Estrategia de trading robusta con media móvil doble

Descripción general

La estrategia de comercio robusto de doble media móvil combina la doble fuerza de un índice relativamente débil (RSI) y un indicador de tasa de cambio (ROC) para identificar la dirección de la tendencia de la línea media y larga. La estrategia establece al mismo tiempo condiciones de filtración y condiciones de stop loss, permite la entrada en la base de la confirmación de la dirección de la tendencia, lo que reduce eficazmente el riesgo de falsas rupturas.

Principio de estrategia

La estrategia se basa en una combinación de indicadores RSI y ROC para determinar el momento de entrada. Cuando el precio está cerca de la zona de sobreventa relativa, se considera un punto de inflexión estructural y se forma una señal de reversión. Cuando el precio fluctúa en la zona de sobreventa relativa, la tendencia actual se mantendrá durante un tiempo.

Además, la estrategia incorpora los dos filtros de SMA y línea de parada a corto plazo para determinar la tendencia de la línea media, lo que permite que la estrategia solo se confirme en la dirección de la tendencia de la línea media y que no haya riesgo de parada a corto plazo. Esta configuración reduce la posibilidad de quedar atrapado en situaciones de crisis y el riesgo para los comerciantes es controlado.

La configuración flexible de la estrategia de la entrada también permite a los comerciantes la libertad de elegir entre utilizar sólo el RSI o el ROC de uno de los indicadores como base de entrada, o utilizar una combinación de los dos, que se puede optimizar para diferentes variedades y tipos de situaciones, lo que amplía aún más el alcance de la estrategia.

Análisis de las ventajas

La mayor ventaja de esta estrategia es la combinación de tendencias y señales de reversión para el juicio de entrada, que tiene en cuenta tanto los factores de tendencia como las oportunidades estructurales, y se basa en la transformación de la estructura del mercado para garantizar la precisión del tiempo de entrada. El uso combinado de RSI y ROC también hace que la estrategia sea más resistente a la interferencia de ruido aleatorio en el mercado en comparación con un solo indicador.

Otra ventaja es que el filtro de tendencia (SMA) y los paros a corto plazo incorporados en la estrategia pueden reducir efectivamente la probabilidad de ser cubierto en situaciones de crisis. La configuración de los dos líneas de defensa para el juicio de tendencias y los paros a corto plazo lo convierten en una estrategia robusta y controlada de riesgo.

Finalmente, la estrategia tiene una combinación de configuraciones de parámetros que el comerciante puede optimizar para diferentes variedades y tipos de situaciones, lo que hace que la estrategia tenga una amplia gama de aplicaciones. Ya sea que se trate de situaciones de tendencia o de consolidación, la estrategia puede adaptarse a los cambios en el mercado a través de parámetros.

Análisis de riesgos

El mayor riesgo de esta estrategia es que los indicadores de señales de reversión como el RSI y el ROC tienen un cierto retraso. Cuando la tendencia cambia, estos indicadores suelen tener un cierto retraso para que los parámetros alcancen el nivel de umbral establecido. Este retraso puede causar que la estrategia entre demasiado tarde y no pueda capturar la etapa inicial de inicio de la tendencia.

Otro riesgo potencial es que los parámetros del RSI y el ROC pueden ser demasiado sensibles en las tendencias oscilantes, lo que puede generar ciertas falsas señales. Si se activa el parón a corto plazo, estas falsas señales pueden causar pérdidas reales directamente.

Dirección de optimización

La estrategia puede ser optimizada en los siguientes aspectos:

Añadir más indicadores para combinar, como KDJ, MACD, etc., para usar más dimensiones para juzgar la estructura del mercado y mejorar la precisión de la señal

La inclusión de un mecanismo de optimización de adaptación a la configuración de los parámetros de RSI y ROC permite que los parámetros del indicador se ajusten dinámicamente a la volatilidad en tiempo real

Optimización de la lógica de entrada, estableciendo un mecanismo de confirmación cuando los indicadores de tendencia y los indicadores de reversión cumplen con las condiciones, evitando la aparición de falsas señales en los temblores

Ampliar el límite de pérdidas o establecer un límite de pérdidas libres para dar más espacio a la inversión para reducir las ganancias perdidas causadas por un límite de pérdidas demasiado denso

Resumir

La estrategia de comercio robusto de doble media móvil combina con éxito el juicio de tendencia y el indicador de reversión para capturar oportunidades estructurales basadas en la confirmación de tendencias en la línea media y larga. La estrategia también tiene una gran configurabilidad, y los operadores pueden optimizar los parámetros para cada acción y tipo de situación.

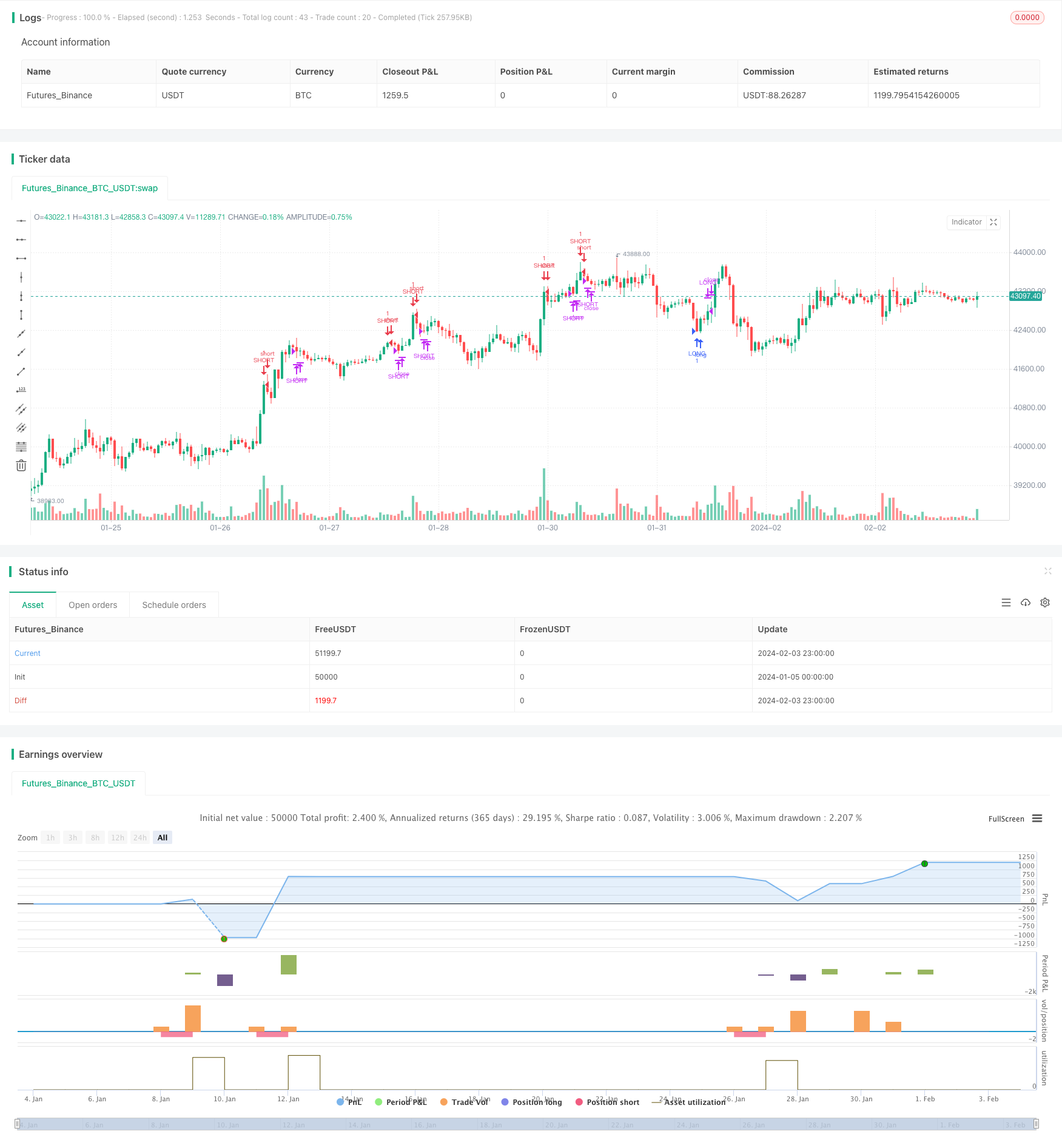

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GlobalMarketSignals

//@version=4

strategy("GMS: RSI & ROC Strategy", overlay=true)

LongShort = input(title="Long Only or Short Only or Both?", type=input.string, defval="Both", options=["Both", "Long Only", "Short Only"])

RSIroc = input(title="RSI Only, ROC Only, Both?", type=input.string, defval="Both", options=["Both", "RSI Only", "ROC Only"])

RSILength = input(title="RSI Length", type = input.integer ,defval=14)

RSIUpper = input(title="RSI Upper Threshold", type = input.float ,defval=70)

RSILower = input(title="RSI Lower Threshold", type = input.float ,defval=30)

ROCLength = input(title="ROC Length", type = input.integer ,defval=14)

ROCUpper = input(title="ROC Upper Threshold", type = input.float ,defval=0.01)

ROCLower = input(title="ROC Lower Threshold", type = input.float ,defval=-0.01)

LongExit = input(title="Long Exit SMA Length", type = input.integer ,defval=5)

ShortExit = input(title="Short Exit SMA Length", type = input.integer ,defval=5)

AboveBelow = input(title="Trend SMA Filter?", type=input.string, defval="Above", options=["Above", "Below", "Don't Include"])

TrendLength = input(title="Trend SMA Length", type = input.integer ,defval=200)

//RSI ONLY

//Long Side

if LongShort =="Long Only" and AboveBelow == "Above" and RSIroc == "RSI Only"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and close< sma(close,LongExit) and close>sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Long Only" and AboveBelow == "Below" and RSIroc == "RSI Only"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and close< sma(close,LongExit) and close<sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Long Only" and AboveBelow == "Don't Include" and RSIroc == "RSI Only"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and close< sma(close,LongExit))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Above" and RSIroc == "RSI Only"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and close< sma(close,LongExit) and close>sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Below" and RSIroc == "RSI Only"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and close< sma(close,LongExit) and close<sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Don't Include" and RSIroc == "RSI Only"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and close< sma(close,LongExit))

strategy.close("LONG", when = close>sma(close,LongExit))

//RSI ONLY

//SHORT SIDE

if LongShort =="Short Only" and AboveBelow == "Above" and RSIroc == "RSI Only"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and close> sma(close,ShortExit) and close>sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Short Only" and AboveBelow == "Below" and RSIroc == "RSI Only"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and close> sma(close,ShortExit) and close<sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Short Only" and AboveBelow == "Don't Include" and RSIroc == "RSI Only"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and close> sma(close,ShortExit))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Above" and RSIroc == "RSI Only"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and close> sma(close,ShortExit) and close>sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Below" and RSIroc == "RSI Only"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and close> sma(close,ShortExit) and close<sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Don't Include" and RSIroc == "RSI Only"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and close> sma(close,ShortExit))

strategy.close("SHORT", when = close<sma(close,ShortExit))

///////-----------------/////////////

///////-----------------/////////////

///////-----------------/////////////

//ROC ONLY

//Long Side

if LongShort =="Long Only" and AboveBelow == "Above" and RSIroc == "ROC Only"

strategy.entry("LONG", true, when = roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close>sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Long Only" and AboveBelow == "Below" and RSIroc == "ROC Only"

strategy.entry("LONG", true, when = roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close<sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Long Only" and AboveBelow == "Don't Include" and RSIroc == "ROC Only"

strategy.entry("LONG", true, when = roc(close,ROCLength)<ROCLower and close< sma(close,LongExit))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Above" and RSIroc == "ROC Only"

strategy.entry("LONG", true, when = roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close>sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Below" and RSIroc == "ROC Only"

strategy.entry("LONG", true, when = roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close<sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Don't Include" and RSIroc == "ROC Only"

strategy.entry("LONG", true, when = rsi(close,ROCLength)<ROCLower and close< sma(close,LongExit))

strategy.close("LONG", when = close>sma(close,LongExit))

//ROC ONLY

//SHORT SIDE

if LongShort =="Short Only" and AboveBelow == "Above" and RSIroc == "ROC Only"

strategy.entry("SHORT", false, when = roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close>sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Short Only" and AboveBelow == "Below" and RSIroc == "ROC Only"

strategy.entry("SHORT", false, when = roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close<sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Short Only" and AboveBelow == "Don't Include" and RSIroc == "ROC Only"

strategy.entry("SHORT", false, when = roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Above" and RSIroc == "ROC Only"

strategy.entry("SHORT", false, when = roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close>sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Below" and RSIroc == "ROC Only"

strategy.entry("SHORT", false, when = roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close<sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Don't Include" and RSIroc == "ROC Only"

strategy.entry("SHORT", false, when = roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit))

strategy.close("SHORT", when = close<sma(close,ShortExit))

///////-----------------/////////////

///////-----------------/////////////

///////-----------------/////////////

//BOTH

//Long Side

if LongShort =="Long Only" and AboveBelow == "Above" and RSIroc == "Both"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close>sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Long Only" and AboveBelow == "Below" and RSIroc == "Both"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close<sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Long Only" and AboveBelow == "Don't Include" and RSIroc == "Both"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and roc(close,ROCLength)<ROCLower and close< sma(close,LongExit))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Above" and RSIroc == "Both"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close>sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Below" and RSIroc == "Both"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and roc(close,ROCLength)<ROCLower and close< sma(close,LongExit) and close<sma(close,TrendLength))

strategy.close("LONG", when = close>sma(close,LongExit))

if LongShort =="Both" and AboveBelow == "Don't Include" and RSIroc == "Both"

strategy.entry("LONG", true, when = rsi(close,RSILength)<RSILower and roc(close,ROCLength)<ROCLower and close< sma(close,LongExit))

strategy.close("LONG", when = close>sma(close,LongExit))

//BOTH

//SHORT SIDE

if LongShort =="Short Only" and AboveBelow == "Above" and RSIroc == "Both"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close>sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Short Only" and AboveBelow == "Below" and RSIroc == "Both"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close<sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Short Only" and AboveBelow == "Don't Include" and RSIroc == "Both"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Above" and RSIroc == "Both"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close>sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Below" and RSIroc == "Both"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit) and close<sma(close,TrendLength))

strategy.close("SHORT", when = close<sma(close,ShortExit))

if LongShort =="Both" and AboveBelow == "Don't Include" and RSIroc == "Both"

strategy.entry("SHORT", false, when = rsi(close,RSILength)>RSIUpper and roc(close,ROCLength)>ROCUpper and close> sma(close,ShortExit))

strategy.close("SHORT", when = close<sma(close,ShortExit))