Supertendencia del punto de pivote

El autor:¿ Qué pasa?, Fecha: 2022-05-17 15:45:37Las etiquetas:El ejeEl ATR

Hola a todos,

Hay muchos tipos de SuperTrend alrededor. Recientemente pensé en una SuperTrend basada en Pivot Points luego escribí

La idea detrás de este script es encontrar puntos de pivote, calcular el promedio de ellos y como en supertrend creando bandas más altas/bajas por ATR. Como se puede ver en el algoritmo el script da peso a los puntos de pivote pasados, esto se hace para suavizar un poco.

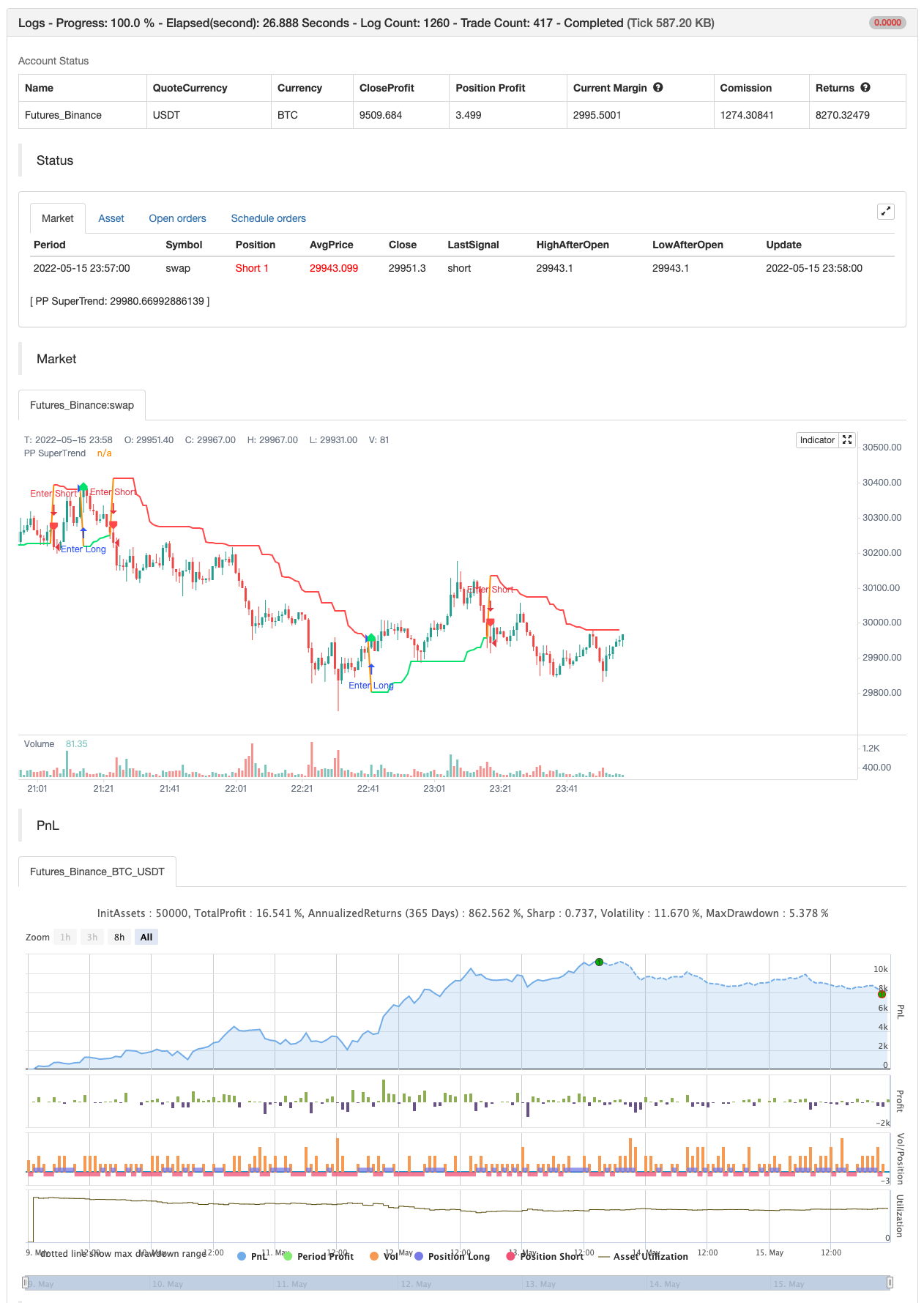

Prueba posterior

/*backtest

start: 2022-05-09 00:00:00

end: 2022-05-15 23:59:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeTheBlue

//@version=4

study("Pivot Point SuperTrend", overlay = true)

prd = input(defval = 3, title="Pivot Point Period", minval = 1, maxval = 50)

Factor=input(defval = 2, title = "ATR Factor", minval = 1, step = 0.1)

Pd=input(defval = 6, title = "ATR Period", minval=1)

showpivot = input(defval = false, title="Show Pivot Points")

showlabel = input(defval = true, title="Show Buy/Sell Labels")

showcl = input(defval = false, title="Show PP Center Line")

showsr = input(defval = false, title="Show Support/Resistance")

// get Pivot High/Low

float ph = pivothigh(prd, prd)

float pl = pivotlow(prd, prd)

// drawl Pivot Points if "showpivot" is enabled

plotshape(ph and showpivot, text="H", style=shape.labeldown, color=na, textcolor=color.red, location=location.abovebar, transp=0, offset = -prd)

plotshape(pl and showpivot, text="L", style=shape.labeldown, color=na, textcolor=color.lime, location=location.belowbar, transp=0, offset = -prd)

// calculate the Center line using pivot points

var float center = na

float lastpp = ph ? ph : pl ? pl : na

if lastpp

if na(center)

center := lastpp

else

//weighted calculation

center := (center * 2 + lastpp) / 3

// upper/lower bands calculation

Up = center - (Factor * atr(Pd))

Dn = center + (Factor * atr(Pd))

// get the trend

float TUp = na

float TDown = na

Trend = 0

TUp := close[1] > TUp[1] ? max(Up, TUp[1]) : Up

TDown := close[1] < TDown[1] ? min(Dn, TDown[1]) : Dn

Trend := close > TDown[1] ? 1: close < TUp[1]? -1: nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// plot the trend

linecolor = Trend == 1 and nz(Trend[1]) == 1 ? color.lime : Trend == -1 and nz(Trend[1]) == -1 ? color.red : na

plot(Trailingsl, color = linecolor , linewidth = 2, title = "PP SuperTrend")

plot(showcl ? center : na, color = showcl ? center < hl2 ? color.blue : color.red : na)

// check and plot the signals

bsignal = Trend == 1 and Trend[1] == -1

ssignal = Trend == -1 and Trend[1] == 1

plotshape(bsignal and showlabel ? Trailingsl : na, title="Buy", text="Buy", location = location.absolute, style = shape.labelup, size = size.tiny, color = color.lime, textcolor = color.black, transp = 0)

plotshape(ssignal and showlabel ? Trailingsl : na, title="Sell", text="Sell", location = location.absolute, style = shape.labeldown, size = size.tiny, color = color.red, textcolor = color.white, transp = 0)

//get S/R levels using Pivot Points

float resistance = na

float support = na

support := pl ? pl : support[1]

resistance := ph ? ph : resistance[1]

// if enabled then show S/R levels

plot(showsr and support ? support : na, color = showsr and support ? color.lime : na, style = plot.style_circles, offset = -prd)

plot(showsr and resistance ? resistance : na, color = showsr and resistance ? color.red : na, style = plot.style_circles, offset = -prd)

// alerts

alertcondition(Trend == 1 and Trend[1] == -1, title='Buy Signal', message='Buy Signal')

alertcondition(Trend == -1 and Trend[1] == 1, title='Sell Signal', message='Sell Signal')

alertcondition(change(Trend), title='Trend Changed', message='Trend Changed')

if Trend == 1 and Trend[1] == -1

strategy.entry("Enter Long", strategy.long)

else if Trend == -1 and Trend[1] == 1

strategy.entry("Enter Short", strategy.short)

Contenido relacionado

- El eje de resistencia de soporte dinámico se adapta a la estrategia de negociación cuantitativa

- Estrategia de supertrend de pivote dinámico de Villa

- Estrategias de negociación en intervalos de fluctuación basadas en indicadores de oscilación aleatoria

- Estrategias de seguimiento de tendencias dinámicas

- Estrategias de gestión de posiciones basadas en la volatilidad y la elección dinámica

- SUPERTREND es una estrategia de seguimiento de tendencias con múltiples paradas y pérdidas

- La progresión de Fibonacci con brechas

- La máquina de moler

- Salida de la lámpara

- HalfTrend sigue la tendencia más vacía de la estrategia de compra de límites de pérdida

Más contenido

- Ratio de energía direccional acelerada por volumen de RedK

- Donchian Breakout sin repintura

- Barras de impulso de RedK

- Super Salto Volver hacia atrás Banda de Bollinger

- Tendencia de Fukuiz

- El BOT de Johnny

- SSL híbrido

- Salida de la lámpara

- El RISOTTO

- Estrategia intradiaria de la nube de la EMA

- Supertrend+4 en movimiento

- ZigZag basado en el impulso

- VuManChu Cifrado B + Divergencias Estrategia

- Concepto SuperTendencia Doble

- El Super Scalper

- Pruebas de retroceso - Indicador

- Tendencia

- Es el asesino de los BTC.

- Modelo de alertas de ML

- La progresión de Fibonacci con brechas