Estrategia de seguimiento de tendencia de media móvil basada en SSL

Descripción general

La estrategia es una estrategia que utiliza el indicador del canal SSL para determinar la tendencia del mercado y el seguimiento de la tendencia en la línea media como referencia. Se aplica a la línea de 4 horas y la línea de sol en la línea media y larga.

Principio de estrategia

El canal SSL se compone de la línea media de Kelt y el real de la amplitud. Puede determinar la dirección de la tendencia del mercado.

La estrategia utiliza un indicador de línea media como la EMA para calcular una línea media de referencia. Esta línea media puede filtrar algunas brechas falsas.

La estrategia se hace más cuando el precio se rompe la línea de la vía superior de SSL, y se hace vacío cuando el precio se rompe la línea de la vía inferior de SSL.

El método de parada de pérdidas tiene un porcentaje de parada, una parada de ATR y una revisión de la parada mínima / máxima. La parada es N veces la parada de pérdidas. Los parámetros específicos son determinados por el usuario.

Análisis de las ventajas

El canal SSL determina la dirección de la tendencia con precisión, reduciendo las falsas señales. La colaboración con la unión de la línea de paridad es la base de entrada en el mercado, evitando la búsqueda de la parte inferior.

Se puede elegir con flexibilidad entre diferentes tipos de líneas medias para adaptarse a un contexto más amplio de mercado.

El método de stop loss es flexible y el riesgo se puede controlar. El multiplicador de stop loss también se puede configurar de manera flexible para satisfacer diferentes preferencias.

El objetivo de la iniciativa es crear un mercado de trabajo abierto, que permita a los empresarios y a las empresas explotar las oportunidades que ofrece el mercado.

Análisis de riesgos

Los indicadores de la línea media están rezagados y es posible que haya pérdidas acumuladas.

En el caso de una sacudida, la primera vez que se sube y baja de la vía hay una reversión, por lo que es fácil de atrapar.

El ATR y el Stop Loss de Revisión pueden ser demasiado flexibles en caso de una ruptura anormal, ampliando las pérdidas.

Las medidas de respuesta al riesgo:

- Ajuste adecuadamente los parámetros de la línea media, o elija otro tipo de línea media.

- El objetivo es aumentar la cantidad de pérdidas y detenerlas en el momento oportuno.

- Añadir un factor multiplicador en el ATR, o ajustar el ciclo de revisión.

Dirección de optimización

- Prueba más tipos de medias para encontrar los mejores parámetros.

- Parámetros de ciclo ATR para la optimización de la pérdida.

- Prueba de los diferentes parámetros de los multiplicadores de la pérdida.

- Prueba de los diferentes coeficientes de riesgo de parálisis.

Resumir

Esta estrategia combina el uso de SSL para juzgar las tendencias y los indicadores de línea media para confirmar la entrada en el mercado, lo que permite un seguimiento eficaz de las tendencias. Ofrece una forma flexible de detener y detener los pérdidas, obteniendo mayores ganancias al mismo tiempo que controla el riesgo. Mediante la prueba y optimización continua de los parámetros, se puede obtener un mejor rendimiento comercial.

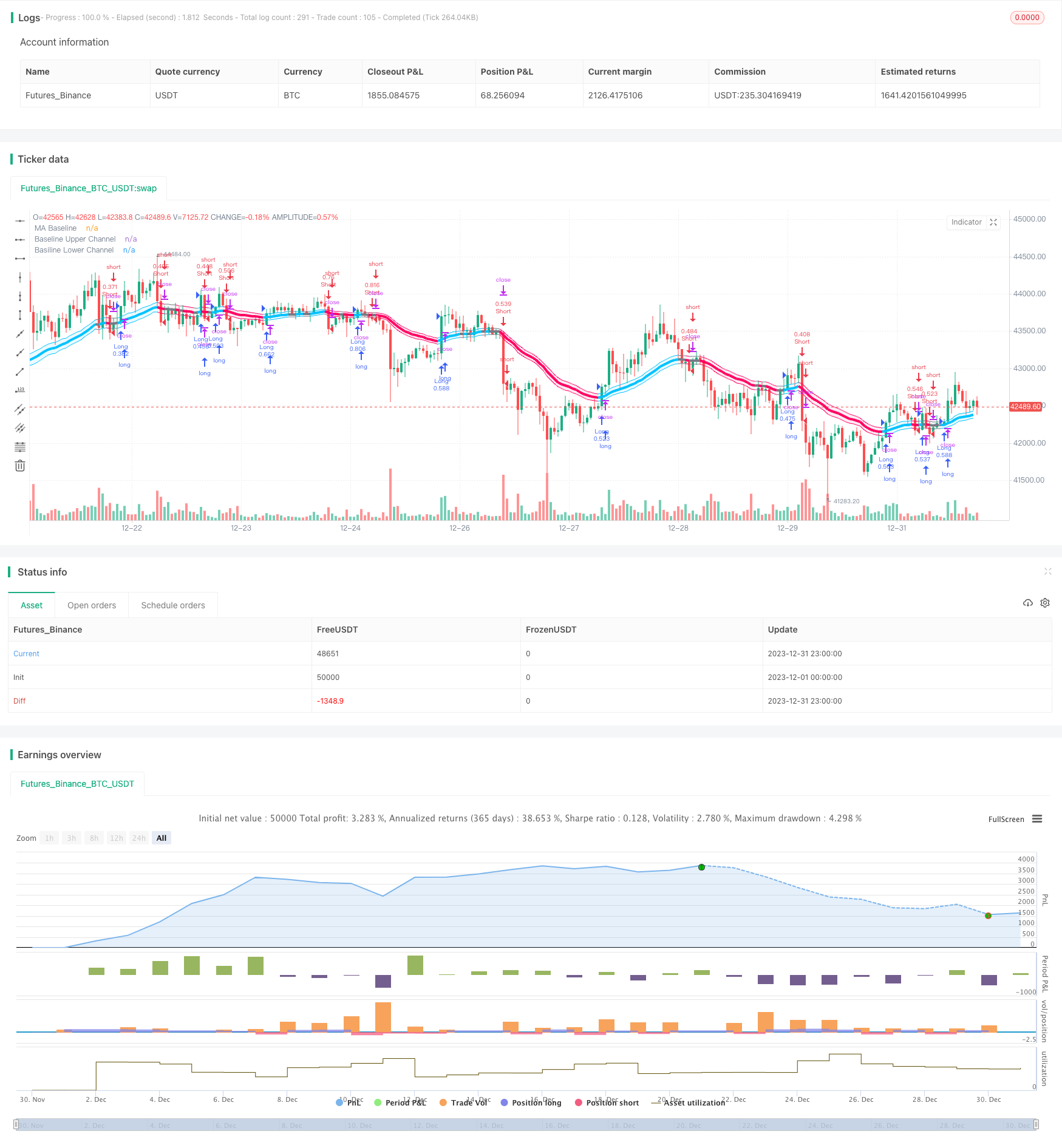

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Thanks to @kevinmck100 for opensource strategy template and @Mihkel00 for SSL Hybrid

// @fpemehd

// @version=5

strategy(title = '[fpemehd] SSL Baseline Strategy',

shorttitle = '[f] SSL',

overlay = true)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

inDateRange = true

// 2. Inputs for direction: Long? Short? Both?

// i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "1", group = "Long / Short" )

// i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "1", group = "Long / Short" )

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: ATR or Percent?

i_slType = input.string (defval = "ATR", title = "SL Type ", group = "Strategy: Stop Loss Conditions", options = ["Percent", "ATR", "Previous LL / HH"], tooltip = "Stop Loss based on %? ATR?", inline = "1")

i_slPercent = input.float (defval = 3, title = "SL % ", group = "Strategy: Stop Loss Conditions", inline = "2")

i_slAtrLength = input.int (14, "SL ATR Length ", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, maxval = 10000)

i_slAtrMultiplier = input.float (4, "SL ATR Multiplier", group = "Strategy: Stop Loss Conditions", inline = "3", minval = 0, step = 0.1, tooltip = "Length of ATR used to calculate Stop Loss. \nSize of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

i_slLookBack = input.int(30, "Lowest Price Before Entry", group = "Strategy: Stop Loss Conditions", inline = "4", minval = 30, step = 1, tooltip = "Lookback to find the Lowest Price. \nStopLoss is determined by the Lowest price of the look back period. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

//// 3-2. Inputs for Quantity & Risk Manangement: Take Profit

i_riskReward = input.float(2, "Risk : Reward Ratio ", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

i_accountRiskPercent = input.float(1, "Portfolio Risk %", group = "Strategy: Risk Management", inline = "1", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// 4. Inputs for Drawings

i_showTpSlBoxes = input.bool(false, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

i_showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "1", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

i_showDashboard = input.bool(false, "Show Dashboard", group = "Strategy: Drawings", inline = "1", tooltip = "Show Backtest Results")

i_show_color_bar = input.bool(false , "Color Bars", group = "Strategy: Drawings", inline = "1")

// 5. Inputs for Indicators

//// 5-1. Inputs for Indicator - 1: SSL Hybrid

i_useTrueRange = input.bool(defval = true , title = "use true range for Keltner Channel?", tooltip = "", inline = " ", group = "1: SSL Hybrid")

i_maType = input.string(defval='EMA', title='Baseline Type', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'],group = "1: SSL Hybrid")

i_len = input.int(defval=30,title='Baseline Length', group = "1: SSL Hybrid")

i_multy = input.float(0.2, step=0.05, title='Base Channel Multiplier', group = "1: SSL Hybrid")

// Input for Baseline

i_kidiv = input.int(defval=1, maxval=4, minval=0, title='Kijun MOD Divider',inline="Kijun v2", group="1: SSL Hybrid")

i_jurik_phase = input.int(defval=3, title='Baseline Type = JMA -> Jurik Phase', inline='JMA',group="1: SSL Hybrid")

i_jurik_power = input.int(defval=1, title='Baseline Type = JMA -> Jurik Power', inline='JMA',group="1: SSL Hybrid")

i_volatility_lookback = input.int(defval=10, title='Baseline Type = VAMA -> Volatility lookback length', inline='VAMA',group="1: SSL Hybrid")

// MF

i_beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Baseline Type = MF (Modular Filter, General Filter) ->Beta', inline='MF',group="1: SSL Hybrid")

i_feedback = input.bool(defval=false, title='Baseline Type = MF (Modular Filter) -> Use Feedback?', inline='MF',group="1: SSL Hybrid")

i_z = input.float(0.5, title='Baseline Type = MF (Modular Filter) -> Feedback Weighting', step=0.1, minval=0, maxval=1, inline='MF',group="1: SSL Hybrid")

// EDSMA

i_ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20, inline='EDSMA',group="1: SSL Hybrid")

i_ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3], inline='EDSMA',group="1: SSL Hybrid")

// # ========================================================================= #

// # Functions for Stop Loss & Take Profit & Plots

// # ========================================================================= #

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if i_showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if i_showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##") + "\nExit Price: " + str.tostring(close,"#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + " " + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

// 1. Calculate Indicators

//// 1-1. Calculate Indicators for SSL Hybrid Baseline

////// TEMA

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

////// EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = i_feedback ? i_z * src + (1 - i_z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = i_beta * b + (1 - i_beta) * c

lower = i_beta * c + (1 - i_beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, i_volatility_lookback)

vol_down = ta.lowest(dev, i_volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = i_jurik_phase < -100 ? 0.5 : i_jurik_phase > 100 ? 2.5 : i_jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, i_jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / i_kidiv), ta.highest(len / i_kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = i_ssfPoles == 2 ? get2PoleSSF(avgZeros, i_ssfLength) : get3PoleSSF(avgZeros, i_ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

////// Keltner Baseline Channel (Baseline)

BBMC = ma(i_maType, close, i_len)

Keltma = ma(i_maType, close, i_len)

range_1 = i_useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, i_len)

upperk = Keltma + rangema * i_multy

lowerk = Keltma - rangema * i_multy

// 2. Entry Condition for Long and Short

// Condition 1

bullSSL = close > upperk

bearSSL = close < lowerk

// Enter Position based on Condition 1

goLong = inDateRange and bullSSL

goShort = inDateRange and bearSSL

// # ========================================================================= #

// # Position Control Logic (Entry & Exit)

// # ========================================================================= #

// 1. Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// 2. Entry decisions

openLong = (goLong and not inLong) // Long entry condition & not in long position

openShort = (goShort and not inShort) // Short entry condition & not in short position

flippingSides = (goLong and inShort) or (goShort and inLong) // (Long entry condition & in short position) and the opposite

enteringTrade = openLong or openShort // Entering Long or Short Condition

inTrade = inLong or inShort

// 3. Stop Loss & Take Profit Percent

lowestLow = ta.lowest(source = low, length = i_slLookBack)

highestHigh = ta.highest(source = high, length = i_slLookBack)

llhhSLPercent = openLong ? math.abs((close - lowestLow) / close) * 100 : openShort ? math.abs((highestHigh - close) / close) * 100 : na

atr = ta.atr(i_slAtrLength)

slAmount = atr * i_slAtrMultiplier

slPercent = i_slType == 'ATR' ? math.abs((1 - (close - slAmount) / close) * 100) : i_slType == 'Percent' ? i_slPercent : llhhSLPercent

tpPercent = slPercent * i_riskReward

// 4. Risk calculations & Quantity Management

riskAmt = strategy.equity * i_accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

// 5. Open Position

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

// Can add more take profit Actions

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// # ========================================================================= #

// # Plots (Bar Color, Plot, Label, Boxes)

// # ========================================================================= #

// 1. SSL Hybrid Baseline

longColor = #00c3ff

shortColor = #ff0062

color_bar = close > upperk ? longColor : close < lowerk ? shortColor : color.gray

p1 = plot(BBMC, color=color.new(color=color_bar, transp=0), linewidth=4, title='MA Baseline')

// 2. Bar color Based On SSL Hybrid Baseline

barcolor(i_show_color_bar ? color_bar : na)

up_channel = plot(upperk, color=color_bar, title='Baseline Upper Channel')

low_channel = plot(lowerk, color=color_bar, title='Basiline Lower Channel')

fill(up_channel, low_channel, color.new(color=color_bar, transp=90))

// 3. Stoploss Boxes

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

if (inTrade and exitTriggered)

inShort := false

inLong := false

printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// 4. Data Windows

plotchar(slPrice, "Stop Loss Price", "")

plotchar(tpPrice, "Take Profit Price", "")

// 5. Showing Labels

plotDebugLabels = false

if plotDebugLabels

if bar_index == tradeEntryBar

printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))

// 6. Showing Dashboard

if i_showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)