Algoritmo de cruz dorada de media móvil doble

Descripción general

El algoritmo de cruce de oro de doble línea media determina el momento de compra y venta calculando el cruce de la línea rápida y la línea lenta. La línea rápida utiliza una media móvil de 8 días y la línea lenta utiliza la media móvil de los precios más bajos de los últimos 8 días. La línea rápida genera una señal de compra cuando atraviesa la línea lenta desde abajo; la línea rápida genera una señal de venta cuando atraviesa la línea lenta desde arriba.

Principio de estrategia

El principio central de la estrategia es: la línea rápida representa la tendencia de los cambios de precios recientes, la línea lenta representa los niveles de precios más bajos recientes. Cuando la línea rápida atraviesa la línea lenta, indica que los precios comienzan a subir, superando los precios más bajos recientes, lo que genera una señal de compra; cuando la línea rápida atraviesa la línea lenta, indica que los precios comienzan a bajar, por debajo de los precios más bajos recientes, lo que genera una señal de venta.

Concretamente, la estrategia utiliza el promedio móvil del índice de 8 días como línea rápida y el promedio móvil del índice de los precios más bajos de los últimos 8 días como línea lenta. Luego, calcula la diferencia entre el precio y la línea rápida y determina la tendencia de cambio de la diferencia. Cuando la diferencia comienza a ser positiva, el precio comienza a subir; cuando la diferencia comienza a ser negativa, el precio comienza a bajar.

Análisis de las ventajas

La mayor ventaja del algoritmo de cruce de oro de doble línea media es que la idea de la estrategia es simple, clara y fácil de entender y implementar. El cruce de la línea media rápida y lenta para determinar el momento de compra y venta es un método más maduro y comúnmente utilizado en el análisis técnico. La estrategia utiliza este método maduro, al mismo tiempo que se mejora, para generar una señal de negociación más confiable utilizando una combinación cruzada de líneas rápidas y lentas.

Además, la estrategia incorpora un mecanismo de stop loss. Cuando el precio sube más del 20%, se establece el stop loss de la posición como 1.2 veces el precio de entrada. Esto puede bloquear la mayor parte de las ganancias y evitar pérdidas.

Análisis de riesgos

El algoritmo de cruce de oro de doble línea equilibrada también presenta ciertos riesgos. La estrategia solo decide el momento de la negociación en función de la relación entre el precio y la media móvil. Si el precio se mueve de manera anormal y la media móvil no puede reaccionar a tiempo, puede generar una señal de negociación errónea.

Además, el mecanismo de parada de pérdidas establecido como 1.2 veces el precio de entrada también puede ser demasiado conservador y no puede mantener toda la situación. Si la situación continúa en alza, el sistema de parada de pérdidas puede detenerse prematuramente y no obtener mayores ganancias. Para esto, se deben probar diferentes parámetros para encontrar la posición de parada más adecuada.

Dirección de optimización

La estrategia tiene espacio para una optimización adicional. Primero, se pueden probar diferentes parámetros, optimizar los parámetros periódicos de las medias móviles, encontrar la mejor combinación de parámetros para la calidad de la señal que nace. Segundo, se pueden agregar indicadores de volatilidad, etc., para evitar la generación de señales erróneas durante los períodos de oscilación de precios.

Resumir

El algoritmo de cruce de oro de doble línea uniforme es, en conjunto, una estrategia de comercio cuantitativa muy práctica. Utiliza métodos de análisis técnico avanzados de cruce de línea uniforme para generar señales de comercio, a la vez que mejora la optimización de los parámetros y las reglas. La estrategia de señales es simple, clara y fácil de entender; filtra eficazmente parte del ruido, mejora la calidad de la señal; y establece un mecanismo de control de riesgos de pérdidas.

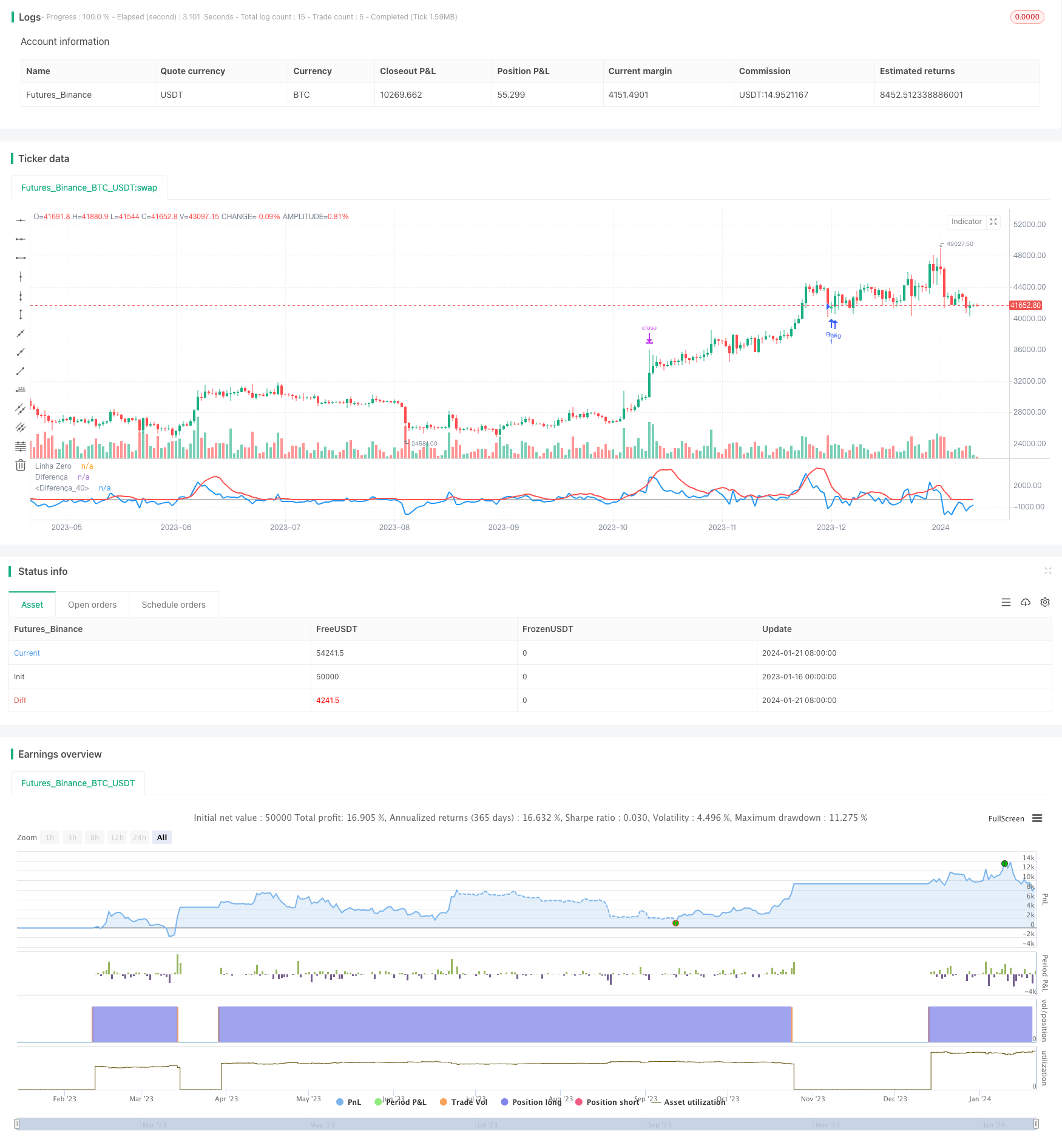

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = "Estratégia de Cruzamento das Linhas")

// Configuração da Média Móvel

emaPeriod = 8

ema= ema(close, emaPeriod)

ema1= ema(close[1], emaPeriod)

lowestEMA = lowest(ema, 8)

// Calcula a diferença entre o preço e a média móvel

diff = close - ema

diff1 = close[1] - ema1

diffLow = ema - lowestEMA

//Condições

diffZero = diff < 0

diffUnder = diff < diffLow

diffUm = diff > 0

Low0 = diffLow == 0

gain = strategy.position_avg_price*(1+0.2)

// Sinais de entrada

buy_signal = diffUnder and crossover(diff, diff1) and diffZero

sell_signal = diffUm and diffUnder and crossunder(diff, diff1)

// Executa as operações de compra/venda

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.exit("Buy", limit = gain)

// Plota as linhas

plot(0, title="Linha Zero", color=color.gray)

plot(diff, title="Diferença", color=color.blue, linewidth=2)

plot(diffLow, title="Diferença", color=color.red, linewidth=2)