = 2

self.COVER_MINUS = 3

self.arrTradeTypeDesc = ["positive arbitrage", "reverse arbitrage", "close positive arbitrage", "close reverse arbitrage"]

self.updateTickers = function() {

self.fuEx.goGetTickers()

self.spEx.goGetTickers()

var fuExTickers = self.fuEx.getTickers()

var spExTickers = self.spEx.getTickers()

if (!fuExTickers || !spExTickers) {

return null

}

self.fuExTickers = fuExTickers

self.spExTickers = spExTickers

self.tickerUpdateTS = new Date().getTime()

return true

}

self.hedge = function(index, fuSymbol, spSymbol, tradeType, amount) {

var fe = self.fuEx

var se = self.spEx

var pair = self.pairs[index]

var timeStamp = new Date().getTime()

var fuDirection = null

var spDirection = null

var fuPrice = null

var spPrice = null

if (tradeType == self.PLUS) {

fuDirection = fe.OPEN_SHORT

spDirection = se.OPEN_LONG

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else if (tradeType == self.MINUS) {

fuDirection = fe.OPEN_LONG

spDirection = se.OPEN_SHORT

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_PLUS) {

fuDirection = fe.COVER_SHORT

spDirection = se.COVER_LONG

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_MINUS) {

fuDirection = fe.COVER_LONG

spDirection = se.COVER_SHORT

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else {

throw "unknow tradeType!"

}

fe.goGetAcc(fuSymbol, timeStamp)

se.goGetAcc(spSymbol, timeStamp)

var nowFuAcc = fe.getAcc(fuSymbol, timeStamp)

var nowSpAcc = se.getAcc(spSymbol, timeStamp)

if (!nowFuAcc || !nowSpAcc) {

Log(fuSymbol, spSymbol, ", failed to get account data")

return

}

pair.nowFuAcc = nowFuAcc

pair.nowSpAcc = nowSpAcc

var nowFuPos = fe.getFuPos(fuSymbol, timeStamp)

var nowSpPos = se.getSpPos(spSymbol, spPrice, pair.initSpAcc, pair.nowSpAcc)

if (!nowFuPos || !nowSpPos) {

Log(fuSymbol, spSymbol, ", failed to get position data")

return

}

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

var fuAmount = amount

var spAmount = amount

if (tradeType == self.PLUS || tradeType == self.MINUS) {

if (nowFuAcc.Balance < (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio + (fuAmount * fuPrice / self.fuMarginLevel)) {

Log(pair.fuSymbol, "insufficient deposit!", "this plan uses", (fuAmount * fuPrice / self.fuMarginLevel), "currently available:", nowFuAcc.Balance,

"Plan to reserve:", (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio)

return

}

if ((tradeType == self.PLUS && nowSpAcc.Balance < spAmount * spPrice)) {

Log(pair.spSymbol, "insufficient funds!", "this purchase plans to use", spAmount * spPrice, "currently available:", nowSpAcc.Balance)

return

} else if (tradeType == self.MINUS && nowSpAcc.Stocks < spAmount) {

Log(pair.spSymbol, "insufficient funds!", "this selling plans to use", spAmount, "currently available:", nowSpAcc.Stocks)

return

}

} else {

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if ((tradeType == self.COVER_PLUS && !fuShortPos) || (tradeType == self.COVER_MINUS && !fuLongPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in futures!")

return

} else if (tradeType == self.COVER_PLUS && Math.abs(fuShortPos.amount) < fuAmount) {

fuAmount = Math.abs(fuShortPos.amount)

} else if (tradeType == self.COVER_MINUS && Math.abs(fuLongPos.amount) < fuAmount) {

fuAmount = Math.abs(fuLongPos.amount)

}

if ((tradeType == self.COVER_PLUS && !spLongPos) || (tradeType == self.COVER_MINUS && !spShortPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in the spot!")

return

} else if (tradeType == self.COVER_PLUS && Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks) < spAmount) {

spAmount = Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks)

} else if (tradeType == self.COVER_MINUS && Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice) < spAmount) {

spAmount = Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice)

}

}

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount)

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, spAmount)

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

} else {

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount[1])

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, Math.min(fuAmount[1], spAmount[1]))

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

}

}

Log("contract code:", fuSymbol + "/" + spSymbol, "direction:", self.arrTradeTypeDesc[tradeType], "difference:", fuPrice - spPrice, "quantity of futures:", fuAmount, "quantity of spots:", spAmount, "@")

fe.goGetTrade(fuSymbol, fuDirection, fuPrice, fuAmount[0])

se.goGetTrade(spSymbol, spDirection, spPrice, spAmount[0])

var feIdMsg = fe.getTrade()

var seIdMsg = se.getTrade()

return [feIdMsg, seIdMsg]

}

self.process = function() {

var nowTS = new Date().getTime()

if(!self.updateTickers()) {

return

}

_.each(self.pairs, function(pair, index) {

var fuTicker = null

var spTicker = null

_.each(self.fuExTickers, function(ticker) {

if (ticker.originalSymbol == pair.fuSymbol) {

fuTicker = ticker

}

})

_.each(self.spExTickers, function(ticker) {

if (ticker.originalSymbol == pair.spSymbol) {

spTicker = ticker

}

})

if (fuTicker && spTicker) {

pair.canTrade = true

} else {

pair.canTrade = false

}

fuTicker = fuTicker ? fuTicker : {}

spTicker = spTicker ? spTicker : {}

pair.fuTicker = fuTicker

pair.spTicker = spTicker

pair.plusDiff = fuTicker.bid1 - spTicker.ask1

pair.minusDiff = fuTicker.ask1 - spTicker.bid1

if (pair.plusDiff && pair.minusDiff) {

pair.plusDiff = _N(pair.plusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.bid1), self.spEx.judgePrecision(spTicker.ask1)))

pair.minusDiff = _N(pair.minusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.ask1), self.spEx.judgePrecision(spTicker.bid1)))

}

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.fuEx.goGetAcc(pair.fuSymbol, nowTS)

self.spEx.goGetAcc(pair.spSymbol, nowTS)

var fuAcc = self.fuEx.getAcc(pair.fuSymbol, nowTS)

var spAcc = self.spEx.getAcc(pair.spSymbol, nowTS)

if (fuAcc) {

pair.nowFuAcc = fuAcc

}

if (spAcc) {

pair.nowSpAcc = spAcc

}

var nowFuPos = self.fuEx.getFuPos(pair.fuSymbol, nowTS)

var nowSpPos = self.spEx.getSpPos(pair.spSymbol, (pair.spTicker.ask1 + pair.spTicker.bid1) / 2, pair.initSpAcc, pair.nowSpAcc)

if (nowFuPos && nowSpPos) {

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

self.keepBalance(pair)

} else {

Log(pair.fuSymbol, pair.spSymbol, "portfolio position update failed, nowFuPos:", nowFuPos, " nowSpPos:", nowSpPos)

}

self.accAndPosUpdateCount++

}

})

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.preUpdateAccTS = nowTS

self.profit = self.calcProfit()

LogProfit(self.profit[0], "futures:", self.profit[1], "spots:", self.profit[2], "&") // Print the total profit curve, use the & character not to print the profit log

}

var cmd = GetCommand()

if(cmd) {

Log("interactive commands:", cmd)

var arr = cmd.split(":")

if(arr[0] == "plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.PLUS, self.cmdHedgeAmount)

} else if (arr[0] == "cover_plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.COVER_PLUS, self.cmdHedgeAmount)

}

}

LogStatus("current time:", _D(), "data update time:", _D(self.tickerUpdateTS), "position account update count:", self.accAndPosUpdateCount, "\n", "Profit and loss:", self.profit[0], "futures profit and loss:", self.profit[1],

"spot profit and loss:", self.profit[2], "\n`" + JSON.stringify(self.returnTbl()) + "`", "\n`" + JSON.stringify(self.returnPosTbl()) + "`")

}

self.keepBalance = function (pair) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if (fuLongPos || spShortPos) {

Log("reverse arbitrage is not supported")

}

if (fuShortPos || spLongPos) {

var fuHoldAmount = fuShortPos ? fuShortPos.amount : 0

var spHoldAmount = spLongPos ? spLongPos.amount : 0

var sum = fuHoldAmount + spHoldAmount

if (sum > 0) {

var spAmount = self.spEx.calcAmount(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, Math.abs(sum), true)

if (spAmount) {

Log(pair.fuSymbol, pair.spSymbol, "excess spot positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.spEx.goGetTrade(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, spAmount[0])

var seIdMsg = self.spEx.getTrade()

}

} else if (sum < 0) {

var fuAmount = self.fuEx.calcAmount(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, Math.abs(sum), true)

if (fuAmount) {

Log(pair.fuSymbol, pair.spSymbol, "long futures positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.fuEx.goGetTrade(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, fuAmount[0])

var feIdMsg = self.fuEx.getTrade()

}

}

}

}

self.getLongPos = function (positions) {

return self.getPosByDirection(positions, PD_LONG)

}

self.getShortPos = function (positions) {

return self.getPosByDirection(positions, PD_SHORT)

}

self.getPosByDirection = function (positions, direction) {

var ret = null

if (positions.length > 2) {

Log("position error, three positions detected:", JSON.stringify(positions))

return ret

}

_.each(positions, function(pos) {

if ((direction == PD_LONG && pos.amount > 0) || (direction == PD_SHORT && pos.amount < 0)) {

ret = pos

}

})

return ret

}

self.calcProfit = function() {

var arrInitFuAcc = []

var arrNowFuAcc = []

_.each(self.pairs, function(pair) {

arrInitFuAcc.push(pair.initFuAcc)

arrNowFuAcc.push(pair.nowFuAcc)

})

var fuProfit = self.fuEx.calcProfit(arrInitFuAcc, arrNowFuAcc)

var spProfit = 0

var deltaBalance = 0

_.each(self.pairs, function(pair) {

var nowSpAcc = pair.nowSpAcc

var initSpAcc = pair.initSpAcc

var stocksDiff = nowSpAcc.Stocks + nowSpAcc.FrozenStocks - (initSpAcc.Stocks + initSpAcc.FrozenStocks)

var price = stocksDiff > 0 ? pair.spTicker.bid1 : pair.spTicker.ask1

spProfit += stocksDiff * price

deltaBalance = nowSpAcc.Balance + nowSpAcc.FrozenBalance - (initSpAcc.Balance + initSpAcc.FrozenBalance)

})

spProfit += deltaBalance

return [fuProfit + spProfit, fuProfit, spProfit]

}

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "positions",

cols : ["index", "future", "future leverage", "qunatity", "spot", "qunatity"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

for (var i = 0 ; i < nowFuPos.length ; i++) {

if (nowSpPos.length > 0) {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, nowSpPos[0].symbol, nowSpPos[0].amount])

} else {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, "--", "--"])

}

}

})

return posTbl

}

self.returnTbl = function() {

var fuExName = "[" + self.fuEx.getExName() + "]"

var spExName = "[" + self.spEx.getExName() + "]"

var combiTickersTbl = {

type : "table",

title : "combiTickersTbl",

cols : ["future", "code" + fuExName, "entrusted selling", "entrusted purchase", "spot", "code" + spExName, "entrusted selling", "entrusted purchase", "positive hedging spreads", "reverse hedging spreads", "positive hedge", "positive hedge closeout"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

combiTickersTbl.rows.push([

pair.fuTicker.symbol,

pair.fuTicker.originalSymbol,

pair.fuTicker.ask1,

pair.fuTicker.bid1,

pair.spTicker.symbol,

pair.spTicker.originalSymbol,

pair.spTicker.ask1,

pair.spTicker.bid1,

pair.plusDiff,

pair.minusDiff,

{'type':'button', 'cmd': 'plus:' + String(index), 'name': 'positive arbitrage'},

{'type':'button', 'cmd': 'cover_plus:' + String(index), 'name': 'close positive arbitrage'}

])

})

var accsTbl = {

type : "table",

title : "accs",

cols : ["code" + fuExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money",

"code" + spExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money"],

rows : []

}

_.each(self.pairs, function(pair) {

var arr = [pair.fuTicker.originalSymbol, pair.initFuAcc.Stocks, pair.initFuAcc.FrozenStocks, pair.initFuAcc.Balance, pair.initFuAcc.FrozenBalance, pair.nowFuAcc.Stocks, pair.nowFuAcc.FrozenStocks, pair.nowFuAcc.Balance, pair.nowFuAcc.FrozenBalance,

pair.spTicker.originalSymbol, pair.initSpAcc.Stocks, pair.initSpAcc.FrozenStocks, pair.initSpAcc.Balance, pair.initSpAcc.FrozenBalance, pair.nowSpAcc.Stocks, pair.nowSpAcc.FrozenStocks, pair.nowSpAcc.Balance, pair.nowSpAcc.FrozenBalance]

for (var i = 0 ; i < arr.length ; i++) {

if (typeof(arr[i]) == "number") {

arr[i] = _N(arr[i], 6)

}

}

accsTbl.rows.push(arr)

})

var symbolInfoTbl = {

type : "table",

title : "symbolInfos",

cols : ["contract code" + fuExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity", "spot code" + spExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity"],

rows : []

}

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuTicker.originalSymbol)

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

symbolInfoTbl.rows.push([fuSymbolInfo.symbol, fuSymbolInfo.amountPrecision, fuSymbolInfo.pricePrecision, fuSymbolInfo.multiplier, fuSymbolInfo.min,

spSymbolInfo.symbol, spSymbolInfo.amountPrecision, spSymbolInfo.pricePrecision, spSymbolInfo.multiplier, spSymbolInfo.min])

})

var allPairs = []

_.each(self.fuExTickers, function(fuTicker) {

_.each(self.spExTickers, function(spTicker) {

if (fuTicker.symbol == spTicker.symbol) {

allPairs.push({symbol: fuTicker.symbol, fuSymbol: fuTicker.originalSymbol, spSymbol: spTicker.originalSymbol, plus: fuTicker.bid1 - spTicker.ask1})

}

})

})

_.each(allPairs, function(pair) {

var findPair = null

_.each(self.allPairs, function(selfPair) {

if (pair.fuSymbol == selfPair.fuSymbol && pair.spSymbol == selfPair.spSymbol) {

findPair = selfPair

}

})

if (findPair) {

findPair.minPlus = pair.plus < findPair.minPlus ? pair.plus : findPair.minPlus

findPair.maxPlus = pair.plus > findPair.maxPlus ? pair.plus : findPair.maxPlus

pair.minPlus = findPair.minPlus

pair.maxPlus = findPair.maxPlus

} else {

self.allPairs.push({symbol: pair.symbol, fuSymbol: pair.fuSymbol, spSymbol: pair.spSymbol, plus: pair.plus, minPlus: pair.plus, maxPlus: pair.plus})

pair.minPlus = pair.plus

pair.maxPlus = pair.plus

}

})

return [combiTickersTbl, accsTbl, symbolInfoTbl]

}

self.onexit = function() {

_G("pairs", self.pairs)

_G("allPairs", self.allPairs)

Log("perform tailing processing and save data", "#FF0000")

}

self.init = function() {

var fuExName = self.fuEx.getExName()

var spExName = self.spEx.getExName()

var gFuExName = _G("fuExName")

var gSpExName = _G("spExName")

if ((gFuExName && gFuExName != fuExName) || (gSpExName && gSpExName != spExName)) {

throw "the exchange object has changed and the data needs to be reset"

}

if (!gFuExName) {

_G("fuExName", fuExName)

}

if (!gSpExName) {

_G("spExName", spExName)

}

self.allPairs = _G("allPairs")

if (!self.allPairs) {

self.allPairs = []

}

var arrPair = _G("pairs")

if (!arrPair) {

arrPair = []

}

var arrStrPair = self.symbolPairs.split(",")

var timeStamp = new Date().getTime()

_.each(arrStrPair, function(strPair) {

var arrSymbol = strPair.split("|")

var recoveryPair = null

_.each(arrPair, function(pair) {

if (pair.fuSymbol == arrSymbol[0] && pair.spSymbol == arrSymbol[1]) {

recoveryPair = pair

}

})

if (!recoveryPair) {

var pair = {

fuSymbol : arrSymbol[0],

spSymbol : arrSymbol[1],

fuTicker : {},

spTicker : {},

plusDiff : null,

minusDiff : null,

canTrade : false,

initFuAcc : null,

initSpAcc : null,

nowFuAcc : null,

nowSpAcc : null,

nowFuPos : null,

nowSpPos : null,

fuMarginLevel : null

}

self.pairs.push(pair)

Log("初始化:", pair)

} else {

self.pairs.push(recoveryPair)

Log("恢复:", recoveryPair)

}

self.fuEx.pushSubscribeSymbol(arrSymbol[0])

self.spEx.pushSubscribeSymbol(arrSymbol[1])

if (!self.pairs[self.pairs.length - 1].initFuAcc) {

self.fuEx.goGetAcc(arrSymbol[0], timeStamp)

var nowFuAcc = self.fuEx.getAcc(arrSymbol[0], timeStamp)

self.pairs[self.pairs.length - 1].initFuAcc = nowFuAcc

self.pairs[self.pairs.length - 1].nowFuAcc = nowFuAcc

}

if (!self.pairs[self.pairs.length - 1].initSpAcc) {

self.spEx.goGetAcc(arrSymbol[1], timeStamp)

var nowSpAcc = self.spEx.getAcc(arrSymbol[1], timeStamp)

self.pairs[self.pairs.length - 1].initSpAcc = nowSpAcc

self.pairs[self.pairs.length - 1].nowSpAcc = nowSpAcc

}

Sleep(300)

})

Log("self.pairs:", self.pairs)

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuSymbol)

if (!fuSymbolInfo) {

throw pair.fuSymbol + ", species information acquisition failure!"

} else {

Log(pair.fuSymbol, fuSymbolInfo)

}

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spSymbol)

if (!spSymbolInfo) {

throw pair.spSymbol + ", species information acquisition failure!"

} else {

Log(pair.spSymbol, spSymbolInfo)

}

})

_.each(self.pairs, function(pair) {

pair.fuMarginLevel = self.fuMarginLevel

var ret = self.fuEx.setMarginLevel(pair.fuSymbol, self.fuMarginLevel)

Log(pair.fuSymbol, "leverage settings:", ret)

if (!ret) {

throw "initial setting of leverage failed!"

}

})

}

self.init()

return self

}

var manager = null

function main() {

if(isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("reset all data", "#FF0000")

}

if (isOKEX_V5_Simulate) {

for (var i = 0 ; i < exchanges.length ; i++) {

if (exchanges[i].GetName() == "Futures_OKCoin" || exchanges[i].GetName() == "OKEX") {

var ret = exchanges[i].IO("simulate", true)

Log(exchanges[i].GetName(), "switch analog disk")

}

}

}

var fuConfigureFunc = null

var spConfigureFunc = null

if (exchanges.length != 2) {

throw "two exchange objects need to be added!"

} else {

var fuName = exchanges[0].GetName()

if (fuName == "Futures_OKCoin" && isOkexV5) {

fuName += "_V5"

Log("Use OKEX V5 interface")

}

var spName = exchanges[1].GetName()

fuConfigureFunc = $.getConfigureFunc()[fuName]

spConfigureFunc = $.getConfigureFunc()[spName]

if (!fuConfigureFunc || !spConfigureFunc) {

throw (fuConfigureFunc ? "" : fuName) + " " + (spConfigureFunc ? "" : spName) + " not support!"

}

}

var fuEx = $.createBaseEx(exchanges[0], fuConfigureFunc)

var spEx = $.createBaseEx(exchanges[1], spConfigureFunc)

manager = createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio)

while(true) {

manager.process()

Sleep(interval)

}

}

function onerror() {

if (manager) {

manager.onexit()

}

}

function onexit() {

if (manager) {

manager.onexit()

}

}

Dado que la estrategia de múltiples especies es más adecuada para el diseño de IO, una biblioteca de clases de plantilla llamadaMultiSymbolCtrlLibPor lo tanto, la estrategia no puede ser probada con el bot simulado (aunque el bot real se ha ejecutado durante 2 meses, la etapa de prueba y familiarización todavía se ejecuta con el bot simulado).

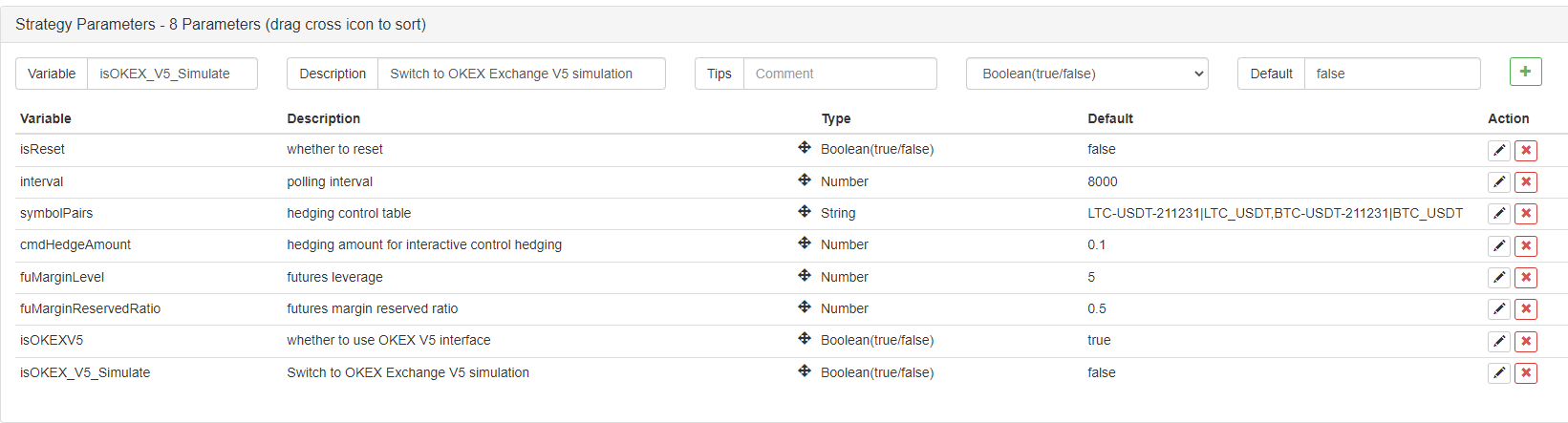

Parámetros

Antes de comenzar la prueba, hablemos primero del diseño de parámetros.

No hay muchos parámetros estratégicos, los más importantes son:

-

Cuadro de control de cobertura

LTC-USDT-211231|LTC_USDT,BTC-USDT-211231|BTC_USDTAquí está la estrategia de configuración para monitorear esas combinaciones. Por ejemplo, la configuración anterior es monitorear el contrato Litecoin (LTC-USDT-211231) del intercambio de futuros y el Litecoin (LTC_USDT) del intercambio al contado.

|Las combinaciones diferentes se separan por,¡Nota que los símbolos aquí están todos en el estado del método de entrada en inglés! Estos códigos de contrato y los pares de negociación al contado están definidos por el intercambio, no por la plataforma FMZ. Por ejemplo,LTC-USDT-211231es un contrato del segundo trimestre actualmente, llamadonext_quarteren FMZ, y el sistema de interfaz de OKEXse llama LTC-USDT-211231Para elEl valor de las acciones de las entidades de créditoel bot de simulación de WexApp está escrito comoLTC_USDTAsí que cómo rellenar aquí depende del nombre definido en el intercambio. -

Valor de cobertura para la cobertura de control interactivo Haga clic en el botón de control de la barra de estado para cubrir la cantidad. La unidad es el número de monedas, y la estrategia se convertirá automáticamente en el número de contratos para realizar un pedido.

Otras funciones son configurar el disco analógico, restablecer los datos, usar la interfaz OKEX V5 (ya que también es compatible con V3) y así sucesivamente, que no son particularmente importantes.

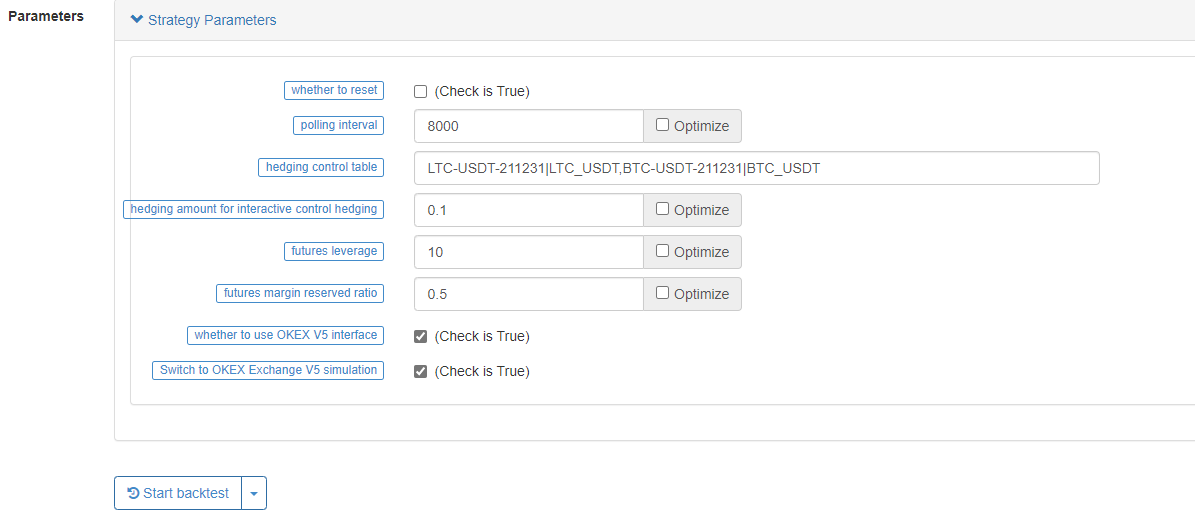

Pruebas

El primer objeto de intercambio agrega el intercambio de futuros, y el segundo agrega el objeto de intercambio al contado.

Las bolsas de futuros utilizan bots de simulación de interfaz V5 de OKEX

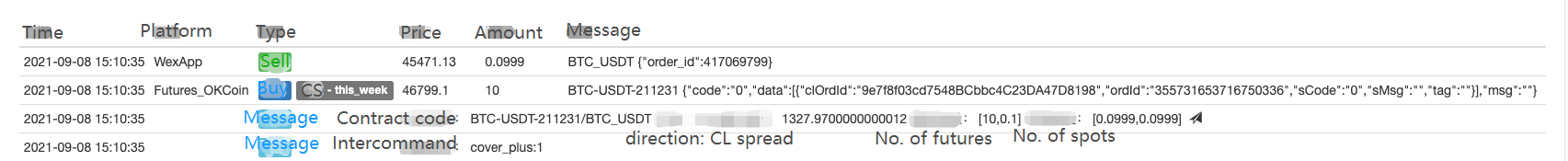

Haga clic en el botón de conjunto positivo de la combinación BTC y abra la posición.

Haga clic para cerrar el arbitraje positivo entonces.

Perder!!! Parece que cerrar la posición no puede cubrir la tarifa de manejo cuando el diferencial de ganancias es pequeño, es necesario calcular la tarifa de manejo, el deslizamiento aproximado, y planificar el diferencial razonablemente, y luego cerrar la posición.

Código fuente de la estrategia:https://www.fmz.com/strategy/314352

Los interesados pueden usarlo y modificarlo.

- Prácticas de cuantificación de las bolsas DEX ((1) -- dYdX v4 Guía de uso

- Introducción al conjunto de Lead-Lag en las monedas digitales (3)

- Introducción al arbitraje de lead-lag en criptomonedas (2)

- Introducción al conjunto de Lead-Lag en las monedas digitales (2)

- Discusión sobre la recepción de señales externas de la plataforma FMZ: una solución completa para recibir señales con servicio HTTP incorporado en la estrategia

- Exploración de la recepción de señales externas de la plataforma FMZ: estrategias para una solución completa de recepción de señales de servicios HTTP integrados

- Introducción al arbitraje de lead-lag en criptomonedas (1)

- Introducción al conjunto de Lead-Lag en las monedas digitales (1)

- Discusión sobre la recepción de señales externas de la plataforma FMZ: API extendida VS estrategia Servicio HTTP incorporado

- Exploración de la recepción de señales externas de la plataforma FMZ: API de expansión vs estrategia de servicio HTTP incorporado

- Discusión sobre el método de prueba de estrategias basado en el generador de tickers aleatorios

- Diseño de un sistema de gestión de sincronización de pedidos basado en FMZ Quant (1)

- Análisis de la estrategia de LeeksReaper (1)

- El importe de las pérdidas derivadas de las operaciones de cobertura de las operaciones de cobertura de las operaciones de cobertura de las operaciones de cobertura de las operaciones de cobertura de las operaciones de cobertura de las operaciones de cobertura de las operaciones de cobertura.

- Estado actual y funcionamiento recomendado de la estrategia de tasas de financiación

- Revisión del mercado de divisas digitales en 2021 y la estrategia más simple 10 veces perdida

- Modelo de factor de moneda digital

- La estrategia mágica de doble EMA de la línea uniforme de YouTube

- Escribir una herramienta de transacción semiautomática en el lenguaje Pine

- Modelo de factores de la moneda digital

- Ser su propio salvador en el negocio.

- Diseño de una estrategia de cobertura al contado de criptomonedas (1)

- Una estrategia de equilibrio perpetuo adecuada para el mercado bajista

- Comercio cuantitativo de criptomonedas para principiantes - acercándote a la criptomoneda cuantitativa (8)

- Comercio cuantitativo de criptomonedas para principiantes - acercándote a la criptomoneda cuantitativa (7)

- Comercio cuantitativo de criptomonedas para principiantes - acercándote a la criptomoneda cuantitativa (6)

- Visión general y arquitectura de la interfaz principal de la plataforma de negociación cuántica FMZ

- Diseño de estrategia de Martingale para futuros de criptomonedas

- Comercio cuantitativo de criptomonedas para principiantes - acercándote a la criptomoneda cuantitativa (5)

- Comercio cuantitativo de criptomonedas para principiantes - acercándote a la criptomoneda cuantitativa (4)

- Comercio cuantitativo de criptomonedas para principiantes - acercándote a la criptomoneda cuantitativa (3)