La estrategia de negociación de varios períodos basada en el índice de volatilidad y el oscilador estocástico

El autor:¿ Qué pasa?, Fecha: 2023-12-21 14:34:42Las etiquetas:

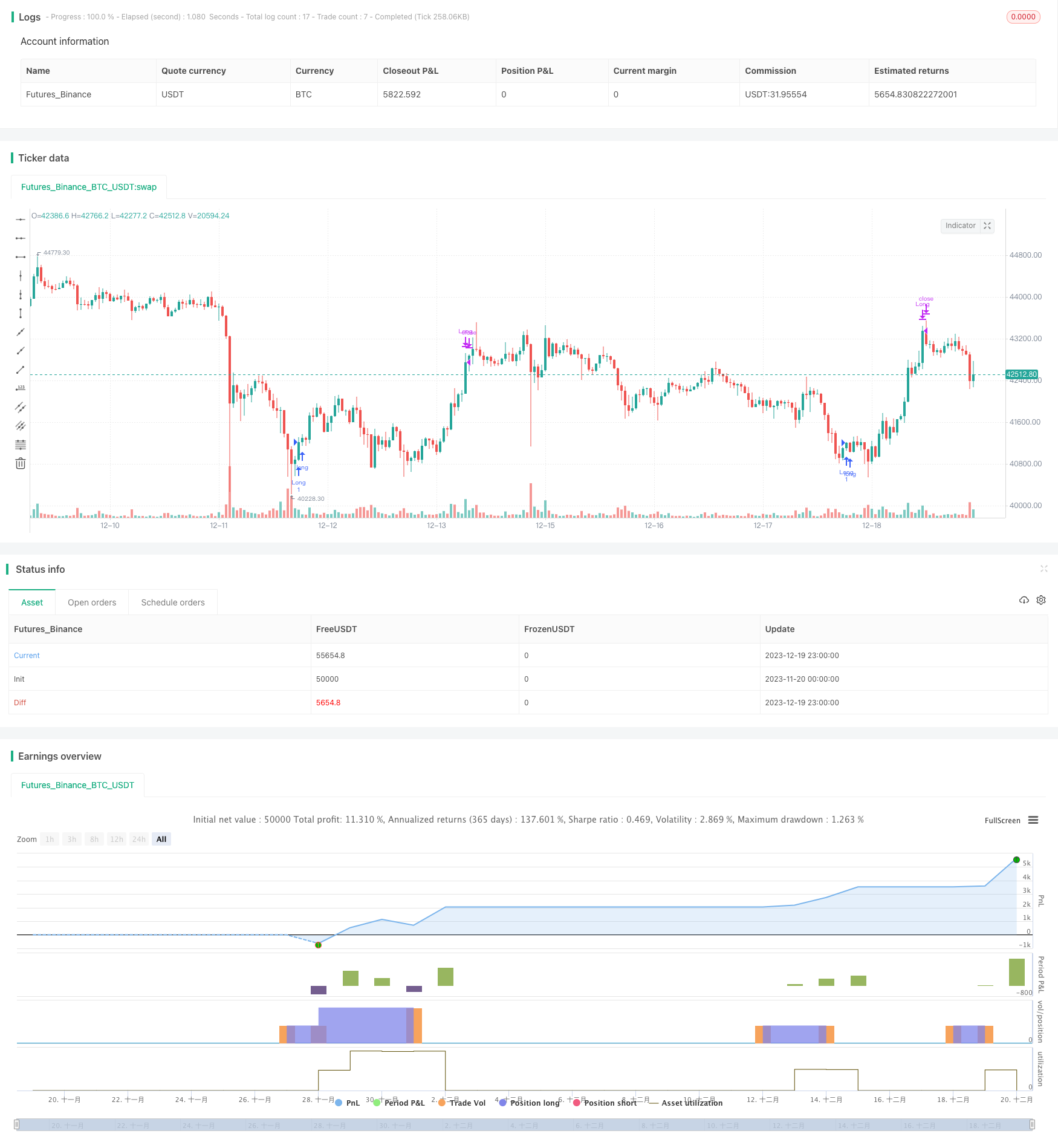

Resumen general Esta estrategia combina el índice de volatilidad VIX y el oscilador estocástico RSI a través de una composición de indicadores en diferentes períodos de tiempo, con el fin de lograr entradas de ruptura eficientes y salidas de sobrecompra / sobreventa.

Principios

-

Calcular el índice de volatilidad VIX: tomar los precios más altos y más bajos en los últimos 20 días para calcular la volatilidad.

-

Calcule el oscilador RSI: tome los cambios de precios en los últimos 14 días.

-

Combine los dos indicadores. vaya largo cuando VIX rompe la banda superior o el percentil más alto. cierre largos cuando el RSI va por encima de 70.

Ventajas

- Integra múltiples indicadores para una evaluación integral del momento del mercado.

- Los indicadores a través de los marcos de tiempo se verifican entre sí y mejora la precisión de la decisión.

- Los parámetros personalizables pueden optimizarse para diferentes instrumentos de negociación.

Los riesgos

- Un ajuste incorrecto de parámetros puede causar múltiples señales falsas.

- Un solo indicador de salida puede no ver las reversiones de precios.

Sugerencias para optimizar

- Incorporar más indicadores de confirmación como promedios móviles y bandas de Bollinger a las entradas de tiempo.

- Añadir más indicadores de salida como patrones de candlestick de inversión.

Resumen de las actividades Esta estrategia utiliza el VIX para medir el momento del mercado y los niveles de riesgo, y filtra las operaciones desfavorables utilizando lecturas de sobrecompra / sobreventa del RSI, con el fin de entrar en momentos oportunos y salir a tiempo con paradas.

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © timj

strategy('Vix FIX / StochRSI Strategy', overlay=true, pyramiding=9, margin_long=100, margin_short=100)

Stochlength = input.int(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input.int(80, title="Stochastic overbought condition")

StochOverSold = input.int(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = ta.sma(ta.stoch(close, high, low, Stochlength), smoothK)

d = ta.sma(k, smoothD)

///////////// RSI

RSIlength = input.int( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input.int( 70 , title="RSI overbought condition")

RSIOverSold = input.int( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = ta.rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input.float(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Show Text Plot if WVF WAS True and IS Now False")

sbcc = input(false, title="Show Text Plot if WVF IS True")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input.float(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input.float(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input.int(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title="Show Alert WVF = True?")

sa2 = input(false, title="Show Alert WVF Was True Now False?")

sa3 = input(false, title="Show Alert WVF Filtered?")

sa4 = input(false, title="Show Alert WVF AGGRESSIVE Filter?")

//Williams Vix Fix Formula

wvf = ((ta.highest(close, pd)-low)/(ta.highest(close, pd)))*100

sDev = mult * ta.stdev(wvf, bbl)

midLine = ta.sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (ta.highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

isOverBought = (ta.crossover(k,d) and k > StochOverBought) ? 1 : 0

isOverBoughtv2 = k > StochOverBought ? 1 : 0

filteredAlert = alert3 ? 1 : 0

aggressiveAlert = alert4 ? 1 : 0

if (filteredAlert or aggressiveAlert)

strategy.entry("Long", strategy.long)

if (isOverBought)

strategy.close("Long")

- Estrategia de negociación a corto plazo basada en el indicador de volatilidad de Chaikin

- Estrategia de seguimiento de tendencias cruzadas de doble MA

- Super Tendencia Triple Estrategia

- Estrategia dinámica de suspensión de pérdidas

- Estrategia de cruce de promedio móvil con stop-loss y take-profit

- Estrategia inversa de inversión media basada en la media móvil

- Estrategia de negociación de alta frecuencia basada en bandas de Bollinger

- Una estrategia cuantitativa de comercio en la nube de Ichimoku

- Estrategia de impulso basada en el modelo de ruptura de doble fondo

- Estrategia del vórtice estocástico

- Estrategia de comercio de productos básicos de la pesca de fondo adaptativa ampliada de la CCI

- Estrategia de impulso basada en la presión de LazyBear

- Estrategia de detención de ganancias con dientes de sierra de cruce de piso basada en la media móvil

- Estrategia de negociación de media móvil dinámica ponderada

- Última estrategia de la vela

- Estrategia cuantitativa de inversión del índice de volumen negativo

- Estrategia de ruptura de la súper tendencia triple

- MACD de la estrategia de fortaleza relativa

- El sistema del triple dragón

- Opciones de negociación de alto nivel basadas únicamente en la estrategia semanal de EMA8