Estrategia de ruptura impulsada por el sentimiento

El autor:¿ Qué pasa?, Fecha: 2024-01-17 17:53:55Las etiquetas:

Resumen general

Esta estrategia incorpora el indicador QQE Mod, el indicador SSL Hybrid y el indicador Waddah Attar Explosion, formando señales comerciales y perteneciendo a múltiples indicadores impulsados por la estrategia de ruptura del sentimiento.

Estrategia lógica

La lógica central de esta estrategia se basa en las decisiones comerciales formadas por tres indicadores:

Indicador de mod QQE: Este indicador mejora el indicador RSI para hacerlo más sensible en el juicio del sentimiento del mercado.

Indicador híbrido SSL: Este indicador considera de forma exhaustiva las situaciones de ruptura de las medias móviles múltiples para determinar las señales del mercado.

Indicador de explosión de Waddah Attar: Este indicador juzga el poder explosivo de los precios dentro del canal.

Cuando el indicador QQE emite una señal de reversión inferior, el indicador SSL muestra la ruptura superior del canal y el indicador Waddah Attar determina el impulso explosivo, esta estrategia genera una decisión de compra.

La estrategia también establece un stop loss preciso y toma ganancias para bloquear las ganancias en la medida máxima, que es una estrategia de ruptura de alta calidad impulsada por el sentimiento.

Análisis de ventajas

Esta estrategia tiene las siguientes ventajas:

- Integrar múltiples indicadores para determinar el sentimiento del mercado y evitar los riesgos de falsas rupturas

- Considere de manera integral los indicadores de reversión, los indicadores de canal e indicadores de impulso para garantizar un alto grado de confirmación durante la ruptura

- Adoptar un stop loss móvil de alta precisión para limitar los riesgos y bloquear las ganancias

- Los parámetros han pasado por muchas pruebas de optimización con buena estabilidad, adecuado para la retención a medio y largo plazo

- Los parámetros del indicador pueden configurarse para ajustar el estilo de la estrategia a condiciones de mercado más amplias

Análisis de riesgos

Los principales riesgos de esta estrategia incluyen:

- Tiende a generar más pequeñas operaciones perdedoras durante tendencias a la baja sostenidas

- Se basa en múltiples señales de indicadores concurrentes, que pueden fallar extraordinariamente en algunos mercados.

- Existe riesgo de sobre-optimización para múltiples indicadores como QQE, los parámetros deben establecerse con cuidado

- El movimiento del stop loss difícilmente puede desempeñar su papel normal en algunas condiciones de mercado inusuales.

Para hacer frente a los riesgos anteriores, se sugiere ajustar los parámetros del indicador para que sean más estables y aumentar adecuadamente el período de retención para obtener una tasa de ganancia más alta.

Direcciones de optimización

Esta estrategia puede optimizarse aún más en los siguientes aspectos:

- Ajustar los parámetros de los indicadores para que sean más estables o sensibles

- Añadir un módulo de optimización del tamaño de la posición basado en la volatilidad

- Añadir un módulo de control de riesgos de aprendizaje automático para evaluar las condiciones del mercado de forma dinámica

- Utilizar modelos de aprendizaje profundo para predecir patrones de indicadores y mejorar la precisión de las decisiones

- Introducir un análisis cruzado de los marcos de tiempo para reducir la probabilidad de falsos brotes

Conclusión

Esta estrategia integra las ventajas de múltiples indicadores de sentimiento convencionales para construir una estrategia de breakout eficiente impulsada por el sentimiento. Evita con éxito los riesgos derivados de muchas breakouts de baja calidad, y cuenta con nociones de stop loss de alta precisión para bloquear las ganancias. Es una estrategia de breakout madura y confiable que vale la pena aprender y aprovechar. Con la optimización continua de parámetros y la predicción del modelo, tiene el potencial de generar rendimientos excesivos más consistentes.

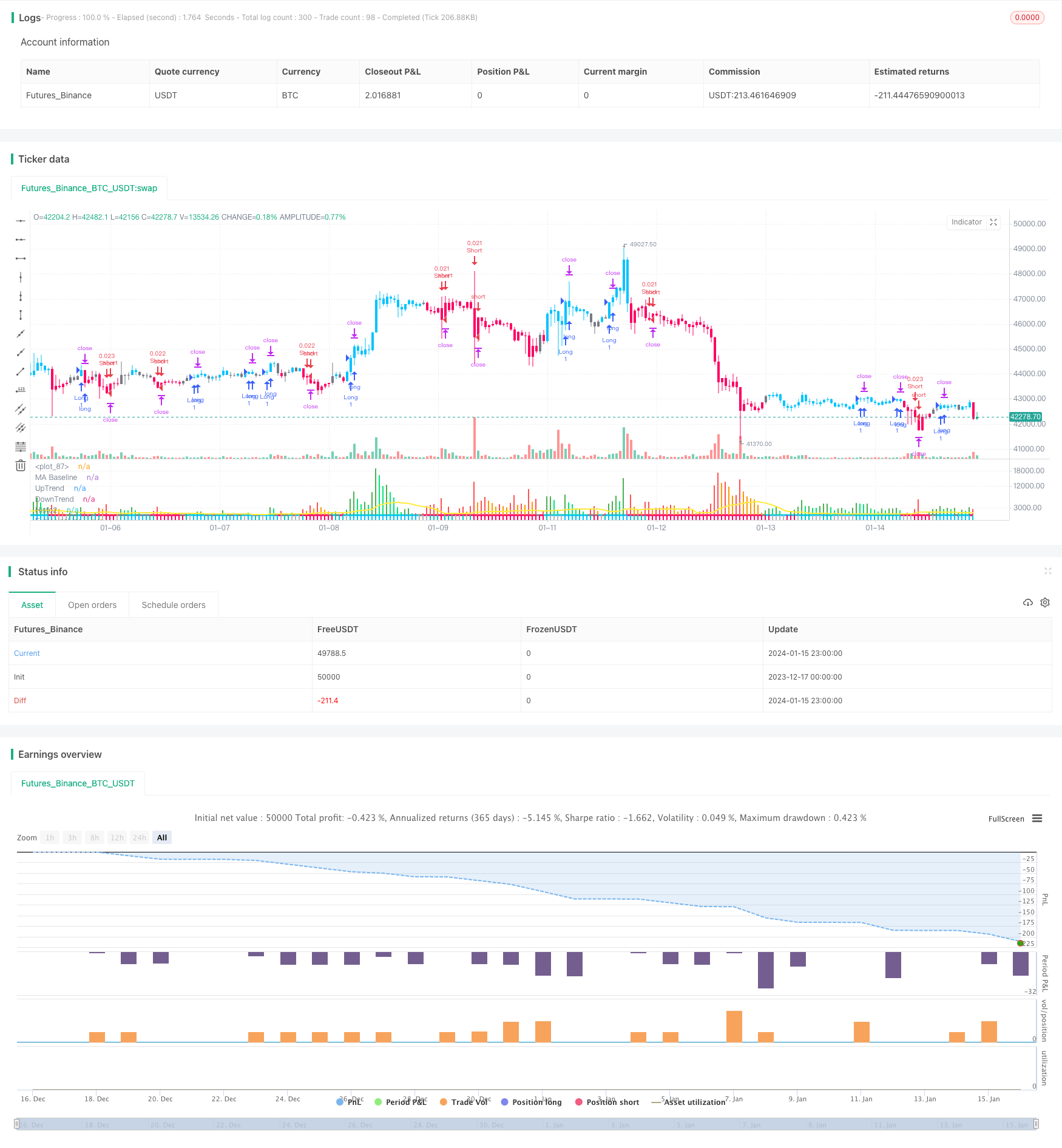

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - QQE MOD

// - SSL Hybrid

// - Waddah Attar Explosion

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - QQE MOD: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - SSL Hybrid: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - Waddah Attar Explosion: shayankm (https://www.tradingview.com/u/shayankm/)

//@version=5

strategy("QQE MOD + SSL Hybrid + Waddah Attar Explosion", overlay=false)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(10, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(2, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// -------

// QQE MOD

// -------

RSI_Period = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF = input.int(6, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE = input.int(3, title='Fast QQE Factor', group='Indicators: QQE Mod Settings')

ThreshHold = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

qqeSrc = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(qqeSrc, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

length = input.int(50, minval=1, title='Bollinger Length', group='Indicators: QQE Mod Settings')

qqeMult = input.float(0.35, minval=0.001, maxval=5, step=0.1, title='BB Multiplier', group='Indicators: QQE Mod Settings')

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = qqeMult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

//qqe_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1, display=display.none)

RSI_Period2 = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF2 = input.int(5, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE2 = input.float(1.61, title='Fast QQE2 Factor', group='Indicators: QQE Mod Settings')

ThreshHold2 = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

src2 = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

// ----------

// SSL HYBRID

// ----------

show_Baseline = input(title='Show Baseline', defval=true)

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='HMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=60)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0, display=display.none)

p1 = plot(0, color=color_bar, linewidth=3, title='MA Baseline', transp=0)

barcolor(show_color_bar ? color_bar : na)

// ---------------------

// WADDAH ATTAR EXPLOSION

// ---------------------

sensitivity = input.int(180, title="Sensitivity", group='Indicators: Waddah Attar Explosion')

fastLength=input.int(20, title="FastEMA Length", group='Indicators: Waddah Attar Explosion')

slowLength=input.int(40, title="SlowEMA Length", group='Indicators: Waddah Attar Explosion')

channelLength=input.int(20, title="BB Channel Length", group='Indicators: Waddah Attar Explosion')

waeMult=input.float(2.0, title="BB Stdev Multiplier", group='Indicators: Waddah Attar Explosion')

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength))*sensitivity

e1 = (calc_BBUpper(close, channelLength, waeMult) - calc_BBLower(close, channelLength, waeMult))

trendUp = (t1 >= 0) ? t1 : 0

trendDown = (t1 < 0) ? (-1*t1) : 0

plot(trendUp, style=plot.style_columns, linewidth=1, color=(trendUp<trendUp[1]) ? color.lime : color.green, transp=45, title="UpTrend", display=display.none)

plot(trendDown, style=plot.style_columns, linewidth=1, color=(trendDown<trendDown[1]) ? color.orange : color.red, transp=45, title="DownTrend", display=display.none)

plot(e1, style=plot.style_line, linewidth=2, color=color.yellow, title="ExplosionLine", display=display.none)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// QQE Mod

qqeGreenBar = Greenbar1 and Greenbar2

qqeRedBar = Redbar1 and Redbar2

qqeBuy = qqeGreenBar and not qqeGreenBar[1]

qqeSell = qqeRedBar and not qqeRedBar[1]

// SSL Hybrid

sslBuy = close > upperk and close > BBMC

sslSell = close < lowerk and close < BBMC

// Waddah Attar Explosion

waeBuy = trendUp > 0 and trendUp > e1

waeSell = trendDown > 0 and trendDown > e1

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = qqeBuy and sslBuy and waeBuy and in_date_range

shortCondition = qqeSell and sslSell and waeSell and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

longStopPercent = math.abs((1 - (swingLow / close)) * 100)

shortStopPercent = math.abs((1 - (swingHigh / close)) * 100)

// Position sizing (default risk 2% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inShort and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=swingLow, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=0)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent))

if (shortCondition and not inLong and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=swingHigh, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=0)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent))

openTradesInProfit() =>

result = 0.

for i = 0 to strategy.opentrades-1

result += strategy.opentrades.profit(i)

result > 0

exitLong = inLong and base_cross_Short and openTradesInProfit()

strategy.close(id = "Long", when = exitLong, comment = "Closing Long", alert_message="Long TP Hit")

exitShort = inShort and base_cross_Long and openTradesInProfit()

strategy.close(id = "Short", when = exitShort, comment = "Closing Short", alert_message="Short TP Hit")

// =============================================================================

// DATA WINDOW PLOTTING

// =============================================================================

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(0, "BUY SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(qqeBuy, "QQE Mod: Buy Signal", "", location = location.top, color=qqeBuy ? color.green : color.orange)

plotchar(sslBuy, "SSL Hybrid: Buy Signal", "", location = location.top, color=sslBuy ? color.green : color.orange)

plotchar(waeBuy, "Waddah Attar Explosion: Buy Signal", "", location = location.top, color=waeBuy ? color.green : color.orange)

plotchar(inLong, "inLong", "", location = location.top, color=inLong ? color.green : color.orange)

plotchar(exitLong, "Exit Long", "", location = location.top, color=exitLong ? color.green : color.orange)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(0, "SELL SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(qqeSell, "QQE Mod: Sell Signal", "", location = location.top, color=qqeSell ? color.red : color.orange)

plotchar(sslSell, "SSL Hybrid: Sell Signal", "", location = location.top, color=sslSell ? color.red : color.orange)

plotchar(waeSell, "Waddah Attar Explosion: Sell Signal", "", location = location.top, color=waeSell ? color.red : color.orange)

plotchar(inShort, "inShort", "", location = location.top, color=inShort ? color.red : color.orange)

plotchar(exitShort, "Exit Short", "", location = location.top, color=exitShort ? color.red : color.orange)

- Estrategia de negociación cuantitativa de varios plazos basada en SAR parabólico, indicadores de acciones y valores

- Estrategia de negociación de la EMA para el despegue rápido del oro

- Estrategia de inversión de seguimiento de impulso de dos factores

- Estrategia de negociación de reversión de impulso

- La banda de Bollinger y el RSI se mezclan con la estrategia DCA

- Emma Pullback Estrategia corta

- Estrategia de posición de impulso de NoroBands

- Estrategia de seguimiento de tendencias de inversión de la doble confirmación

- Estrategia de negociación cuantitativa basada en el indicador MACD OBV

- Promedio del costo en dólares después de la estrategia de tendencia bajista

- Una estrategia de inversión de tendencia basada en promedios móviles, patrones de precios y volumen

- Estrategia de media móvil doble

- Estrategia de negociación cruzada de promedio móvil de impulso

- Estrategia de doble media móvil de la Cruz de Oro

- Estrategia de tendencia de las bandas de Bollinger de la onda de impulso

- Estrategia de negociación de impulso inverso

- Estrategia del indicador de PB de banda media

- RSI y estrategia de negociación de 5 minutos de Fibonacci

- La media móvil triple combinada con la estrategia cuantitativa MACD

- Optimización de la ruptura de impulso