Estrategia de retroceso de la tendencia del coral

El autor:¿ Qué pasa?, fecha: 2024-02-04 12:18:03Las etiquetas:

Resumen general

Esta estrategia utiliza el indicador de tendencia de coral de LazyBear

El mecanismo de salida utiliza el precio más alto/más bajo de las N velas más recientes multiplicado por una relación riesgo-recompensa configurable para establecer el stop loss y tomar ganancias.

Estrategia lógica

Después de determinar la dirección de la tendencia principal basada en el indicador Coral Trend, cuando el color del indicador permanece sin cambios, y el precio muestra un pequeño retroceso en la dirección opuesta.

Las condiciones de entrada incluyen:

-

La dirección del indicador Coral Trend es consistente con la dirección del comercio (largo=verde, corto=rojo)

-

Desde la última vez que el precio rompió completamente el indicador Coral Trend (el punto más alto de la última barra excede la línea Coral Trend), ha habido al menos 1 barra con puntos bajos por encima (largos) o puntos altos por debajo (cortos) del indicador Coral Trend

-

Se produce un pequeño retroceso en la dirección opuesta, durante el cual el precio de cierre permanece en el lado opuesto de la tendencia del coral

-

Después de que finalice el retroceso, el precio de cierre vuelve a la dirección de tendencia principal indicada por Coral Trend

Las condiciones principales son las mencionadas anteriormente y, al mismo tiempo, la estrategia adopta el indicador ADX o el histograma de fuerza absoluta y el indicador de volumen HawkEye como condiciones de confirmación para la entrada.

El indicador ADX requiere que su valor sea > 20 y que suba sobre el último 1 bar.

El histograma de fuerza absoluta requiere que su color sea consistente con la dirección del comercio (largo = azul, corto = rojo).

El mecanismo de salida utiliza el precio más alto / más bajo de las N velas más recientes multiplicado por la relación riesgo-recompensa para establecer el stop loss y tomar ganancias.

Análisis de ventajas

La mayor ventaja de esta estrategia es que después de determinar la dirección de la tendencia principal utilizando el indicador Coral Trend, detecta oportunidades de entrada mediante la identificación de reversiones, evitando la deriva en mercados que no están en tendencia. Al mismo tiempo, el uso del indicador Confirm puede filtrar muchas roturas falsas, mejorando así la tasa de éxito de entrada.

Además, esta estrategia proporciona un mecanismo completo de control de riesgos, que incluye el establecimiento de la magnitud de la parada de pérdida y el control del porcentaje de exposición al riesgo, de modo que incluso si las operaciones individuales pierden dinero, no causará un impacto importante en el capital total.

Análisis de riesgos

El mayor riesgo de esta estrategia es que el uso de indicadores para el juicio de entrada puede crear fácilmente ilusiones, creyendo que puede ganar dinero automáticamente solo confiando en configuraciones de parámetros.

Además, el establecimiento de stop loss y take profit también debe ser apropiado. Los múltiplos de take profit demasiado grandes pueden resultar en la falta de take profit, mientras que un stop loss demasiado pequeño resultará en un riesgo excesivo. Esto debe establecerse de acuerdo con la volatilidad de los diferentes productos y la tolerancia personal al riesgo.

Direcciones de optimización

Las direcciones que pueden optimizarse de esta estrategia incluyen:

-

Ajustar los parámetros del indicador Coral Trend para hacerlo más sensible a los cambios de precios de diferentes productos

-

Pruebe diferentes indicadores de confirmación o combinaciones de indicadores, como KDJ, MACD, etc., para hacer que las señales de entrada sean más precisas

-

En función de la volatilidad de los diferentes productos, ajustar el método de cálculo de stop loss y take profit para lograr un mejor control del riesgo

-

Añadir un módulo de gestión de fondos para ajustar la cantidad de orden única en función del número de posiciones mantenidas, controlando eficazmente las pérdidas totales

-

Añadir un módulo de control del tiempo de negociación para que la estrategia solo se ejecute durante períodos específicos para evitar pérdidas durante períodos de volatilidad extrema

Conclusión

Esta estrategia primero utiliza Coral Trend para determinar la tendencia a mediano y largo plazo de los precios, luego al juzgar su reversión, combinada con señales de confirmación para filtrar las fallas, construye una tendencia relativamente confiable después de la estrategia. Al mismo tiempo, los ajustes de control de riesgos mejorados también permiten que esta estrategia se ejecute durante mucho tiempo con capital estable.

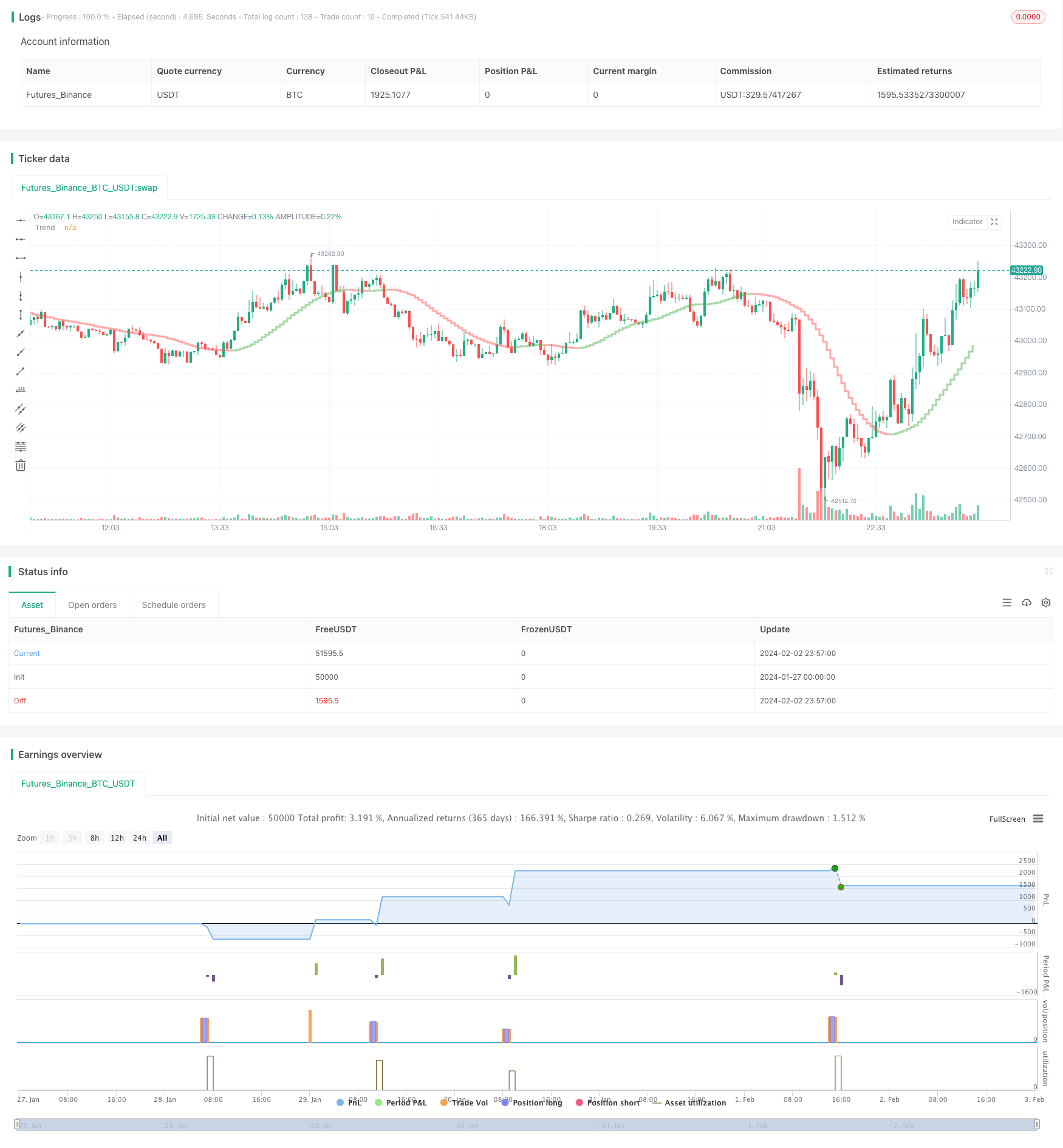

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-03 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @description

//

// Strategy is taken from the TradeIQ YouTube video called "I Finally Found 80% Win Rate Trading Strategy For Crypto"

// Check out the full video for further details/clarification on strategy entry/exit conditions.

//

// It incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Conditions outlines below

//

// - Trade exit: Conditions outlined below

//

// - Backtesting: Configurable backtesting range by date

//

// - Trade drawings: TP/SL boxes drawn for all trades (can be turned on and off)

// Trade exit information labels (can be turned on and off)

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: Coral Trend is bullish

// C2: At least 1 candle where low is above Coral Trend since last cross above Coral Trend

// C3: Pullback happens and price closes below Coral Trend

// C4: Coral Trend colour remains bullish for duration of pullback

// C5: After valid pullback, price then closes above Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Green line is above red line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is blue

// C6.2.2: HawkEye Volume Indicator colour is green

// SHORT: C1: Coral Trend is bearish

// C2: At least 1 candle where high is below Coral Trend since last cross below Coral Trend

// C3: Pullback happens and price closes above Coral Trend

// C4: Coral Trend colour remains bearish for duration of pullback

// C5: After valid pullback, price then closes below Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Red line is above green line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is red

// C6.2.2: HawkEye Volume Indicator colour is red

// NOTE: All the optional confirmation indicators cannot be overlayed with Coral Trend so feel free to add each separately to the chart for visual purposes

//

//

// - Trade exit: Stop Loss: Calculated by recent swing low over previous X candles (configurable with "Local High/Low Lookback")

// Take Profit: Calculated from R:R multiplier * Stop Loss size

//

// @credits

//

// Coral Trend Indicator [LazyBear] by @LazyBear

// Absolute Strength Histogram | jh by @jiehonglim

// Indicator: HawkEye Volume Indicator by @LazyBear

// ADX and DI by @BeikabuOyaji

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("Coral Trend Pullback Strategy (TradeIQ)", "Coral Trend Pullback", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ---------------

// Risk Management

// ---------------

riskReward = input.float(1.5, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

accountRiskPercent = input.float(1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM2", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

localHlLookback = input.int (5, "Local High/Low Lookback ", group = "Strategy: Stop Loss Settings", inline = "SL1", minval = 1, tooltip = "This strategy calculates the Stop Loss value from the recent local high/low. This lookback period determines the number of candles to include for the local high/low.")

// ----------

// Date Range

// ----------

startYear = input.int (2010, "Start Date ", group = "Strategy: Date Range", inline = "DR1", minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = "Strategy: Date Range", inline = "DR2", minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Drawing Settings

// ----------------

showTpSlBoxes = input.bool(true, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// ------------------

// Indicator Settings

// ------------------

// Coral Trend

ctSm = input.int (25, "Smoothing Period ", group = "Leading Indicator: Coral Trand Settings", inline = "CT1")

ctCd = input.float(0.4, "Constant D ", group = "Leading Indicator: Coral Trand Settings", inline = "CT2", step = 0.1)

// Confirmation indicator inputs

confirmationInd = input.string("ADX and DI", "Entry Confirmation Method ", group = "Confirmation Indicator: Indicator Selection", inline = "IS1", options=["None", "ADX and DI", "Absolute Strength Histogram + HawkEye Volume"], tooltip = "Select one of the possible confirmation indicator(s) which can be used to confirm entry signals from the main Coral Trend indicator conditions. See strategy conditions to understand the logic behind each confirmation indicator")

// ADX and DI

adxLen = input.int(14, "ADX Length ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD1")

midLine = input.int(20, "Mid Line ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD2", tooltip = "Mid line on standard ADX and DI indicator. In this strategy the DI must be above this line for entry confirmation.")

// Absolute Strength Histogram

ashLength = input.int(9, "Period of Evaluation ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH1")

ashSmooth = input.int(6, "Period of Smoothing ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH2")

ashSrc = input.source(close, "Source ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH3")

ashMode = input.string("RSI", "Indicator Method ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH4", options=["RSI", "STOCHASTIC", "ADX"])

sahMaType = input.string("SMA", "MA ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH5", options=["ALMA", "EMA", "WMA", "SMA", "SMMA", "HMA"])

ashAlmaOffset = input.float(0.85, "* Arnaud Legoux (ALMA) Offset", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH6", minval=0, step=0.01)

ashAlmaSigma = input.int(6, "* Arnaud Legoux (ALMA) Sigma", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH7", minval=0)

// HawkEye Volume Indicator

hevLength = input.int(200, "Length ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV1")

hevDivisor = input.float(1.6, "Divisor ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV2", step=0.1)

// =============================================================================

// INDICATORS

// =============================================================================

// -----------

// Coral Trend

// -----------

src = close

di = (ctSm - 1.0) / 2.0 + 1.0

c1 = 2 / (di + 1.0)

c2 = 1 - c1

c3 = 3.0 * (ctCd * ctCd + ctCd * ctCd * ctCd)

c4 = -3.0 * (2.0 * ctCd * ctCd + ctCd + ctCd * ctCd * ctCd)

c5 = 3.0 * ctCd + 1.0 + ctCd * ctCd * ctCd + 3.0 * ctCd * ctCd

var float i1 = na

var float i2 = na

var float i3 = na

var float i4 = na

var float i5 = na

var float i6 = na

i1 := c1 * src + c2 * nz(i1[1])

i2 := c1 * i1 + c2 * nz(i2[1])

i3 := c1 * i2 + c2 * nz(i3[1])

i4 := c1 * i3 + c2 * nz(i4[1])

i5 := c1 * i4 + c2 * nz(i5[1])

i6 := c1 * i5 + c2 * nz(i6[1])

bfr = -ctCd * ctCd * ctCd * i6 + c3 * i5 + c4 * i4 + c5 * i3

bfrC = bfr > nz(bfr[1]) ? color.new(color.green, 50) : bfr < nz(bfr[1]) ? color.new(color.red, 50) : color.new(color.blue, 50)

plot(bfr, "Trend", linewidth = 3, style = plot.style_stepline, color = bfrC)

// ----------

// ADX and DI

// ----------

TrueRange = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - nz(SmoothedTrueRange[1]) / adxLen + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - nz(SmoothedDirectionalMovementPlus[1]) / adxLen + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - nz(SmoothedDirectionalMovementMinus[1]) / adxLen + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(DX, adxLen)

// ---------------------------

// Absolute Strength Histogram

// ---------------------------

ashMa(ashType, ashSrc, ashLen) =>

float result = 0

if ashType == 'SMA' // Simple

result := ta.sma(ashSrc, ashLen)

result

if ashType == 'EMA' // Exponential

result := ta.ema(ashSrc, ashLen)

result

if ashType == 'WMA' // Weighted

result := ta.wma(ashSrc, ashLen)

result

if ashType == 'SMMA' // Smoothed

ashWma = ta.wma(ashSrc, ashLen)

ashSma = ta.sma(ashSrc, ashLen)

result := na(ashWma[1]) ? ashSma : (ashWma[1] * (ashLen - 1) + ashSrc) / ashLen

result

if ashType == 'HMA' // Hull

result := ta.wma(2 * ta.wma(ashSrc, ashLen / 2) - ta.wma(ashSrc, ashLen), math.round(math.sqrt(ashLen)))

result

if ashType == 'ALMA' // Arnaud Legoux

result := ta.alma(ashSrc, ashLen, ashAlmaOffset, ashAlmaSigma)

result

result

Price = ashSrc

Price1 = ashMa('SMA', Price, 1)

Price2 = ashMa('SMA', Price[1], 1)

//RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

//STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ashLength)

Bears1 = ta.highest(Price1, ashLength) - Price1

//ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ashMode == 'RSI' ? Bulls0 : ashMode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ashMode == 'RSI' ? Bears0 : ashMode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = ashMa(sahMaType, Bulls, ashLength)

AvgBears = ashMa(sahMaType, Bears, ashLength)

SmthBulls = ashMa(sahMaType, AvgBulls, ashSmooth)

SmthBears = ashMa(sahMaType, AvgBears, ashSmooth)

isTrendBullish = SmthBulls > SmthBears ? true : false

// ------------------------

// HawkEye Volume Indicator

// ------------------------

hevRange1 = high - low

hevRangeAvg = ta.sma(hevRange1, hevLength)

hevVolumeA = ta.sma(volume, hevLength)

hevHigh1 = high[1]

hevLow1 = low[1]

hevMid1 = hl2[1]

hevU1 = hevMid1 + (hevHigh1 - hevLow1) / hevDivisor

hevD1 = hevMid1 - (hevHigh1 - hevLow1) / hevDivisor

rEnabled1 = hevRange1 > hevRangeAvg and close < hevD1 and volume > hevVolumeA

rEnabled2 = close < hevMid1

rEnabled = rEnabled1 or rEnabled2

gEnabled1 = close > hevMid1

gEnabled2 = hevRange1 > hevRangeAvg and close > hevU1 and volume > hevVolumeA

gEnabled3 = high > hevHigh1 and hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA

gEnabled4 = low < hevLow1 and hevRange1 < hevRangeAvg / 1.5 and volume > hevVolumeA

gEnabled = gEnabled1 or gEnabled2 or gEnabled3 or gEnabled4

grEnabled1 = hevRange1 > hevRangeAvg and close > hevD1 and close < hevU1 and volume > hevVolumeA and volume < hevVolumeA * 1.5 and volume > volume[1]

grEnabled2 = hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA / 1.5

grEnabled3 = close > hevD1 and close < hevU1

grEnabled = grEnabled1 or grEnabled2 or grEnabled3

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// ---------

// FUNCTIONS

// ---------

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

printVerticalLine(col) => line.new(bar_index, close, bar_index, close * 1.01, extend = extend.both, color = col)

// ----------

// CONDITIONS

// ----------

inDateRange = true

// Condition 1: Coral Trend color matches trend direction (long=green, short=red)

isCoralBullish = bfr > nz(bfr[1])

isCoralBearish = bfr < nz(bfr[1])

// Condition 2: At least 1 candle completely above/below (long/short) Coral Trend since last cross above/below (long/short) Coral Trend (could potentially try also with only close above)

sincePrePullbackBullBreakout= ta.barssince(ta.crossover(close, bfr))

sincePrePullbackBearBreakout= ta.barssince(ta.crossunder(close, bfr))

prePullbackBullBreakout = ta.barssince(low > bfr and high > bfr) < sincePrePullbackBullBreakout[1]

prePullbackBearBreakout = ta.barssince(low < bfr and high < bfr) < sincePrePullbackBearBreakout[1]

// Condition 3: Pullback closes below/above (long/short) Coral Trend

barssinceBullPullbackStart = ta.barssince(ta.crossunder(close, bfr))

barssinceBearPullbackStart = ta.barssince(ta.crossover(close, bfr))

barssincePullbackStart = isCoralBullish ? barssinceBullPullbackStart : isCoralBearish ? barssinceBearPullbackStart : na

// Condition 4: Coral Trend colour matched trend direction for duration of pullback

sinceBullish = ta.barssince(ta.crossover(bfr, nz(bfr[1])))

sinceBearish = ta.barssince(ta.crossunder(bfr, nz(bfr[1])))

barssinceCoralflip = isCoralBullish ? sinceBullish : isCoralBearish ? sinceBearish : na

isPullbackValid = barssincePullbackStart < barssinceCoralflip

// Condition 5: After valid pullback, price then closes above/below (long/short) Coral Trend

entryBreakout = (isCoralBullish and ta.crossover(close, bfr)) or (isCoralBearish and ta.crossunder(close, bfr))

// Condition 6: Confirmation indicators (6.1 or 6.2, optional depending on settings) confirms trade entry

// 6.1: ADX and DI

// 6.1.1: Green and red match trend (long=(green > red), short=(red > green))

// 6.1.2: Blue > 20

// 6.1.3: Blue trending up over last 1 candle

// 6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator

// 6.2.1: Absolute Strengeh Histogram colour matches trend (long=blue, short=red)

// 6.2.2: HawkEye Volume Indicator colour matches trend (long=green, short=red)

var longTradeConfirmed = false

var shortTradeConfirmed = false

if confirmationInd == "ADX and DI"

isAdxUp = ADX > ADX [1]

isAdxValid = ADX > midLine and isAdxUp

longTradeConfirmed := DIPlus > DIMinus and isAdxValid

shortTradeConfirmed:= DIMinus > DIPlus and isAdxValid

else if confirmationInd == "Absolute Strength Histogram + HawkEye Volume"

isAshBullish = SmthBulls > SmthBears ? true : false

isHevBullish = not grEnabled and gEnabled ? true : false

isHevBearish = not grEnabled and rEnabled ? true : false

longTradeConfirmed := isAshBullish and isHevBullish

shortTradeConfirmed:= not isAshBullish and isHevBearish

else if confirmationInd == "None"

longTradeConfirmed := true

shortTradeConfirmed:= true

// Combine all entry conditions

goLong = inDateRange and isCoralBullish and prePullbackBullBreakout and isPullbackValid and entryBreakout and longTradeConfirmed

goShort = inDateRange and isCoralBearish and prePullbackBearBreakout and isPullbackValid and entryBreakout and shortTradeConfirmed

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

var entryPrice = 0.

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// Exit calculations

entryPrice := close

longSlPrice = ta.lowest(localHlLookback)

shortSlPrice = ta.highest(localHlLookback)

slAmount = isCoralBullish ? entryPrice - longSlPrice : shortSlPrice - entryPrice

slPercent = math.abs((1 - (entryPrice - slAmount) / entryPrice) * 100)

tpPercent = slPercent * riskReward

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

ctEntryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

// printTpSlHitBox(tradeEntryBar, bar_index, slHit, tpHit, ctEntryPrice, slPrice, tpPrice)

// printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, ctEntryPrice, pnl)

// Print TP/SL box for current open trade

// if barstate.islastconfirmedhistory and strategy.position_size != 0

// printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// // =============================================================================

// // DEBUGGING

// // =============================================================================

// Data window plots

plotchar(prePullbackBullBreakout, "prePullbackBullBreakout", "")

plotchar(prePullbackBearBreakout, "prePullbackBearBreakout", "")

plotchar(barssincePullbackStart, "barssincePullbackStart", "")

plotchar(isCoralBullish, "isCoralBullish", "")

plotchar(isCoralBearish, "isCoralBearish", "")

plotchar(barssinceCoralflip, "barssinceCoralflip", "")

plotchar(isPullbackValid, "isPullbackValid", "")

plotchar(entryBreakout, "entryBreakout", "")

plotchar(slHit, "slHit", "")

plotchar(tpHit, "tpHit", "")

plotchar(slPrice, "slPrice", "")

// Label plots

// plotDebugLabels = false

// if plotDebugLabels

// if bar_index == tradeEntryBar

// printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))

- Estrategia de negociación cuantitativa de EMA y RSI poderosa

- Estrategia de negociación combinada de bandas de Bollinger y RSI

- Tendencia de Divergencia MACD de Candlestick Demigod Siguiendo la Estrategia

- Estrategia de negociación de doble media móvil cruzada en plazos temporales

- El índice de variabilidad de los precios de las operaciones de la bolsa de valores de la entidad es el índice de variabilidad de los precios de las operaciones de la bolsa de valores de la entidad.

- Tendencia alcista cruzada de la SMA siguiendo la estrategia

- Bollinger Bands Breakout Estrategia de negociación cuantitativa

- Tendencia siguiendo la estrategia basada en la SMA de varios períodos

- Estrategia de ruptura de Ichimoku basada en el sentimiento del mercado

- Estrategia de negociación cuantitativa dinámica de varios indicadores

- Estrategia de negociación basada en el impulso

- Estrategia de negociación de ruptura de impulso

- Estrategia de captura del índice de variación de tendencia

- Estrategia de bandas de Bollinger SAR parabólicas de doble carril

- Estrategia de obtención de ganancias y de detención de pérdidas de media móvil triple exponencial

- Estrategia de comercio de anchura del canal de Donchian

- Estrategia de cruce de promedio móvil optimizada

- Estrategia de seguimiento de la oscilación de la banda de aislamiento

- Estrategia de ruptura del doble canal de Donchian

- Estrategia de la media móvil del CRSI