Estrategia de combinación de bandas de Bollinger y línea K

Descripción general

Esta es una estrategia de seguimiento de tendencias que utiliza las bandas de Bollinger y la forma de la línea K como señales de entrada al mismo tiempo. Su objetivo es capturar tendencias en períodos de tiempo más largos y se aplica al comercio de divisas.

Principio de estrategia

La estrategia establece bandas de Bollinger calculando el rango de diferencia estándar del precio. La amplitud de la banda representa la volatilidad del mercado. Se considera una señal de sobreventa cuando el precio está cerca de la subida o bajada de la subida.

Concretamente, hacer más señales es: el punto bajo hacia arriba rompe la vía baja, y aparece el trago múltiple o la línea K de la sombra hacia abajo. Hacer señales de vacío es: el punto alto hacia abajo rompe la vía alta, y aparece el trago vacío o la línea K de la sombra hacia arriba.

El modo stop loss es un precio de stop loss preestablecido. El modo stop stop es un precio que se detiene parcialmente cuando el precio cruza la línea central de Brin.

Análisis de las ventajas

Esta estrategia combina tendencias y oportunidades de reentrada. Las bandas Bollinger reconocen tendencias y oportunidades de sobreventa y sobrecompra. La línea K juzga el momento de reentrada y evita falsas rupturas.

La configuración de Stop Loss es clara y el riesgo es controlado. Es adecuado para operaciones en línea larga y reduce la frecuencia de las operaciones.

Análisis de riesgos

El mayor riesgo de esta estrategia es que no se capte la tendencia o que se produzcan fuertes sacudidas. En este caso, el stop loss se activa en serie.

Además, la parada de salida depende de la línea media, lo que puede ocurrir si la parada es demasiado temprana o demasiado tarde.

Se puede optimizar la combinación de parámetros de ajuste, identificar formas de línea K más fiables, o modificar los parámetros de frenado según la fluctuación.

Dirección de optimización

Se puede combinar con otros indicadores para determinar la tendencia del ciclo mayor, evitando la operación de contratiempo. O se puede agregar un algoritmo de aprendizaje automático para determinar la combinación óptima de parámetros.

El modo de parada también se puede cambiar a parada móvil o considerar parada de fluctuación, etc., para maximizar las ganancias.

Resumir

Se trata de una estrategia de tendencias de largo ciclo basada en indicadores técnicos de bandas de Bollinger y líneas K. Es adecuada para su uso como estrategia básica, tiene cierta fiabilidad y margen de ganancia, pero aún necesita ser probada y optimizada constantemente para mejorar la estabilidad.

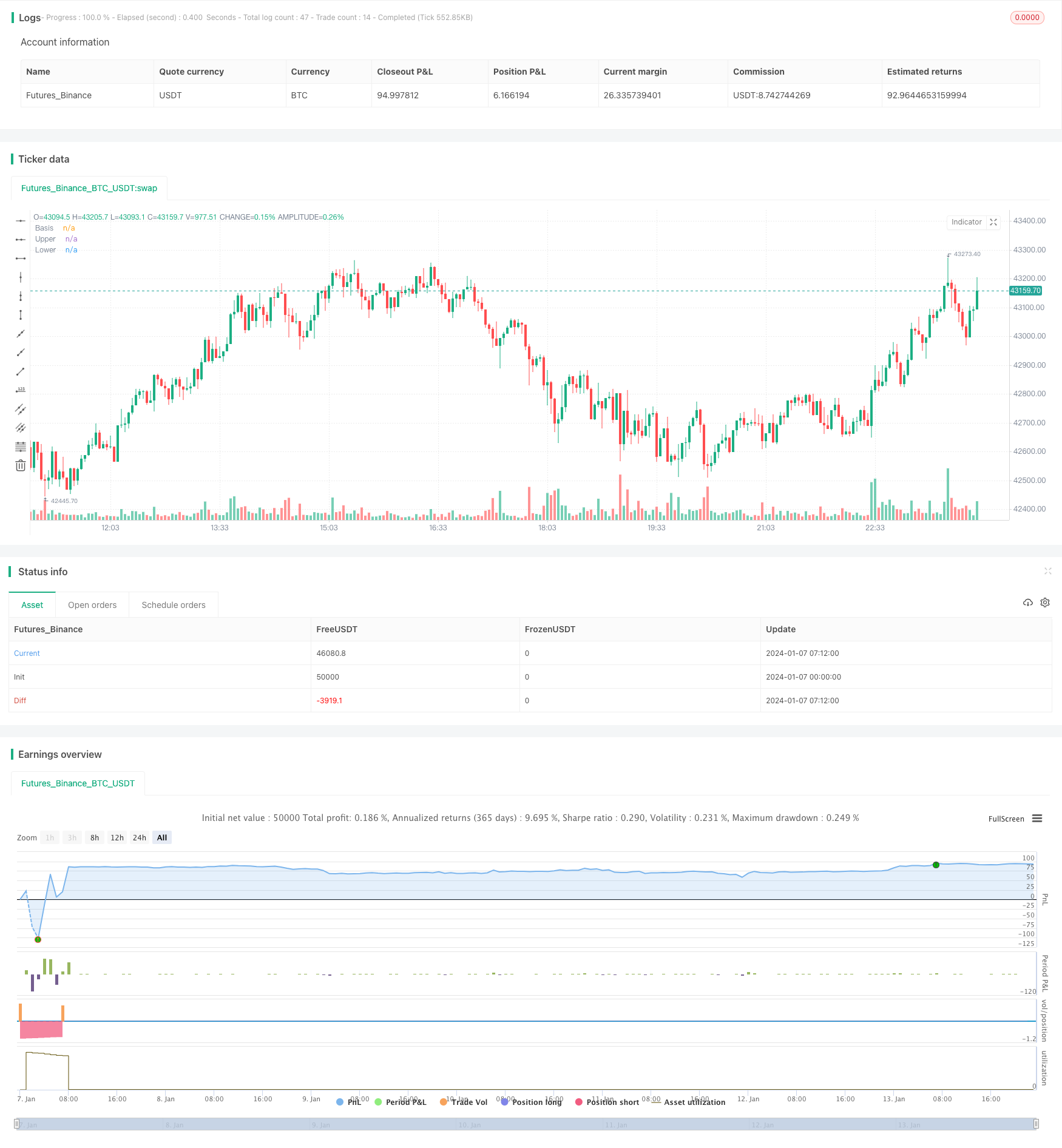

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BB策略", overlay=true)

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upper, "Upper", color=color.teal, offset = offset)

p2 = plot(lower, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

diff=upper-lower

//plot(upper*0.9985, "Upper", color=color.white, offset = offset)

//plot(lower*1.0015, "Lower", color=color.white, offset = offset)

//Engulfing Candles

openBarPrevious = open[1]

closeBarPrevious = close[1]

openBarCurrent = open

closeBarCurrent = close

//If current bar open is less than equal to the previous bar close AND current bar open is less than previous bar open AND current bar close is greater than previous bar open THEN True

bullishEngulfing = openBarCurrent <= closeBarPrevious and openBarCurrent < openBarPrevious and

closeBarCurrent > openBarPrevious

//If current bar open is greater than equal to previous bar close AND current bar open is greater than previous bar open AND current bar close is less than previous bar open THEN True

bearishEngulfing = openBarCurrent >= closeBarPrevious and openBarCurrent > openBarPrevious and

closeBarCurrent < openBarPrevious

//bullishEngulfing/bearishEngulfing return a value of 1 or 0; if 1 then plot on chart, if 0 then don't plot

//plotshape(bullishEngulfing, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

//plotshape(bearishEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//alertcondition(bullishEngulfing, title="Bullish Engulfing", message="[CurrencyPair] [TimeFrame], Bullish candle engulfing previous candle")

//alertcondition(bearishEngulfing, title="Bearish Engulfing", message="[CurrencyPair] [TimeFrame], Bearish candle engulfing previous candle")

//Long Upper Shadow - Bearish

C_Len = 14 // ema depth for bodyAvg

C_ShadowPercent = 5.0 // size of shadows

C_ShadowEqualsPercent = 100.0

C_DojiBodyPercent = 5.0

C_Factor = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi = max(close, open)

C_BodyLo = min(close, open)

C_Body = C_BodyHi - C_BodyLo

C_BodyAvg = ema(C_Body, C_Len)

C_SmallBody = C_Body < C_BodyAvg

C_LongBody = C_Body > C_BodyAvg

C_UpShadow = high - C_BodyHi

C_DnShadow = C_BodyLo - low

C_HasUpShadow = C_UpShadow > C_ShadowPercent / 100 * C_Body

C_HasDnShadow = C_DnShadow > C_ShadowPercent / 100 * C_Body

C_WhiteBody = open < close

C_BlackBody = open > close

C_Range = high-low

C_IsInsideBar = C_BodyHi[1] > C_BodyHi and C_BodyLo[1] < C_BodyLo

C_BodyMiddle = C_Body / 2 + C_BodyLo

C_ShadowEquals = C_UpShadow == C_DnShadow or (abs(C_UpShadow - C_DnShadow) / C_DnShadow * 100) < C_ShadowEqualsPercent and (abs(C_DnShadow - C_UpShadow) / C_UpShadow * 100) < C_ShadowEqualsPercent

C_IsDojiBody = C_Range > 0 and C_Body <= C_Range * C_DojiBodyPercent / 100

C_Doji = C_IsDojiBody and C_ShadowEquals

patternLabelPosLow = low - (atr(30) * 0.6)

patternLabelPosHigh = high + (atr(30) * 0.6)

C_LongUpperShadowBearishNumberOfCandles = 1

C_LongShadowPercent = 75.0

C_LongUpperShadowBearish = C_UpShadow > C_Range/100*C_LongShadowPercent

//alertcondition(C_LongUpperShadowBearish, title = "Long Upper Shadow", message = "New Long Upper Shadow - Bearish pattern detected.")

//if C_LongUpperShadowBearish

// var ttBearishLongUpperShadow = "Long Upper Shadow\nTo indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices."

// label.new(bar_index, patternLabelPosHigh, text="LUS", style=label.style_label_down, color = color.red, textcolor=color.white, tooltip = ttBearishLongUpperShadow)

//gcolor(highest(C_LongUpperShadowBearish?1:0, C_LongUpperShadowBearishNumberOfCandles)!=0 ? color.red : na, offset=-(C_LongUpperShadowBearishNumberOfCandles-1))

C_Len1 = 14 // ema depth for bodyAvg

C_ShadowPercent1 = 5.0 // size of shadows

C_ShadowEqualsPercent1 = 100.0

C_DojiBodyPercent1 = 5.0

C_Factor1 = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi1 = max(close, open)

C_BodyLo1 = min(close, open)

C_Body1 = C_BodyHi1 - C_BodyLo1

C_BodyAvg1 = ema(C_Body1, C_Len1)

C_SmallBody1 = C_Body1 < C_BodyAvg1

C_LongBody1 = C_Body1 > C_BodyAvg1

C_UpShadow1 = high - C_BodyHi1

C_DnShadow1 = C_BodyLo1 - low

C_HasUpShadow1 = C_UpShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_HasDnShadow1 = C_DnShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_WhiteBody1 = open < close

C_BlackBody1 = open > close

C_Range1 = high-low

C_IsInsideBar1 = C_BodyHi1[1] > C_BodyHi1 and C_BodyLo1[1] < C_BodyLo1

C_BodyMiddle1 = C_Body1 / 2 + C_BodyLo1

C_ShadowEquals1 = C_UpShadow1 == C_DnShadow1 or (abs(C_UpShadow1 - C_DnShadow1) / C_DnShadow1 * 100) < C_ShadowEqualsPercent1 and (abs(C_DnShadow1 - C_UpShadow1) / C_UpShadow1 * 100) < C_ShadowEqualsPercent1

C_IsDojiBody1 = C_Range1 > 0 and C_Body1 <= C_Range1 * C_DojiBodyPercent1 / 100

C_Doji1 = C_IsDojiBody1 and C_ShadowEquals1

patternLabelPosLow1 = low - (atr(30) * 0.6)

patternLabelPosHigh1 = high + (atr(30) * 0.6)

C_LongLowerShadowBullishNumberOfCandles1 = 1

C_LongLowerShadowPercent1 = 75.0

C_LongLowerShadowBullish1 = C_DnShadow1 > C_Range1/100*C_LongLowerShadowPercent1

//alertcondition1(C_LongLowerShadowBullish1, title = "Long Lower Shadow", message = "New Long Lower Shadow - Bullish pattern detected.")

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=1, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=11, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2030, minval=1800, maxval=2100)

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

//多單

if ((bullishEngulfing or C_LongLowerShadowBullish1) and inDateRange and cross(low,lower))

strategy.entry("L", strategy.long, qty=1,stop=(low[1]))

//strategy.close("L",comment = "L exit",when=cross(basis,close),qty_percent=50)

if crossunder(close,upper*0.9985)

strategy.close("L",comment = "L exit",qty_percent=1)

//空單

if (((bullishEngulfing == 0) or C_LongUpperShadowBearish) and inDateRange and cross(close,upper))

strategy.entry("S", strategy.short,qty= 1,stop=(high[1]))

//strategy.close("S",comment = "S exit",when=cross(basis,close),qty_percent=50)

if crossunder(lower*1.0015,close)

strategy.close("S",comment = "S exit",qty_percent=1)