Estrategia de negociación de DCA ponderada gradualmente cuantificada

El autor:¿ Qué pasa?, Fecha: 2023-11-16 11:32:12Las etiquetas:

Resumen general

La Estrategia de Negociación DCA Cuantizada Gradual Ponderada es una estrategia de negociación cuantitativa que combina indicadores de promedio móvil para el desencadenamiento de señales y mecanismos de promedio de costos en dólares ponderados gradualmente.

Principios

La estrategia consta de tres componentes principales:

-

Enjuiciamiento de la señal de entrada

Utiliza cruces de promedios móviles rápidos y lentos como señal de entrada. Los usuarios pueden elegir entre SMA, EMA o HMA para los promedios móviles rápidos y lentos. Cuando el MA rápido cruza por encima del MA lento, se genera una señal de compra. Cuando el MA rápido cruza por debajo del MA lento, se genera una señal de venta.

-

DCA ponderado gradualmente

Después de una señal de compra, la estrategia abrirá inmediatamente una posición base. A medida que el precio continúa cayendo, la estrategia aumentará gradualmente el tamaño de posiciones de seguridad adicionales de manera ponderada. El precio de cada nueva posición de seguridad se reducirá en un porcentaje fijo en relación con la anterior. Además, los fondos asignados para cada nueva posición de seguridad se amplificarán en un factor.

Este aumento gradual del tamaño de la posición permite una forma de mediación de costes, obteniendo un mejor coste medio manteniendo los riesgos bajo control.

-

Tome ganancias y detenga pérdidas

Cuando el precio se eleva por encima de la línea de toma de ganancias, la estrategia cerrará las posiciones para obtener ganancias.

La línea de rentabilidad se fija al precio medio de la posición base * (1 + porcentaje fijo).

La línea de stop loss fluctúa en función del precio de la última posición de seguridad, un porcentaje fijo por debajo de él.

Ventajas

-

La combinación de tendencia y promedio de costos lo hace más estable

El uso de tendencias evita problemas sin sentido, y el promedio de costos proporciona mejores costos de entrada.

-

El tamaño de la posición gradual controla el riesgo

La amplificación fija de los tamaños de las posiciones de seguridad, con umbral de reingreso, mantiene el riesgo bajo control.

-

Monitoreo en tiempo real de los fondos utilizados

El indicador de utilización del saldo incorporado evita el apalancamiento excesivo y las liquidaciones forzadas.

-

TP/SL por separado para cada posición

Las salidas independientes permiten asegurar ganancias y reducir pérdidas.

Riesgos y mejoras

-

Los cambios en los precios pueden desencadenar múltiples órdenes de seguridad

En situaciones de volatilidad extrema, se pueden agregar múltiples órdenes de seguridad innecesarias, aumentando la pérdida.

-

Los parámetros de media móvil necesitan optimización

Diferentes instrumentos necesitan diferentes períodos de media móvil.

-

Los niveles de TP/SL necesitan una optimización de las pruebas de retroceso

Los ratios TP/SL determinan el perfil riesgo/recompensación.

-

Añadir la extracción máxima o la salida forzada basada en el tiempo de retención

Puede probar incorporando salidas forzadas basadas en el tiempo de retirada o retención para limitar aún más los riesgos.

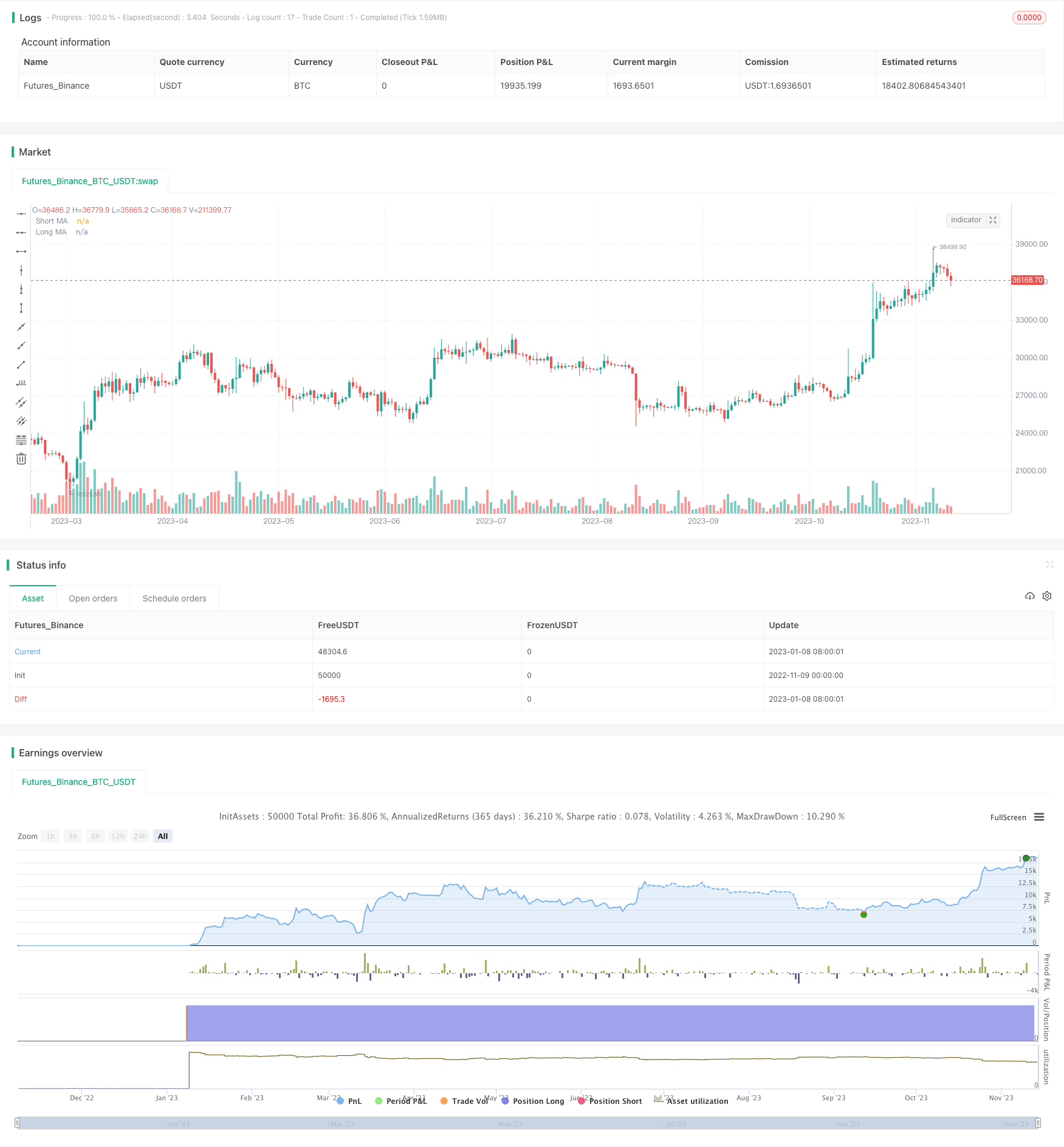

Resumen de las actividades

La estrategia de negociación DCA gradual ponderada cuantificada combina las ventajas de la negociación de tendencias y el promedio de costos para producir rendimientos constantes en tendencias fuertes. Con parámetros optimizados, tamaño de posición y umbrales de reingreso, puede lograr operaciones estables con riesgo controlado. Aplicable para fondos de cobertura, CTA y estrategias neutrales de mercado.

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MGTG

//@version=5

Strategy = input.string('Long', options=['Long'], group='Strategy', inline='1',

tooltip='Long bots profit when asset prices rise, Short bots profit when asset prices fall'

+ '\n\n' + 'Please note: to run a Short bot on a spot exchange account, you need to own the asset you want to trade. The bot will sell the asset at the current chart price and buy it back at a lower price - the profit made is actually trapped equity released from an asset you own that is declining in value.')

Profit_currency = input.string('Quote (USDT)', 'Profit currency', options=['Quote (USDT)', 'Quote (BTC)', 'Quote (BUSD)'], group='Strategy', inline='1')

Base_order_size = input.int(10, 'Base order Size', group='Strategy', inline='2',

tooltip='The Base Order is the first order the bot will create when starting a new deal.')

Safety_order_size = input.int(20, 'Safety order Size', group='Strategy', inline='2',

tooltip="Enter the amount of funds your Safety Orders will use to Average the cost of the asset being traded, this can help your bot to close deals faster with more profit. Safety Orders are also known as Dollar Cost Averaging and help when prices moves in the opposite direction to your bot's take profit target.")

Triger_Type = input.string('Over', 'Entry at Cross Over / Under', options=['Over', 'Under'], group='Deal start condition > Trading View custom signal', inline='1',

tooltip='Deal start condition decision')

Short_Moving_Average = input.string('SMA', 'Short Moving Average', group='Deal start condition > Trading View custom signal', inline='2',

options=["SMA", "EMA", "HMA"])

Short_Period = input.int(5, 'Period', group='Deal start condition > Trading View custom signal', inline='2')

Long_Moving_Average = input.string('HMA', 'Long Moving Average', group='Deal start condition > Trading View custom signal', inline='3',

options=["SMA", "EMA", "HMA"])

Long_Period = input.int(50, 'Period', group='Deal start condition > Trading View custom signal', inline='3')

Target_profit = input.float(1.5, 'Target profit (%)', step=0.05, group='Take profit / Stop Loss', inline='1') * 0.01

Stop_Loss = input.int(15, 'Stop Loss (%)', group='Take profit / Stop Loss', inline='1',

tooltip='This is the percentage that price needs to move in the opposite direction to your take profit target, at which point the bot will execute a Market Order on the exchange account to close the deal for a smaller loss than keeping the deal open.'

+ '\n' + 'Please note, the Stop Loss is calculated from the price the Safety Order at on the exchange account and not the Dollar Cost Average price.') * 0.01

Max_safety_trades_count = input.int(10, 'Max safety trades count', maxval=10, group='Safety orders', inline='1')

Price_deviation = input.float(0.4, 'Price deviation to open safety orders (% from initial order)', step=0.01, group='Safety orders', inline='2') * 0.01

Safety_order_volume_scale = input.float(1.8, 'Safety order volume scale', step=0.01, group='Safety orders', inline='3')

Safety_order_step_scale = input.float(1.19, 'Safety order step scale', step=0.01, group='Safety orders', inline='3')

// daily_volume = input.int(500, "Don't start deal(s) if the daily volume is less than", group='Advanced settings', inline='1')

// Minimum_price = input.int(500, "Minimum price to open deal", group='Advanced settings', inline='1')

// Maximum_price = input.int(500, "Maximum price to open deal", group='Advanced settings', inline='1')

// Close_deal_after_timeout = input.int(5, "Close deal after timeout (Hrs)", group='Advanced settings', inline='1')

initial_capital = 8913

strategy(

title='3Commas Visible DCA Strategy',

overlay=true,

initial_capital=initial_capital,

pyramiding=11,

process_orders_on_close=true,

commission_type=strategy.commission.percent,

commission_value=0.01,

max_bars_back=5000,

max_labels_count=50)

// Position

status_none = strategy.position_size == 0

status_long = strategy.position_size[1] == 0 and strategy.position_size > 0

status_long_offset = strategy.position_size[2] == 0 and strategy.position_size[1] > 0

status_short = strategy.position_size[1] == 0 and strategy.position_size < 0

status_increase = strategy.opentrades[1] < strategy.opentrades

Short_Moving_Average_Line =

Short_Moving_Average == 'SMA' ? ta.sma(close, Short_Period) :

Short_Moving_Average == 'EMA' ? ta.ema(close, Short_Period) :

Short_Moving_Average == 'HMA' ? ta.sma(close, Short_Period) : na

Long_Moving_Average_Line =

Long_Moving_Average == 'SMA' ? ta.sma(close, Long_Period) :

Long_Moving_Average == 'EMA' ? ta.ema(close, Long_Period) :

Long_Moving_Average == 'HMA' ? ta.sma(close, Long_Period) : na

Base_order_Condition = Triger_Type == "Over" ? ta.crossover(Short_Moving_Average_Line, Long_Moving_Average_Line) : ta.crossunder(Short_Moving_Average_Line, Long_Moving_Average_Line) // Buy when close crossing lower band

safety_order_deviation(index) => Price_deviation * math.pow(Safety_order_step_scale, index - 1)

pd = Price_deviation

ss = Safety_order_step_scale

step(i) =>

i == 1 ? pd :

i == 2 ? pd + pd * ss :

i == 3 ? pd + (pd + pd * ss) * ss :

i == 4 ? pd + (pd + (pd + pd * ss) * ss) * ss :

i == 5 ? pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss :

i == 6 ? pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss :

i == 7 ? pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss :

i == 8 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss :

i == 9 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss :

i == 10 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss : na

long_line(i) =>

close[1] - close[1] * (step(i))

Safe_order_line(i) =>

i == 0 ? ta.valuewhen(status_long, long_line(0), 0) :

i == 1 ? ta.valuewhen(status_long, long_line(1), 0) :

i == 2 ? ta.valuewhen(status_long, long_line(2), 0) :

i == 3 ? ta.valuewhen(status_long, long_line(3), 0) :

i == 4 ? ta.valuewhen(status_long, long_line(4), 0) :

i == 5 ? ta.valuewhen(status_long, long_line(5), 0) :

i == 6 ? ta.valuewhen(status_long, long_line(6), 0) :

i == 7 ? ta.valuewhen(status_long, long_line(7), 0) :

i == 8 ? ta.valuewhen(status_long, long_line(8), 0) :

i == 9 ? ta.valuewhen(status_long, long_line(9), 0) :

i == 10 ? ta.valuewhen(status_long, long_line(10), 0) : na

TP_line = strategy.position_avg_price * (1 + Target_profit)

SL_line = Safe_order_line(Max_safety_trades_count) * (1 - Stop_Loss)

safety_order_size(i) => Safety_order_size * math.pow(Safety_order_volume_scale, i - 1)

plot(Short_Moving_Average_Line, 'Short MA', color=color.new(color.white, 0), style=plot.style_line)

plot(Long_Moving_Average_Line, 'Long MA', color=color.new(color.green, 0), style=plot.style_line)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 1 ? Safe_order_line(1) : na, 'Safety order1', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 2 ? Safe_order_line(2) : na, 'Safety order2', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 3 ? Safe_order_line(3) : na, 'Safety order3', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 4 ? Safe_order_line(4) : na, 'Safety order4', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 5 ? Safe_order_line(5) : na, 'Safety order5', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 6 ? Safe_order_line(6) : na, 'Safety order6', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 7 ? Safe_order_line(7) : na, 'Safety order7', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 8 ? Safe_order_line(8) : na, 'Safety order8', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 9 ? Safe_order_line(9) : na, 'Safety order9', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 10 ? Safe_order_line(10) : na, 'Safety order10', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 ? TP_line : na, 'Take Profit', color=color.new(color.orange, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 ? SL_line : na, 'Safety', color=color.new(color.aqua, 0), style=plot.style_linebr)

currency =

Profit_currency == 'Quote (USDT)' ? ' USDT' :

Profit_currency == 'Quote (BTC)' ? ' BTC' :

Profit_currency == 'Quote (BUSD)' ? ' BUSD' : na

if Base_order_Condition

strategy.entry('Base order', strategy.long, qty=Base_order_size/close, when=Base_order_Condition and strategy.opentrades == 0,

comment='BO' + ' - ' + str.tostring(Base_order_size) + str.tostring(currency))

for i = 1 to Max_safety_trades_count by 1

i_s = str.tostring(i)

strategy.entry('Safety order' + i_s, strategy.long, qty=safety_order_size(i)/close,

limit=Safe_order_line(i), when=(strategy.opentrades <= i) and strategy.position_size > 0,

comment='SO' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency))

for i = 1 to Max_safety_trades_count by 1

i_s = str.tostring(i)

// strategy.close('Base order', when=shortCondition)

// strategy.close('Safety order' + i_s, when=shortCondition)

// strategy.cancel('Safety order' + i_s, when=shortCondition)

strategy.cancel('SO' + i_s, when=ta.crossunder(low, SL_line) or ta.crossover(high, TP_line) or status_none)

strategy.exit('TP/SL','Base order', limit=TP_line, stop=SL_line, comment = Safe_order_line(100) > close ? 'SL' + i_s + ' - ' + str.tostring(Base_order_size) + str.tostring(currency) : 'TP' + i_s + ' - ' + str.tostring(Base_order_size) + str.tostring(currency))

strategy.exit('TP/SL','Safety order' + i_s, limit=TP_line, stop=SL_line, comment = Safe_order_line(100) > close ? 'SL' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency) : 'TP' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency))

// strategy.cancel('TP/SP' + i_s, when=Base_order_Condition)

// strategy.exit('Stop Loss','Base order', stop=SL_line)

// strategy.exit('Stop Loss','Safety order' + i_s, stop=SL_line)

//----------------label A----------------//

bot_usage(i) =>

i == 1 ? Base_order_size + safety_order_size(1) :

i == 2 ? Base_order_size + safety_order_size(1) + safety_order_size(2) :

i == 3 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) :

i == 4 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) :

i == 5 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) :

i == 6 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) :

i == 7 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) :

i == 8 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) :

i == 9 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) + safety_order_size(9) :

i == 10 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) + safety_order_size(9) + safety_order_size(10) : na

equity = strategy.equity

bot_use = bot_usage(Max_safety_trades_count)

bot_dev = float(step(Max_safety_trades_count)) * 100

bot_ava = (bot_use / equity) * 100

string label_A =

'Balance : ' + str.tostring(math.round(equity, 0), '###,###,###,###') + ' USDT' + '\n' +

'Max amount for bot usage : ' + str.tostring(math.round(bot_use, 0), '###,###,###,###') + ' USDT' + '\n' +

'Max safety order price deviation : ' + str.tostring(math.round(bot_dev, 0), '##.##') + ' %' + '\n' +

'% of available balance : ' + str.tostring(math.round(bot_ava, 0), '###,###,###,###') + ' %'

+ (bot_ava > 100 ? '\n \n' + '⚠ Warning! Bot will use amount greater than you have on exchange' : na)

if status_long

day_label =

label.new(

x=time[1],

y=high * 1.03,

text=label_A,

xloc=xloc.bar_time,

yloc=yloc.price,

color=bot_ava > 100 ? color.new(color.yellow, 0) : color.new(color.black, 50),

style=label.style_label_lower_right,

textcolor=bot_ava > 100 ? color.new(color.red, 0) : color.new(color.silver, 0),

size=size.normal,

textalign=text.align_left)

- Estrategia de cruce de la media móvil del RSI en varios plazos

- Estrategia de ruptura de tendencia basada en bandas de Bollinger

- Estrategia de arbitraje de medias móviles regularizadas adaptativas entre mercados

- Estrategia de seguimiento de tendencia doble y fuerte para detener pérdidas

- Estrategia del indicador de impulso

- Estrategia inversa de Heikin-Ashi

- Estrategia de ruptura de oscilación dinámica

- Tendencia tras la estrategia de cruce de la EMA de 5 minutos

- Tendencia de los índices de rentabilidad de acuerdo con la estrategia

- Estrategia de divergencia de los índices de riesgo

- Desviación de la media móvil doble combinada con la tendencia del indicador ATR Siguiendo la estrategia

- Estrategia de tendencias múltiples

- Estrategia de precios de equilibrio

- Tendencia de la estrategia de negociación a corto plazo

- BB21_SMA200 Seguimiento de la tendencia de la estrategia

- Momentum Ichimoku estrategia de negociación en la nube

- Estrategia de negociación de volatilidad de fin de semana

- Estrategia de reversión de la ruptura de impulso

- Estrategia de negociación cuantitativa modificada de OBV y MACD

- Tendencia basada en el indicador de flujo de volumen siguiendo la estrategia