Estrategia de suspensión de pérdidas basada en las brechas de precios

El autor:¿ Qué pasa?, Fecha: 2023-11-28 13:53:16Las etiquetas:

Resumen general

Esta estrategia adopta el principio de diferencia de precios para ir largo cuando el precio rompe los mínimos recientes, con órdenes de stop loss y take profit para seguir el precio más bajo para obtener ganancias.

Estrategia lógica

Identifica las brechas cuando el precio se rompe por debajo del precio más bajo en N horas recientes, va largo basado en el porcentaje configurado, con órdenes de stop loss y take profit.

- Calcular el precio más bajo en N horas recientes como precio vinculante

- Ir largo cuando el precio en tiempo real está por debajo del precio vinculante * comprar el porcentaje

- Se establecen las ganancias basadas en el precio de entrada * el porcentaje de venta

- El importe de las pérdidas de liquidación se calcula en función de las pérdidas de liquidación.

- El tamaño de la posición es el porcentaje del capital de la estrategia

- Línea de pérdida de trazado con el precio más bajo

- Posiciones cerradas cuando se activa la opción de obtener ganancias o stop loss

Análisis de ventajas

Las ventajas de esta estrategia:

- Utilice el concepto de diferencia de precios, mejore la tasa de ganancia

- Detención automática de pérdidas para obtener la mayor parte de las ganancias

- Porcentaje de pérdida de detención y ganancia personalizable para diferentes mercados

- Funciona bien para instrumentos con rebotes obvios

- Lógica sencilla y fácil de implementar

Análisis de riesgos

También hay algunos riesgos:

- La ruptura de brechas puede fallar con mínimos más bajos

- Las configuraciones incorrectas de stop loss o take profit pueden causar una salida prematura

- Requerir ajustes periódicos de parámetros para los cambios del mercado

- Los instrumentos limitados de aplicación pueden no funcionar para algunos

- Intervención manual necesaria de vez en cuando

Direcciones de optimización

La estrategia puede mejorarse en los siguientes aspectos:

- Añadir modelos de aprendizaje automático para ajuste automático de parámetros

- Añadir más tipos de órdenes de stop loss/take profit, por ejemplo, órdenes de stop loss de seguimiento, órdenes entre paréntesis

- Optimizar la lógica stop loss/take profit para salidas más inteligentes

- Incorpore más indicadores para filtrar señales falsas

- Extensión a más instrumentos para mejorar la universalidad

Conclusión

En conclusión, esta es una estrategia de stop loss simple y efectiva basada en las brechas de precios. Reduce las entradas falsas y bloquea las ganancias de manera efectiva. Todavía hay mucho espacio para mejoras en la sintonización de parámetros y el filtrado de señales. Merece más investigación y refinamiento.

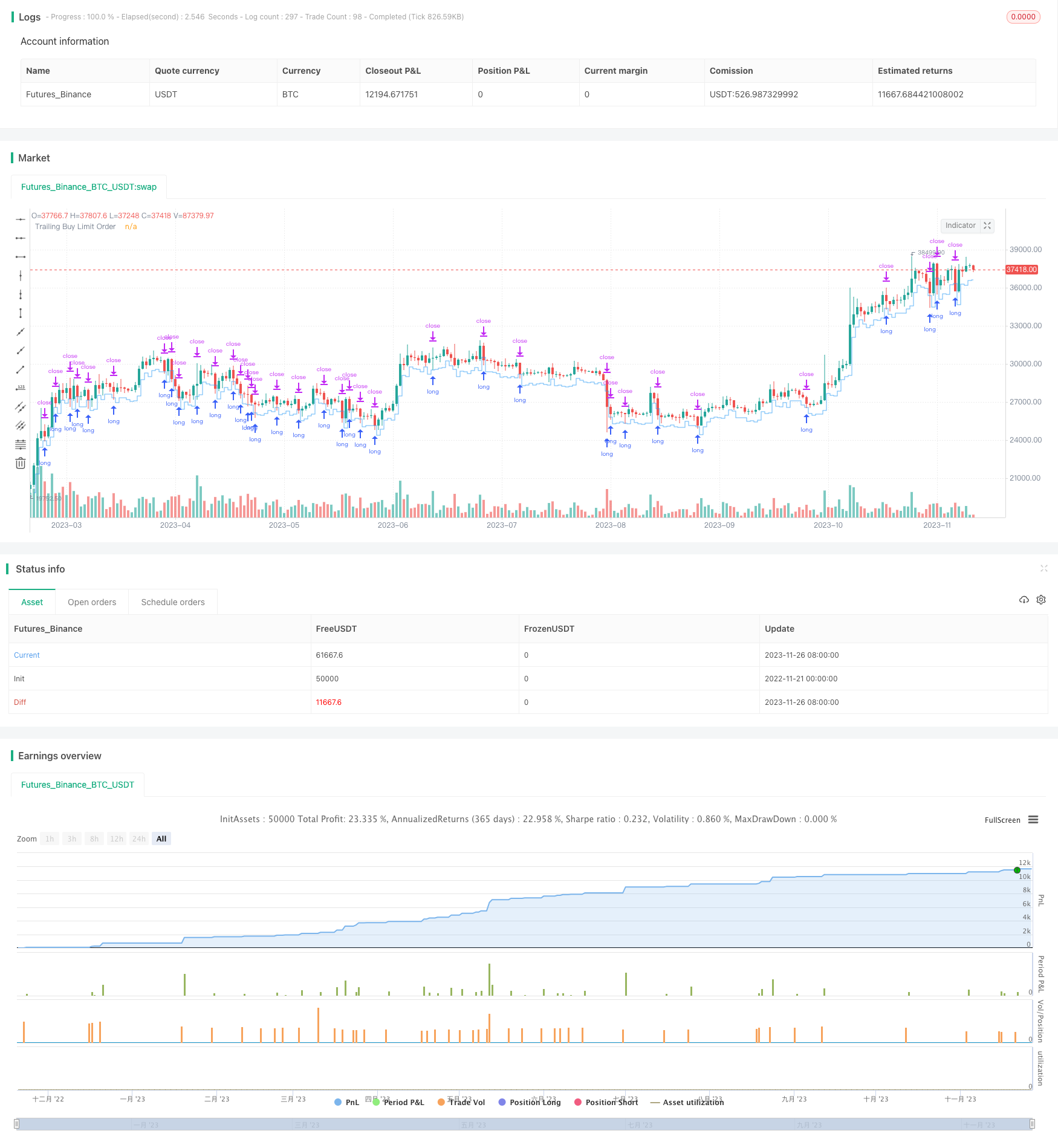

/*backtest

start: 2022-11-21 00:00:00

end: 2023-11-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Squeeze Backtest by Shaqi v1.0", overlay=true, pyramiding=0, currency="USD", process_orders_on_close=true, commission_type=strategy.commission.percent, commission_value=0.075, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=100, backtest_fill_limits_assumption=0)

strategy.risk.allow_entry_in(strategy.direction.long)

R0 = "6 Hours"

R1 = "12 Hours"

R2 = "24 Hours"

R3 = "48 Hours"

R4 = "1 Week"

R5 = "2 Weeks"

R6 = "1 Month"

R7 = "Maximum"

buyPercent = input( title="Buy, %", type=input.float, defval=3, minval=0.01, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

sellPercent = input(title="Sell, %", type=input.float, defval=1, minval=0.01, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

stopPercent = input(title="Stop Loss, %", type=input.float, defval=1, minval=0.01, maxval=100, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

isMaxBars = input( title="Max Bars To Sell", type=input.bool, defval=true , inline="MaxBars", group="Squeeze Settings")

maxBars = input( title="", type=input.integer, defval=2, minval=0, maxval=1000, step=1, inline="MaxBars", group="Squeeze Settings")

bind = input( title="Bind", type=input.source, defval=close, group="Squeeze Settings")

isRange = input( title="Fixed Range", type=input.bool, defval=true, inline="Range", group="Backtesting Period")

rangeStart = input( title="", defval=R4, options=[R0, R1, R2, R3, R4, R5, R6, R7], inline="Range", group="Backtesting Period")

periodStart = input(title="Backtesting Start", type=input.time, defval=timestamp("01 Aug 2021 00:00 +0000"), group="Backtesting Period")

periodEnd = input( title="Backtesting End", type=input.time, defval=timestamp("01 Aug 2022 00:00 +0000"), group="Backtesting Period")

int startDate = na

int endDate = na

if isRange

if rangeStart == R0

startDate := timenow - 21600000

endDate := timenow

else if rangeStart == R1

startDate := timenow - 43200000

endDate := timenow

else if rangeStart == R2

startDate := timenow - 86400000

endDate := timenow

else if rangeStart == R3

startDate := timenow - 172800000

endDate := timenow

else if rangeStart == R4

startDate := timenow - 604800000

endDate := timenow

else if rangeStart == R5

startDate := timenow - 1209600000

endDate := timenow

else if rangeStart == R6

startDate := timenow - 2592000000

endDate := timenow

else if rangeStart == R7

startDate := time

endDate := timenow

else

startDate := periodStart

endDate := periodEnd

afterStartDate = (time >= startDate)

beforeEndDate = (time <= endDate)

notInTrade = strategy.position_size == 0

inTrade = strategy.position_size > 0

barsFromEntry = barssince(strategy.position_size[0] > strategy.position_size[1])

entry = strategy.position_size[0] > strategy.position_size[1]

entryBar = barsFromEntry == 0

notEntryBar = barsFromEntry != 0

buyLimitPrice = bind - bind * buyPercent

buyLimitFilled = low <= buyLimitPrice

sellLimitPriceEntry = buyLimitPrice * (1 + sellPercent)

sellLimitPrice = strategy.position_avg_price * (1 + sellPercent)

stopLimitPriceEntry = buyLimitPrice - buyLimitPrice * stopPercent

stopLimitPrice = strategy.position_avg_price - strategy.position_avg_price * stopPercent

if afterStartDate and beforeEndDate and notInTrade

strategy.entry("BUY", true, limit = buyLimitPrice)

strategy.exit("INSTANT", limit = sellLimitPriceEntry, stop = stopLimitPriceEntry)

strategy.cancel("INSTANT", when = inTrade)

if isMaxBars

strategy.close("BUY", when = barsFromEntry >= maxBars, comment = "Don't Sell")

strategy.exit("SELL", limit = sellLimitPrice, stop = stopLimitPrice)

showStop = stopPercent <= 0.03

plot(showStop ? stopLimitPrice : na, title="Stop Loss Limit Order", style=plot.style_linebr, color=color.red, linewidth=1)

plot(sellLimitPrice, title="Take Profit Limit Order", style=plot.style_linebr, color=color.purple, linewidth=1)

plot(strategy.position_avg_price, title="Buy Order Filled Price", style=plot.style_linebr, color=color.blue, linewidth=1)

plot(buyLimitPrice, title="Trailing Buy Limit Order", style=plot.style_stepline, color=color.new(color.blue, 30), offset=1)

- Estrategia MACD de varios plazos

- Estrategias de superscalping basadas en el canal RSI y ATR

- Estrategia de tendencia de Donchian

- Estrategia de cruce de las medias móviles multi-SMA

- Estrategia de negociación de indicadores múltiples de RSI

- Estrategia de Supertrend con pérdida de parada de seguimiento

- Estrategia de reversión de la media móvil ponderada de ruptura

- Estrategia del índice de fuerza relativa de la media móvil

- Estrategia de seguimiento de tendencias inteligente de ADX

- Estrategia de agregación del impulso del RSI

- Estrategia de ruptura de la media móvil

- Estrategia de cruce de tendencia combinada de inversión de la media móvil

- Estrategia de divergencia de los indicadores de rentabilidad basada en el eje

- La estrategia de breakout de la proporción dorada

- Estrategia de bandas de Bollinger con filtro RSI

- Una tendencia que sigue una estrategia basada en los canales de Keltner

- Estrategia de cruce de la media móvil del RSI

- estrategia de negociación de ruptura de impulso

- Estrategia de negociación cuantitativa multifáctor combinada de RSI dinámico y CCI

- Super Z Estrategia de tendencia cuantitativa