Estrategia de seguimiento de tendencia doble y fuerte para detener pérdidas

El autor:¿ Qué pasa?, Fecha: 2023-11-16 15:50:54Las etiquetas:

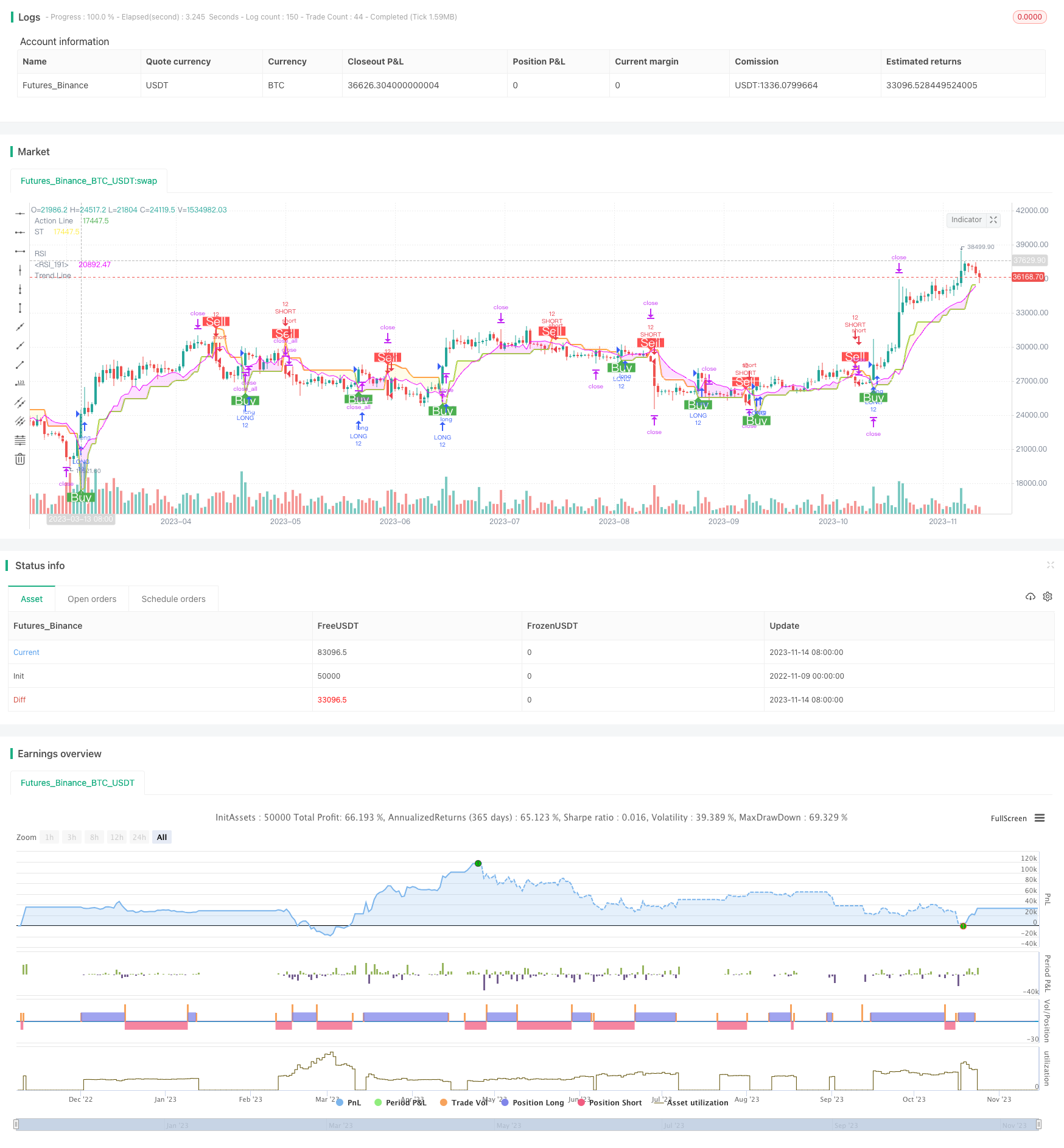

Resumen general

Esta estrategia está diseñada con mecanismos de seguimiento de tendencias duales basados en Supertrend e Índice de Fuerza Relativa para determinar con precisión la tendencia del mercado y establecer puntos de stop loss y take profit razonables.

Estrategia lógica

-

Calcular la Supertrend para determinar la dirección de la tendencia principal.

-

Calcular el índice de fuerza relativa (RSI) como un indicador auxiliar para el juicio de tendencia.

-

Ir largo cuando el precio de cierre cruza por encima de la línea de Supertrend, y ir corto cuando el precio de cierre rompe por debajo de la línea de Supertrend.

-

Establezca razonablemente puntos de stop loss y take profit. Cuando vaya largo, establezca la línea de Supertrend como la línea de stop loss, y la línea de Supertrend más ganancia razonable como la línea de take profit. Cuando vaya corto, establezca la línea de Supertrend como la línea de stop loss, y la línea de Supertrend menos ganancia razonable como la línea de take profit.

-

Los puntos de stop loss flotarán de acuerdo con la fluctuación del mercado.

-

Solo ingrese operaciones cuando el RSI se alinee con Supertrend, lo que indica una tendencia actual más fuerte. Evite ingresar cuando el RSI diverge de Supertrend, lo que indica una posible inversión de tendencia.

Análisis de ventajas

-

El mecanismo de evaluación de la doble tendencia puede reducir las señales falsas y mejorar la estabilidad de la estrategia.

-

Los puntos de stop loss se mueven con la tendencia para maximizar el bloqueo de ganancias y evitar una stop loss prematura.

-

La aplicación del RSI filtra algunas señales comerciales débiles.

-

El posicionamiento razonable para obtener beneficios maximiza las ganancias.

-

Los parámetros de estrategia ajustables pueden optimizarse para diferentes productos y condiciones de mercado.

-

Las reducciones controlables dan a la estrategia fuertes capacidades de gestión de riesgos.

Análisis de riesgos

-

En el caso de eventos de cisne negro como noticias importantes de política, grandes oscilaciones del mercado pueden detener las posiciones y causar grandes pérdidas.

-

Las configuraciones incorrectas de los parámetros pueden llevar a un stop loss irrazonable y tomar puntos de ganancia, aumentando las pérdidas o reduciendo las ganancias.

-

La divergencia entre el RSI y la Supertrend puede generar señales falsas durante los mercados de rango.

Direcciones de optimización

-

Optimizar el parámetro del período ATR para diferentes productos.

-

Optimizar los ajustes del RSI para encontrar condiciones de tendencia auxiliares más estables.

-

Incorporar otros indicadores como las bandas de Bollinger y KDJ para establecer reglas de entrada y salida más precisas.

-

Prueba diferentes estrategias de toma de ganancias como el trailing stop, la toma escalonada de ganancias, el wick stop, etc. para mejorar la rentabilidad.

-

Ajustar el tamaño de las posiciones en función de los resultados de las pruebas de retroceso para reducir los riesgos de operaciones individuales.

Conclusión

La estrategia demuestra una fuerte estabilidad y rentabilidad en general. El juicio de tendencia dual filtra el ruido de manera efectiva y la estrategia de toma de pérdidas / ganancias bloquea las ganancias y controla los riesgos. La optimización continua de los parámetros y las condiciones de entrada / salida permitirá un gran rendimiento en diferentes entornos de mercado. Puede servir como una excelente estrategia de plantilla para el comercio cuantitativo y vale la pena una investigación y aplicación en profundidad.

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title='DEO SESSSION', shorttitle='DEO S', overlay=true, precision=8, calc_on_order_fills=true, calc_on_every_tick=true, backtest_fill_limits_assumption=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000, currency=currency.USD, linktoseries=true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title='════════════ FROM ════════════', defval=true)

// selected dates

i_startTime = input(title="START FILTER", defval=timestamp("02 Jan 2023 00:00 +0000"), group="RISK MANAGEMENT", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="END FILTER", defval=timestamp("12 Dec 2100 00:00 +0000"), group="RISK MANAGEMENT", tooltip="End date & time to stop searching for setups")

afterStartDate = true

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title='══════════ STRATEGY ══════════', defval=true)

// === INPUT TO SELECT POSITION ===

positionType = input.string(defval='LONG', title='Position Type', options=['LONG', 'SHORT'])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input.float(defval=3.0, minval=0.0, title='Initial Stop Loss')

// === INPUT TO SELECT BARS BACK

barsBack = input(title='ATR Period', defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input.float(title='ATR multplierFactoriplier', step=0.1, defval=3.0)

RSI = input.int(title='RSI', defval=7, minval=1, maxval=100)

calcSection = input(title='══════════ LOT CALC ══════════', defval=true)

accountBalance = input.float(title="ACCOUNT BALANCE", defval=250000, minval=1, group="INPUTS")

entryPrice = input.float(title="ENTRY PRICE", defval=100, minval=1, group="INPUTS")

slPrice = input.float(title="STOP LOSS PRICE", defval=100, minval=1, group="INPUTS")

riskPer = input.float(title="RISK USD", defval=1, minval=0.1, group="INPUTS")

lotSize = input.float(title="LOT SIZE", defval=10, minval=0.1, group="INPUTS")

RiskSize = riskPer

qtyLongTargetPrice = math.abs((RiskSize / ((entryPrice - slPrice) * syminfo.pointvalue)) / lotSize)

trendcSection = input(title='══════════ TREND LINE ══════════', defval=true)

// ema trend

tLen = input.int(200, minval=1, title="Trend Line")

tSrc = input(close, title="Source")

thisEma = ta.ema(tSrc, tLen)

plot(thisEma, title = "Trend Line",color=#ffffff)

MTSection = input(title='══════════ MT LOGIN ══════════', defval=true)

exchange = input.string(defval='MT5', title='EXCHANGE', options=['MT4', 'MT5'])

mtLogin= input.string(defval="", title='MT LOGIN', group = "mt")

mtPassword =input.string(defval='', title='MT PASSWORD', group = "mt")

mtServer =input.string(defval='', title='MT SERVER', group = "mt")

mtIsOn = input.string(defval='ON', title='STRATEGY ON', options=['ON', 'OFF'])

mtEntryMode = input.string(defval='CLOSE OPEN', title='ENTRY MODE', options=['CLOSE OPEN', 'OPEN'])

displaySection = input(title='══════════ DISPLAY LOGIN ══════════', defval=true)

displayTable = input(title="DISPLAY TABLE", defval=false, group = 'PRODUCTION', tooltip = "MAKES YOUR STRATEGY TRIGGER SLOWER")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * ta.atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if direction == 1

valueToPlot := longStop

colorToPlot := color.green

colorToPlot

else

valueToPlot := shortStop

colorToPlot := color.red

colorToPlot

//RSI

src = close

ep = 2 * RSI - 1

auc = ta.ema(math.max(src - src[1], 0), ep)

adc = ta.ema(math.max(src[1] - src, 0), ep)

x1 = (RSI - 1) * (adc * 70 / (100 - 70) - auc)

ub = x1 >= 0 ? src + x1 : src + x1 * (100 - 70) / 70

x2 = (RSI - 1) * (adc * 30 / (100 - 30) - auc)

lb = x2 >= 0 ? src + x2 : src + x2 * (100 - 30) / 30

//Affichage

plot(math.avg(ub, lb), color=color.white ,linewidth=1, title='RSI')

plot(valueToPlot == 0.0 ? na : valueToPlot, title='Action Line', linewidth=2, color=color.new(colorToPlot, 0))

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title='Buy', style=shape.labelup, location=location.absolute, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title='Sell', style=shape.labeldown, location=location.absolute, size=size.normal, text='Sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

p_ma1 = plot(valueToPlot, title = "ST", color = color.rgb(255, 236, 66))

p_ma2 = plot(math.avg(ub, lb), title = "RSI", color = color.rgb(234, 0, 255))

// Definitions: Trends

TrendUp1() =>

valueToPlot > math.avg(ub, lb)

TrendDown1() =>

valueToPlot < math.avg(ub, lb)

trendColor1 = TrendUp1() ? color.rgb(255, 236, 66, 85): TrendDown1() ? color.rgb(234, 0, 255, 85) : color.rgb(255, 255, 255, 85)

fill(p_ma1, p_ma2, color=trendColor1)

longCondition () =>

ta.crossover(close, valueToPlot)

shortCondition () =>

ta.crossunder(close, valueToPlot)

IsLongShort() =>

strategy.position_size != 0

getNewLotSize() =>

math.abs(riskPer / (close - valueToPlot))

// plot(getNewLotSize(), "new lot size")

newLotS = getNewLotSize()

alertManagement = str.tostring(exchange) + "," + str.tostring(mtLogin) + "," +str.tostring(mtPassword) + ","

alertManagement += str.tostring(mtServer) + "," + str.tostring(newLotS)

// alertManagement += str.tostring(stopLoss) + "," + str.tostring(applyingSL) + "," + str.tostring(applyTrailingStop) + ","

// alertManagement += str.tostring(exchange) + "," + str.tostring(exchangeAccount) + "," + str.tostring(slAmount) + "," + str.tostring(closeTpAmount) + ","

// alertManagement += str.tostring(exchangeLeverage) + "," + str.tostring(exchangeLeverageType) + ","

// alertManagement += str.tostring(mtLogin) + "," + str.tostring(mtPassword) + "," + str.tostring(mtServer) + "," + str.tostring(mtLot) + ","

// alertManagement += str.tostring(mtTp) + "," + str.tostring(mtTs) + "," + str.tostring(orderStrategy)

// alertManagement = "alertManagement"

myStop = 0.0

myTarget = 0.0

if (longCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("LONG", strategy.long, qty=12, comment="LONG", alert_message=alertManagement)

strategy.exit("TPL", "LONG", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

if (shortCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("SHORT", strategy.short, qty=12, comment="SHORT", alert_message=alertManagement)

strategy.exit("TPS", "SHORT", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

// Calculate the average profit per open trade

// avgProfit = profitSum / strategy.opentrades

getTotalProfit()=>

// Sum the profit of all open trades

profitSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) > 0

profitSum += strategy.closedtrades.profit(tradeNumber)

result = profitSum

getTotalLoss()=>

// Sum the profit of all open trades

lossSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) < 0

lossSum += strategy.closedtrades.profit(tradeNumber)

result = lossSum

maxLossRun()=>

lossRun = 0.0

currentMaxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNo) < 0.0

lossRun += strategy.closedtrades.profit(tradeNo)

else

currentMaxLoss := math.min(currentMaxLoss, lossRun)

lossRun := 0.0

result = currentMaxLoss

TotalTrades() =>

strategy.closedtrades + strategy.opentrades

maxDrawDown() =>

maxDrawdown = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxDrawdown := math.max(maxDrawdown, strategy.closedtrades.max_drawdown(tradeNo))

result = maxDrawdown

maxRunUp() =>

maxRunup = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxRunup := math.max(maxRunup, strategy.closedtrades.max_runup(tradeNo))

result = maxRunup

tradeMaxLossReached() =>

maxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxLoss := math.min(maxLoss, strategy.closedtrades.profit(tradeNo))

result = maxLoss

tradingStartTime() =>

strategy.closedtrades.entry_time(0)

daysBetween(t1, t2) => (t1 - t2) / 86400000

// Table

var InfoPanel = table.new(position = position.bottom_right, columns = 2, rows = 40, border_width = 1)

ftable(_table_id, _column, _row, _text, _bgcolor) =>

table.cell(_table_id, _column, _row, _text, 0, 0, color.black, text.align_right, text.align_center, size.small, _bgcolor)

tfString(int timeInMs) =>

// @function Produces a string corresponding to the input time in days, hours, and minutes.

// @param (series int) A time value in milliseconds to be converted to a string variable.

// @returns (string) A string variable reflecting the amount of time from the input time.

float s = timeInMs / 100000

float m = s / 60

float h = m / 60

float d = h / 24

float mo = d / 30.416

int tm = math.floor(m % 60)

int tr = math.floor(h % 24)

int td = math.floor(d % 30.416)

int tmo = math.floor(mo % 12)

int ys = math.floor(d / 365)

string result =

switch

d == 30 and tr == 10 and tm == 30 => "1M"

d == 7 and tr == 0 and tm == 0 => "1W"

=>

string yStr = ys ? str.tostring(ys) + "Y " : ""

string moStr = tmo ? str.tostring(tmo) + "M " : ""

string dStr = td ? str.tostring(td) + "D " : ""

string hStr = tr ? str.tostring(tr) + "H " : ""

string mStr = tm ? str.tostring(tm) + "min" : ""

yStr + moStr + dStr + hStr + mStr

if displayTable

maxLossRunInMarket= maxLossRun()

maxLossReached = tradeMaxLossReached()

tradeMaxLossReached = tradeMaxLossReached()

tradingInDays=daysBetween(time, tradingStartTime())

totalTrades=TotalTrades()

- Estrategia de negociación de redes fijas

- Indice de fuerza relativa Estrategia larga/corta

- Estrategia de ruptura de doble impulso

- Estrategia de negociación de reversión media basada en bandas de Bollinger y índice de oro

- Tendencia de impulso después de la estrategia de oscilación

- Seguimiento de la estrategia basada en la tendencia de la onda y la CMF

- Estrategia de seguimiento de tendencias de Bollinger adaptativa

- Estrategia de cruce de la media móvil del RSI en varios plazos

- Estrategia de ruptura de tendencia basada en bandas de Bollinger

- Estrategia de arbitraje de medias móviles regularizadas adaptativas entre mercados

- Estrategia del indicador de impulso

- Estrategia inversa de Heikin-Ashi

- Estrategia de ruptura de oscilación dinámica

- Tendencia tras la estrategia de cruce de la EMA de 5 minutos

- Tendencia de los índices de rentabilidad de acuerdo con la estrategia

- Estrategia de divergencia de los índices de riesgo

- Estrategia de negociación de DCA ponderada gradualmente cuantificada

- Desviación de la media móvil doble combinada con la tendencia del indicador ATR Siguiendo la estrategia

- Estrategia de tendencias múltiples

- Estrategia de precios de equilibrio